Private-sector payroll jobs rose 52,000 in October and 69,000 in November, according to data released today by the Labor Department’s Bureau of Labor Statistics (BLS). In other news today, the Commerce Department (Census) reported that headline retail sales were unchanged in October, but that the more closely watched “control” sales measure rose a robust 0.8%, after having seen no change in September. (The control measure excludes sales at car dealers, service stations, building materials stores and restaurants in order to focus on store types frequented predominantly by consumers rather than other businesses.)

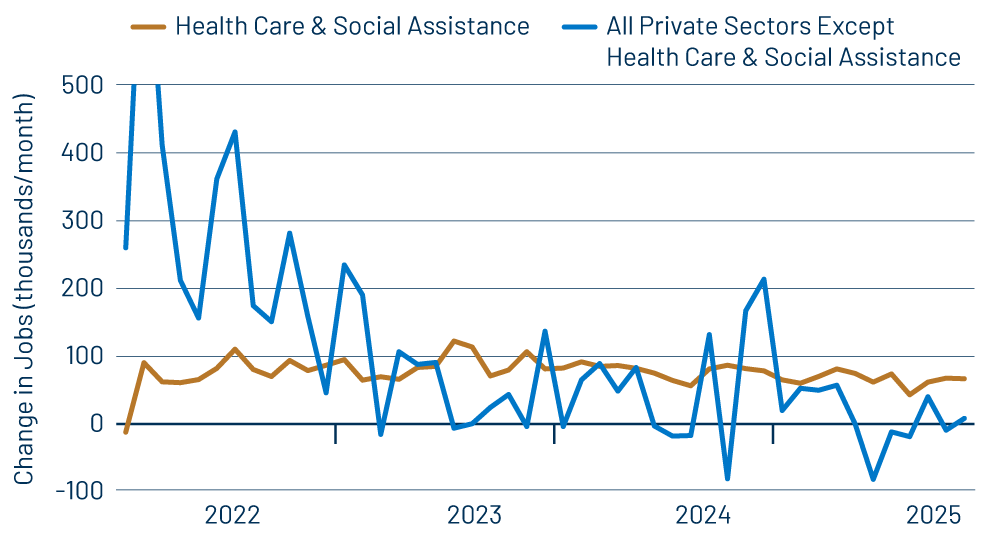

With respect to the jobs data, it continued to be the case that almost all the private-sector job gains occurred in health care and social services, as seen in Exhibit 1. Financial market commentaries we have seen today assert that these data portray a “continued weakening” in the labor market. However, we take some issue with that assessment.

There is no question that job growth has been sluggish, but Exhibit 1 shows clearly that this has actually been the case for nearly three years. What’s more, job growth outside health and social looks only slightly softer than what we saw last year, with that softening being in place all year long rather than setting in recently. Still, there is no question that the job market could use a little pepping up.

When the September jobs data were released last month, we commented (cf. our 11/20 post) that the October/November numbers, when they were released, might be a little hairy, but that the September data were likely more credible than “preliminary” jobs data usually are. Both those assertions reflected the likely effects of the shutdown on BLS’s data collection techniques. Well, the latter assertion was certainly on point, and the former assertion was somewhat accurate.

That is, the September jobs data today showed essentially no revision from what was announced last month. As for the October/November data, the details showed a wider-than-usual dispersion between production and supervisory jobs, with the former flat in October and up 126,000 in November, while the latter showed a gain of 52,000 in October and a loss of -57,000 in November. These swings might be just statistical noise, but they catch the attention of wonky sorts such as ourselves.

Another interesting factoid was an October decline of -162,000 jobs for federal workers other than postal. (Keep in mind that our jobs data up to this point focused on the private sector.) Apparently, a good portion of the “Trump layoffs” of federal workers occurred with the onset of the shutdown.

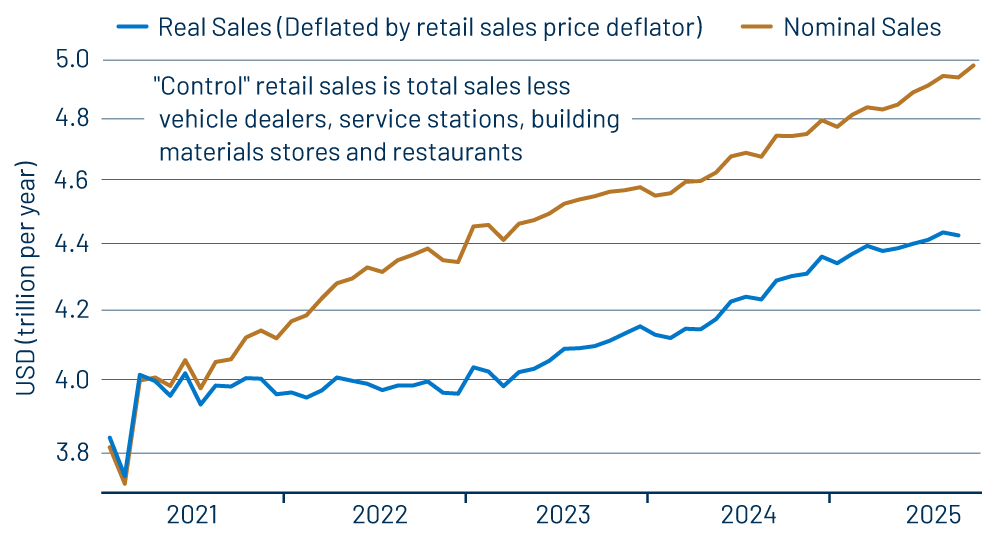

Meanwhile, the buoyant October retail sales data support the assertion in our 11/25 post that softer September sales data were likely merely a “breather” after very strong sales gains in July and August. October consumer price data have not yet been released, so we can’t make an estimate of real sales growth in the month. However, the October gain in nominal control sales clearly sustains the growth trend of previous months, and it is almost a sure thing that real sales gains in October will be similarly strong.

Sales gains occurred in most store types within the control group. Meanwhile, headline sales were held down by declining gas prices and a fluctuation in car sales. Worker wages and workweeks have been performing better than job growth, so it is likely that personal income growth in October was more supportive of these spending gains than the jobs data would suggest.