About a year and a half ago, investors started to get concerned about the significant growth in BBB rated debt issues, which represent the lowest rung of investment-grade (IG) credit. Today, BBBs comprise nearly 50% of the IG market, which has more than doubled since the financial crisis 10 years ago. But what happens when the next recession inevitably arrives? Will many of the BBB rated issues deteriorate out of IG and into high-yield (HY) territory to cause a disruptive oversupply situation? Our view is that while this is certainly a risk, we’re seeing some encouraging behavior from corporate management that seems to be shifting in the right direction.

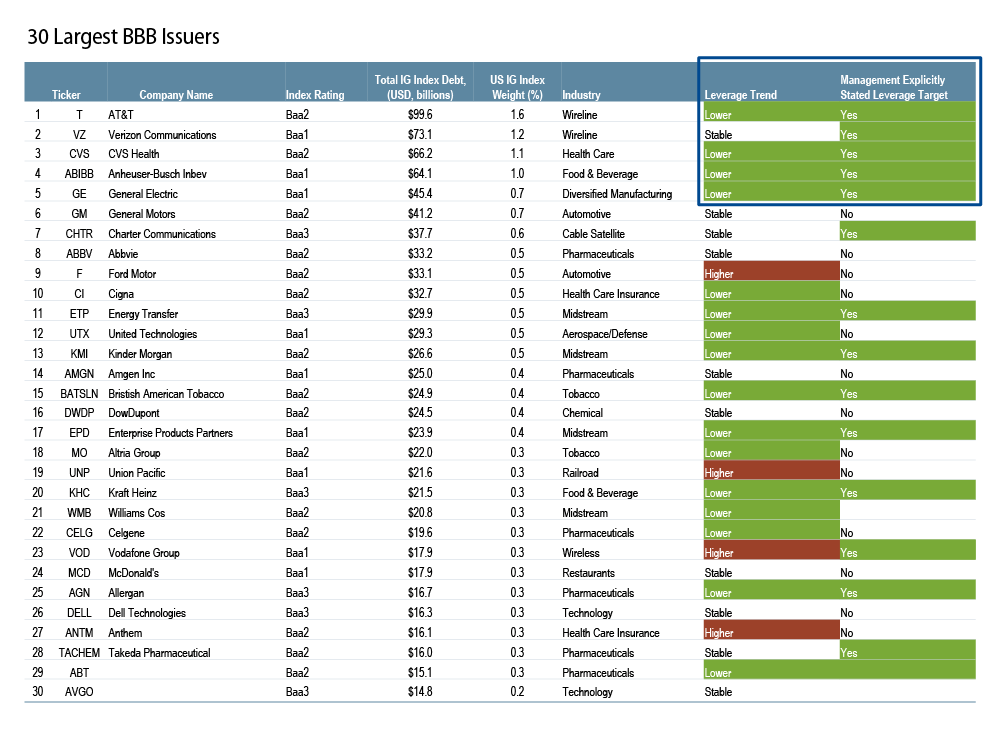

Here we list the top 25 IG issuers based on assets (rated BBB or better). We reviewed each company’s very near-term trends with respect to leverage and made a quick dashboard assessment—under “Leverage Trend,” green means decreasing leverage and red represents increasing leverage—to determine if a company’s debt situation is getting better or worse. In the far right-hand column, we also captured whether company management has stated outright that lower leverage is a desired goal (have they committed to a “debt diet”?). The good news is that many issuers’ management teams are being proactive, reducing leverage in an effort to improve their financial situation, strengthen their balance sheet ahead of any potential economic stress and avoid rating downgrades to HY. But liquidity concerns remain.

Market Liquidity

We all witnessed a dramatic pullback in markets this past December. But by the end of 1Q19, the losses were all but erased. Within the IG and HY markets, we rationalize this move as big buyers responding to the Fed’s early-January dovish pivot as well as recognizing attractive relative opportunities in these developed credit markets. We didn’t see any fundamental credit reason for these markets to dip, so we view the event as more of a technical selloff. Given additional regulations governing broker-dealers, there’s a limited amount of dealer capital available for secondary market-making activity—which exacerbates volatility by restricting liquidity. So when values dip and then become attractive, big buyers find those value points abruptly and quickly, and we get volatile, V-shaped recoveries.

The 2019 Milken Institute Global Conference

A few weeks ago I was honored to participate in a panel session, “Credit Markets: Back to Neutral?” at the Milken Institute’s annual MI Global Conference in Beverly Hills, CA. There was a good diversity of opinions on the stage, and we talked about many of the topics I mentioned here and also discussed the late-cycle market, bond covenants, collateral stripping and more. The full session is available for free on YouTube.