A range of factors—including cyclical forces, trade policy, shifts in demographics, technology, immigration policy and geopolitics—are impacting global labor markets. Western Asset CIO Michael Buchanan and the Firm’s key macro decision makers discuss how these dynamics may impact the trajectory of interest rates, central bank policy and the overall economic outlook.

KEY TAKEAWAYS

- Global Labor Market: Working-age populations in the OECD have declined steadily since peaking in 2007. Labor market conditions vary by region but in general are influenced by cyclical factors which include economic growth, inflation, and fiscal, monetary and trade policies. Secular factors including demographics, technology, immigration policies and geopolitics are becoming increasingly influential on longer-term trends.

- US Labor Market: The US has seen a modest rise in unemployment due to both increased labor supply and job losses. Moderation in wage growth and higher layoff rates indicate a normalization rather than contraction.

- Eurozone Labor Market: The eurozone has achieved a historically low unemployment rate, driven by recoveries in Southern economies and immigration which have mitigated the decline in the working-age population.

- Demographic Challenges: Aging populations pose significant challenges for policymakers across regions given their impact on labor force growth, economic growth potential and worsening fiscal sustainability.

- Regional Variations: Different regions face unique labor market challenges, from labor shortages in Japan to youth unemployment in emerging economies, requiring tailored policy responses.

Global labor markets are experiencing significant shifts due to various factors including cyclical and secular forces, trade policy changes, demographic trends, technological advancements, immigration policies and geopolitical developments. The postpandemic economy has been characterized by strong labor market performance in most regions, with massive fiscal support driving job creation and reducing unemployment rates to historic lows. However, recent trends indicate a slowdown in job creation and a gradual increase in unemployment rates. The US Federal Reserve (Fed) and most other central banks have responded by lowering policy rates despite inflation remaining above their target rates. This complex environment requires careful analysis of labor market dynamics and their implications for interest rates, central bank policy, and the economic outlook.

This edition of Macro Market Trends provides an review of labor market trends across various regions, including the US, eurozone, UK, Japan, Australia, Latin America and Asia. We highlight the impact of demographic changes, immigration policies, and technological advancements on labor markets and cover important regional factors to consider. While some regions are experiencing labor shortages and wage growth, others are facing challenges related to certain categories of workers.

GLOBAL PERSPECTIVES

United States

Mark S. Lindbloom

Deputy CIO & Head of Broad Market Portfolios

Nicholas J. Mastroianni, CFA

Portfolio Manager

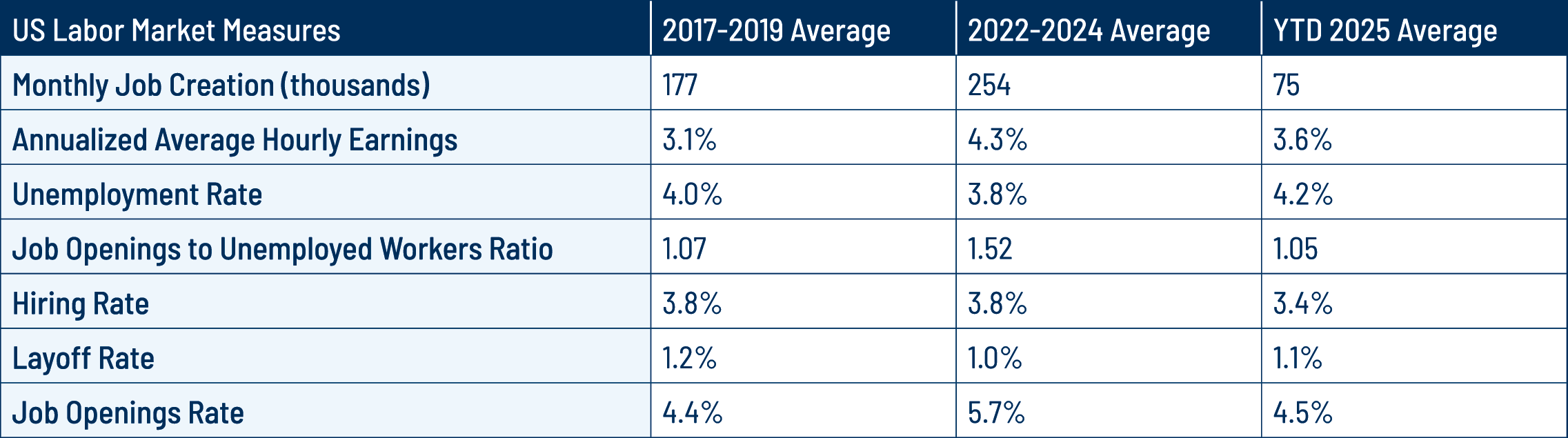

Labor market strength has been a defining feature of the post-pandemic US economy. Massive demand for goods and services, fueled by public sector fiscal support, has turbo-charged job creation, boosted wages and had pushed the unemployment rate to its lowest point in over 50 years. However, since bottoming in April 2023 at 3.4%, the unemployment rate has risen gradually to 4.3% due in almost equal parts to rising labor supply and job losses. More recently, restrictive immigration policies and the impact of aging populations have slowed labor force growth, raising questions about the level of job creation needed to keep the unemployment rate from drifting higher.

While headline job creation has slowed, the shift has thus far been accompanied by only a gradual uptick in the unemployment rate. The Fed has characterized the “low hire, low fire” job market as potentially worrisome. The scope of job creation has narrowed significantly, with the health care sector creating over 80% of the jobs in 2025. That said, wage growth, layoff rates and job openings give an impression of labor market normalization rather than contraction. Recent trade and immigration policies under the Trump administration have created shocks in the labor market, dampening demand through heightened uncertainty and constraining supply by reducing the inflow of new workers.

The Fed has acknowledged the slowing in job creation, the rising unemployment rate and growing downside risks as justification for lowering policy rates. This comes despite inflation holding above the 2.0% target for more than four years. With both sides of the dual mandate now in sharper tension, the Fed faces the challenge of supporting a cooling labor market while continuing to guide inflation toward a lower and more sustainable level—all of this at a time when the full impact of tariff-related price pressures on goods remains uncertain.

Recent Fed speeches emphasized the unemployment rate, rather than monthly job gains, as the primary measure of the health of the labor market. A further drift higher in the unemployment rate is likely to bring only limited policy easing. To see the larger declines in policy rates implied by market pricing, we will likely need to see a significant weakening in the labor market. Weekly initial and continuing claims for unemployment insurance have thus far remained near the stable levels of recent years and, in our view, will likely provide the clearest signal of when labor market stress might begin to weigh on aggregate income and spending.

We believe the current environment of sub-trend growth will transition to more trend-like growth in 2026. This improvement would likely be driven by supportive fiscal policies taking effect in 2026, reduced uncertainty related to global trade, lower short-term interest rates, and sustained business and consumer spending. A noticeable increase in unemployment claims would likely cause us to rethink our base case. We acknowledge that our conviction is subject to the higher-than-normal uncertainty regarding the political, geopolitical, fiscal and trade-related factors that influence economic activity. Our portfolio construction process continues to emphasize US yield curve steepening over duration as a source of risk ballast and diversification.

EUROZONE

Richard A. Booth

Portfolio Manager

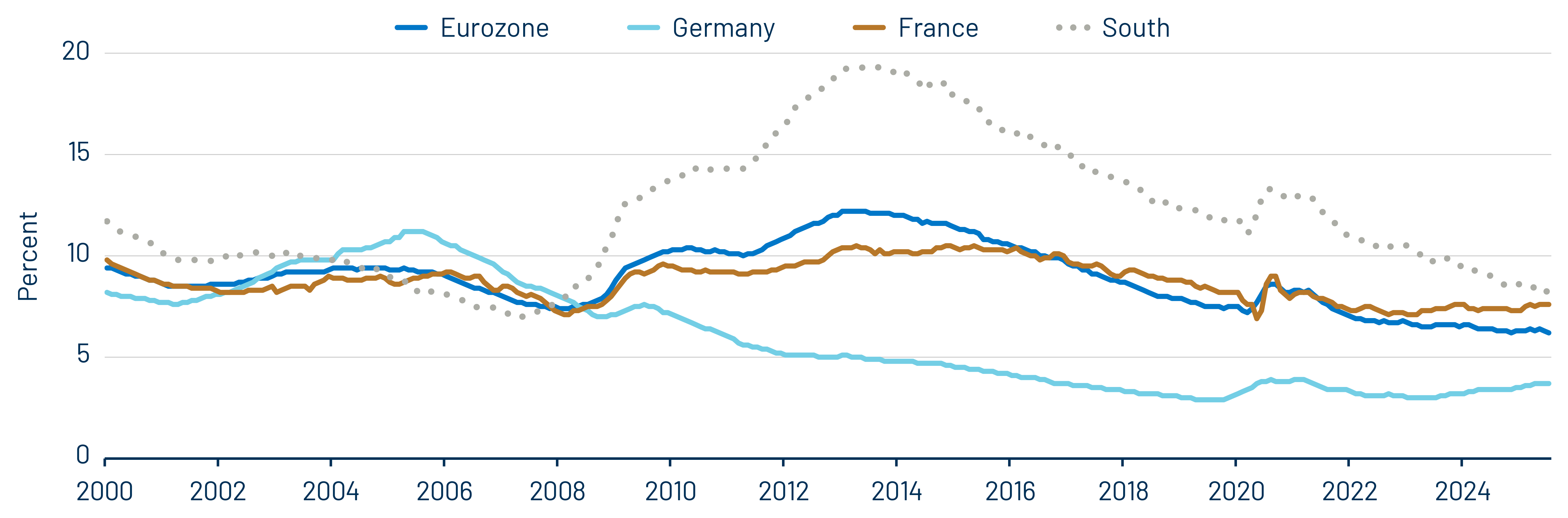

The current unemployment rate of 6.2% for the eurozone is the lowest since the data series began in 1998, down from the 9.0% average from 2000 to 2006, and markedly improved over the last 10 years.

Regional differences have lessened after their marked divergence following the global financial crisis (GFC) and eurozone debt crisis. The Southern economies’ (Italy and Spain) adjustment has driven the broad reduction in the unemployment rate. A gentle rise in unemployment in France and Germany, in part related to weakness in manufacturing, has been offset by continued strength in the South. These divergent trends may help to explain the recent tightening in Italian and Spanish spreads versus France in particular. An overarching secular factor driving European labor markets over the last several years has been an aging demographic tightening labor markets.

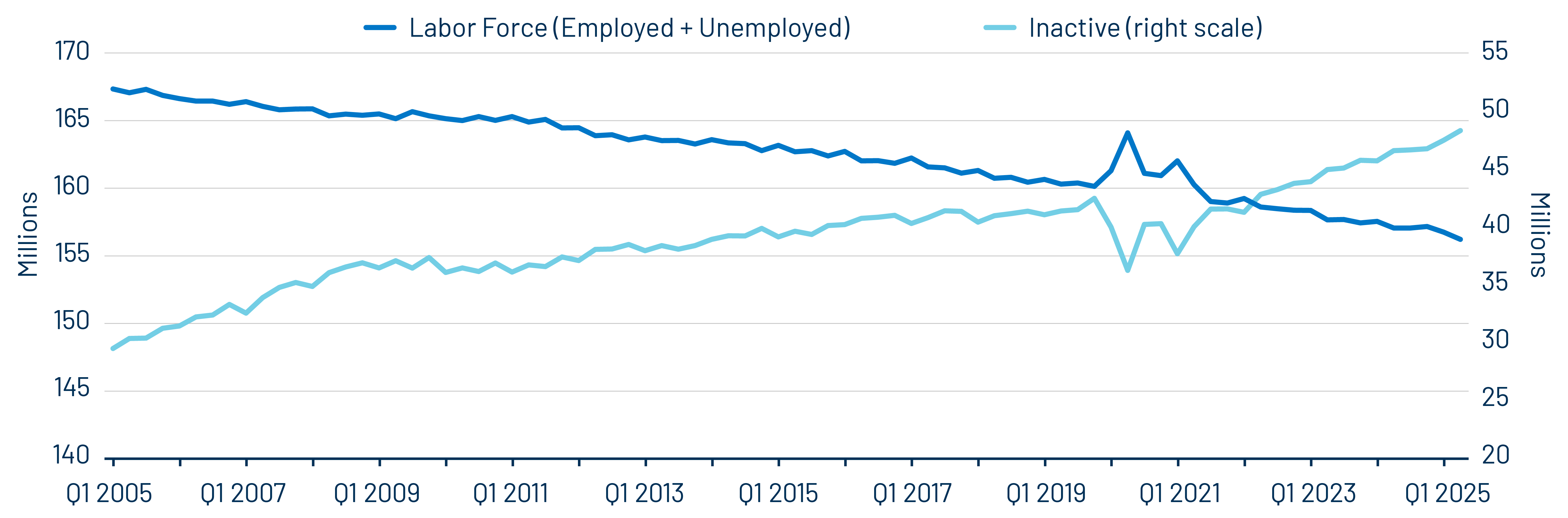

The decline in the working-age population from the GFC to the pandemic is worrisome, especially as projections forecast an even faster decline going forward, but there are mitigating factors.

The working-age labor force (those working or seeking work) has grown steadily while the number of inactive (not seeking work) 20- to 64-year-olds has fallen. In other words, more people are participating in the economy.

Since 2010 a large number of foreign migrants have joined the labor force, related to both geopolitics (Syria 2015, Ukraine 2022) and economic opportunities. This influx has stemmed the expected decline in the national working-age population and has been a factor behind the electoral shift toward political parties promoting tighter immigration policies. Tighter immigration rules recently may have been behind the larger rise in the eurozone domestic (as opposed to migrant) working-age labor force. Labor force growth and productivity drive economic growth, and weakness in total employment or hours worked would decrease growth.

Over the past 20 years the number of inactive over-65-year-olds has risen by 16.4 million, whereas the number of employed 20- to 64-year olds has risen by 19.9 million. This has seen the percentage of retirees to workers rise from 40% to 45%. This move, though modest, speaks to the ongoing fiscal challenge of rising health care and social expenditure to support an older population with relatively fewer tax-paying workers.

For the European Central Bank (ECB), the low unemployment rate it forecasts for 2026 should support growth. It would take a more substantial pick-up in unemployment in France and Germany and a stalling in labor demand in the South to impact ECB policy. For countries facing more pressing fiscal challenges and political wrangling, for example, France, the interplay between immigration, political fragmentation and fiscal policy has raised questions over widening sovereign spreads and valuations for longer-dated bonds (the term premium on yields on longer-dated government debt is in part a reflection of investors’ confidence in the ability of governments to manage the growing burden on public finances). In portfolio construction, we balance a modest overweight stance in intermediate core-eurozone bonds with a long position in the euro.

UK

Dean French

Portfolio Manager

The UK is subject to similar demographic trends, with the share of public spending on pensioners’ benefits and healthcare increasing, while a falling fertility rate will see the working-age population shrink in the decades ahead. While importing labor from overseas could mitigate this trend, a recent YouGov poll1 showed that immigration now tops the list of voters’ most important issues, with 70% of those surveyed saying that immigration is too high. This certainly poses meaningful challenges for policymakers with important implications for the longer-term outlook. Technology may be able to mitigate this challenge to some degree over time but near term the biggest driver of the labor market has been higher employment costs, which have led many UK businesses to reduce hiring. Forward-looking indicators suggest that the labor market will loosen further. If slack continues to build, we would expect wage growth to slow further, which would dampen domestic inflationary pressures. This is a key part of our view that the Bank of England will cut Bank Rate by more than the market is currently pricing. To express this view, have an overweight duration position via front-end rates, and UK gilts at the 5- and 10-year points of the curve.

Japan

Hiroyuki Kimura

Head of Investment Management, Tokyo

In Japan, the demographic problem (i.e., decline in population), has a significant impact on the labor market. The working-age population (aged 15-64) peaked at 87 million in 1995 and has decreased by 16% to 73 million in 2025. Interestingly, however, due to the increase in labor force participation led by the entry of women and the elderly into the labor market, the labor force and the number of employed people increased from 67 million in 1995 to 70 million in 2025, and from 64 million to 68 million, respectively.

The problem is labor shortages. These have become apparent over the last couple of years because of the slower pace of labor force growth and the gradual economic recovery. The Bank of Japan's (BoJ) Tankan employment condition Diffusion Index shows a significant labor shortage. With the unemployment rate falling to 2.3% in August 2025, the Japanese economy is now close to full employment. Wage growth has increased since 2022 and there is a change in corporate pricing behavior toward price increases, suggesting higher inflation expectations. As a result, core CPI has been above the BoJ's policy target of 2% inflation for three years.

On the economic front, with a tight labor market and increases in nominal wages, consumer activities are gradually recovering amid the higher inflation. In addition to digital investment, corporate capital investment is also at a high level to fill the labor shortage, which is a driving force for the economy. On the other hand, labor shortages are a constraint on corporate activities and economic growth.

The BoJ continues to maintain an accommodative monetary policy. The real policy rate is at around -3% on the grounds that long-term inflation expectation is not anchored at the policy target of 2% yet. However, Japan's inflation structure is clearly changing, mainly due to labor shortages, and the normalization of the BoJ’s monetary policy is expected to progress further.

We expect long-term interest rates to rise along with the BoJ's additional interest rate hikes over the short run. Over the long term, however, population decline is a restraining factor for growth rates and inflation due to slower demands, and it is unlikely that interest rates will shift upward.

From another perspective, the decline in the sustainability of social security systems is another big issue. While medical and nursing care costs will expand as the society ages, the number of working generations who bear the burden will decrease. We expect this to cause fiscal expansion and higher long-term interest rates unless fiscal discipline is tightened and productivity improves.

Australia

Anthony Kirkham, CFA

Deputy CIO & Head of Investment Management, Asia Pacific

Australia’s labor market is navigating a complex mix of cyclical, structural and geopolitical forces. While unemployment remains low at 4.2% as at August 2025, almost a percent lower than pre-pandemic levels, job growth has slowed recently. Fortunately, business labor intentions are improving, according to the business surveys.

Cyclical forces caused by the higher Reserve Bank of Australia (RBA) monetary policy setting have been the main driver of slowing employment growth, but critically, since the central bank started to ease policy in May 2025, there are already signs of an improvement in private demand.

On the trade front Australia has been fortunate enough to receive the lowest tariff setting of 10% with the US, helped by the fact that Australia runs the second largest US trade surplus. The thaw in Australia–China relations has buoyed export sectors. Simultaneously, diversification efforts with India and Southeast Asia are creating new employment opportunities. Although the direct impacts from trade policy are light, indirect effects are likely as other major trade partners (particularly China) are challenged by tariffs. This has impacted the timing of some investments but in the short term we expect local events to drive immediate growth returns.

The federal government’s introduction and spending on a National Disability Insurance Scheme (NDIS) has led to growth in the health care sector over the past decade. It also led to significant cost increases, which has led to meaningful controls being put in place and a moderation of employment growth in the health care sector. We expect health care will remain an area of growth as the Baby Boomer generation ages.

Immigration has helped to fill labor gaps not only in health care but also in construction and technology. This was complicated during the pandemic border shutdowns, but post pandemic, it has helped to control wage pressures.

Offsetting this reduction in wage costs is the pressure on the housing sector from a rapidly growing population base. The housing sector was already constrained by the large infrastructure projects at a state and federal government level that absorbed skilled labor and further limited the supply of homes. This will continue to be a balancing act that the RBA will need to monitor, as further immigration will continue to put pressure on home prices and rents—another factor to constrain monetary policy settings.

The RBA’s ability to get inflation back into the target band has driven real wages higher and the tax cuts implemented last year are preventing some bracket creep as well. This, combined with the easing of monetary policy by the RBA of 75 bps this year on a variable-rate mortgage market, means that the consumers’ disposable income has improved significantly. This has allowed the consumer to rebuild savings impacted by the cost-of-living challenges over the past few years and has put them into a position to drive consumption growth. This is likely to make the interest rate cycle relatively shallow, especially if the immigration gates remain open and the demand for housing continues to pressure pricing.

Latin America

Prashant Chandran, CFA

Interim Head of US-Based Emerging Markets Team

Each Latin American (LatAm) country has its own story of economic development, trade partnerships, fiscal and monetary policies, demographic trends and utilization of technological advancement for productivity gains. But generally, most LatAm countries have relatively high real rates with moderating inflation, providing emerging market (EM) central bankers with capacity to cut rates and stimulate growth if necessary.

Using the OECD’s Trade in Employment (TiM) database, we can compare the proportion of domestic labor markets that are dependent on trade with the US. As expected, the picture varies widely across the region.

*Without United Kingdom

Unsurprisingly, Mexico’s labor market is the most exposed to slowing trade with the US, with over 15% of the domestic labor force directly or indirectly linked to US demand for Mexico’s exports. While a decrease in US demand for imports would negatively impact the demand for labor in Mexico ceteris paribus, the re-orienting of trade flows toward “nearshoring” may result in increased demand for labor in Mexico as the comparative advantage Mexico benefits from (geography, relatively cheap labor costs, etc.) strengthen under some tariff policies.

With Mexico the clear outlier, the rest of LatAm illustrates the trade diversity of the region. Export-oriented economies like Peru and Chile have significant dependencies on US demand for labor, but benefit from a diversification of export markets (e.g., China) that can cushion a fall in demand from the US. Colombia’s labor markets are slightly more dependent on the US than the average, while Brazil’s export markets have shifted significantly more toward China in recent years, leaving relatively little exposure to US demand.

Over the long-term, LatAm’s demographic advantages will yield dividends. The dependency ratio measures the ratio of “dependent” persons to the working-age population. The higher the ratio, the fewer workers an economy must have to support its dependent population and vice versa.

When comparing LatAm to other regions, the differences are stark. While much of the developed world saw its lowest dependency ratios in the last few decades, LatAm countries are just approaching theirs. This dynamic is likely to extend, if not strengthen, the relative cost advantage that labor markets in LatAm have benefited from over the last several years.

The growth benefits of LatAm’s demographic dividend are expected to materialize over the coming years. In the near-term, labor markets in LatAm will respond to changes in demand as global trade relations shift. It will likely take at least several quarters to see results, but if labor demand falls more than expected, central banks across the region will react accordingly, cutting rates to dampen the blow to domestic demand.

In summary, while cyclical pressures from US trade and immigration policy could pose challenges to some LatAm economies, the effects will not be uniform across the region. Policy responses will vary based on trade relationships and dependencies to the US while longer-term secular trends will remain intact. A young and expanding labor force should keep wage pressures in check while allowing local governments to invest more in infrastructure and technology, further improving labor force productivity.

Asia (ex. Japan)

Desmond Soon, CFA

Head of Investment Management, Singapore

Asia is an economically diverse region with countries that have developed economies such as South Korea, Hong Kong and Singapore as well as mid-tier economies like China, Malaysia and Thailand along with EM economies such as Indonesia, India and the Philippines. The labor markets in Asia are just as diverse.

Developed Asia

Developed Asia labor markets are more resilient with better paid workers and less underemployment and unemployment. In countries such as South Korea, unions are strong advocates for worker compensation and rights. In China, the problem of youth unemployment and an army of short-term, flexible workers may pose a longer-term issue, but authorities have a long track record of maintaining social stability and levers for government support and assistance. Further, developed Asia economies have current account surpluses and high savings and they generally do not depend on foreign inflows to fund deficits. Hence, they have more headroom to use fiscal and monetary policy to grow their economies and generate jobs

Emerging Asia

Emerging Asian economies with large labor pools, such as India, may suffer from business processing jobs lost from the AI revolution and Trump’s tariffs and visa curbs. In other parts of the region, recent protests in Indonesia and Nepal are emblematic of the labor market stress of underemployed and unemployed youths regarding their economic conditions and opportunities. In response, President Prabowo has expanded fiscal support through social assistance programs, including the free meal program, discounts for electricity bills and minimum wage increases. These populist measures may foreshadow how other emerging Asia policymakers could respond if faced with similar challenges.

CONCLUSION

"Global labor markets are undergoing significant changes driven by both cyclical and secular factors, with regional variations requiring tailored policy responses. Active management is crucial in navigating these complex labor market dynamics, which will have profound effects on politics, economic growth, central bank policy and capital markets."

,

Labor markets globally are undergoing changes, which, while varying widely by region, will have a profound effect on politics, economic growth and capital markets. Both cyclical and secular factors and policies are driving these changes and governments face difficult challenges to balance the effects of declining working-age populations, growing burdens on public spending, hostility to migrant labor and the need to create sufficient opportunities for young people. So far, markets have brushed off these challenges, but the risks of policy errors could drive increased volatility and term premia on longer-dated bonds.

ENDNOTES

1. https://yougov.co.uk/topics/society/trackers/the-most-important-issues-facing-the-country