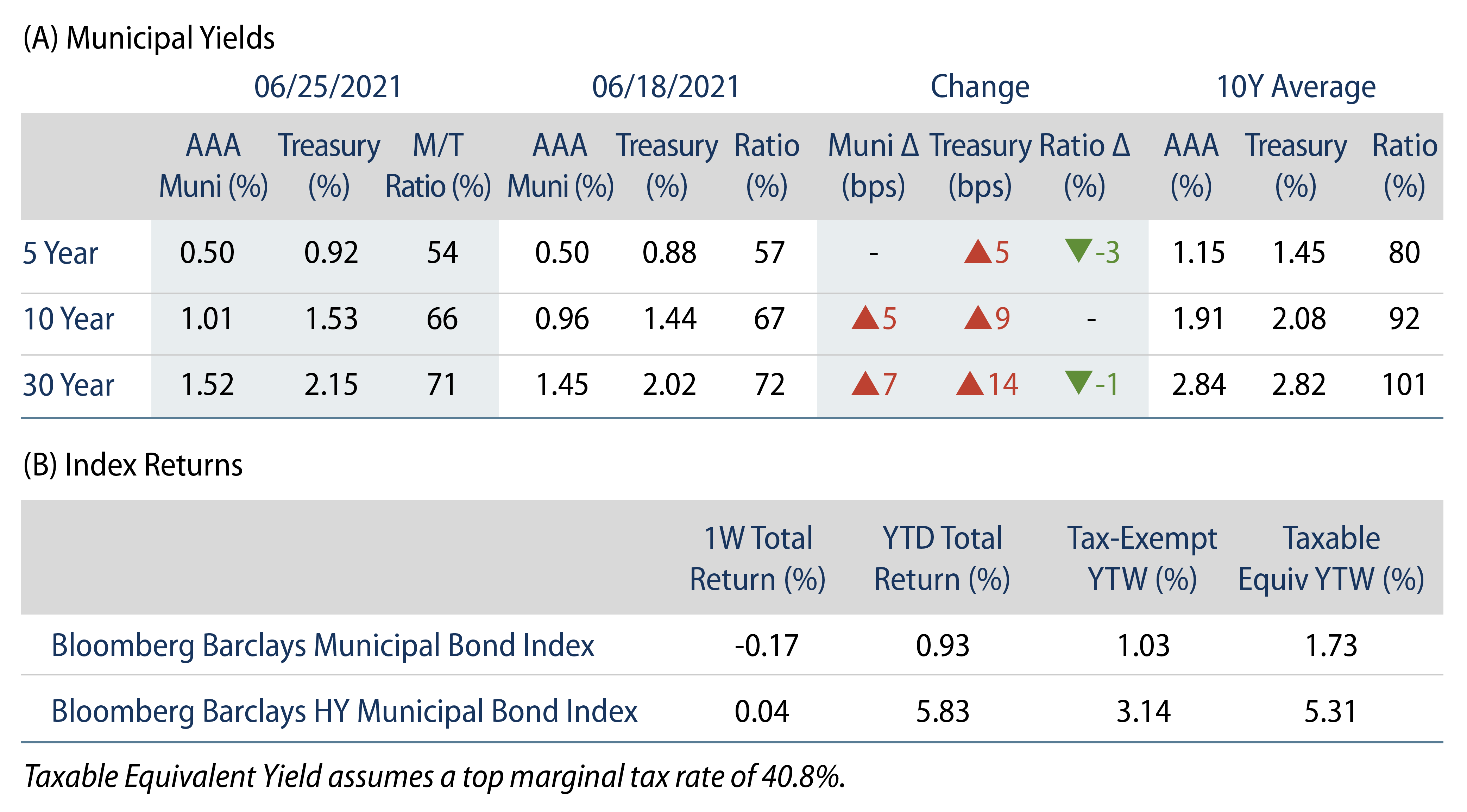

Municipal Yields Moved Higher with Treasuries

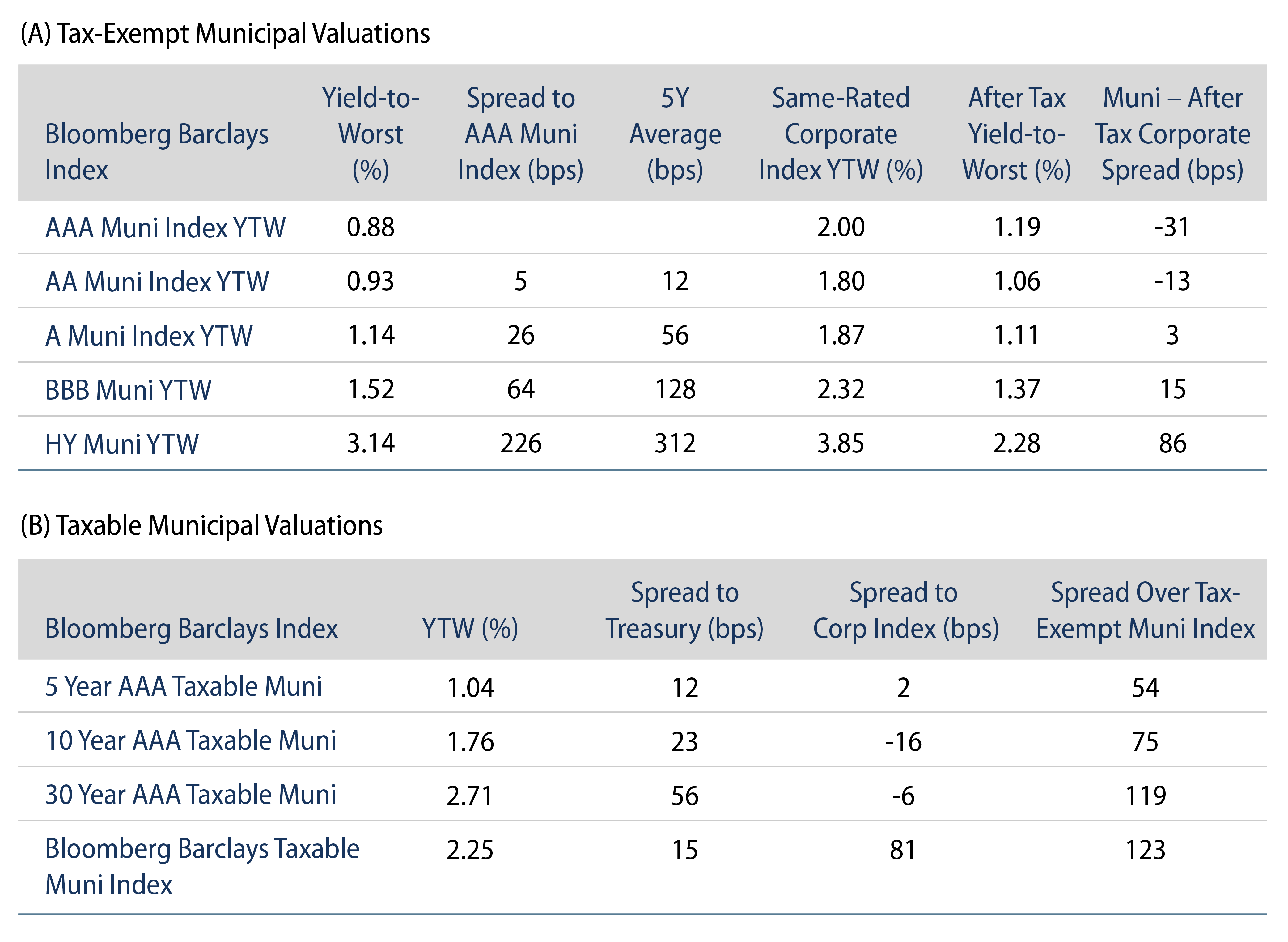

AAA municipal yields moved up to 7 basis points (bps) higher across the curve as municipals outperformed Treasuries (USTs) amid strong technicals. The Bloomberg Barclays Municipal Index returned -0.17%, while the HY Muni Index returned 0.04%. High-grade municipal yields trailed USTs higher during the week. Municipal mutual fund flows maintained a record pace as supply declined. This week we look at the bi-partisan infrastructure deal that was agreed upon by President Joe Biden and a bi-partisan group of Senators last week.

Technicals Remained Favorable as Supply Declined and Flows Remained Positive

Fund Flows: During the week ending June 23, municipal mutual funds recorded $1.9 billion of net inflows, in line with the prior week. Long-term funds recorded $1.3 billion of inflows, high-yield funds recorded $512 million of inflows, and intermediate funds recorded $203 million of inflows. Municipal mutual funds have now recorded inflows 57 of the last 58 weeks totaling $119 billion, with year-to-date net inflows maintaining a record pace of $57.7 billion.

Supply: The muni market recorded $11 billion of new-issue volume during the week (-23% week-over-week). Total year-to-date issuance of $218 billion is 11% higher from last year’s levels, with tax-exempt issuance trending 14% higher year-over-year and taxable issuance 2% higher. This week’s new issue calendar is expected to decline to $6 billion of new issue volume. The largest deals include $557 million Gulf States Gas District and $450 million New York City Municipal Water Finance Agency transactions.

This Week in Munis: Bi-Partisan Infrastructure Plan

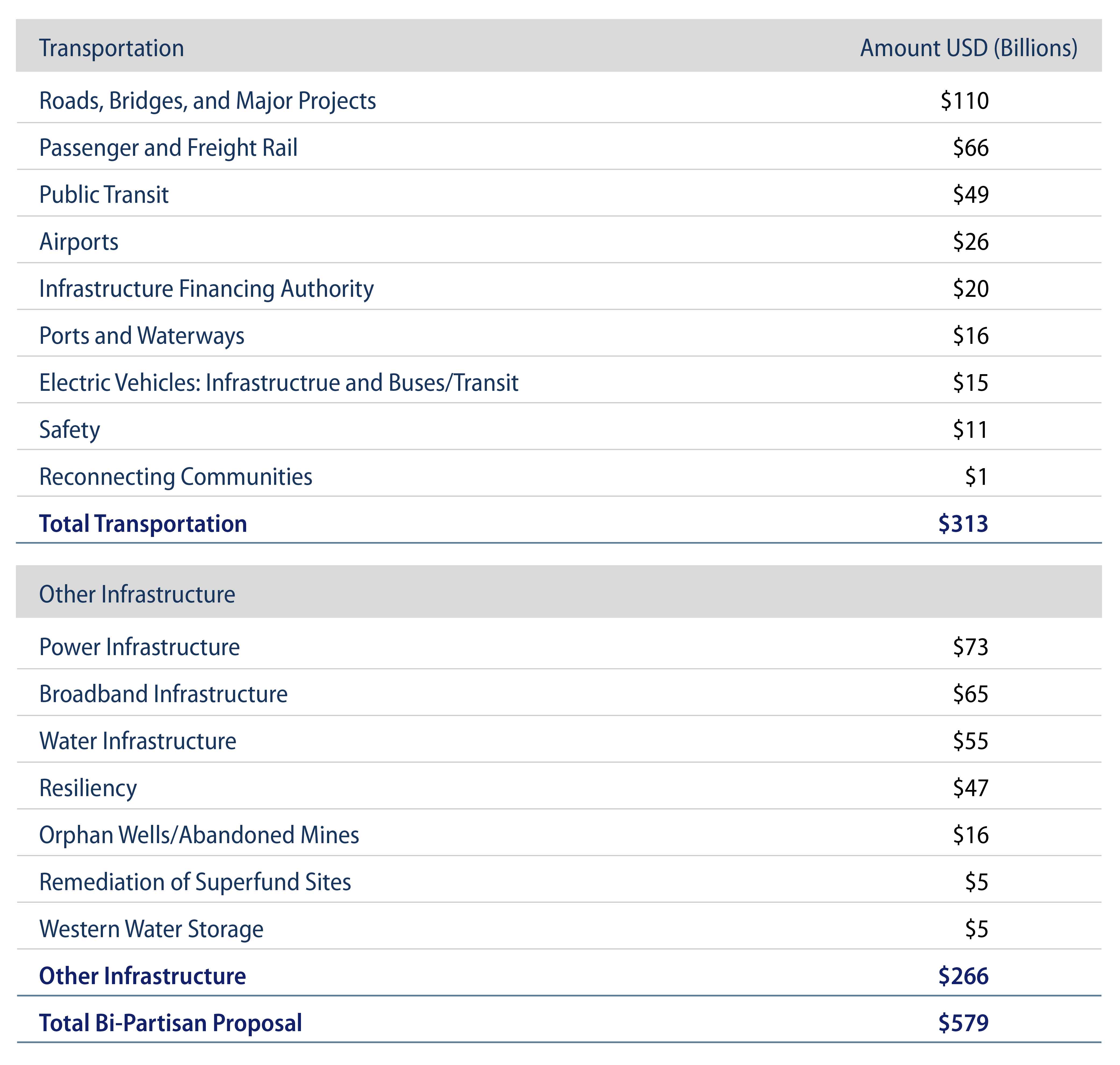

Last week, President Biden and a bi-partisan group of 10 Republican and 10 Democrat senators announced an agreement on a $579 billion infrastructure proposal. The proposal is significantly scaled back from President Biden’s original $2.3 trillion proposal from earlier in the year (as highlighted in our previous blog), has a greater focus on “hard infrastructure,” with less spending on electric vehicles, housing, and workforce development, and community-based healthcare initiatives.

The plan directs $313 billion toward new transportation initiatives and $266 billion of additional spending on “other infrastructure” initiatives. Proposed transportation spending is focused on roads and bridges ($109 billion), passenger and freight rail ($66 billion), and public transit ($49 billion), with additional spending on airports, marine ports and electric commuting. Other infrastructure is focused on power ($73 billion), broadband ($65 billion), water ($55 billion), and other storage, safety and remediation efforts.

Additional federal dollars allocated to transportation, electric utility and water municipal sectors should be supportive of municipal credit, but it remains uncertain how the plan would be ultimately funded. The proposal explicitly excludes income tax increases while outlining a variety of funding mechanisms, including private partnerships, a direct pay BABs-like solution, expanded private activity bonds, expanded eligibility of State and Local COVID relief funds, user fees, gas tax, and electrical vehicle taxes as potential sources of revenues.

While bipartisan efforts to address long-awaited infrastructure challenges have progressed, the ability to advance such legislation could remain difficult. The removal of more progressive measures such as climate initiatives and the child care tax credit could lead to the loss of support from key progressive Democrats, and we would expect any solution that would garner acceptance from a Senate majority to be challenged to pass the House. Whether or not this pared-back measure advances, the Democrat majority could still attempt a second bill under reconciliation, which we expect would include more “social infrastructure” initiatives and be funded through tax increases. However, this path would take time and the scale could be more modest than many expect, which could result in a more limited impact on the muni market than market participants originally anticipated.