Blog

Stay up to date on timely topics and market events. Subscribe to our Blog now.

Net statistical noise, US economic growth has improved very slightly this year, as strong gains in business investment and improvements in the trade balance have offset a slight slowing in consumer spending.

US money market fund balances keep rising in 2025 as investors favor MMFs for their liquidity, competitive yields, and stability amid Federal Reserve rate cuts and ongoing banking sector uncertainty.

In 2026, Multi-Asset Credit (MAC) strategies may find attractive opportunities across fixed-income sectors such as structured credit, high-yield credit and select emerging markets, though investors should carefully consider evolving risks—particularly in private credit and broader macroeconomic conditions.

This week we touch on the steady demand for munis, which has mostly rebounded from the prior outflow cycle.

Private-sector job growth stayed modest in October and November, but strong retail sales show that consumers are still spending confidently.

The 2025 US National Security Strategy redefines national power by prioritizing domestic industrial strength, secure supply chains and strategic economic policies, signaling a major shift for investors and global markets.

The Federal Open Market Committee today lowered interest rates for the third consecutive time, signaling a potential pause as Fed Chair Powell’s term is about to expire and policymakers continue to monitor economic growth, inflation and employment data.

This week we provide a market update for the month of November.

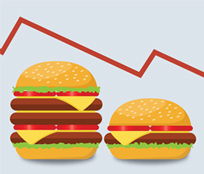

While the US consumer held steady in the third quarter, growth in spending was somewhat tempered by softer retail sales and mild effects from tariffs.

This week we break down the key drivers of the record issuance year.

September retail sales saw a brief pause in core spending, but overall consumer activity remains healthy and continues to support positive economic growth.

Despite a cooling labor market and rising credit delinquencies, US consumers are keeping up their spending and holding steady on net worth amid mounting uncertainty from inflation and tariffs.

With fresh September jobs data finally available after the government shutdown, strong private-sector hiring numbers offer encouraging signs of economic resilience.

This week we touch on election outcomes and their impact on the municipal market.

Fixed-income sectors generally posted positive returns in October amid limited economic data releases due to the partial federal government shutdown.

Despite concerns over fiscal risks and political uncertainty, US Treasuries have remained resilient and delivered strong returns in 2025, maintaining their role as a leading safe-haven asset in the global bond market.

Emerging market reserve managers now operate in fast-changing financial markets where trust is built and lost quickly, making historical perspective and strong risk management essential for stability.

The October 2025 IMF Fall Meetings showcased strong market performance fueled by the AI investment cycle, fiscal sustainability concerns and monetary policy divergence, with emerging markets drawing notable inflows as the global economy continues to evolve.

This week we touch on strong October muni performance.

Despite another 25-bp rate cut today, Federal Reserve officials signaled growing uncertainty about future monetary easing, as persistent inflation, mixed economic signals and limited data suggest a more cautious approach ahead.

This week we discuss the recent upgrade of Illinois’ credit rating by Moody’s and the overall upgrade trend observed this year.

Emerging market central banks can safely modernize their reserve management by using pilot testing to try new strategies, improve operations and stay resilient in a changing global financial environment.

As the government shutdown extends into a third week, we touch on potential implications for the muni market.

Business investment in the US is holding strong, especially in manufacturing construction and high-tech equipment, even as other areas slow down a bit due to changing government policies.

In September, fixed-income market sentiment was bolstered by expectations that the Federal Reserve (Fed) would continue to cut the fed funds rate.

This week we touch on municipal demand data as outlined by last month’s Federal Reserve data release.

US money market funds continue to thrive as high interest rates, market volatility and regulatory shifts drive both institutional and retail investors to chase attractive yields and liquidity.

Recent updates to GDP and consumer spending data show the US economy growing steadily in 2024-2025, with Americans spending more on goods and services—trends that line up well with other positive economic indicators.

This week we touch on the long-end rally observed so far this month.

New sales data diminish hope for a soft landing for the new-home industry this year.

Following last week’s Fed cut, this week we touch on municipal performance during historical rate cut cycles.

In August, fixed-income yields moved lower and contributed to positive returns across most sectors.

The Federal Reserve just lowered rates by 25 basis points to support a slowing job market and hints at more rate cuts in 2025 as it balances concerns about inflation and employment.

Retail sales and inflation-adjusted control sales both increased in August, reflecting steady consumer spending despite ongoing job growth slowdown and tariff pressures.

Following last week’s release of state and local tax collection estimates from the Census, this week we touch on the pace of state and local revenue growth.

Evolving UK labour market conditions and monetary policy developments suggest the potential for further Bank of England rate cuts. Our view is that current market expectations may be underestimating the scope for easing through 2026.

The latest CPI report shows higher shelter and goods prices, steady services inflation and that most new jobs are in health care—all important for the Fed’s rate cut decisions.

Following last week’s Labor Day holiday and the weak jobs report, we check in on state and local payroll data.

Indonesian financial markets face increased volatility and investor caution after nationwide protests and government changes, raising concerns over fiscal policy and political stability.

The August jobs report showed most new private-sector jobs came from health care, while overall job growth remained weak, increasing the likelihood of a Federal Reserve rate cut.

Surging government bond yields in developed markets highlight growing fiscal and inflation challenges for global investors.

Consumer spending in July showed steady growth, with robust merchandise sales and cooling inflation in goods, while persistent price pressures in services suggest the US economy remains resilient but faces ongoing challenges.

This week we touch on significant performance differences across the municipal market, underscoring the potential value of active management.

Recent developments at the Federal Reserve—including a dovish Jackson Hole speech and an unprecedented attempt to remove a sitting governor—are reshaping market expectations for rate cuts and raising concerns about the Fed’s independence amid growing political and fiscal pressures.

Trump is apparently pressuring the Federal Reserve to cut rates, raising concerns that political influence could undermine its independence as US debt grows.

US consumers are feeling the strain from a weaker job market, higher prices and tariff uncertainty—challenges that could grow in the months ahead.

With summer travel underway, this week we touch on transportation sector trends.

Despite rising inventories and price cuts, new-home sales continue to lag behind construction—a trend that may reflect builder caution in the face of affordability challenges and persistently high mortgage rates.

Record supply conditions and negative muni performance YTD have resulted in improved tax-exempt income opportunities and relative valuations.

July retail sales exceeded expectations and upward revisions to May and June figures signal renewed consumer confidence and suggest tariff effects are less severe than previously feared.

This week we touch on muni spread tightening amid headlines about the ability of select high-yield muni borrowers to sustain debt service.

Our Multi-Asset Credit (MAC) strategy can provide investors with diversified credit exposure and potential income by allocating across various global credit sectors, while emphasizing transparency, risk management and liquidity.

This week we touch on the significant muni curve steepening that took place this year.

Job creation appears to be increasingly concentrated in health care and social services, highlighting a broader slowdown as much of the private sector struggles to add new positions.

Despite eye-catching GDP swings this year, much of the volatility likely reflects statistical noise from how imports are counted. In our view, the real story is that economic growth is steady but losing steam as consumers finally start to pull back.

The Federal Reserve maintained its cautious stance today, holding rates steady as officials weighed mixed economic signals. With inflation still above target and growth moderating, policymakers again stressed the importance of incoming data to shape the path forward.

As most states closed out fiscal year 2025 last month, here we review the health of state budgets heading into the new fiscal year.

While sales held steady in June, a rising number of unsold homes and persistent affordability issues signal that builders may soon tap the brakes on new construction.

In June, fixed-income markets responded positively to softer inflation and labor data, as global geopolitical tensions contributed to a flight-to-quality sentiment.

This week we highlight the elevated New York muni issuance of last week, which supports higher income opportunities within the state.

This week we highlight implications from the final Big Beautiful Bill legislation signed by President Trump on July 4.

Emerging market corporate bonds are currently offering attractive returns and showing resilience in 2025, with metals & mining and Europe leading gains despite ongoing global trade and geopolitical risks.

Nominal retail sales rose in June, but inflation and tariffs kept real consumer spending flat across goods and services, raising concerns about future economic and GDP growth if consumer activity doesn’t improve soon.

Despite a new 50% copper import tariff expected by August 2025, core copper fundamentals remain strong, with resilient demand and stable long-term supply outlooks.

Trump’s proposed 50% tariff on Brazilian imports appears primarily political, with limited direct economic risk but potential implications for US-Brazil trade relations and a possible boost to President Lula’s domestic support.

The jobs report for June painted a softer picture for private-sector employment. Modest job gains and seasonal quirks in public education jobs suggest the labor market is losing some momentum, potentially encouraging the Federal Reserve to consider future rate cuts.

This week we provide a mid-year muni market review.

Consumer spending showed uneven momentum in May as tariffs drove up prices for some goods, services spending stalled and underlying income growth remained strong despite headline volatility.

This week we highlight updated Flow of Funds data from the Fed released this month.

US strikes on Iranian nuclear sites have heightened geopolitical risk, threatening disruption of the Strait of Hormuz, potential oil price spikes, and a shift in energy investment strategies.

In May, global government bond market volatility subsided as improved economic data and lower US-China trade tariffs led investors to reduce the perceived risk of a global downturn.

The Federal Open Market Committee (FOMC) kept interest rates steady amid ongoing economic uncertainty, signaling fewer rate cuts ahead due to persistent inflation risks, tariff impacts and potential energy price shocks.

This week we highlight state and local revenue data released by the Census earlier this month.

Beneath the headline swings, resilient core retail sales highlight steady consumer confidence and the underlying strength of the US economy.

Credit markets are currently stable despite Israel-Iran tensions, but an extended conflict could weaken risk appetite and increase volatility, especially if oil prices surge.

We saw oil futures spiking and market volatility rising following Israel’s strike on Tehran and Iran’s nuclear escalation. While US rates markets have remained steady, energy shocks and geopolitical risks could reshape inflation, Fed policy and emerging market prospects.

May’s inflation data revealed price increases well below the Fed’s 2% target, with easing in both headline and core measures, especially as shelter costs slow.

This week we highlight the elevated supply observed this month (and year).

Latin American central banks are adapting to global market changes by diversifying reserves beyond US dollar assets into corporate bonds and sustainable investments to enhance returns and manage risk.

US job growth in May brought some good news but big revisions to previous job reports and slower hiring in construction kept overall gains in check while wages remained unchanged.

The US housing market is cooling as high mortgage rates and growing inventory slow buyer demand and moderate home price growth, leading us to favor bonds and multi-family real estate.

This week we highlight the 2025 muni market’s underperformance, which has contributed to what we view as attractive relative valuations.

US consumer credit growth and utilization slowed in the first quarter, with rising delinquencies expected later in the year. As a result, we favor high-quality consumer credit investments and remain cautious on subprime assets.

Consumer spending and inflation stayed stable in April, with minor shifts driven by vehicle sales and tariffs, while overall inflation trends remain within the Fed’s comfort zone.

In April, municipal bonds underperformed due to elevated supply and weak demand amid market volatility, even as credit fundamentals remained resilient and after-tax yields improved.

This week we highlight potential municipal market implications arising from the recent House Ways and Means Committee’s tax bill.

Moody’s US credit rating downgrade signals rising fiscal risks and market uncertainty as debt and deficits grow amid political gridlock.

Despite a modest dip and April figures being revised downward, US sales remain strong, with small businesses continuing to drive consistent growth in the retail sector.

Given the headlines about federal funding cuts and the possible elimination of higher education’s tax-exempt status, this week we look at emerging risks in the muni sector.

The US-China tariff pause offers a welcome break in trade tensions, while ongoing discussions about US trade policy, the strength of US Treasuries and the dollar, as well as evolving global capital flows, provide reasons for cautious optimism in the markets.

Amid mixed economic signals and rising global risks, the Federal Reserve (Fed) is holding interest rates steady and staying flexible as it monitors how conditions develop.

This week we highlight state and local payroll conditions following a better-than-expected nonfarm payrolls report.

The US merchandise trade deficit rose by an annualized rate of $566 billion for the first quarter of 2025.

The Spring IMF meetings offered insights into potential frontier market opportunities as investors reconsider regional allocations, political considerations and evolving global macroeconomic dynamics amid tariff uncertainty.

Steady job and wage growth support a stable US labor market, but conflicting economic data cast doubt on the true strength of the goods sector.

This week we highlight evolving tax policy rhetoric that can impact municipal valuations.

Despite a decline in housing starts, new-home sales show unexpected resilience, with builders maintaining production levels amid high inventories and easing home prices.

The March retail sales report shows a rise in consumer spending that may serve as a counterpoint to recession fears.

Municipal bonds experienced negative returns and underperformed taxable fixed-income in March due to heightened market volatility, weaker economic data, and increased supply and demand pressures.

This week we highlight the record volatility observed last week in the muni market and elevated income opportunities.

President Trump’s tariffs heightened global financial market uncertainty, prompting strategic adjustments in our Multi-Asset Credit portfolios to help manage risks and explore selective opportunities.

In March, the Consumer Price Index registered a modest decline, signaling a promising stabilization of inflation. This positive trend appears particularly robust when excluding volatile components such as food, energy and shelter costs, suggesting broader price pressures may be easing across the economy.

Mexico is strategically navigating the complexities of the new US tariff regime, leveraging the USMCA trade agreement to avoid additional tariffs. The country is focused on enhancing domestic production and fiscal responsibility, though sectors such as autos, chemicals and utilities still face significant risks.

This week we highlight traditionally challenged technicals observed during tax season.

In the face of market turbulence and the Trump administration's tariffs, US Treasuries continue to be viewed as safe-haven assets due to their lower volatility and reduced exposure to interest-rate risks, particularly those with shorter maturities.

March payrolls highlight robust job growth and stable wages, offering a positive data point amid recent economic concerns.

Amid falling equities and Treasury yields, US investment-grade credit spreads are widening due to market volatility, trade tensions and recession fears. Our investment outlook favors high-quality issuers and industries with strong balance sheets that have seen spreads widen in sympathy.

After Trump’s tariff announcement, we surveyed our Desk to gather insights and assess the impact on markets, revealing concerns about inflation, growth prospects, widening credit spreads, and significant repricing as investors adjust to the new economic uncertainty.

This week we highlight the shifts in municipal demand observed in 2024.

A slowing in spending on goods and services reflects a softening in wage growth and potential downside risks.

This week we highlight state and local revenue data released by the US Census Bureau earlier this month.

The Federal Reserve opted to maintain steady interest rates and decelerate its balance sheet reduction, reflecting a cautious stance amid economic uncertainties.

This week we highlight historical municipal market reactions to recessionary environments.

A rebound in control sales in February indicates strong consumer demand, countering premature claims of a weakening US economy despite a slight overall decline in retail sales.

The municipal bond market in February saw near-record tax-exempt supply, strong investor demand and attractive after-tax yields compared to taxable bonds.

February’s Consumer Price Index showed a notable cooling in overall inflation compared to January, though an unexpected rise in goods prices amid moderating service costs has created new considerations for Federal Reserve policymakers.

This week we highlight the potential impact of federal austerity measures on the muni market.

February’s jobs report shows moderate private-sector growth amid shorter workweeks and modest wage gains, suggesting economic sluggishness that could influence the Federal Reserve’s rate-cut decisions.

Despite concerns about Trump’s tariffs, US fiscal policy and Federal Reserve actions, we believe that the diverse buyer base and evolving global risks will continue to support strong demand for US Treasuries.

As the short-term muni rate declined nearly 1% last week, this week we highlight the year-to-date disinversion of the muni yield curve.

President Trump’s reaffirmation of tariff policies has led to responses from trading partners, sparking debates about the potential economic impacts and the effectiveness of his approach.

Despite rising delinquencies and low housing turnover, the Western Asset Housing Market Score has risen to 50, primarily driven by a shortage of available homes and strong home builder sentiment.

Economic data for January reveals a dip in consumer spending, a modest rise in personal income and mixed inflation rates, underscoring the complexities and uncertainties of early-year economic trends.

Fannie Mae and Freddie Mac’s exit from federal conservatorship aims to stabilize the housing market while preserving mortgage affordability and liquidity, maintaining government backing of agency MBS and ensuring a safe release from the conservatorship without negative market impacts.

This week we touch on the Illinois budget proposal released last week.

Single-family housing starts declined in January, maintaining steady activity despite regional variations, but excess inventories and higher mortgage rates indicate potential vulnerabilities in the housing market.

Sales decline substantially in a month where prices increased: January price and sales data confound even the most savvy economists.

Municipal issuers raised $37 billion in January with 35% higher inflows than the prior 10-year average January issuance.

This week we highlight positive fund flows amid elevated supply conditions.

Private-sector job growth in January was mainly driven by the health care sector, despite an overall slowdown in job growth across the rest of the economy, indicating that recent upturns are likely statistical noise rather than a genuine recovery.

This week we highlight tax policy rhetoric, which has accelerated following potential proposals put forth by the House Ways and Means Committee.

The Bank of Japan’s cautious interest rate hikes aim to balance price stability with economic risks, while acknowledging potential adverse economic effects. We anticipate further rate increases, driven by concerns over inflation and the depreciation of the yen.

Markets are facing turbulence in 2025 due to Trump’s tariffs on several countries, which are impacting US growth and Fed policy. Multi-asset credit solutions may help investors navigate the uncertainties in today's investment landscape.

The US consumer outlook remains strong, supported by improved labor market data, robust consumer spending and healthy household balance sheets, despite cooling trends from peak pandemic stimulus.

Real GDP grew at an annualized rate of 2.3% in the fourth quarter of 2024, mainly due to strong consumer spending, but declines in business equipment investment and inventories suggest a mixed economic outlook for 2025.

The Fed left rates unchanged today, emphasizing economic resilience, stable labor market conditions and persistent inflation concerns. It also acknowledged the uncertainties posed by the current economic and political landscape, including potential tariff impacts, immigration, fiscal policy and regulatory changes.

This week we highlight the Los Angeles regional wildfires and their potential implications on muni credit.

President Trump’s threat of new tariffs on Colombian goods, following a deportation dispute, highlights his unpredictable tariff strategy. Despite both sides backing off, we see potential implications for emerging markets and global trade.

Muni market yields moved higher across the curve in December 2024, generally underperforming US Treasuries amid rate volatility and weakening supply and demand technicals.

UK gilts may present a compelling investment opportunity for global bond investors due to subdued growth, moderating inflation and potential for more rate cuts by the Bank of England.

Single-family housing starts rose modestly in December 2024, but overall starts have declined from 2023 due to high inventories, rising mortgage rates and hurricane disruptions.

Retail sales in December rose by 0.3%, with consumer-oriented control sales up 0.5%, thanks to strong performance in brick-and-mortar stores. Inflation trends are aligning with the Fed’s 2% target, showing that consumer spending remains strong despite some economic challenges.

This week we highlight key muni-related themes to monitor in 2025.

We believe emerging markets have demonstrated resilience and may be positioned for a potential rebound, despite facing challenges from tariffs, a strong US dollar and higher interest rates.

December’s private-sector payroll increase of 223,000 jobs marks a cautious recovery from hurricane disruptions, highlighting a return to work rather than a genuine job surge.

The Brazilian real experienced significant depreciation in 2024 due to fiscal policy credibility issues, monetary policy concerns and global factors, but it is expected to stabilize as the interest rate differential between Brazil and the US widens and Brazil’s central bank adopts a hawkish stance.

This week we provide a comprehensive 2024 municipal market review.

As the year closes, the US economy is holding steady with the service sector, especially health care, showing growth. Meanwhile, manufacturing and construction face challenges, and recent positive inflation data offers hope for meeting the Fed’s inflation target.

Trump’s tariffs, if implemented, are expected to hinder global growth, particularly affecting Asian export-oriented economies, while also leading to mixed inflation outcomes and modestly negative impacts on Asia’s rates.

The Federal Reserve cut rates by 25 bps today and signaled a “new phase” of monetary policy, with a slower pace of future cuts expected due to higher growth and inflation forecasts and election-related uncertainties.

This week we highlight the release of new Census data on state and local revenues.

Retail sales growth in November was driven by a surge in vehicle sales and strong online shopping trends. Despite a slight decline in brick-and-mortar store performance, overall trends indicate that consumer spending continues to support economic growth.

Muni bonds outperformed taxable fixed-income securities in November 2024, driven by strong supply and demand dynamics, resilient fundamentals and favorable valuations amid volatile markets.

Trump’s policies on tariffs and immigration have the potential to reshape global trade relationships, significantly impacting markets and economies from Latin America to Asia.

November’s inflation report shows rising prices and ongoing pressures, possibly due to recent hurricanes. Easing shelter costs and stable spending suggest the Fed may pause its rate hikes despite a mixed economic outlook.

This week we highlight higher gas prepay issuance trends that have supported the record muni supply seen so far this year.

The fall of the Assad regime in Syria has triggered an unpredictable political landscape with far-reaching geopolitical consequences, including potential escalations in regional conflicts and shifts in global oil markets.

Private-sector payroll jobs rose by 194,000 in November, but overall job growth remains slow, driven mainly by health care and government-supported sectors. Significant downward revisions and a steady decline in household employment may suggest deeper economic issues.

US securitized credit offers investors a range of opportunities for portfolio diversification, attractive yields and enhanced income benefits, presenting an appealing alternative to traditional fixed-income investments.

This week we highlight November’s muni supply slowdown.

In October, real consumer spending experienced a modest increase of 0.1%, largely driven by higher spending on health care services. At the same time, personal income grew by 0.7%, which might have been influenced by the effects of Hurricane Helene.

This week we review market moves as municipal bond supply recovered from US election outcomes and digested potential changes to federal and state tax policy.

While single-family housing starts dipped almost 7% in October, factors like Hurricane Milton and gains from prior months might help explain the decline.

Western Asset responds to investors’ growing demand for customized fixed-income portfolios that break free of benchmark constraints, allowing for better alignment with each client’s risk tolerance and investment goals.

Retail sales saw a 0.4% boost in October, but the more stable control sales measure dipped by 0.1%, showing mixed results possibly influenced by recent hurricanes.

The fall IMF and World Bank meetings offered valuable insights into the resilience and investment opportunities in frontier markets, highlighting structural uncertainties and evolving global macroeconomic dynamics.

The US Consumer Report Card for 3Q24 shows a brighter outlook with an overall grade of B+, thanks to better job market data and strong spending, even though things have cooled a bit from the pandemic highs.

Western Asset CIO Michael Buchanan discusses how Trump’s re-election is likely to impact the bond market due to changes in economic policies, including tax cuts, deregulation and protectionist trade measures.

Muni yields surged in October, driven by record-high municipal supply, robust demand, consistently low default rates and attractive after-tax yield benefits compared to taxable bonds.

The Fed cut rates by 25 bps today and concluded that future monetary policy decisions will be guided by incoming inflation and labor market data, with expectations of continued progress towards the Fed's inflation target.

Central bank reserve managers are increasingly turning to fixed-income investments, particularly US dollar-denominated assets, in an effort to enhance portfolio diversification and capitalize on improving global financial conditions and stabilizing geopolitical risks.

Here we explore how a second Trump term could impact emerging markets by reshaping trade policies, altering geopolitical dynamics and influencing asset price movements.

This week we highlight ballot initiative trends at the state and local levels.

Private-sector payroll employment dropped by 28,000 in October with big downward revisions for August and September, possibly due to recent hurricanes; a strong job growth rebound would confirm hurricane impacts, while ongoing weak growth might point to broader economic issues.

As the US presidential election approaches, agency mortgage-backed securities (MBS) may present an attractive investment opportunity due to their strong fundamentals, relatively favorable spreads and possible benefits from policy changes under different election outcomes.

Real GDP growth of 2.8% in 3Q24, alongside stable nominal GDP growth and controlled inflation, suggests that the Fed’s policies have been effective in maintaining economic stability, despite sector-specific variations in production and spending.

This week we highlight potential election implications of municipal securities subject to the Alternative Minimum Tax (AMT).

Despite ongoing US Treasury volatility and global political uncertainties, the credit market remains resilient supported by strong corporate balance sheets, accommodative global financial conditions and proactive central bank policies.

The American retirement landscape faces challenges like insufficient savings and the uncertain future of Social Security, highlighting the need for thoughtful policy adjustments to ensure sustainable retirement income and benefits.

Despite a recent uptick in new-home sales and single-family housing starts, high inventory levels and downward revisions indicate potential challenges for the homebuilding market.

This week we highlight potential corporate tax policy implications of the upcoming election.

Retail sales surged by 0.4% in September, with control sales jumping 0.7%, showcasing resilient consumer spending despite economic headwinds and hinting at a potential pause in aggressive Federal Reserve rate cuts.

The third quarter of 2024 experienced a notable decline in 30-year mortgage rates driven by the Federal Reserve's rate cut, yet housing affordability remains a challenge due to persistently high home prices.

In September, the municipal bond market saw positive returns for the fourth consecutive month, driven by the Fed’s half-point rate cut. However, the muni market continued to underperform other high-quality fixed-income assets due to elevated supply conditions.

This week we highlight potential individual income tax policy implications of the upcoming election.

September’s CPI showed higher core inflation, potentially due to strike and hurricane impacts, while shelter costs unexpectedly moderated, highlighting the complexity of measuring homeowners’ costs in inflation data.

This week we highlight muni exposure to climate risks following the damage caused by Hurricane Helene.

September’s private-sector payrolls surged by 223,000 jobs, with notable gains in health care and restaurant sectors, while average hourly wages rose by 0.37%, potentially challenging expectations for further Fed rate cuts.

Following the Fed’s rate cut last week, we highlight the municipal market reaction to prior rate-cutting cycles.

Recent global economic shifts, including central bank rate cuts, China's stimulus measures and Saudi Arabia's oil strategy change, are likely to boost investor sentiment and asset prices despite slowing global economic activity.

September 27, 2024

ECONOMY

Following a 50-bp cut by the Fed, inflation appears in check amid strong services spending and soft goods spending.

China has unveiled a significant economic support package including monetary easing and market interventions to boost growth and stabilize markets, but these measures may not fully address complex economic challenges or match the scale of previous stimulus efforts.

September 25, 2024

INVESTING

Proposed regulatory changes in Australia could impact the country’s hybrid securities market, and diversified fixed-income and credit strategies may offer investors a better alternative for generating defensive income.

Following the Fed’s rate cut last week, we highlight the municipal market reaction to prior rate-cutting cycles.

Treasury Inflation-Protected Securities (TIPS) can offer attractive value as inflation expectations trend lower, with real yields above historical averages and breakeven inflation rates nearing Fed targets.

As global inflation eases and central banks shift toward rate cuts, bond yields are expected to remain low, potentially creating attractive opportunities in high-yield corporate credit, bank loans, CLO tranches, structured credit and emerging market debt.

The Fed cut interest rates today for the first time since 2020, lowering the fed funds rate by 50 basis points, citing progress on inflation and balanced economic risks, while projecting additional cuts for 2024.

This week we provide an update on state and local tax collection estimates released last week.

Despite worries about a slowdown, August retail sales held strong with a 0.1% rise in headline sales and a 0.3% boost in “control” sales, thanks to gains in drug stores and online shopping. Meanwhile, everyone is eagerly awaiting the Fed’s rate decision tomorrow.

Learn how Climate Resilient Debt Clauses (CRDCs) are changing sovereign debt contracts. We believe these innovative clauses integrate climate risk, boost financial resilience and promote sustainability in vulnerable countries.

Core inflation excluding housing remains low, but elevated shelter costs pose a dilemma for the Federal Reserve’s monetary policy decisions.

As muni mutual funds record a 10th consecutive week of inflows, we highlight the implications of an inflow cycle in the muni market.

Slowing job growth outside Covid epicenter sectors, coupled with downward revisions in job counts, highlight imminent needs for a September rate cut.

US consumer spending rose 0.4% in July, outpacing income growth and pushing the savings rate to 2.9%, surprising analysts who expected a pullback and potentially influencing the Fed's upcoming rate decision.

The Western Asset Consumer Report Card introduces a new quarterly assessment of US consumer financial health, analyzing seven key economic indicators to provide insights for investors.

This week we touch on Vice President Kamala Harris' new tax plan.

Divergent trends in new-home sales and construction during July suggest builders may be tackling excess inventory, potentially disputing claims of a widespread housing shortage.

Following the July payrolls report and as we approach Labor Day, this week we highlight state and local payroll trends.

As Claudia Sheinbaum is about to become Mexico’s President, we are closely monitoring her potential energy and utility policies, considering AMLO's populist legacy and Morena’s congressional supermajority.

July's retail sales rose 1.0%, with core sales beating expectations at 0.3%, suggesting steady consumer spending and potentially delaying any Federal Reserve rate cuts.

This week we touch on municipal performance during past recession periods.

This week we touch on the record tax-exempt muni supply observed this year.

Here we discuss the major factors driving significant global market volatility and how these forces are compelling investors to reassess their portfolios. Western Asset’s active management approach aims to navigate these turbulent conditions by identifying mispricing opportunities across fixed-income asset classes.

Nonfarm payrolls grew by just 114,000 for the month, down from the downwardly revised 179,000, and private-sector payroll jobs rose a scant 97,000 in July, setting the stage for a near-term Fed rate cut.

The Federal Reserve holds rates steady and signals a potential September rate cut amid a shifting economic landscape and balanced risk assessment.

This week we highlight recent yield curve reversion and the potential implications for muni investors.

Real GDP surged at a 2.8% annualized rate in 2Q24, driven by robust business investment and motor vehicle production, while easing inflationary pressures suggest sustained economic stability.

This week we highlight pension funding improvements.

Here we examine how Biden's potential withdrawal from the 2024 presidential race could reshape Democratic leadership dynamics and trigger market volatility, impacting Treasury yields, US dollar strength and emerging market assets as investors reassess economic policy expectations.

Despite challenges from high mortgage rates, the US housing market is holding steady in 2024, with home prices still growing modestly even as buyers and sellers navigate a changing landscape.

The 2024 US presidential race raises concerns for investors regarding potential impacts on emerging market assets, particularly if Trump's proposed trade policies are implemented.

This week we present an update on the transportation sector as we enter the summer travel season.

As global central banks begin to cut rates, investors may want to explore hidden opportunities across various credit sectors—including high-yield corporate bonds, bank loans, structured credit, investment-grade credit and emerging market debt—to potentially capitalize on attractive income and total return prospects.

June’s CPI declined by 0.06%, following a 0.2% increase in May, driven primarily by a sharp drop in energy prices and a decrease in core CPI, excluding shelter costs. This broad-based moderation in inflation could potentially justify future Fed rate cuts.

This week we provide a mid-year market update for muni investors.

With job growth having fallen to rates slower than what we saw pre-Covid, with much of that growth centered in health care, and with wages and total hours worked also slowing, we likely are at a point where further softening would connote actual weakness … in which case it might be time for the Fed to start cutting.

Weakening consumer spending and easing inflation in May bolster the case for a Fed rate cut, as core inflation excluding shelter hits the Fed’s 2% target.

Monetary policy tightening is straining credit markets, especially for smaller firms, potentially signaling recession; however, this environment may offer CLO equity investors improved margins and opportunities for enhanced returns.

Despite stable new-home sales, there is a concerning gap between single-family housing starts and sales, suggesting potential oversupply and future challenges for homebuilders.

This week we provide an update on state and local tax collections.

Sukuk, or Islamic bonds that comply with Shariah law, are experiencing growth in their use for financing, especially for infrastructure and green projects, although potential risks exist and regulatory standardization is needed for the market’s continued expansion.

Recent retail sales data is showing signs of consumers tightening their spending in 2024 across most shopping categories after a stronger rebound last year, which could point toward a slowing economy ahead.

This week we discuss Federal Reserve municipal holdings data, highlighting shifts in municipal bond demand.

Mexico’s new president, Claudia Sheinbaum, will need to balance investor concerns over potential constitutional reforms with fulfilling promises to her base, while also pursuing opportunities presented by nearshoring trends that benefit the country.

May’s flat consumer prices with low core inflation, especially when excluding shelter costs, signal that the Fed will likely consider rate cuts in the months ahead.

The Fed maintained its data-dependent approach, suggesting inflation and employment trends could prompt rate cuts later this year.

This week we highlight the robust municipal issuance observed this year.

As Narendra Modi is poised for a third term as India’s Prime Minister with backing from allies, India's markets rallied on expectations of continued economic reforms and fiscal prudence. The country’s bond market now anticipates inflows after getting included in a major global index.

Private-sector payroll jobs surged by 229,000 in May, with significant gains in Covid-affected sectors like health care and restaurants, despite a slight downward revision to April's jobs estimate and a rise in the unemployment rate to 4.0%.

The European Central Bank vows to remain data-dependent, which in our view is likely to precipitate further easing in the third and fourth quarters that should buoy euro area bonds.

This week we highlight the Illinois budget that was passed last week.

Consumer spending slowed in April with continued goods declines and stagnant services spending. Despite easing inflation, the broad softening coupled with low consumer savings and high debt levels signals a potential downtrend risk.

New single-family home sales dropped sharply in April, signaling potential declines ahead in homebuilding that could weigh on economic growth.

This week we highlight a muni supply bill proposed last week in the US House of Representatives.

The South African election outlook favors policy stability, as an ANC victory or coalition government would likely maintain the country’s attractive high real yields, which should make local bonds an appealing investment opportunity.

Western Asset believes emerging market assets may provide attractive opportunities in 2024 following the Fed's last rate-hiking cycle and sees potential upside in Mexican local bonds due to factors like high yields and potential supply chain shifts.

Today’s inflation data, which shows progress in taming core inflation along with sluggish retail sales, bolsters the case for a summer Fed rate cut, provided inflation keeps decelerating and consumer spending doesn't rebound sharply.

This week we highlight tobacco consumption data released last week and its impact on the muni tobacco sector.

Investors should monitor Panama’s economic landscape as newly elected President José Raúl Mulino grapples with stimulating growth, addressing fiscal and pension deficits, and renegotiating the halted Cobre Panamá mine project amid a divided congress, which may sway business confidence and market stability.

Sovereign debt sustainability requires assessing countries’ climate policies and enabling investment vehicles tied to economy-wide targets, rather than following the project-based approach used for corporate debt.

This week we highlight drivers of challenged muni performance during the month of April.

Early financial market comments on the release referred to a “weak” jobs report. This is not really true with respect to the headline payroll gains. In any case, the breadth of today’s data is once again consistent with declining inflation.

This week we highlight potential challenges faced by popular municipal ladder strategies.

Here we explore the key factors influencing the 2024 oil markets, including geopolitical events, global elections, supply and demand trends, and the implications for energy investments.

Our take has been that despite all the hubbub about the economy’s strength, nominal GDP growth has been decelerating steadily; real GDP growth is a bit more puzzling.

Here we explore how 2024 elections in Mexico and India may affect global economic trends, trade stability and international relations, with a focus on the potential impact to emerging market (EM) investments.

This week we highlight themes from the New York state budget passed over the weekend.

Amid low interest rates and market volatility, Latin American institutions are turning to money market funds due to their attractive yields, liquidity and capital preservation advantages.

Western Asset’s Housing Market Monitor assesses critical aspects of supply, demand, pricing and mortgage stress in the US housing market to offer investors insights into prospective home price trends and the residential mortgage-backed securities sector's potential opportunities or risks.

This week we highlight key tax themes we are monitoring around Tax Day.

Retail sales appeared to soften in January and February, but today’s report obliterated that apparent softness. We thought consumers were over-extended, but there is no indication of this in today’s news.

Given today’s CPI release, shelter remains a major puzzle—and is a major sticking point for the inflation data. Here are our thoughts, and our questions.

This week we highlight the increasing call activity associated with taxable Build America Bonds (BABs).

This was easily the cleanest jobs report we have seen since 2022. Here’s our breakdown of the numbers.

Active management in emerging market (EM) debt can generate alpha and outperform passive investments due to the idiosyncrasies and inefficiencies present in the asset class.

We thought consumer spending trends were moderating. Instead, as in a game of whack-a-mole, moderating goods spending has been offset by jumps in services.

A renewed US-China trade war under a potential second Trump presidency could disrupt global growth, financial markets and supply chains through aggressive tariff measures against China and other trading partners.

This week we highlight state and local revenue estimates released last week by the US Census Bureau.

In a historic shift signaling gradual policy normalization amid rising wages and inflation, Japan's central bank ended its long-standing negative interest rate and yield curve control policies, a move Western Asset believes will put upward pressure on Japanese government bond yields.

Declining net worth of floating-rate credit issuers presents a risk of higher defaults unless asset values rise, creating potential headwinds for the economy but opportunities for active credit investors.

The Fed’s policy announcement today hints at a potential desire to maintain a lower profile and avoid surprising markets during this election year. Our view is that the Fed is likely to initiate policy actions over the summer to sidestep any perceptions of unduly influencing voters.

This week we highlight wealth trends from recent IRS data.

We believe Western Asset's time-tested approach of combining long-term fundamental value investing with dynamic risk management is well-suited to position global bond portfolios through turbulent periods.

It is simply impossible to tell for sure at this point whether the January/February softness indicates an incipient downshift in consumer spending or just statistical noise. Here’s our take.

Western Asset's proprietary Housing Market Monitor Score evaluates key supply, demand, pricing and mortgage stress factors in the US housing market, providing investors with valuable insights into potential future home price movements and opportunities or risks in the residential mortgage-backed securities sector.

This week we highlight historical performance prior to and following historical fed funds rate cuts.

Private-sector payroll employment rose by 223,000 in February, but there was a massive, -204,000 revision to January data. This jobs report was very much a mixed bag for bulls and bears on the economy.

Here we make the case for why we believe emerging market investment-grade bonds could be a compelling relative value allocation for investors.

This week we highlight key takeaways from the beginning of budget season.

The Bank of Japan (BoJ) has signaled a potential future shift toward less accommodative monetary policy. Here we discuss the key economic metrics and whether the timing and extent of the BoJ’s policy shifts are likely to provide adequate economic support.

Capital spending—and manufacturing activity in general—is one area that has clearly softened as interest rates have risen. Not only is equipment investment declining steadily, but manufacturing output is as well.

February 27, 2024

MARKETS

This week we highlight the deteriorating supply trends in the taxable muni market.

Frontier markets prove detractors wrong with a resurgence after a troubled 2022, as the primary market shows renewed appetite for frontier issuers.

January retail sales figures released today showed a -0.8% decline in total sales and a -0.5% revision to the December estimate. Maybe the spending spree that began in July began to sputter in January, maybe the reported declines are just a seasonal blip?

This week we highlight diverging valuations between top-quality munis and credit-oriented counterparts.

This week we highlight active versus passive muni fund performance and the structural benefit of active management within the muni market.

Today’s January payroll news is so beyond the pale that it is wise to wait and gain some perspective before commenting further. Here are our observations in the meantime.

Robust growth in the asset-backed securities (ABS) market highlights the strong fundamentals of US consumers, suggesting a positive economic outlook for 2024.

Ahead of this week’s nonfarm payroll report, we highlight recent state and local employment trends.

Real GDP is reported to have grown at a 3.3% annualized rate in 4Q23, while the GDP price index shows a 1.5% annualized rate of inflation. Elsewhere, growth was a bit below our expectations. Here’s how we slice it, and why we think inflation will remain restrained.

This week we highlight drivers of underperformance in the muni market so far this year, which have countered the traditionally strong “January Effect.”

The Fed has expanded and contracted its balance sheet over the past decade, using quantitative easing to purchase US Treasuries and mortgage-backed securities, and quantitative tightening to sell assets. Here we discuss how these actions have impacted the level of bank reserves and broader financial market liquidity.

US investment-grade credit historically has posted strong total returns after the Fed concludes a tightening cycle and prepares to ease policy—is this what we can expect ahead?

This week we highlight key market themes we’re tracking for muni investors in 2024.

Overall, there are no meaningful signs of softening consumer spending in today’s data, quite the opposite. Here’s how we see it.

Even with the somewhat higher December print, the average annualized inflation rate for core CPI excluding shelter over the last seven months is only 1.3%—way below the Fed’s 2% inflation target. Here are the details on the latest inflation data, along with our take.

While cash-equivalent rates may look attractive today, there’s much evidence to suggest that bonds may be a more attractive choice over the longer term.

This week we recap 2023 muni performance and market trends.

Labor market activity is not weak, but we would assert that it is not as strong as the headline job growth data would suggest, and the apparent deceleration in job growth bears watching.

Today’s data suggest a slight, incipient parting of the ways between goods and services spending. One month doesn’t make a trend, so it is way too early to jump on today’s data for services, but the softer pattern there in the November release bears watching.

This week we highlight 3Q23 state and local revenue estimates released by the Census last week.

Ironically, recent sales growth resurgence has occurred with job growth and wage growth slowing. That sales growth rebounded in the summer and has continued at a decent pace since then has been a surprise to this analyst and others.

As the Fed left interest rates unchanged at today’s FOMC meeting, the conversation understandably turned to the prospect of rate cuts, and in particular to the potential timing of cuts in 2024. We think the discussion of rate cuts is usefully framed as whether interest rates need to be so high.

This week we highlight Federal Reserve muni holders data released last week.

While interest in environmental, social and governance (ESG) investing may be waning according to recent media headlines, our analysis shows continued investor demand and issuer commitment.

Yes, there are elements to today’s payroll report that led some analysts to tout a “strong” report. However, looking at both the effect of worker strikes and the revised data, the story is a bit more complex. Here’s what we see.

Softer growth, declining inflation and expected central bank rate cuts in 2024 set the stage for further downward pressure on global bond yields.

With inflation moderating and expectations for Fed easing ahead, investors might want to consider the benefit of securing today’s fixed-income yields through near-term corporate bonds.

This week we highlight record performance of munis observed over the month of November.

Income growth was soft and PCE inflation was softer, but consumer spending grew decently. Here’s how we account for this.

Usually when durables orders swing down or up by such a large magnitude in one month, the swing is dominated by downs or ups in aircraft orders. This was indeed the case with today’s release. Here are the details.

This week we highlight diverging municipal bond flow dynamics seen so far this year.

Emerging market (EM) corporate bonds have shown an ability to weather volatility, offer resilient yields and provide diversification, which we believe makes them an appealing component for fixed-income portfolios.

Retail sales changes released today were softer than what we had seen in preceding months, but perhaps the bigger surprise is that there were no noticeable sales declines.

This week we highlight recent record trading activity among muni investors driven by late-year tax-loss harvesting.

Despite emerging markets confronting challenges posed by contrasting growth outlooks and policy trajectories, we believe their recent lagging returns could offer an attractive entry point for investors.

With credit markets showing resilience amid volatility since 2022, here we discuss why we believe uncertainties are fading.

This week we highlight election day implications for municipal bonds.

Here we discuss three reasons why we believe collateralized loan obligation (CLO) equity may be undervalued: optionality, structural advantages and relative collateral.

To our minds, the October payroll data were a return to the trends seen over most of 2023, after a bounce to the upside in September, and here’s why we think today’s report will strengthen the case for the Fed halting its rate hikes in FOMC meetings to come.

This week we highlight the impact Treasury rate volatility can have on the municipal market.

We believe the concerns over rising US deficits, growing debt burdens and decreasing demand for US Treasuries are somewhat overstated. In our view, these factors are not likely to substantially threaten America's financial strength or lead to sustained high interest rates over time.

The pace was markedly faster than the 2% growth occurring over the previous four quarters, but it was slightly lower than some financial market analysts had predicted. Here are the details.

This week we highlight seasonally high muni supply levels observed in October, offering investors attractive entry points.

With real incomes flat, with saving rates extremely low, with consumer interest rates up sharply, and consumer borrowing slowing, we have been expecting consumer spending activity to slow markedly.

This week we highlight a key driver of challenged municipal demand this year: competition from nominal cash yields.

Against a fast-changing backdrop, emerging markets (EM) may be an attractive source of returns for fixed-income investors. Here we discuss why we think EM presents a compelling story.

As interest rates climb, corporate bond issuers face increasing pressure on their finances. Here we discuss how higher rates also pose risks that could reverberate across credit markets.

Here we discuss why we believe frontier markets have the potential to offer compelling investment opportunities. However, their complexity demands rigorous country-specific analysis to manage default risks shaped by unique political and economic contexts.

Today’s data will make for an interesting Fed decision. Will it look at the trend of slowing job growth, or will it focus on the much stronger September job gains? Will it look at the apparent trend of wage growth around 4% so far this year, or will it focus on the more modest wage gains of August and September?

While the consensus market outlook has shifted, US Treasuries don’t appear to be following along. Here we explore what’s happening in the US Treasury market.

This week we highlight recent elevated supply, and relative value within the gas pre-pay sector.

It’s been a busy two days! GDP growth is now estimated to be a little slower over the last year than previously estimated, ditto for consumer spending and recent data supports the assertion that a 2% inflation rate is unattainable. Here’s our analysis.

This week we highlight state and local revenue data released from the Census and what it means for muni investors.

Here we discuss Indian bonds, which present investors with a unique opportunity as India’s bond market is underpinned by strong fundamentals, attractive valuations and positive technical tailwinds.

This week we highlight details from the city of Chicago budget forecast released last week and its implications for municipals.

Data for August were released today by the U.S. Census Bureau, and the details within the report are every bit as chaotic as the mix of rising permits and falling starts would suggest. We’ll try to make sense of things here.

Even with July revisions and August softness, retail sales growth shows better performance over recent months than in 2022 and early-2023. It’s just that a bit of the “bloom on the rose” has faded with today’s data.

As the Federal Reserve just released its flow of funds data on September 8, this week we highlight changes in muni demand and the market liquidity landscape.

On a number of fronts, today’s employment report offered encouraging news to financial markets, even if bond investors, for now, think otherwise.

Today’s data from the Bureau of Economic Analysis do not seem a good parlay so far as financial markets are concerned. Here’s why.

August 29, 2023

MARKETS

Ahead of the Labor Day holiday, this week we highlight the state of muni payrolls. While national nonfarm payrolls remain well-above pre-pandemic highs, state and local payrolls continue to lag pre-pandemic levels by 1.3%.

Today in Jackson Hole, Fed Chair Jerome Powell reaffirmed his well-communicated views that monetary policy is now restrictive and he expects it to remain so until inflation declines further. In our view, his remarks suggest there may be considerable value in the bond market at current yields.

Both new-home sales and single-family starts have been trending higher this year, something that was not in our forecast at the start of the year. It’s a tale of two sectors, with data for existing-home inventories and the new-home market apparently conflicting. Here’s what we make of it.

This week we evaluate negative net supply trends that took place over the summer and helped insulate the municipal market from the rate volatility that affected other fixed-income asset classes.

Here we discuss the recent steepening of the US Treasury yield curve, and what it might mean for investors in the months ahead.

This week we highlight elevated Texas Permanent School Fund issuance which underscores supply dynamics that contribute to opportunities for active management.

Evidence of a meaningful response to Fed tightening is hard to find. This doesn’t mean such a response is not coming, but the retail sector has clearly held up better and longer in the face of higher interest rates than we expected.

Granted, two months of satisfactory prints are most likely not enough for the Fed, but there is no reason to think that the Fed will wait for 12 months of benign data before pausing or reversing its rate hikes. Here’s our thinking.

This week we evaluate the muni market reaction to the US downgrade by Fitch Ratings.

Private-sector payroll jobs and total nonfarm gains sound decent, and various financial market analysts will describe them as such. Keep in mind, however, that there are some less favorable elements to the data lurking underneath.

On the heels of Fitch’s US credit rating downgrade, here we discuss how the ratings work for money market funds.

August 02, 2023

REGULATORY

Here is our initial assessment of the impact that Fitch’s rating downgrade of US credit may have on fixed-income investments.

This week we evaluate the year-to-date municipal default rates.

With inflation continuing its downward trend and many central banks approaching the end of their tightening cycles, here we provide an update to our outlook for global bonds.

This week we highlight the New York Metropolitan Transportation Authority’s (MTA) recently released budget and fare increases.

Here we highlight the recent investment activity of central bank reserve managers in Latin America, which may also be relevant to actions taken by other central bankers around the world.

Last week the SEC released major changes to Rule 2a-7, the regulations governing money market funds. In this post, we summarize the main elements of the reforms and weigh in on their potential impact.

This week we highlight the supply slowdown in the taxable muni market.

June sales gains were decent, better than what we had generally seen in preceding months, but not substantially so.

CPI inflation came in at 0.2% for headline and core aggregates, and was right in the Fed’s target range. One month doesn’t make a trend, but one month’s data coming in favorably is better than a kick in the head, and inflation data actually look even better than the “headline” figures.

This week we recap muni market performance drivers from the first half of the year.

On top of a below-expectations tally, there was a sharp downward revision to previous months’ job counts. No, labor markets aren’t cratering, but there is clearly a slowing trend in the data.

With May consumer spending coming in flat and several revisions to March and April figures, we’re looking at a very mixed bag. Here we drill down on the underlying components of the spending data.

This week we highlight recently released 1Q23 state and local revenue data that show a rare decline in overall revenues.

Total housing starts rose by 21.7% in May, and starts of single-family units rose by 18.5%, following slight declines in April. This was a much stronger performance than we were expecting.

With the Fed’s decision last week not to increase the target fed funds rate for the first time since the start of this hiking cycle, here we evaluate historical performance of munis versus other asset classes following the final Fed hike.

Today’s release says headline sales rose by 0.3% in May, but in real terms, adjusting for inflation, both headline and control sales declined in May.

Insurers that add asset-backed securities (ABS) to their portfolios can benefit from risk diversification and a more capital-efficient way to manage their portfolios than using investment-grade corporates alone.

With todays’ announcement that the Federal Reserve (Fed) will keep rates on hold for now, many are already anticipating hikes at future meetings. But we think that distracts from the realities of the long-term outlook.

This week we highlight divergent demand trends within the municipal market.

UK Consumer Price Index headline numbers don’t tell the full story about inflation. Here we discuss our assessment of the latest inflation readings, as well as our expectations for what may lie ahead.

Data released today by the Census Bureau showed a deterioration in foreign trade for the US in April. Though the trend is downward, we think the large decline may be overstated—here’s why.

This week we highlight the progress of ridership recovery trends across the municipal transportation sector.

Labor markets turned in another month of healthy growth, with private-sector payroll jobs rising 283,000, boosted by a +23,000 revision to the April estimate. We’ve been projecting job growth would soften as reopening momentum waned and effects of Fed tightening bit in but we’re still waiting for that development.

There was much significant data released today. We cover consumption and inflation first, then finish up with the income data and how the landscape looks from here.

This week we highlight the IRS expansion of the Texas Permanent School Fund (PSF) guarantee program.

Today’s headline retail sales numbers have given us a torrent of conflicting information. Here’s our take on what’s beneath the data.

This week we highlight the scope of banking sector muni liquidations associated with regional bank challenges.

Even against today’s backdrop of elevated uncertainty, we have a strong view that investment-grade credit currently offers investors attractive return potential while also providing significant cushion in the event of an economic downturn.

Watching the economy slow has been like watching paint dry—nothing dramatic, but only gradually cumulative changes. Well, watching inflation slow has been like watching a game of whack-a-mole. Progress on one front has been typically countered by backsliding (bounces) on others.

With tax season behind us, this week our Muni Monitor highlights recently released IRS income data from the 2020 tax year.

Despite all the political rhetoric around the debt ceiling, we believe US default is a very unlikely outcome. Here’s our rationale.

The Federal Reserve—and most economists—have been expecting labor markets to weaken in response to the Fed’s rate hikes of the past 15 months. It is fair to say that we are all still waiting.

Although the Bank of Japan (BoJ) is now under new leadership, markets had expected its policy to remain largely the same. However, following the BoJ’s first meeting under Kazuo Ueda, we’re noticing some important differences in logic.

Following Climate Week, we highlight the progress of green and social issuance in the muni market.

Here are our insights from attending the spring IMF/World Bank meetings in Washington, DC last month. Hot topics included geopolitics, inflation, Fed policy, banking sector stress, ESG, emerging markets and more.

With JPMorgan taking over the assets of First Republic Bank after it failed, our view is that systemic fears should decrease going forward as we believe the US banking system is healthy.

Real GDP growth was below market expectations but above our forecast. Nominal GDP growth is the best ultimate measure of the impact of Fed policy; we take the deceleration to mean policy is reining in spending such that inflation will fall within the Fed’s target range. We weren’t there in 1Q, but we’re getting there.

This week we highlight key upgrades during the current credit cycle and their impact on muni index composition.

Is de-dollarization well underway? Is the USD in jeopardy of losing its status as the world’s preferred currency? Here we answer these questions and examine the position of the US dollar in light of the history of transitions in the global reserve currency.

After a very difficult 2022 for all risk assets, including bonds, here are four reasons why we believe investors should not overlook fixed-income in the year ahead.

Both single-family starts and new-home sales look to have stabilized over the last six months at levels roughly equal to pre-pandemic, after both dropped sharply in 2021 and early 2022. The problem we see for homebuilding is the gap between starts and sales that opened up in 2021 and continued through most of 2022.

This week we highlight rarely seen strong technicals for March that supported the market ahead of tax season.

The growth pace of the last eight months looks milder than pre-Covid. Then again, it’s occurred alongside the Fed’s tightening. The markets were looking for a net softening in retail sales trends, but the data have not delivered that. So where are sales gains occurring?

This week we highlight Census Bureau population estimates that were released at the end of last month.

Short of recession, it is hard to imagine a more inflation-friendly payroll report than what we saw in March. Here’s what we see, and what we hope Powell and his colleagues are perspicacious enough to notice, too.

As March Madness concludes, this week we highlight an update on state and local gaming revenues.

The current stress in the banking system is extremely complex, but in our view is likely not systemic. Here’s a breakdown of our outlook for both US and European banks.

Today’s BEA data releases covered February data for consumer spending, personal income and the PCE measure of consumer inflation that is the Fed’s target inflation indicator. We cover each in turn, here.

Given the recent banking stress, there’s been a flight to quality into Government money market funds. Here we highlight why these funds may now look attractive to both institutional and retail investors.

Here we highlight multiple factors that support a better risk-adjusted opportunity in public credit versus private credit markets that address the issues of multiples, defaults and refinancing risk.

This week we highlight the potential impact that recent banking sector stress could have on the municipal market.

We could say today’s figure is a deterioration, but we can’t deny new-home sales look to have stabilized after a 33% decline from late-2020 through mid-2022. The problem now is homebuilders were woefully late to adjust to the 2020-2022 downtrend in sales and are facing bulging inventories of unsold new homes.

Today’s Fed meeting involved a number of exceptional moving pieces. Among them, given challenges facing the US banking system, Powell’s implicit guarantee of depositors in US banks is particularly significant, perhaps even consequential. Here’s why it matters, and what it means for policymakers.

This week we highlight state and local revenue data released by the Census Bureau.

There was no reversal of January gains in February—quite the contrary. Generally, real retail sales and real consumer spending on goods have been declining for nearly two years, and we don’t see anything in income or consumer sentiment data that would point to a sudden upturn in spending. For now, the data indicate...

The sudden failure of Silicon Valley Bank sent shock waves throughout the country, with many comparing it to the global financial crisis. But we think the current situation is unique and contagion to the rest of the US banking system is unlikely.

This week we highlight implications around proposed tax increases associated with President Biden’s budget proposal released last week.

We were perplexed a month ago when January payroll data appeared to disrupt a number of apparent trends. Well, between February changes and revisions to January data, today’s report has brought those trends mostly back in line. Here’s how.

In the absence of a strong conviction about how the Fed’s hiking plans will unfold, shorter-maturity investment-grade corporate bonds may now present an attractive opportunity.

This week we highlight muni performance challenges in February, which reversed a strong start to the year.

Here we discuss our outlook for the Bank of Japan’s policy under the newly nominated leader, Kazuo Ueda, and what it could mean for monetary easing, inflation targeting, the bank’s balance sheet and more.

This week we highlight the recently released Illinois budget, which included themes that helped the state earn an upgrade by S&P last week.

Real consumer spending rose 1.1% in January, real spending on merchandise rose 2.2% and real spending on services rose 0.6%. But seasonal volatility this time of year and the difficulty government statisticians have adjusting data for seasonal fluctuations mean the data are volatile and suspect.

The current combination of higher yields and a flat credit yield curve present an opportunity for some corporate pension plans to cash flow match their liabilities with the smallest upfront investment in the last 15 years.

This week we highlight the recently released Puerto Rico Electric Power Authority (PREPA) plan of adjustment, and potential implications for holders of the final Puerto Rico government entity to restructure outstanding debt.

Reported retail sales for January were above consensus forecasts. Here’s why we’re cautious about what only at first appears to be a swing.

This week we highlight implications of the Texas Permanent School Fund program reaching capacity last month.

With emerging markets poised for a rebound following last year’s dismal returns, here we discuss the positive fundamentals of the asset class, as well as our secular concerns and the strategic implications for our portfolio positioning.

China’s abrupt reversal of its Zero-Covid Policy in December 2022 set in motion the massive effects of pent-up demand. Here we explore the implications on the country’s growth, currency, bond yields and more.

Following the blockbuster jobs number last week, here we evaluate state and local government payrolls and potential implications on municipal credit conditions.

With real exports up while nominal exports were down, it should be obvious that US export prices were declining in December. Here’s how we break down the numbers—including some reversals in trends since June—and what we think they mean for inflation and consumer spending.

Private-sector payroll jobs rose by 443,000 jobs in January, with large gains occurring in essentially every industry. By our lights, this means one of two things for the Fed, depending on its criteria for success and how it’s interpreting today’s numbers, which do indeed require careful analysis.

Markets have started to anticipate that the Fed may cut rates in the not too distant future. But, this is in contrast to the Fed’s latest projections reiterated today that rate cuts are unlikely in 2023.

This week we highlight upside surprises in the State of New York tax collections, and the relative value for securities issued within the state.

While GDP was above forecast, the details were actually decidedly weaker than expected—here’s how, and here’s what’s driving that GDP growth surprise.

Hybrid securities issued by Australian banks and insurers (also known as AT1 or Additional Tier 1 Securities) have been long used by Australian investors looking for enhanced income from their cash and fixed-income allocations. Here we examine the risk and rewards of these securities.

Following a second consecutive week of muni fund inflows, we evaluate the scope of the 2022 record outflow cycle and the factors that could shift demand into the asset class in 2023.

As daunting as today’s reported sales declines might sound, they are really merely in line with the patterns of the last 21 months. Here’s how we break it down, on three different counts.

Municipals continued to rally, as high-grade municipal yields moved 16-20 bps lower last week. This week we provide context on key drivers of the “January Effect” supporting YTD muni outperformance.

Headline Consumer Price Index (CPI) inflation came in at -0.1% in December, for an annualized rate of -0.9%. There are considerable signs that inflation is in the Fed’s desired range, not some months from now, but right now. Here are those signs, in our view.