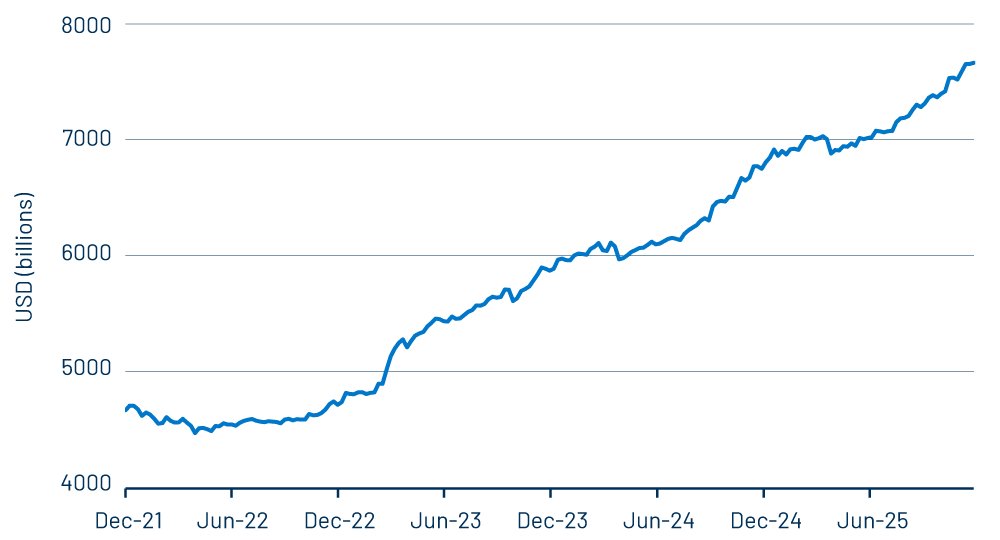

As of late 2025, US money market fund (MMF) balances continue to climb even as the Federal Reserve (Fed) advances through its easing cycle. Assets have recently moved above $8 trillion, supported by steady inflows throughout the year. Many market participants expected cash to rotate into longer-duration fixed-income or risk assets once rate cuts began. Instead, inflows have remained steady from both institutional and retail investors, pushing MMF assets to new highs.

As noted in our October blog post, a significant part of this trend comes down to behavior and structure rather than yield levels alone. MMF investors—whether they are corporations managing operational liquidity, financial institutions maintaining buffers or households seeking stability—tend to treat these vehicles as core cash holdings rather than risk capital. Institutional investors now hold over 60% of total MMF assets and have driven the bulk of inflows so far this year. That behavioral stickiness has only strengthened in the aftermath of recent banking stress, where depositor confidence in traditional channels remains uneven and where institutions continue to prefer off-balance-sheet liquidity solutions.1

The way MMF yields adjust during easing cycles further reinforces this dynamic. Managers typically hold portfolios that have moderate maturities, with the current weighted average maturity sitting near 40 days, which is elevated relative to the long-run average.2 This means yields decline more slowly than policy rates, allowing MMF investors to continue receiving competitive income for months after the Fed begins cutting rates. Historically, this slower repricing has coincided with periods when MMF balances either hold steady or increase rather than decline.

Front-end Treasury market dynamics also support elevated MMF demand. T-bill supply has meaningfully expanded this year, and volatility in shorter-dated securities has led many investors, especially institutions, to prefer the simplicity and daily liquidity of government MMFs over managing rolling exposure directly.3 This has intensified demand for government funds and provided a stable channel for cash that might otherwise shift into deposits or direct bills.

Regulation plays a role as well. Liquidity requirements have pushed prime funds to hold shorter-dated positions, narrowing their historical yield advantage over government funds. Although inflows into prime funds have picked up this year, the broader preference remains tilted toward government strategies that offer a constant net asset value (NAV) and minimal credit concerns.4

It is also worth underscoring that banks remain selective about the types of deposits they want to retain, particularly large non-operational balances that come with higher regulatory outflow assumptions. This makes deposits less attractive for both banks and large institutional clients, who continue to move excess liquidity toward MMFs instead of traditional bank products.

Finally, the yield advantage of MMFs over alternatives such as savings accounts or time deposits remains meaningful even after several rate cuts. The combination of competitive income, ease of use, daily liquidity and stable NAV features continues to support the appeal of MMFs during the current policy transition.

Collectively, these factors suggest that MMF balances are likely to remain elevated for an extended period. In past easing cycles, cash typically stayed put until well after the first rate cuts, especially when front-end yields remained at levels that investors viewed as acceptable carry for liquidity holdings. Given the structure of today’s cash landscape, from bank balance sheets and bill issuance patterns to investor risk appetite and the slow transmission of policy rates, we see little evidence of a rapid rotation out of MMFs in the near term.

ENDNOTES

1. Another driver of AUM growth in money funds, especially during bull markets in equities and credit, has been CME balances. (CME Group is the world’s leading derivatives marketplace.) Because money funds are approved margin collateral, rising account values increase margin requirements. To meet these requirements, prime brokers are increasingly posting money funds instead of cash, allowing them to earn a higher yield.

2. “Money-Market Assets Rise to Record $8 Trillion, Crane Says” Bloomberg, December 2, 2025; “To $8 Trillion and Beyond” Morgan Stanley, December 5, 2025

3. 'According to SIFMA, in the 12-month period ending November 2025, T-bill supply totaled $27.4 billion, a new issuance record.

4. Prime funds hold corporate paper, CDs and other credit instruments. Traditionally, they offer a yield premium over government funds in exchange for taking modest credit and liquidity risk. They operate with floating NAVs, so investors see daily mark-to-market changes around $1.00. Government funds invest almost entirely in Treasuries and repos and have a constant $1.00 NAV and virtually no credit risk. They naturally meet liquidity bucket rules.