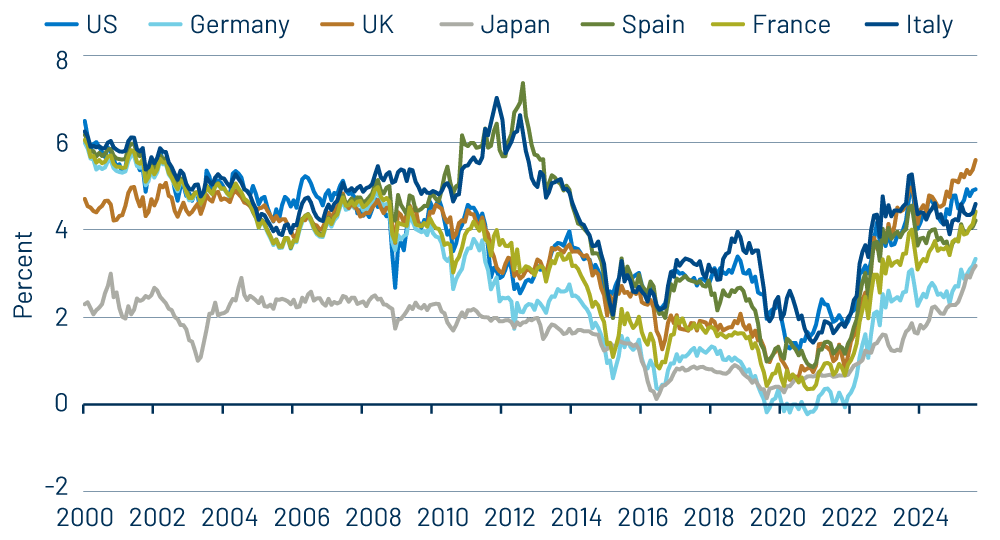

Governments across the developed market (DM) world are facing rising borrowing costs as long-dated bond yields surge to multi-decade highs. The selloff is not confined to the US; across Europe and Asia-Pacific, yields are reaching levels last seen in the early stages of the post-Covid tightening cycle. The underlying drivers are fiscal fragility, political headwinds, persistent inflation concerns and questions about central bank credibility.

In France, 10-year government bond yields at 3.6% are now among the highest in the European bloc after Prime Minister Francois Bayrou announced a surprise confidence vote for September 8. His attempt to pass a budget aiming to cut the fiscal deficit from around 5.4% this year to 3% in four years comes against a backdrop of political fragmentation and weak parliamentary support, a legacy of last year’s snap election. French assets may struggle to find convincing relief until public finances, currently running at 115% of GDP, appear more sustainable.

The UK faces similar strains. Thirty-year gilt yields have surged to roughly 5.7%, their highest since 1998, as stubborn inflation may limit the Bank of England’s (BoE) room to maneuver. Investors remain divided on whether the BoE will cut again this year or stay on hold if inflation drifts higher. Higher interest rates and sluggish growth have combined to keep acute pressure on public finances, with the Chancellor expected to have to take further action to restore headroom against her self-imposed fiscal rules.

Elsewhere in Europe, structural change looms in the Netherlands. The country hosts the EU’s largest pension market, with close to €300 billion in bond holdings. A transition from defined benefit to defined contribution schemes is set to reshape demand, potentially reducing the need for long-dated bonds just as political instability at home unsettles investors.

In Asia, Japan’s challenges are just as pressing, with the yield on the 10-year Japanese government bond (JGB) currently at 1.6%, the highest level since 2008, and the yield on the 30-year JGB reaching an all-time high this week. The government faces fiscal concerns alongside rising inflation pressure and carries the highest debt burden among advanced economies. We expect the Bank of Japan to hike rates, as inflation has been above target for three years running and the real policy rate remains substantially negative.

Further south, yield curves in Australia and New Zealand remain some of the steepest in the world. Short-term debt has stayed anchored thanks to signals from both the Reserve Bank of Australia and the Reserve Bank of New Zealand pointing to more rate cuts ahead. In contrast, yields on long-dated Australian bonds have moved higher—not due to worries about deficits, as Australia has posted budget surpluses in recent years—but largely in response to shifts in sentiment driven by moves in the US and other major markets.

All these pressures point toward a decisive test in the weeks ahead. September is traditionally one of the busiest months for sovereign debt issuance, and governments in Japan, the US and Germany are lining up major auctions. Recent sales have already shown cracks in demand, with Japan’s 20-year auction posting a weaker cover ratio and 30-year US Treasuries (USTs) drawing a bid-to-cover of just 2.27, the lowest since November 2023. In Germany, up to €100 billion in new issuance is expected through September and October, putting additional strain on the market.

We are monitoring global bond demand closely. Any faltering in the market’s ability to absorb new supply would be concerning, as it would not only reinforce the narrative that risk-free assets are a thing of the past, but also push DM government bond risk premia higher. For now, the latest Treasury International Capital (TIC) data offers reassurance, pointing to continued resilience in global bond demand, particularly for USTs. Despite reports that some central banks have reduced their UST holdings over the past year in favor of gold and foreign deposits, foreign investors continue to purchase US assets at a near-record pace, while US investors are steadily building positions in long-term foreign assets.

Historically, periods of bond market volatility have attracted price-sensitive buyers such as hedge funds, pension funds, mutual funds and insurance companies. Given the economic and political headwinds facing many countries, we anticipate further bouts of market volatility in Q4. Nevertheless, we expect these sources of demand to remain in place and provide a stabilizing force should bond yields creep higher.