Headline retail sales rose 0.2% in September, with the August gain essentially unrevised. Financial market analysts focus more closely on a “control” sales measure that excludes sales at volatile auto dealers, services stations, building material stores and restaurants. That measure declined -0.1%, and the August gain was revised downward by -0.1%. Furthermore, a likely 0.1% increase in retail prices for control group merchandise means that real control sales were a tad softer.

Before you wring your hands—or listen to other folks wringing theirs—recall that the two previous retail sales reports were quite strong. Yes, thanks to reporting delays due to the government shutdown, the previous retail sales report, for August, was released on September 16, more than two months ago, making it old news. Still, it is relevant.

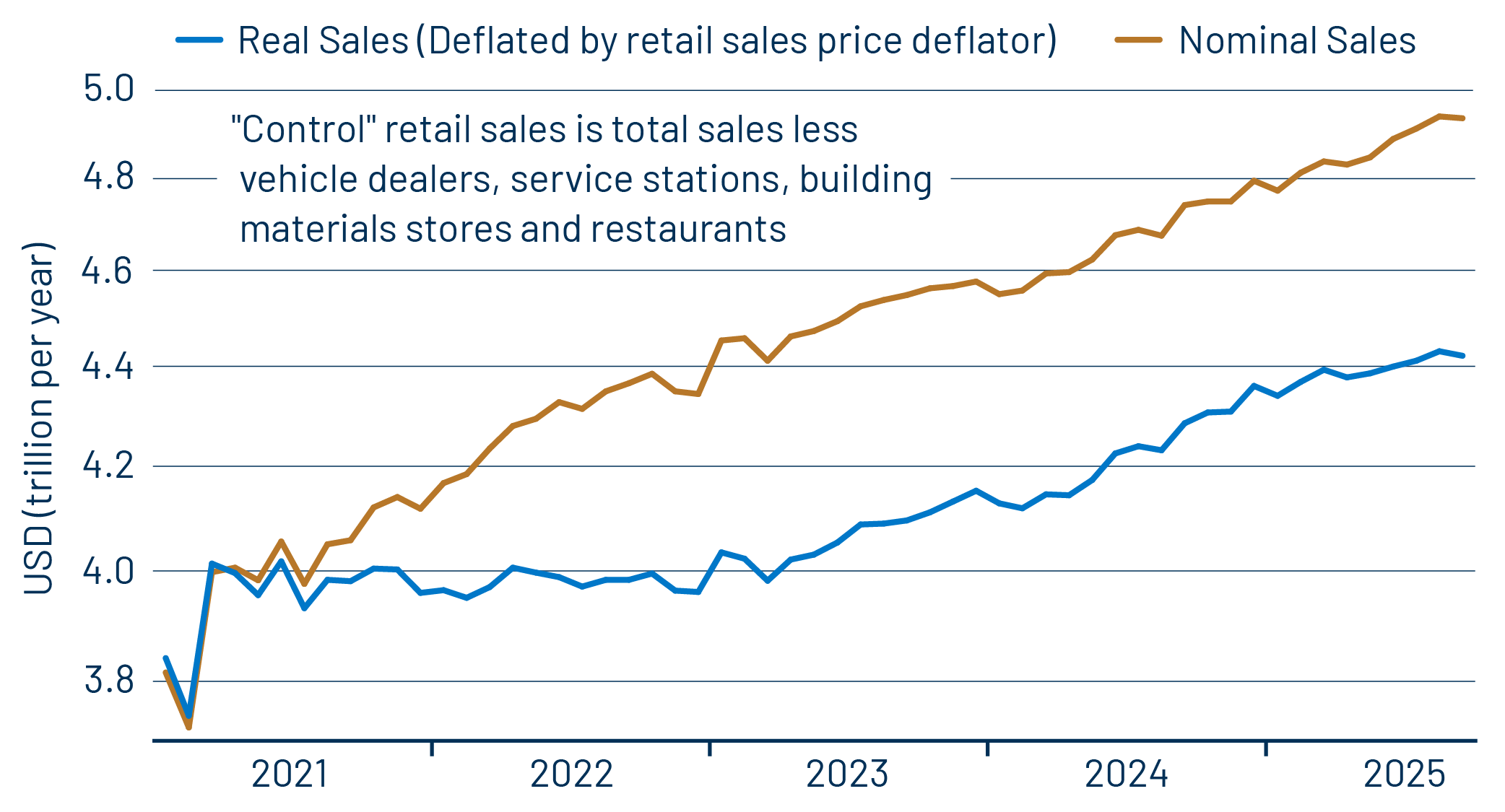

And as you can see in Exhibit 1, even with the slight September decline, in both nominal and real terms, September sales levels are still at or above the trends that had been in place in recent years. We’ve seen some media headlines today claiming that consumers ran out of gas in September. A more likely description, in our estimation, is that softer September sales growth is merely an offset of especially strong sales earlier.

To wit, for 3Q as a whole, nominal control sales show a raucous 6.3% annualized rate of growth, and real control sales will likely show a robust 3.1% rate of growth. This good performance of consumer spending is a linchpin of the 4% growth estimates that various folks are throwing around for 3Q real GDP.

So, any claims of a softening consumer circulating today would seem to be premature. Then again, today’s news covers the month before the government shutdown, so if shutdown worries—and work furloughs for government employees—adversely affect spending, we have yet to see those effects. However, judging by the experience of previous government shutdowns, we would not expect any substantial hit from the shutdown on consumer spending or other economic indicators. As always, though, we’ll have to wait and see whether the data come in aligned with our expectations.

For now, the September sales report looks like a pause following very favorable spending results earlier in 3Q. It will take more news than that released today to make the case for a meaningful shift in consumer behavior away from the decent growth trends previously in place.