Private-sector payroll jobs increased by 492,000 in May, with a +17,000 revision to the April estimated level. Gains were widespread across industries, with the previously Covid-stricken restaurant, recreation, and accommodations industries leading the way, up 186,000, 72,000 and 35,000, respectively.

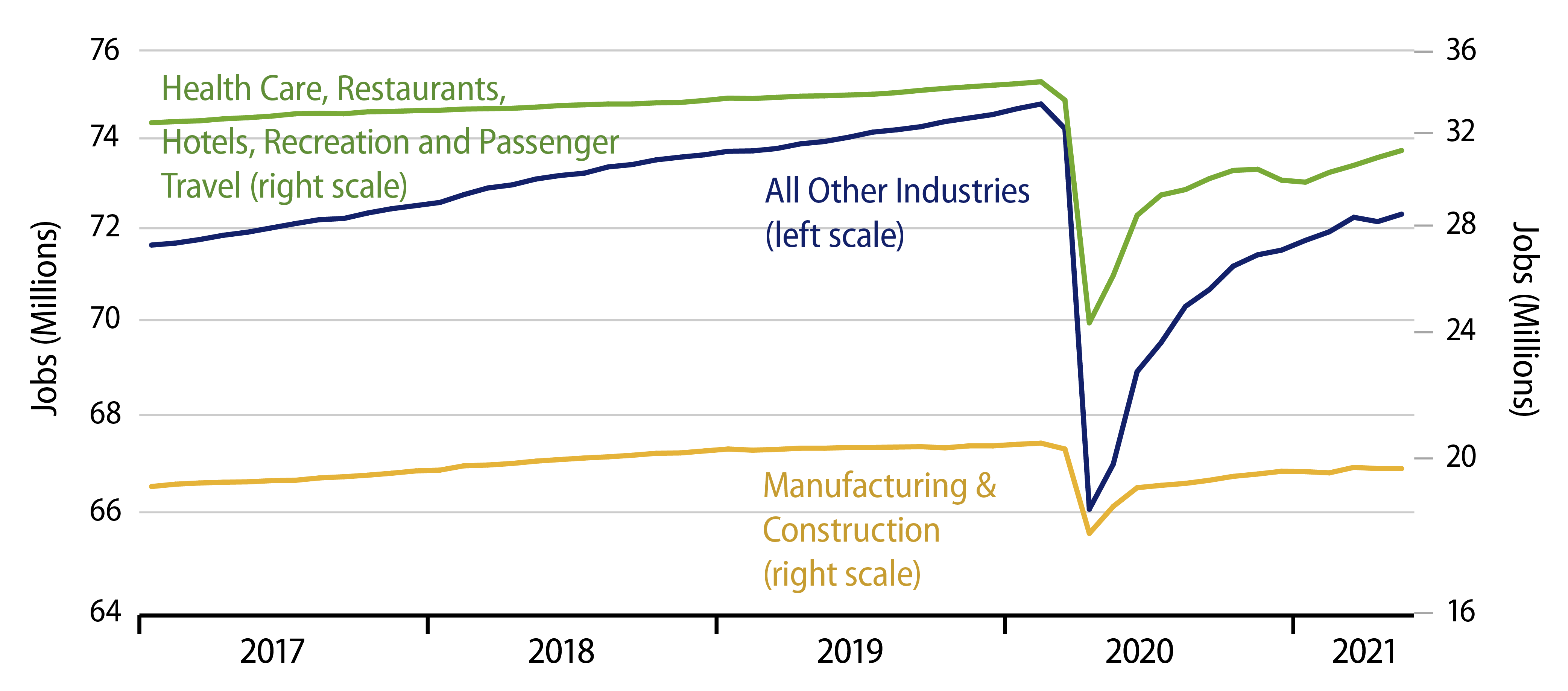

Job gains were about zero in construction, manufacturing and retail trade. However, these sectors saw an essentially complete recovery in late-2020 and have been mostly marking time since then.

The popular press and consensus analysts will probably focus on what these gains are not. Like the April jobs release, there is no “V-shaped” recovery in the jobs market, at least not lately. The V-shaped phase of the US recovery is likely in the past, in the months of spring and summer 2020, when repressed construction, manufacturing and other industries were reopened and saw an abrupt resumption of economic activity.

For the remaining industries, largely services, recovery has been more gradual. How else could it be, when these sectors are still shut down or restrained to some extent?

On that score, we think any downbeat response to today’s—and last month’s—data is off point. What we think bears emphasizing is that at least some pace of recovery is occurring in these service sectors. No, the pace of growth does not match the pace of decline seen in March and April of 2020. No, we will not at this rate get quickly back to pre-Covid employment levels.

However, it is evident from the chart that some recovery is occurring, that recent job growth has been enough above pre-Covid trends to repair some of the pandemic damage. At the current pace, we would get back near pre-Covid activity levels by the end of 2022, and if the further reopening later this month results in a stepped-up pace of growth, full recovery could come sooner.

Perhaps the (mild) disgruntlement in the consensus response is occurring because they were looking for very rapid growth, spurred by the stimulus efforts of the Fed and federal government. We have been more skeptical as to whether those stimulus efforts will indeed spur any growth and we have been more cautious about the growth prospects for service industries that have been in deep freeze for 15 months now. From that perspective, in this “cryogenic” economy, while the pace of growth recently has been disappointing to some, it nevertheless has been undeniable.