Product Specialist Robert Abad converses with Portfolio Manager Kevin Ritter about Western Asset’s latest views on emerging markets (EM) in this period of broad market volatility and select investment opportunities in the asset class.

RA: Despite recent setbacks in EM local currency bonds, do you think they're gearing up for a comeback as the Federal Reserve (Fed) begins easing?

KR: I'd like to address the recent market volatility first because we don't want it to overshadow what we see as a compelling opportunity for EM as we move through 2024. In the short term, EM is more sensitive to macroeconomic scenarios, particularly those involving the Fed. Many of these trades have experienced significant gains throughout the latter part of 2023 and early 2024. So, with the Fed's trajectory undergoing a repricing, we're witnessing a bit of a correction in some of the more crowded, high-carry trades.

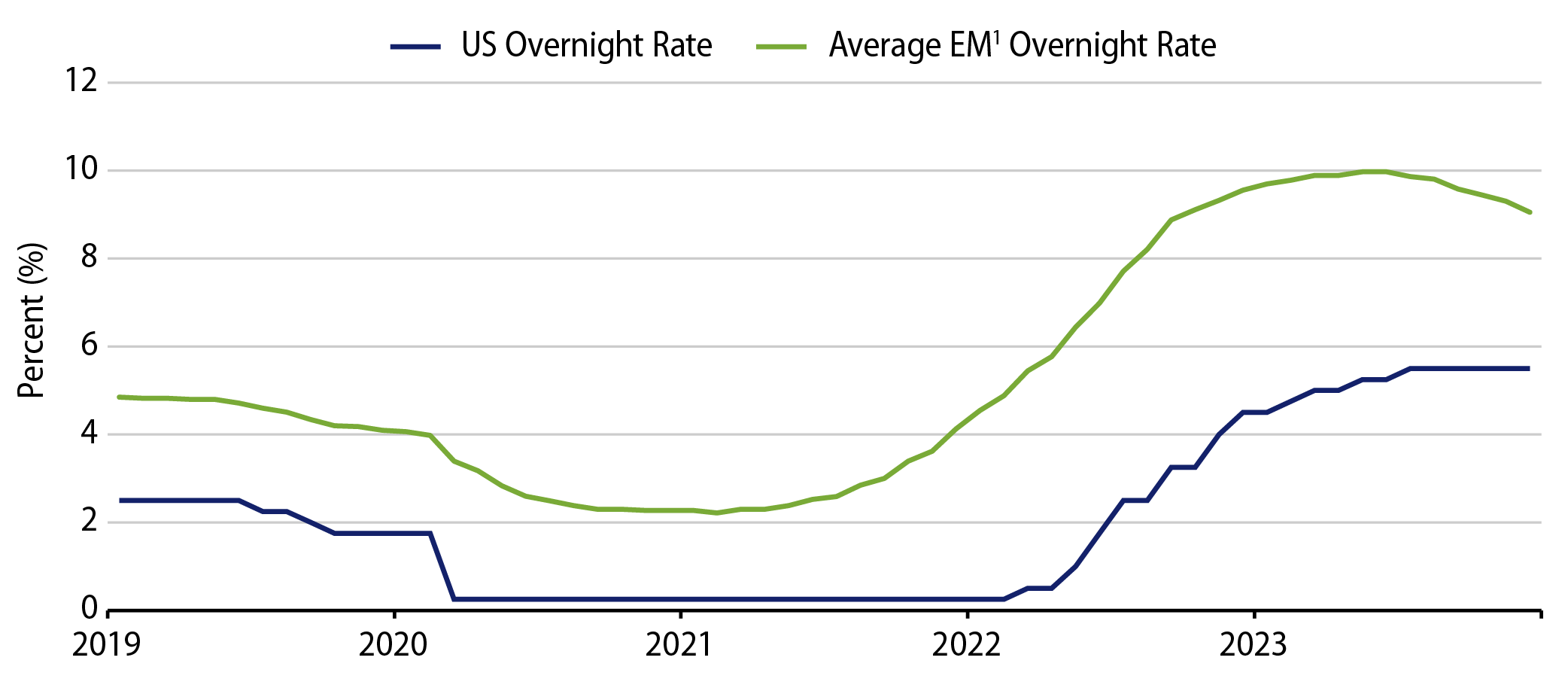

However, let's contrast this short-term view with Western Asset's medium- to longer-term EM outlook. Fundamentally, EM policymakers have been proactive. This is especially evident in countries like Brazil, which began hiking rates as early as March 2021, a full year before the Fed did so. This proactive approach has led to a notable decline in inflation across many EM countries, prompting some to even start easing monetary policy. Additionally, EM growth has remained relatively robust, thanks to fiscal support and a generally strong macroeconomic environment. This combination of high rates, declining inflation, and steady growth creates a positive fundamental backdrop for EM.

Moving on to valuations, they remain attractive, especially when we consider the punishment EM assets endured during the aggressive Fed rate hikes in 2022. Despite some recovery in returns during the latter part of 2023 and early 2024, EM trades still have room for further compression, especially when compared to pre-Fed liftoff levels.

Finally, let's discuss the broader macroeconomic environment. While EM certainly benefits from a dovish Fed stance, it's not necessarily a requirement for their performance to be positive. A notable example is the recent thawing of EM countries’ access to capital markets, with the Ivory Coast and Kenya successfully accessing financing markets after being frozen out for much of 2022 and 2023. In a nutshell, despite recent turbulence, we're optimistic about EM's prospects in 2024 and beyond.

RA: Do you anticipate the outcome of the US elections having a broader impact on EM?

KR: There are always risks associated with EM investing, from conflicts in various regions to election cycles and external shocks from the Fed. As portfolio managers, it's crucial for us to construct resilient portfolios that can navigate through various scenarios. Diversification is key, helping our portfolios to weather risks, whether they're tied to elections or other external factors.

Regarding the US presidential elections, regardless of whether the Democrats or Republicans win, both parties are likely to maintain a tough stance on China. We've already seen indications of this, such as Biden proposing a tripling of tariffs on aluminum and steel imports from China. This ongoing toughness on China could lead to trade frictions, but it also presents opportunities for certain EM countries. For example, Mexico, India, the Dominican Republic and Costa Rica could benefit from supply chain diversification, nearshoring and friend-shoring initiatives. In essence, it's a mix of winners and losers from an EM perspective.

RA: Where do you see the most attractive investment opportunities in EM right now?

KR: Traditionally, EM has seen robust returns about six to 18 months after the last Fed hike, and we expect this trend to continue. From a valuation standpoint, EM assets currently appear more attractive both on a historical basis and compared to other asset classes. However, it's important to recognize the diversity within the EM asset class. On the credit side, there's a wide range—from AAA rated issuers in Singapore to defaulted securities in Venezuela, with unique challenges in local rates and FX.

Our approach to EM investing goes beyond benchmarks. We tailor solutions to meet client needs and identify attractive opportunities. For instance, investment-grade-rated EM debt currently offers spreads about 150 to 200 bps over US Treasuries, which is twice that of the US investment-grade corporate credit market—a compelling proposition. We also see value in frontier or next-generation EM, which were hit hard during the 2022 Fed liftoff but remain attractive compared to US high-yield assets. Additionally, we're exploring niche opportunities such as EM-currency-denominated supranationals, which allow investors to access EM currency and rate exposure within AAA rated securities—a feature many investors find appealing.

RA: Are there any regions or countries that the EM Team finds particularly appealing right now?

KR: Absolutely. Latin America, and specifically Mexico, stand out to us. The current inflation dynamics have created unique opportunities across regions and countries. Take China, for instance, where the situation is the opposite of the US and Western economies. China is combating deflation, and as a result, its local rate yield curve trades significantly lower than that of the US. Therefore, investing in China, particularly on the local side, may be less attractive for US-based investors.

In contrast, Latin America offers higher rate structures. As mentioned earlier, Mexico stands out with an overnight rate of 11% and local Mexican Treasuries are trading between 9.5% and 10.5%, with annual inflation below 4.5%. The Mexican central bank has effectively managed inflation and has recently initiated an easing cycle in a prudent manner. We anticipate this will serve as a tailwind for Mexican assets.

Mexico also has an upcoming election in June, and we view the incoming administration as potentially more favorable compared to the current one. When considering these factors alongside the trends of nearshoring and supply chain diversification, we believe investing in Mexico offers a compelling carry trade opportunity. While it experienced strong performance last year, we still see Mexico fixed-income as an attractive allocation for portfolios throughout 2024.