Macros, Markets and Munis

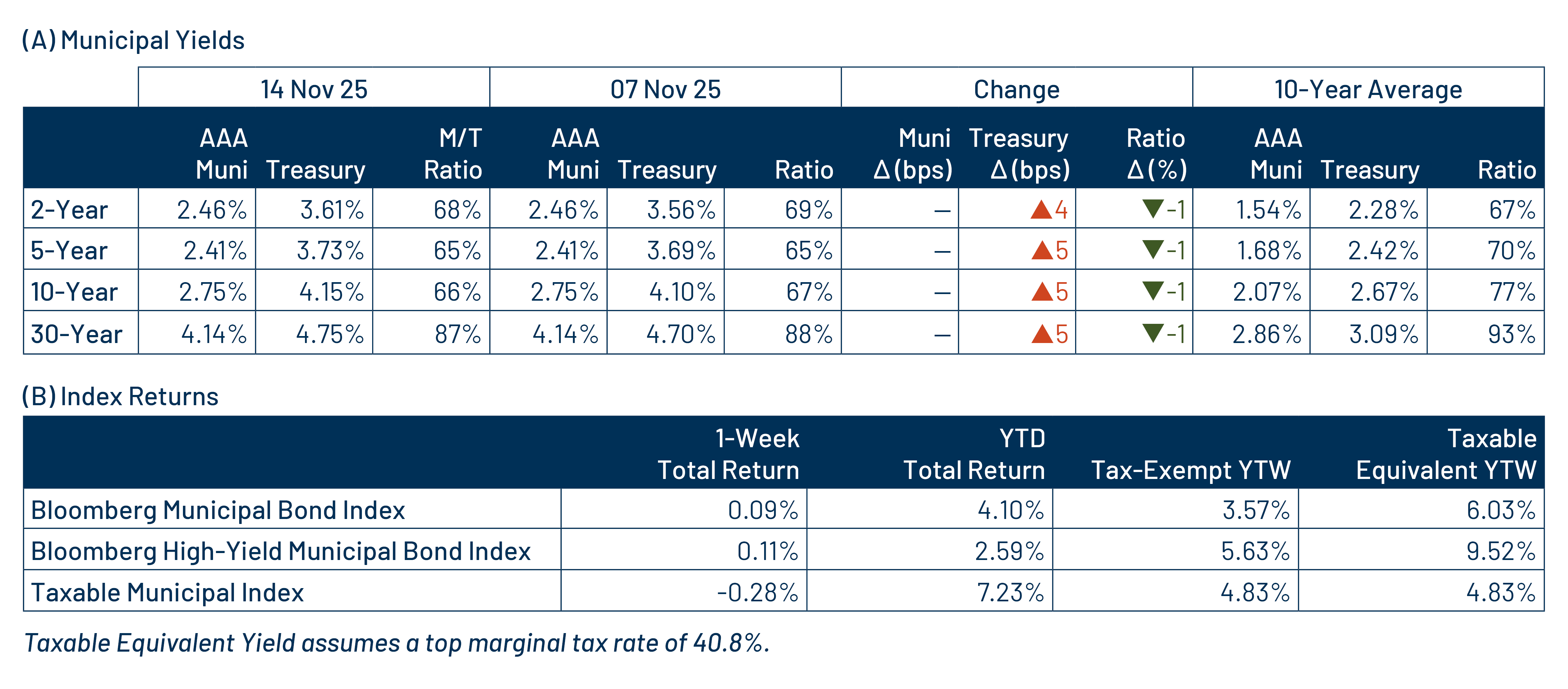

Munis posted positive returns last week and outperformed Treasuries. The Treasury curve sold off during the week, moving 4-5 basis points (bps) higher across the curve. The high-grade muni curve outperformed, with yields remaining unchanged across the curve. Muni technicals were supported by ongoing demand. Meanwhile, economic data releases remained limited through the tail end of the government shutdown. Markets were focused on hawkish commentary from the Federal Reserve (Fed), which contributed to fixed-income and equity market volatility. This week we touch on election outcomes and their impact on the municipal market.

Demand Remained Elevated as Supply Surpassed 2024 Record Levels

Fund Flows ($405 million of net inflows): During the week ending November 12, weekly reporting municipal mutual funds recorded $405 million of net inflows, according to Lipper. Long-term funds recorded $17 million of inflows, intermediate funds recorded $212 million of inflows and the short-term category recorded $158 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $44 billion.

Supply (YTD supply of $516 billion; up 16% YoY): The muni market recorded $10 billion of new-issue supply last week, down 33% from the prior week’s level. YTD new-issue supply of $516 billion is 16% higher than the prior year (surpassing 2024 calendar-year levels), with tax-exempt issuance up 17% year-over-year (YoY) and taxable issuance up 5% YoY. This week’s calendar is expected to increase to $11 billion. The largest deals include $960 million Black Belt Energy and $688 million Newton, MA transactions.

This Week in Munis: Election Outcomes

The November 2025 off-year elections carried several implications for the muni bond market, primarily through local and state races, ballot measures on taxes and bond issuance, and potential shifts in fiscal policy.

New York City Mayoral ElectionFollowing his surprise Democratic primary victory in June, Zohran Mamdani won the New York City mayoral election. The democratic socialist has contributed to headline-driven credit concerns, given the aggressive spending and debt policies outlined in his agenda, which proposes tax increases on high earners and corporations, higher debt levels to support affordable housing initiatives, rent freezes and increased childcare spending. Despite the headline-generating rhetoric, the mayor’s tax and debt authority are constrained by state controls, and many New York City debt liens offer strong bondholder protections.

As highlighted in prior blog posts, since the pandemic-driven market drawdown, New York municipal yields have traded wider than comparable national counterparts, a reversal from pre-pandemic trends when the higher in-state tax rates kept New York yields below national averages. Western Asset believes that additional volatility stemming from these headlines could create opportunities for New York taxpayers who can benefit from the tax-exempt income offered by New York securities.

Gubernatorial ElectionsBoth New Jersey and Virginia gubernatorial candidates won their respective elections, resulting in unified governments in each state. A unified government can enable more decisive and predictable budgeting, including the ability to cut taxes or expenses, raise revenues to fund spending initiatives and develop consistent long-term plans. However, with fewer checks and balances, it will be important to monitor the long-term sustainability of any near-term policy changes.

Tax PolicyIn Colorado, voters approved a 4% income tax increase on individuals earning $300,000 and above to generate an estimated $95 million in additional school funding, primarily to support free meals for all public school children. Meanwhile, Texas increased the homestead tax exemption from $100,000 to $140,000 of a property’s market value, reducing state property tax revenues.

SummaryWestern Asset does not anticipate significant near-term credit implications resulting from the current election cycle. However, even if not implemented immediately, growing sentiment for higher tax rates remains worth monitoring. While the potential for out-migration and credit deterioration exists, the strength and diversity of metropolitan economies, along with balanced budget requirements, often provide greater credit stability than headlines suggest. Potential headline-driven volatility may create attractive near-term entry points for taxpayers seeking higher levels of long-term tax-exempt income, particularly for those in jurisdictions facing potentially higher tax rates, where the relative value of tax-exempt income would improve under a higher-rate regime.

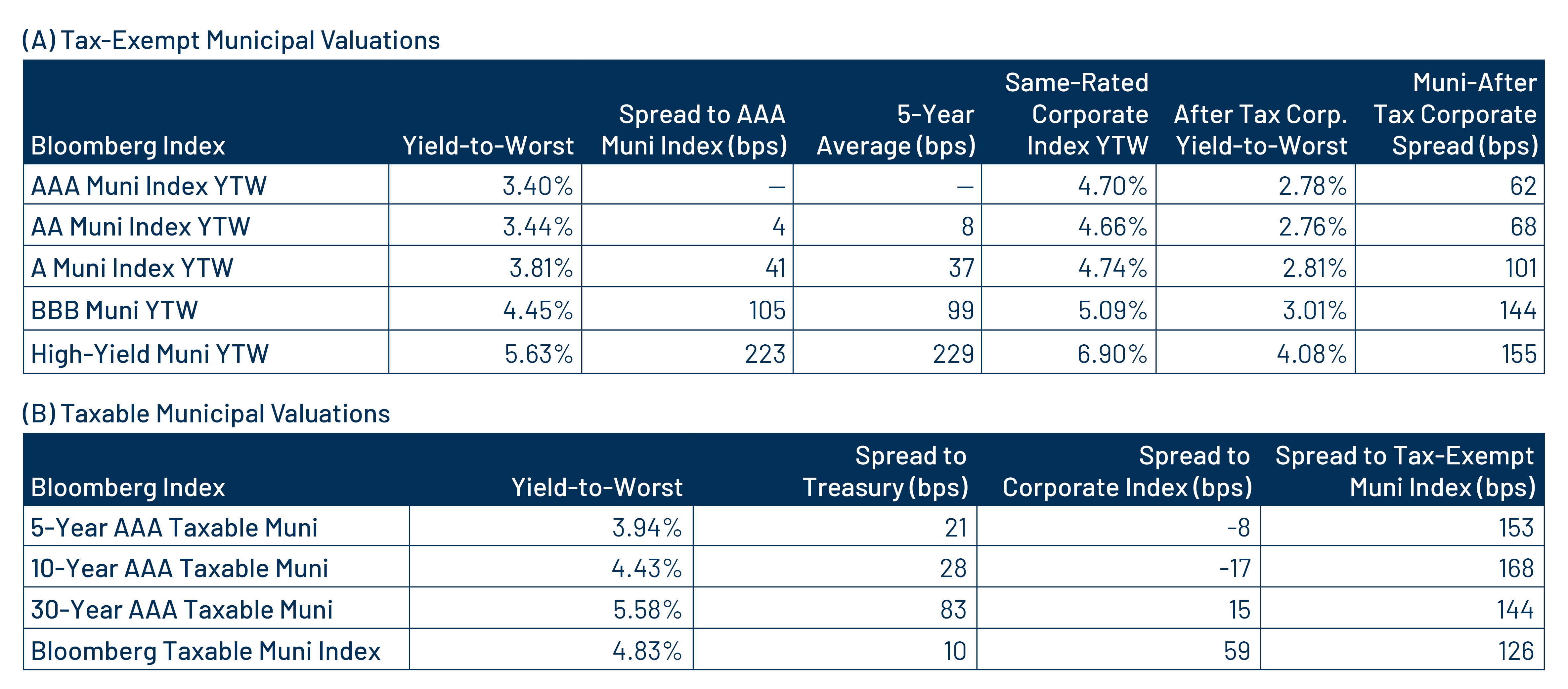

Municipal Credit Curves and Relative Value

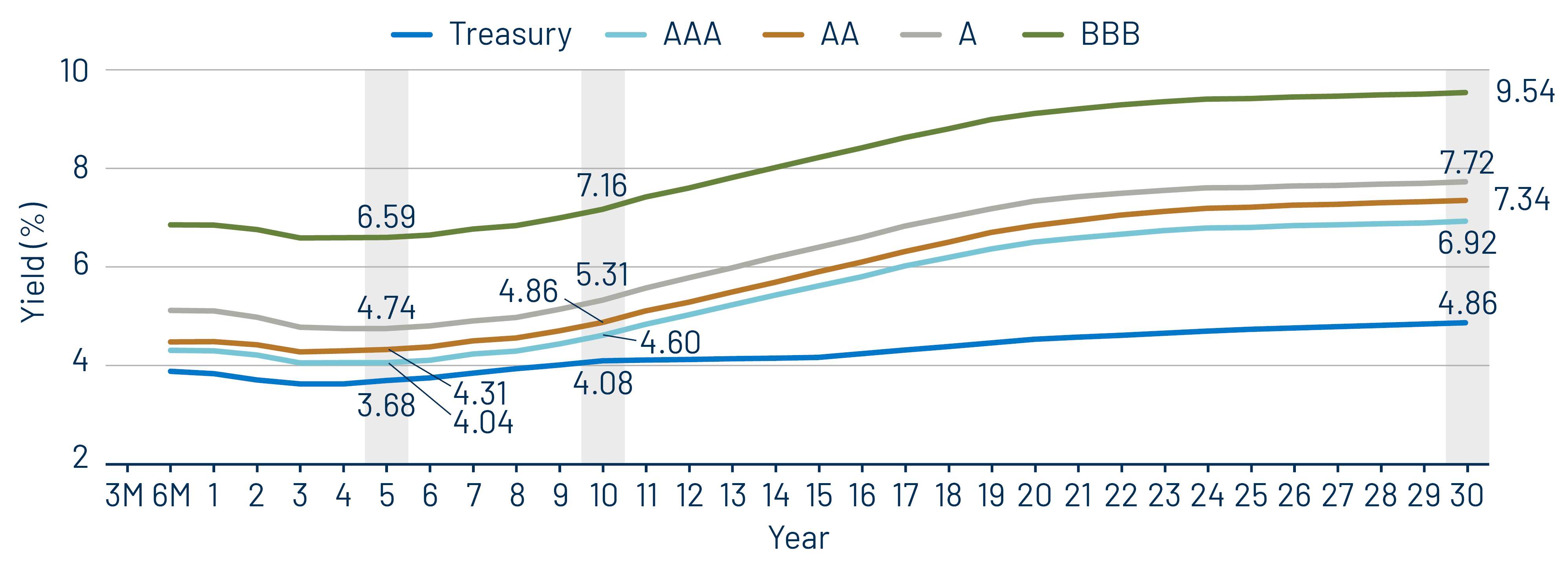

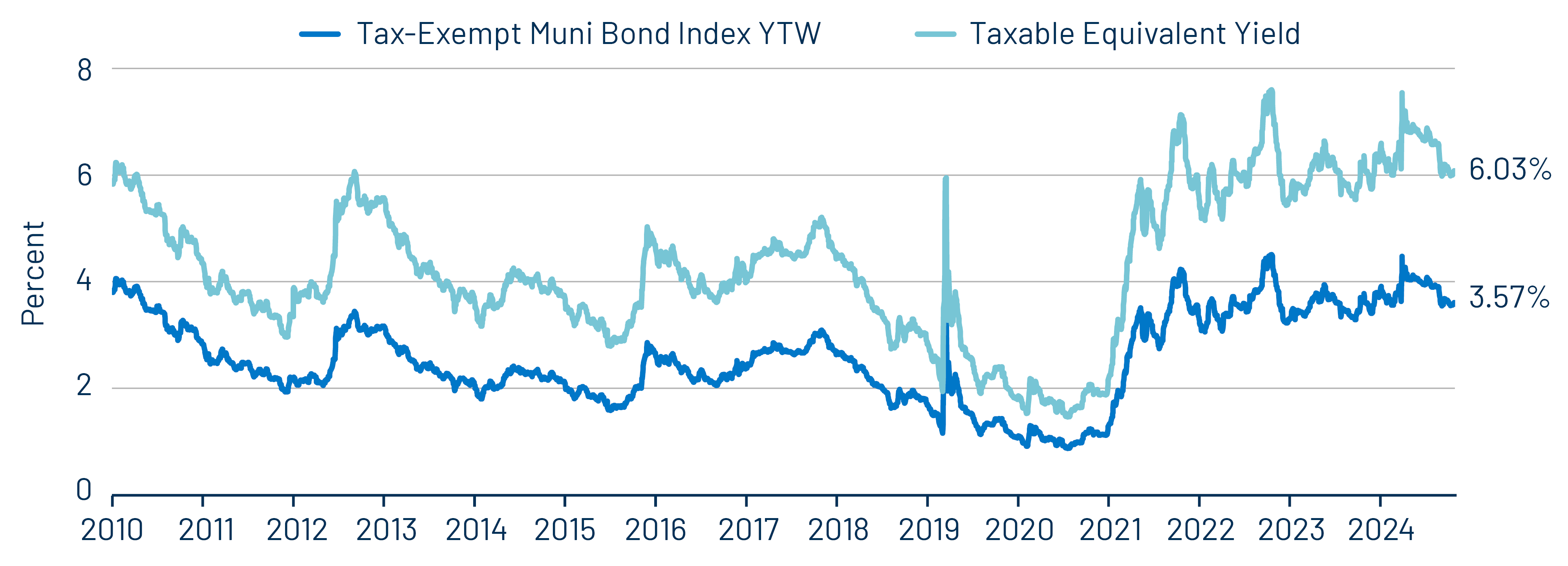

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

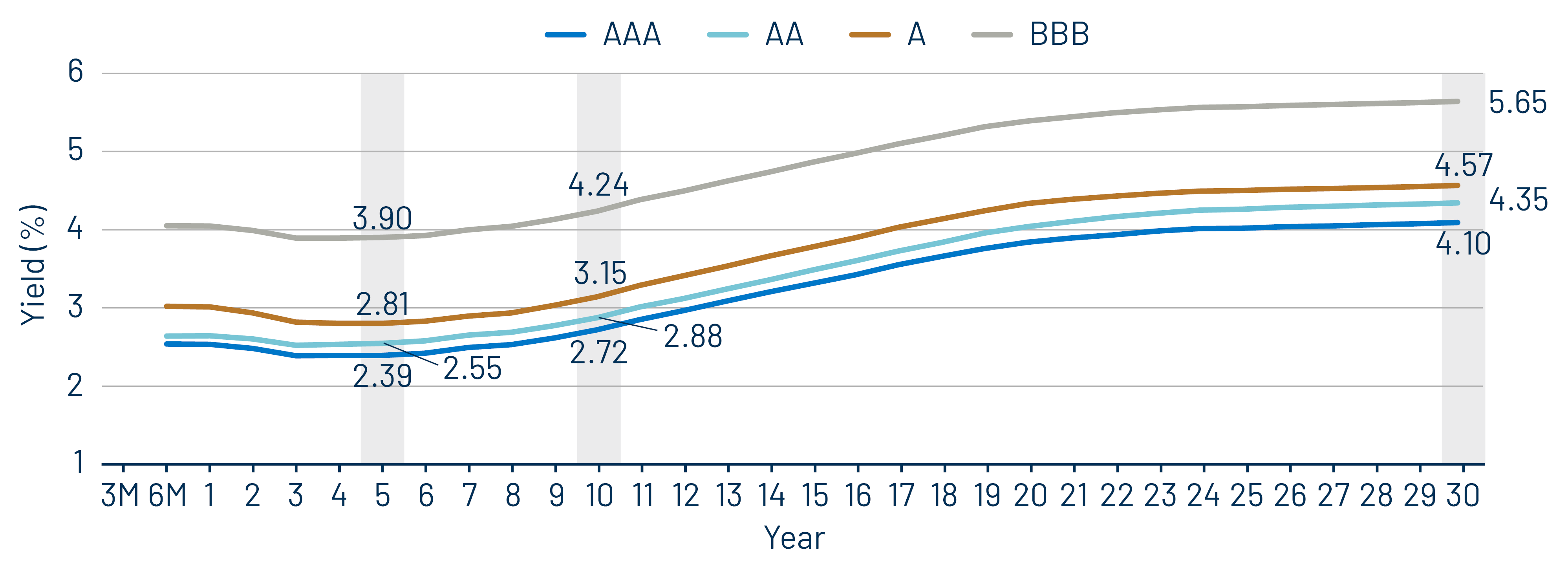

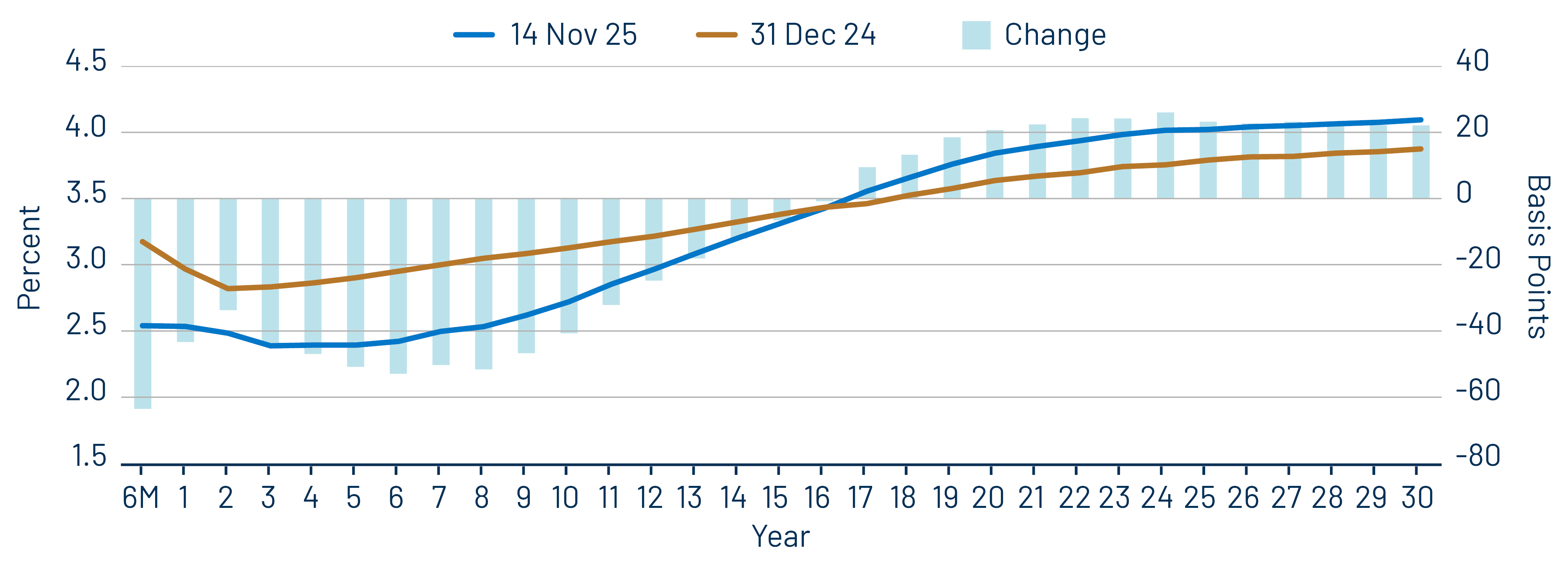

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

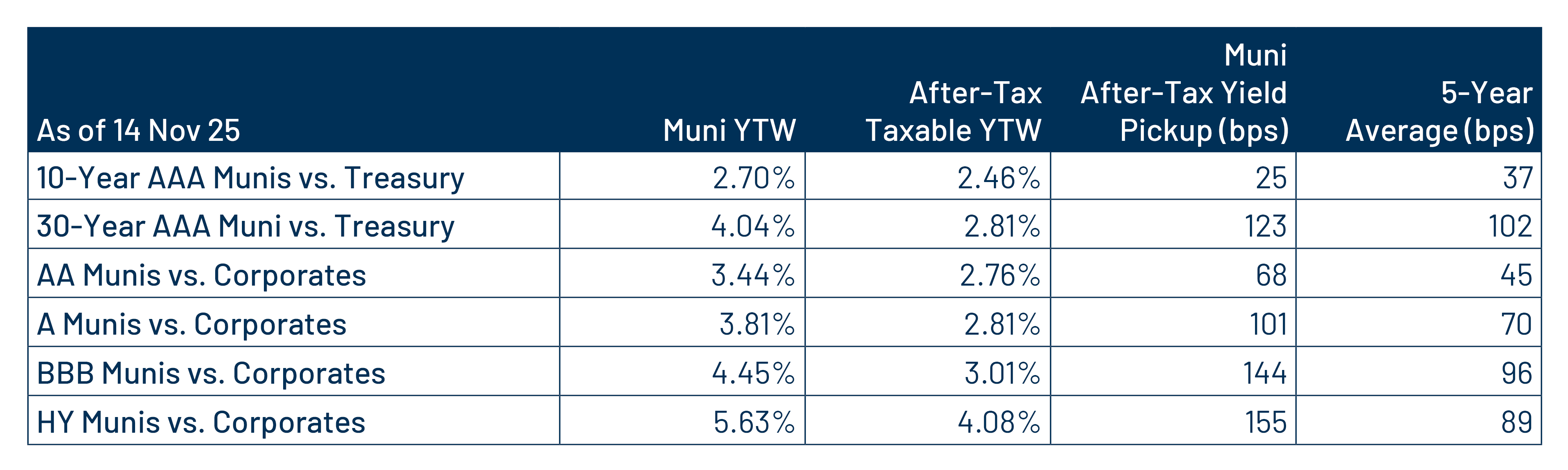

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.