Municipals Posted Positive Returns During the Week

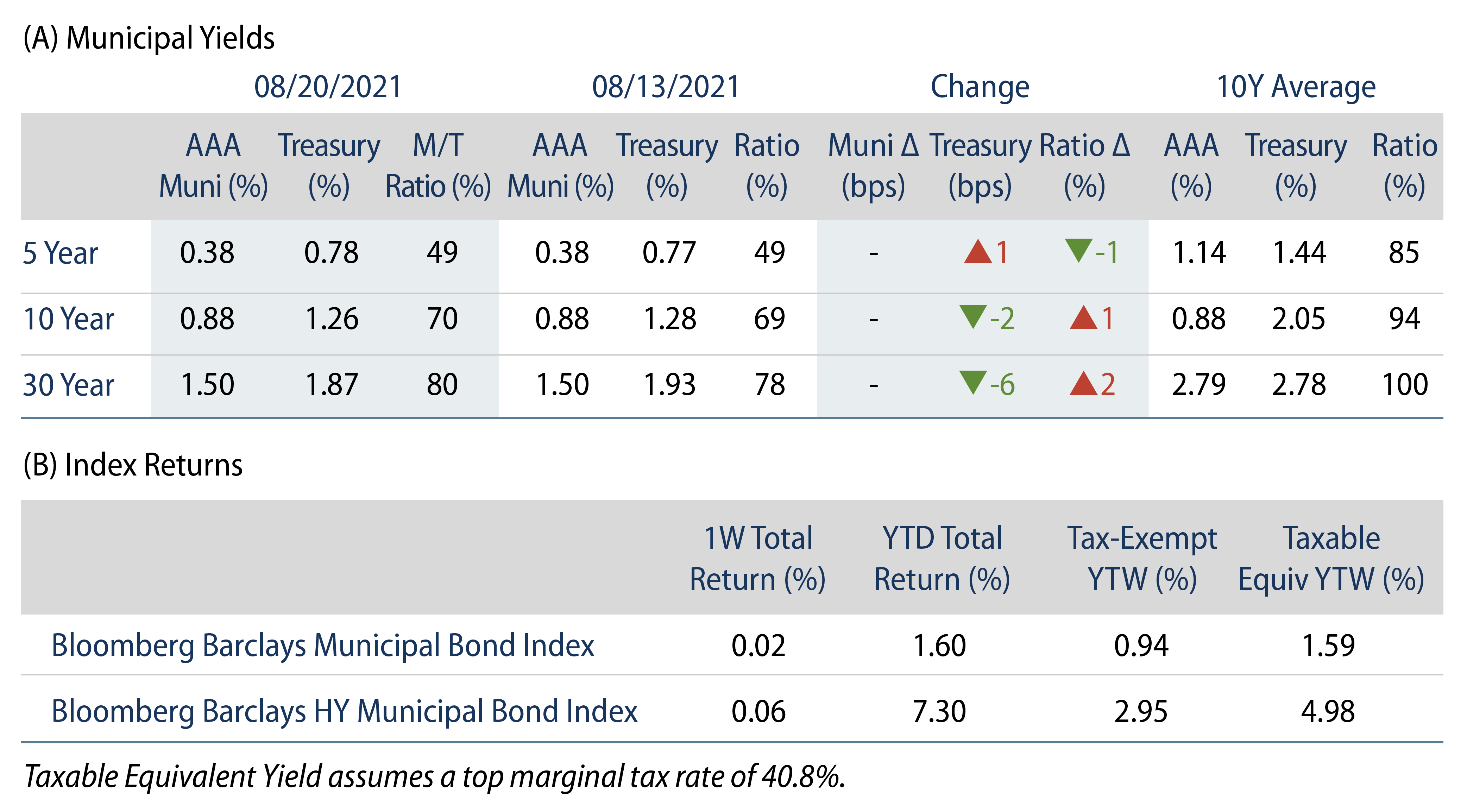

AAA muni yields moved higher across the curve, which continued to steepen; yields moved 1 bp higher in 5-years and 7 bps higher in 30-years. US munis underperformed the Treasury rally seen in intermediate and long maturities. The Bloomberg Barclays Municipal Index returned 0.02%, while the HY Muni Index returned 0.06%. Technicals remain strong as municipal mutual fund flows maintain a record pace. This week, as we approach back-to-school season, we evaluate the potential implications of large Florida school districts shunning the ban on mask mandates.

Strong Demand for Municipals Persists

Fund Flows: During the week ending August 18, municipal mutual funds recorded $1.8 billion of net inflows. Long-term funds recorded $1.0 billion of inflows, high-yield funds recorded $389 million of inflows and intermediate funds recorded $402 million of inflows. Municipal mutual funds have now recorded inflows 65 of the last 66 weeks, extending the record inflow cycle to $141 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $79 billion.

Supply: The muni market recorded $13.5 billion of new-issue volume during the week, up 59% from the prior week. Total issuance YTD of $292 billion is 10% higher from last year’s levels, with tax-exempt issuance trending 19% higher year-over-year (YoY) and taxable issuance trending 10% lower YoY. This week’s new-issue calendar is expected to decline to $7.9 billion of new issuance. The largest deals include $600 million Pennsylvania Turnpike Commission and $427 million South Carolina Public Service Authority (Santee Cooper) transactions.

This Week in Munis—Back to School and Florida’s Mask Mandate Controversy

Last week, the Florida Board of Education sanctioned school districts in Alachua and Broward Counties, following Governor Ron DeSantis’ comments earlier in the month conveying that he would withhold state funds from any school that enforces a mask mandate to combat the pandemic. In addition to Alachua and Broward Counties, Leon, Miami-Dade, Hillsborough and Palm Beach Counties also have enforced mask mandates.

Florida municipal securities are often attractive for municipal investors due to a lack of state income tax, and a resulting lack of natural demand for in-state municipal securities. However, we are selective in our allocation to Florida school district bonds. The state of Florida’s school funding has ranked near the bottom of all states, and despite recent growth, school district cash balances have lagged national medians. Meanwhile, Florida’s costs have escalated as the result of a mandate to restrict class sizes amid increasing school enrollments.

Any withholding of state funds associated with the mask mandates raises additional concern as Florida school districts are reliant on state funding to fund annual budgets. State funding as a percent of total revenues comprised approximately 53% of total revenues over the five years ending 2019, and state funding comprised 48% of the Broward County School District’s operating budget in 2020.

While state funding represents a sizeable proportion of revenues, at this point, the sanctions appear to be modest in just targeting select school officials’ salaries, and not in an amount that would drive significant credit deterioration. Also mitigating credit concerns include improving socioeconomic trends that have supported Florida property tax revenues and the overall credit profile of the state’s ability to support its schools. The Governor boosted school funding last year and while he intends to reduce funding for the coming year, state reserves are strong at 11% of expenses and federal government aid under the American Rescue Plan is nearly 10% of the state’s budget. President Biden has also begun to investigate what the federal government can do to blunt the impact of any action against mask mandates, including expanding the use of federal funds, which could help offset material credit impact from funding reductions.