US Labor Department data released today showed private-sector jobs rising by 406,000 in April, with a modest -37,000 revision to the March jobs estimate. Government commentary stated that job gains were widespread, and this was indeed the case, with all major sectors adding jobs on the month.

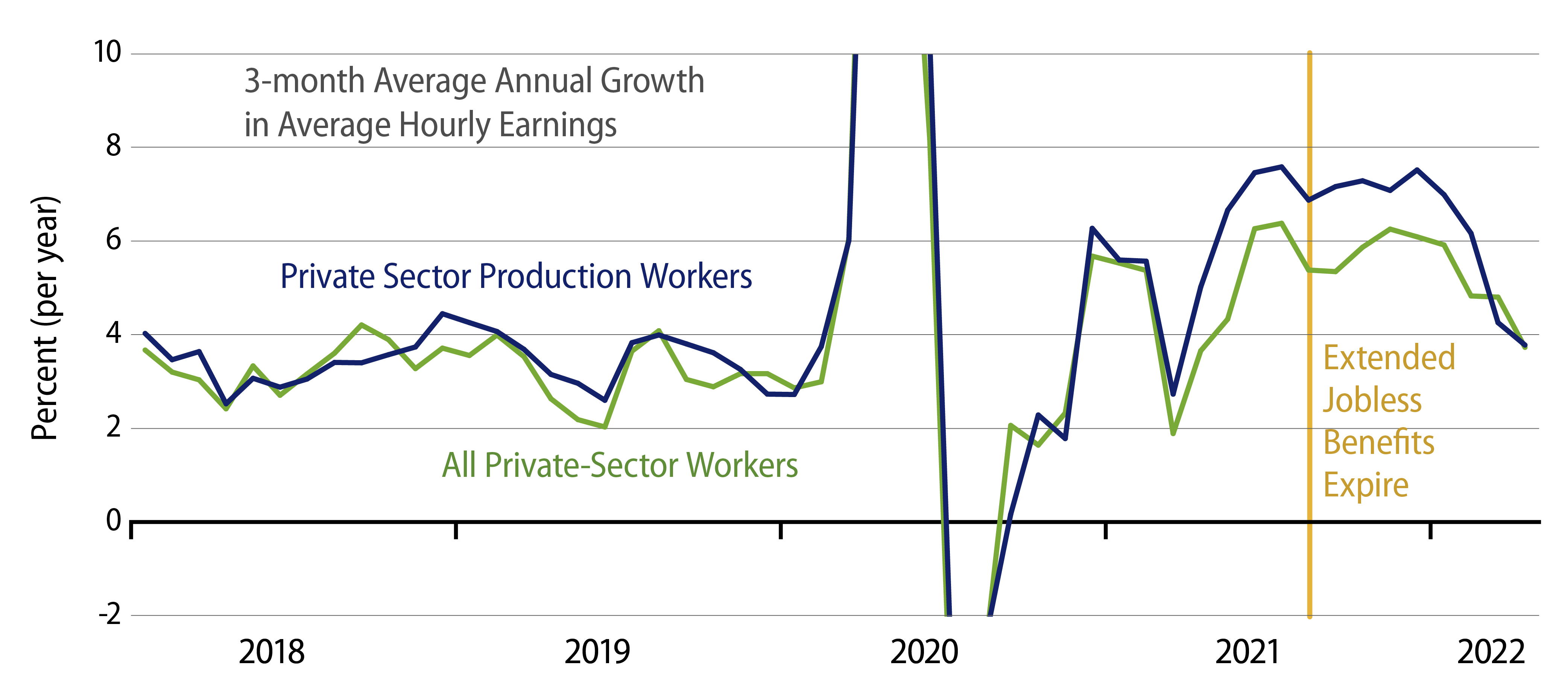

Meanwhile, wage gains moderated further on the month, with all-worker average hourly wages rising 0.3%, down from 0.6% monthly gains late last year. Over the last three months, both all-worker and production workers average hourly wages have risen at a rate of 3.7%, right at pre-Covid rates, as seen in the accompanying chart.

The jobs gains, of course, are way above pre-Covid rates. This reflects the fact that in most industries payroll levels are still way below pre-Covid trends.

We like to focus on six industries that have been hit especially hard by Covid restrictions and related Covid fears among customers: health care, restaurants, amusements and sporting events, lodging, and passenger travel. Combined, these industries are still 3 million jobs below pre-Covid growth trends. At their recent paces of jobs gains, we are still many years away from these sectors fully recovering from Covid effects.

For other service sectors, conditions are not so stressed. Other service sectors are “only” about 1.5 million jobs below pre-Covid growth trends, and at the recent pace of job gains, they could reach full recovery by the end of 2023.

For goods-producing (mostly manufacturing) and construction, employment levels are nearly back to pre-Covid trends. Of course, for these sectors, production and demand levels are above pre-Covid experience, so some net job gains relative to trend would be expected here. This suggests some further room for recovery in jobs here as well. Still, in manufacturing, at least, robust recent job gains have been offset by declines in the workweek, suggesting that employers there are returning to working conditions approximating normalcy (compared to the stressed operations of the last two years).

Both the Fed and Wall Street analysts continually state that labor market conditions are extremely tight. It is worth pointing out that this tightness is due not to high levels of employment or employment demand, but rather to sharp declines in labor force participation brought on both by Covid restrictions and Covid benefits that discouraged work. Conditions are returning toward normalcy, with labor force participation rebounding in recent months. It is reasonable to think that labor market conditions will ease, but it still looks as though full recovery from Covid effects is more than a year away.