Investment-Grade Municipals Posted Negative Returns Last Week

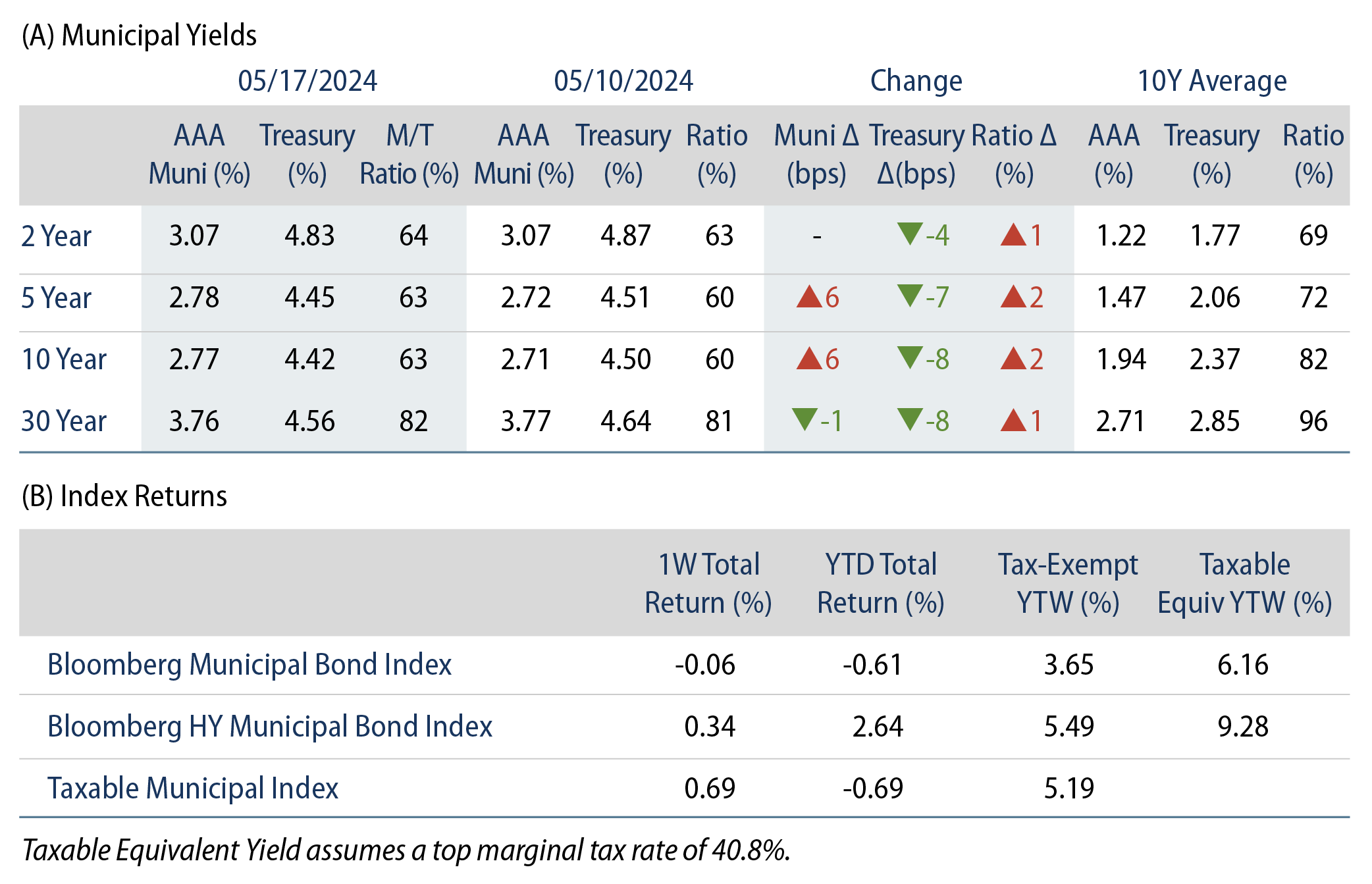

Top-grade munis underperformed Treasuries, which rallied on softer than expected inflation and retail sales data last week. High-grade muni yield changes were mixed across the curve. Meanwhile, market technicals weakened amid elevated supply and fund outflows. The Bloomberg Municipal Index returned -0.06% during the week, the High Yield Muni Index returned 0.34% and the Taxable Muni Index returned 0.69%. This week we highlight a muni supply bill proposed last week.

Weaker Technicals Were Driven by Elevated Supply, Fund Outflows

Fund Flows: During the week ending May 15, weekly reporting municipal mutual funds recorded $548 million of net outflows, according to Lipper. Long-term funds recorded $336 million of outflows, intermediate funds recorded $117 million of outflows and high-yield funds recorded $125 million of inflows. Short-term funds recorded $79 million of outflows. This week’s outflows lead estimated year-to-date (YTD) net inflows lower to $10 billion.

Supply: The muni market recorded $13 billion of new-issue volume last week, in line with the prior week. YTD issuance of $172 billion is 42% higher than last year’s level, with tax-exempt issuance 49% higher and taxable issuance 11% lower year-over-year. This week’s calendar is expected to remain elevated at $13 billion. Largest deals include $950 million Harris County, Texas, and $726 million Burbank, California, airport transactions.

This Week in Munis: Muni Supply Bill

Last week, US House Representative Terri Sewell introduced the Local Infrastructure Financing Tools (LIFT) Act. If enacted, this legislation would expand the scope of both tax-exempt and taxable municipal issuance. The bill proposes the reintroduction of advanced refunding for tax-exempt municipal bonds, enhances bank-qualified debt guidelines, and creates a new taxable direct-pay bond, similar to Build America Bonds, labeled “American Infrastructure Bonds.” These measures could lead to a greater supply in both taxable and tax-exempt municipal markets following years of declining issuance.

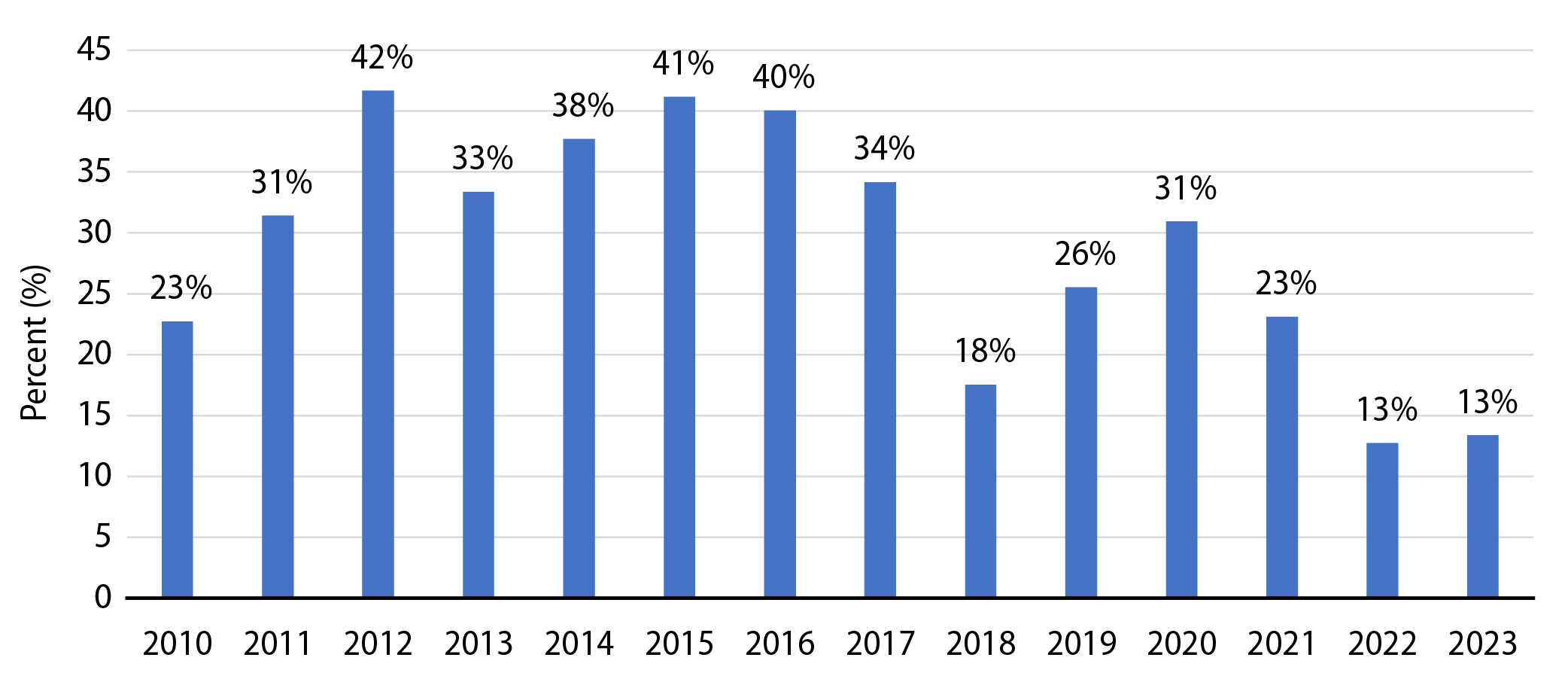

Advanced refunding of tax-exempt municipal debt was eliminated as part of the 2017 Tax Cuts and Jobs Act (TCJA). From 2010 to 2017, refunding issuance comprised 35% of total municipal issuance. Following the passing of the TCJA, refunding issuance fell to as low as 13% of total municipal issuance in both 2022 and 2023, contributing to lower tax-exempt supply in recent years.

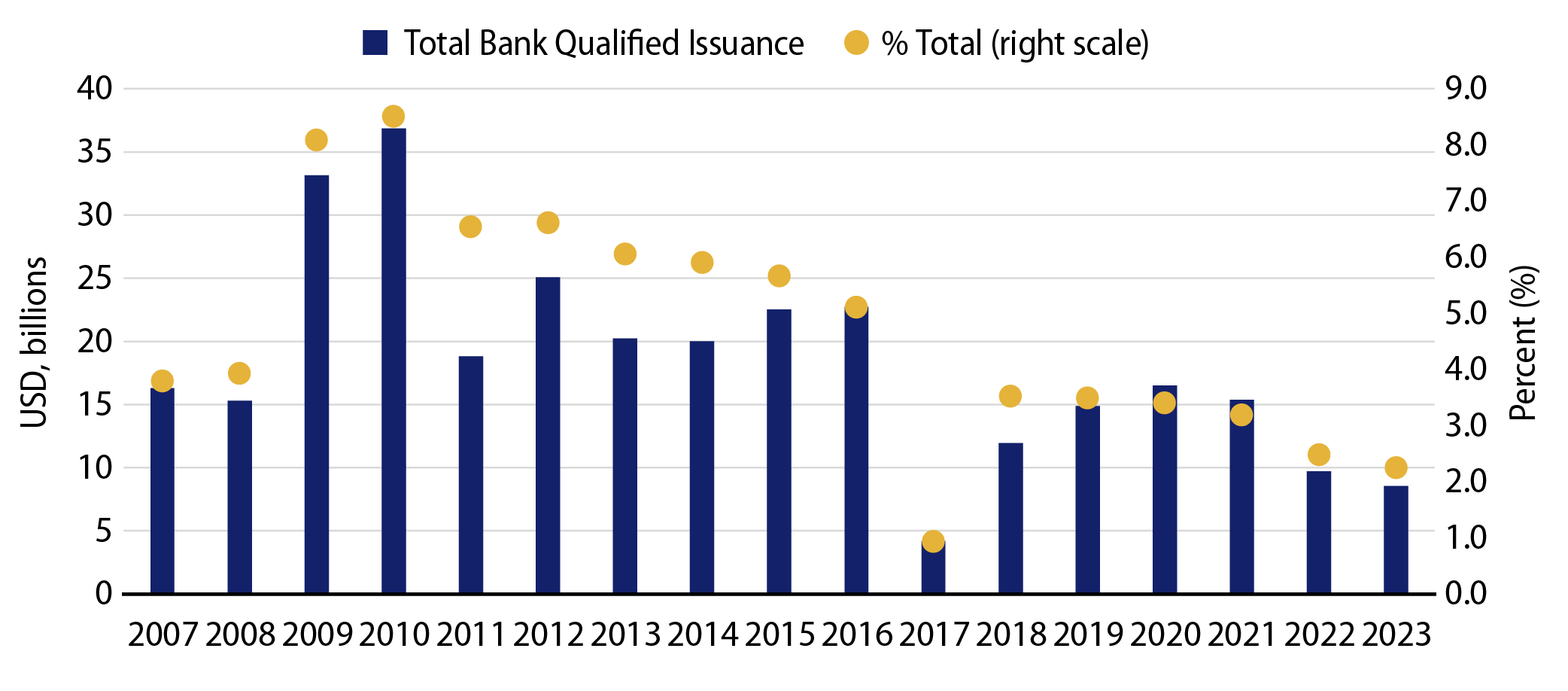

The LIFT Act would increase the maximum bond issuance of bank qualified tax-exempt issuers to $30 million from $10 million. Bank qualified issuance represents a small portion of overall municipal supply at just $8.5 billion, or 2% of total issuance, according to Bond Buyer data. However, this is down from highs of $37 billion (9% of total issuance) observed in 2010. The expansion of bank qualified debt would support tax-exempt new issuance, particularly for smaller borrowers that would benefit from potentially improved liquidity.

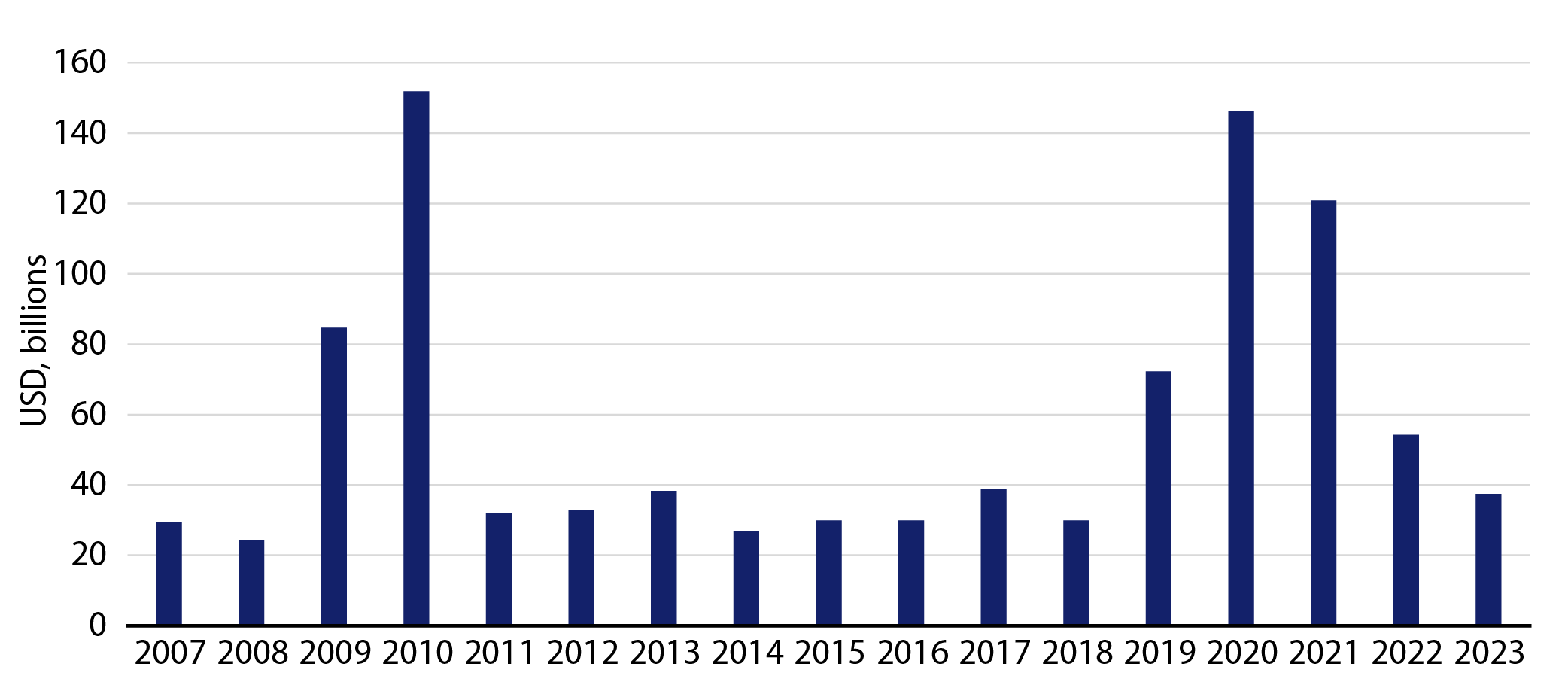

Lastly, the American Infrastructure Bonds initiative would introduce a direct federal subsidy for municipal borrowers that issue taxable municipal bonds, akin to the Build America Bond program that existed in 2009 and 2010 following the global financial crisis. Attracting a larger buyer base beyond the primary US taxpaying investor could support overall government financing rates and stoke the taxable municipal issuance that has dropped from $146 billion in 2020 to $37 billion in 2023.

We expect the likelihood of all these initiatives passing a divided Congress to remain limited, considering that federal support would need to be reconciled with growing deficits during an election year. Nevertheless, the proposal highlights the ongoing support for funding US infrastructure through the tax-exempt and taxable municipal market. Considering recent supply declines, increased and more diverse municipal supply would be welcomed by a growing municipal investor base that has observed tax-exempt and taxable supply decline in recent years.

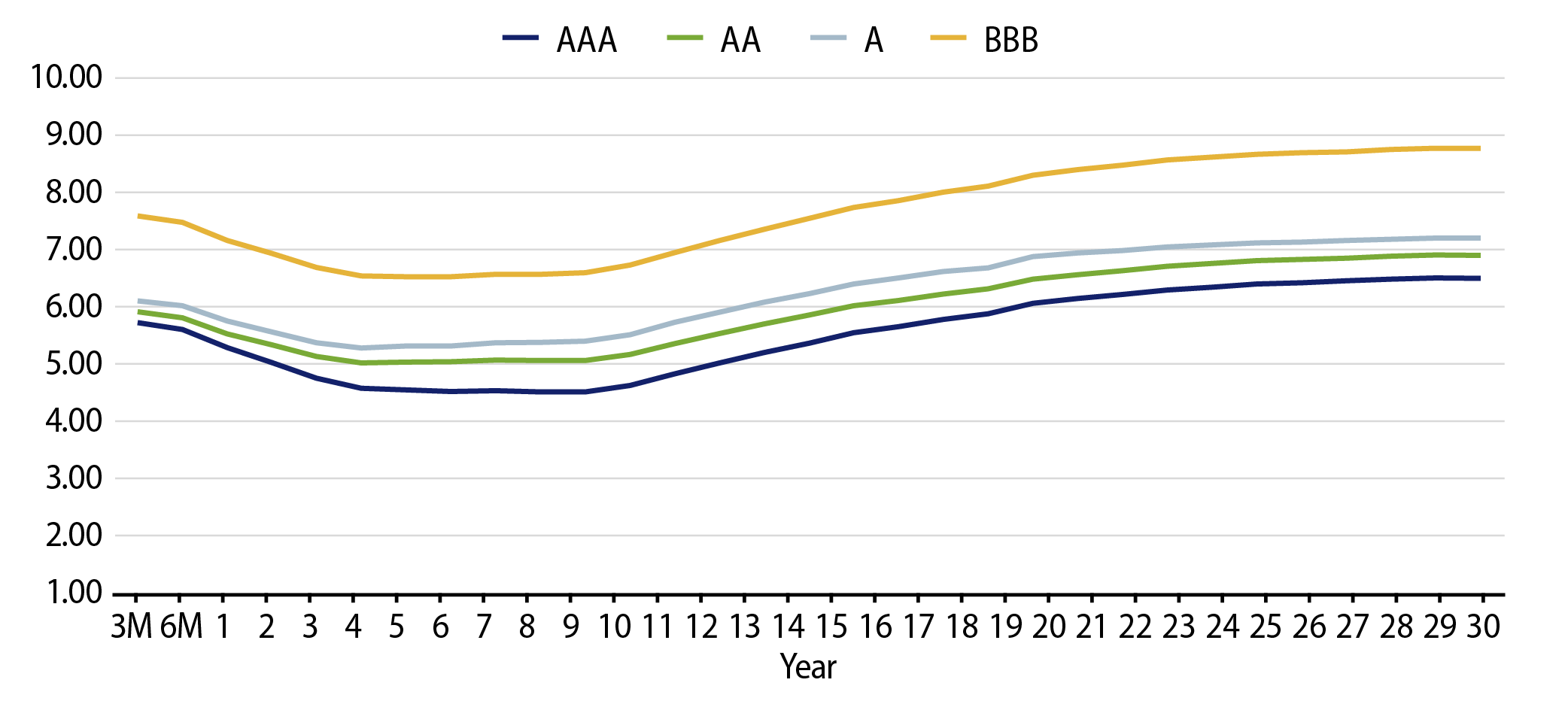

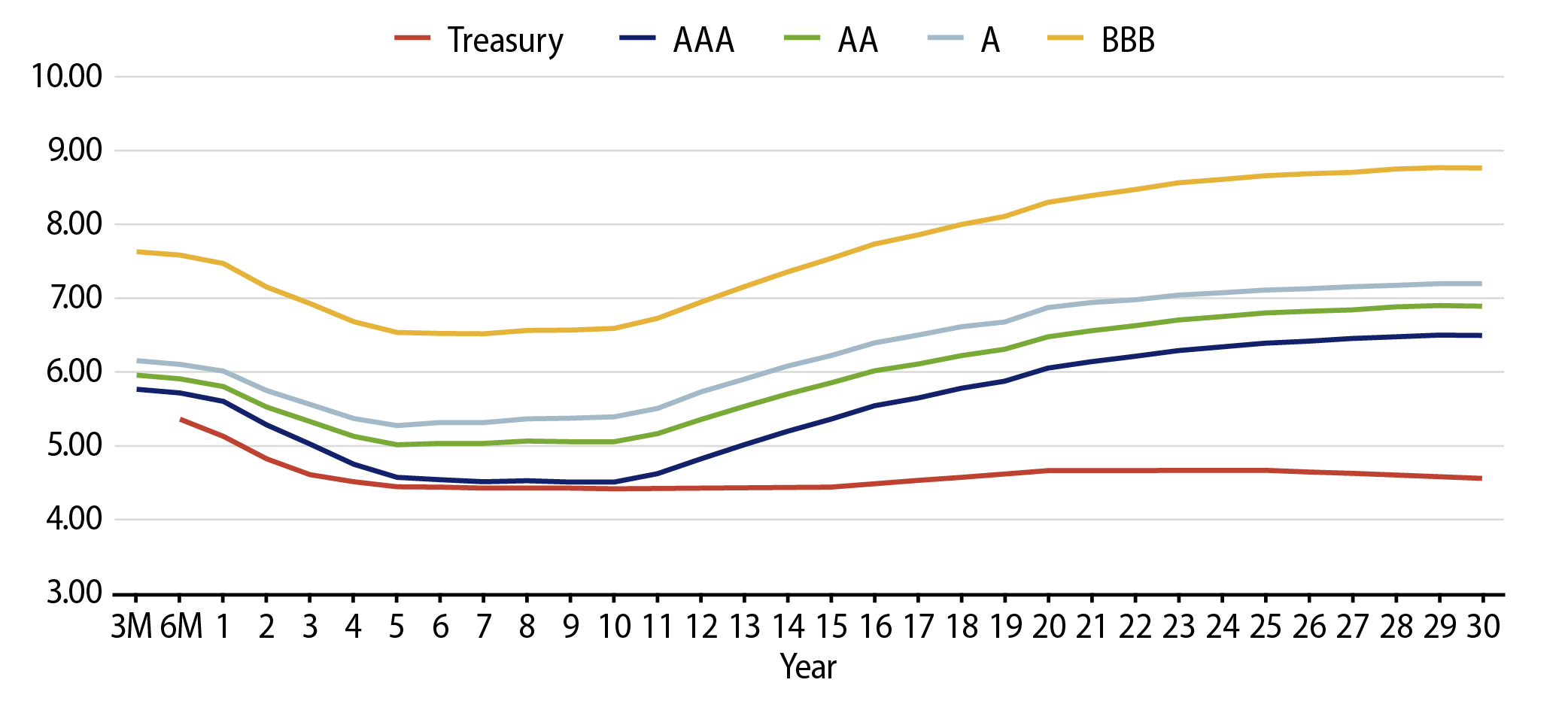

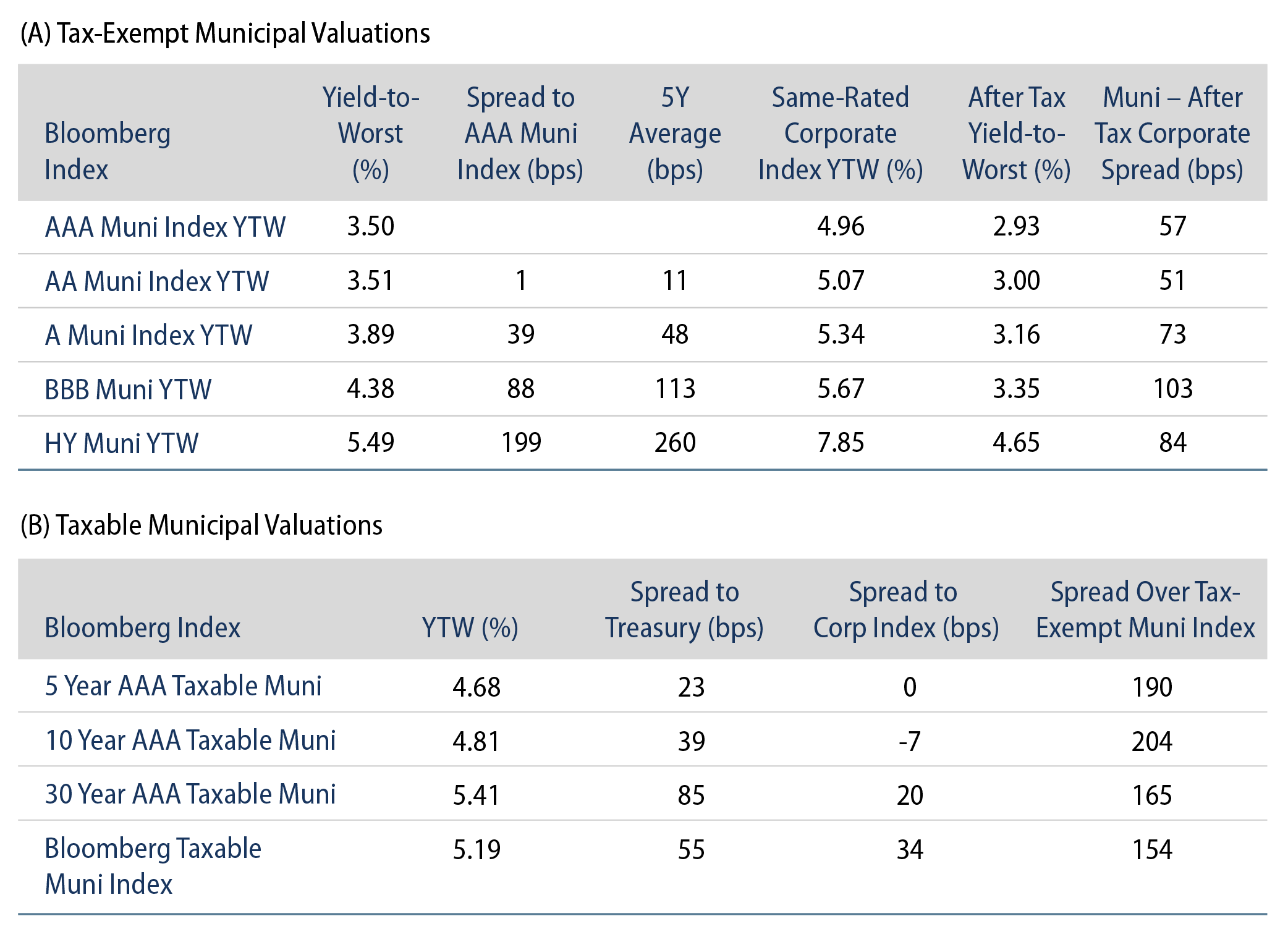

Municipal Credit Curves and Relative Value

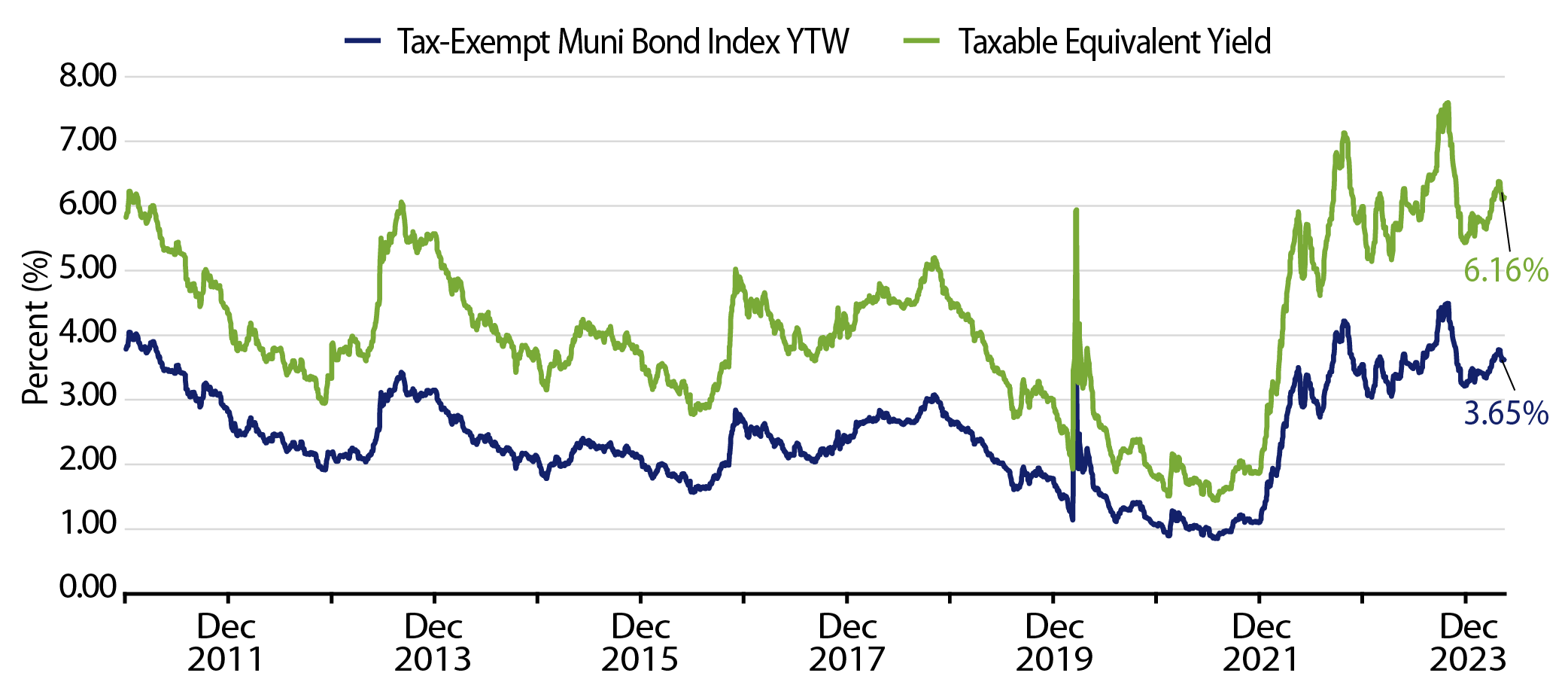

Theme #1: Municipal taxable-equivalent yields are above decade averages.

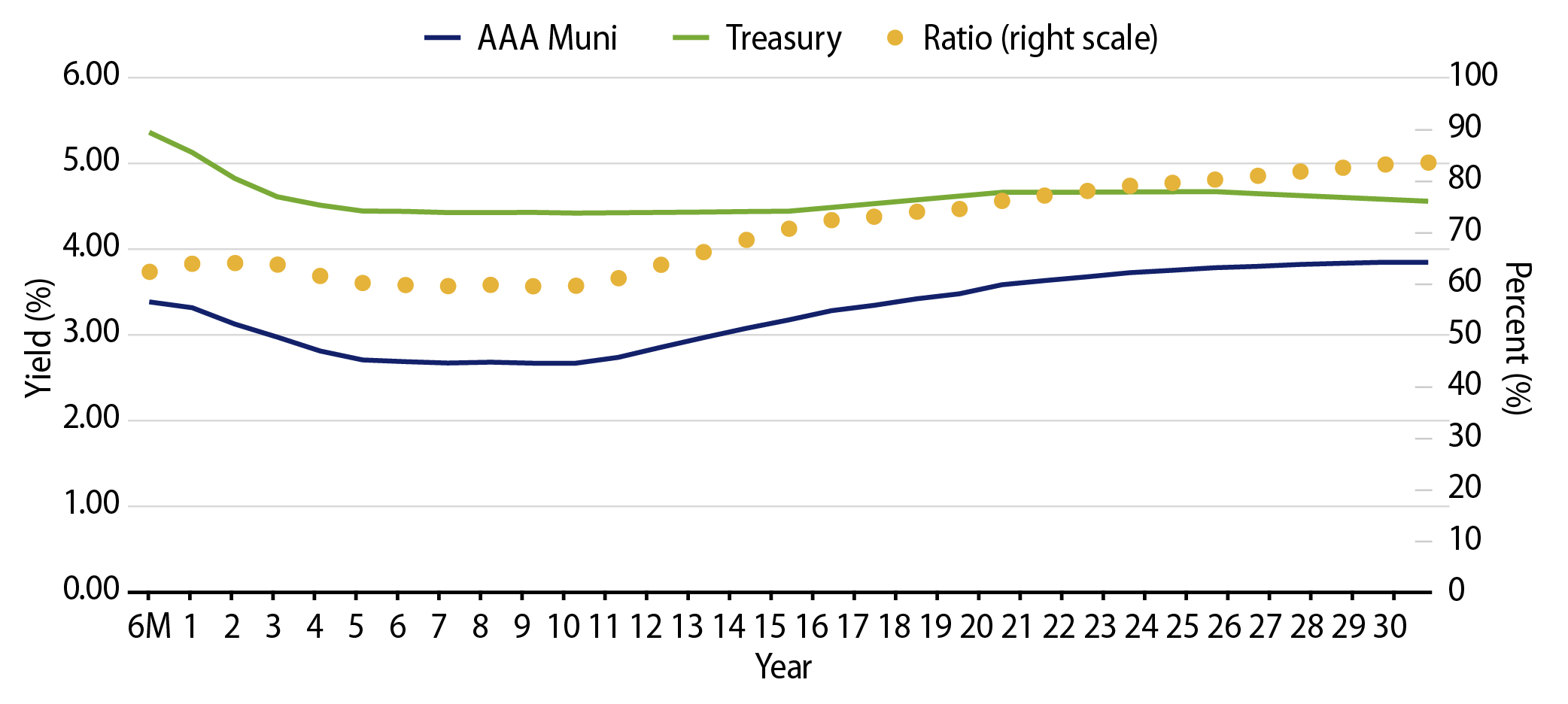

Theme #2: The inverted yield curve suggests less relative value in 5- and 10-year maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.