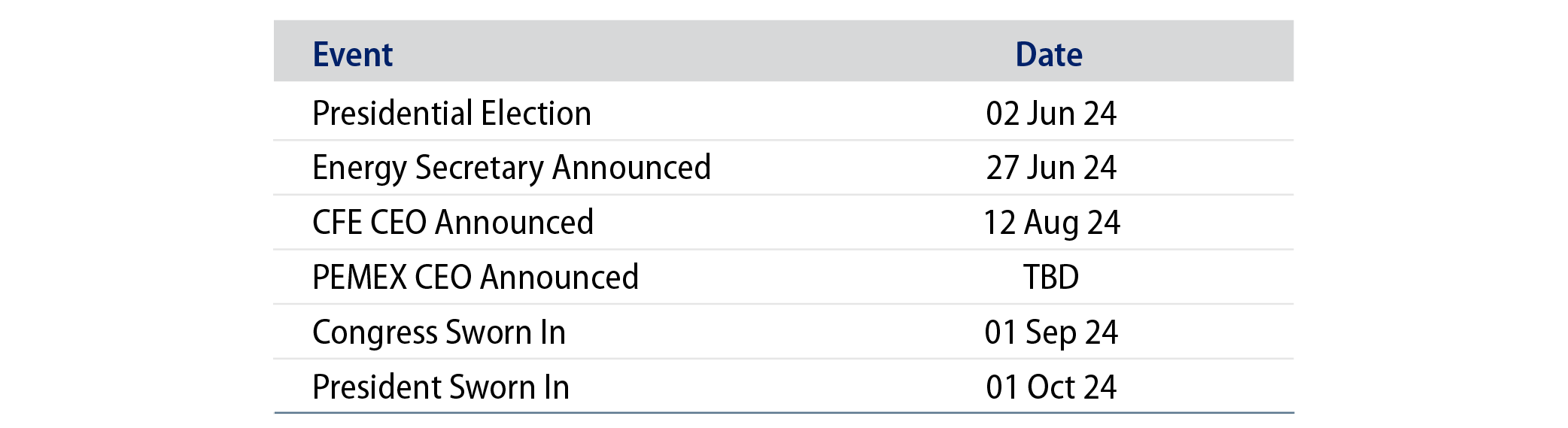

As Mexican President Andrés Manuel Lopez Obrador (AMLO) nears the end of his six-year term, market watchers are analyzing the potential policies of his successor Claudia Sheinbaum. While the new administration will have to operate under the shadow of President AMLO’s popularity and populist approach to governing, President-Elect Sheinbaum’s term may be distinguished by her scientific and technocratic background as well as the Morena party’s expected supermajority in Congress. In the months leading up to Sheinbaum’s inauguration on October 1, Western Asset is focusing on the Mexican energy and utility sectors as key parts of the economy in need of regulatory reform, but also at risk of populist influence.

As readers of Western Asset content know, we view Mexico as continuing to benefit from its proximity to the large US market, especially now as global trade tensions accelerate the nearshoring trend. However, despite the vibrancy of Mexico’s manufacturing sector, the country’s energy and utility sectors continue to bear the burden of heavy government intervention and taxation that challenge Mexican fiscal accounts and growth potential. National oil company PEMEX continues to see stagnant production and negative free cash flow with negligible participation from the private sector, while state-owned electric utility Comisión Federal de Electricidad (CFE) has underperformed both developed market (DM) and emerging market (EM) peers in terms of growing renewable generation and remains dependent on natural gas imports from the US. We expect the incoming Sheinbaum administration to have flexibility to enact new policies that could help these two entities become a more productive part of the Mexican economy. However, hopes of market-friendly changes have been clouded by the Morena party’s ongoing desire to reverse 2013-era energy reforms and cement the roles of PEMEX and CFE as public enterprises less focused on profitability or efficiency.

PEMEX: In Need of a Workover

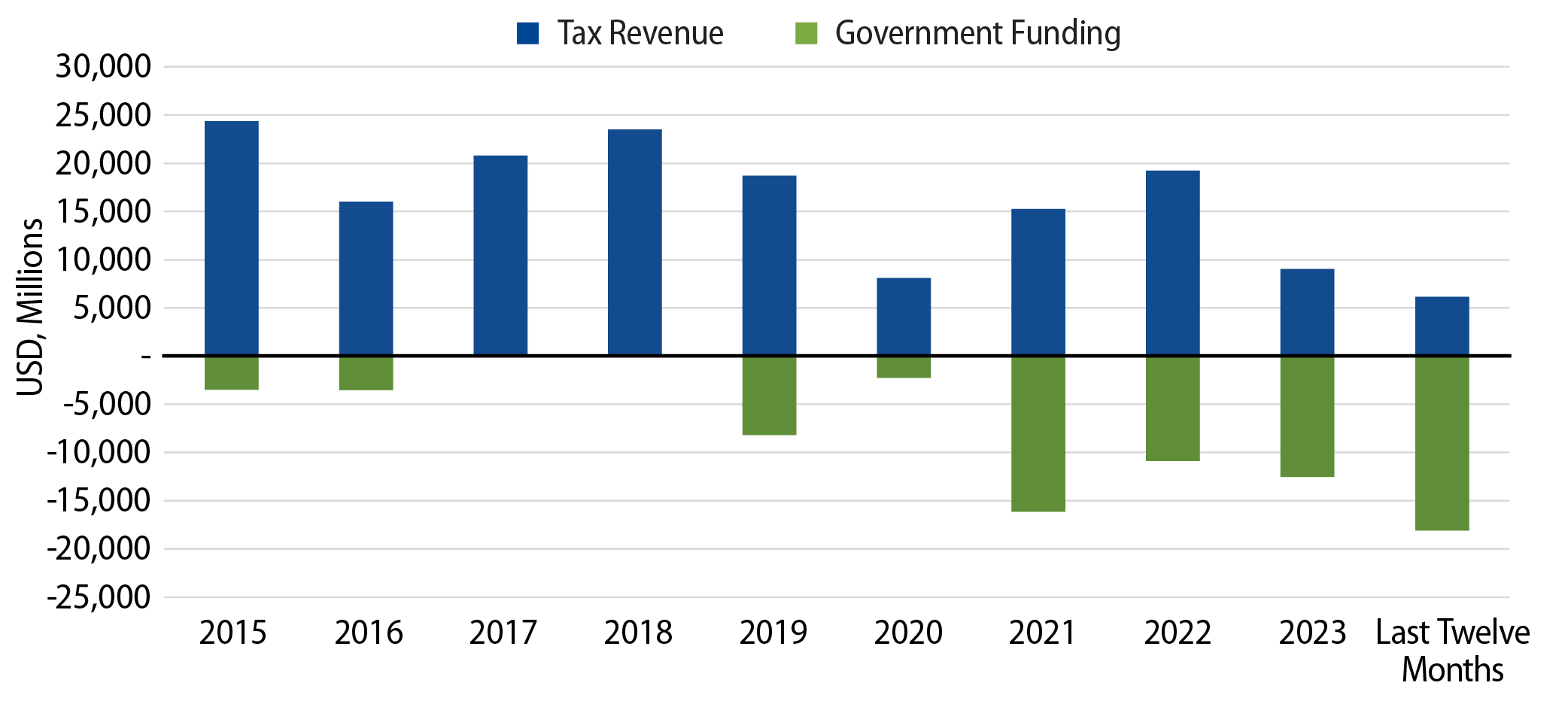

Long gone are the days in which Mexican national oil company PEMEX produced three million barrels of oil per day and generated gushers of government tax revenue for Mexico. While PEMEX has been close to AMLO’s heart over the past five years in the form of significant government funding (Exhibit 1) and a new $18 billion refinery, the company continues to toil under an approximately $100 billion debt load while being unable to grow its production or earnings. Hopes of private sector funding and involvement in the Mexican oil & gas sector withered during AMLO’s term given his preference for national champion PEMEX to control all upstream and downstream activity. While Sheinbaum has not yet named a new head of PEMEX, early comments from her administration suggest a more pragmatic approach to private sector involvement, which could include farm outs that provide off-balance-sheet funding for oil development projects. We believe the comparatively underexplored southern Gulf of Mexico still has the potential to be a source of economic growth for Mexico, mirroring the boost that the revitalized Permian Basin has provided to the US, but the right regulatory and funding environment will be required. With regard to PEMEX’s balance sheet, we expect the government to continue to have to fund its front-end maturities, while our base case is that Sheinbaum will not be eager to officially take on its debt load given negative implications for sovereign ratings. While our wish list for PEMEX reforms would include a leaner cost structure, a delevered balance sheet and private sector funding of oil & gas development, the new Sheinbaum administration will have to balance her more technocratic approach to governing with the continued presence of AMLO’s nationalistic energy sector views in the Mexican political sphere.

CFE: Sunrise in the Desert?

In recent years, Mexico’s electricity consumption has expanded rapidly due to strong economic activity supported by foreign corporations’ nearshoring investments. Under the current growth trajectory, Mexico may not have sufficient power-generation capacity to accommodate future demand:

- Mexico’s electricity supply/demand balance is significantly tighter now compared to when AMLO assumed office. The country is facing a shrinking reserve margin (generation capacity relative to peak power demand), which could lead to more blackouts during high power usage seasons.

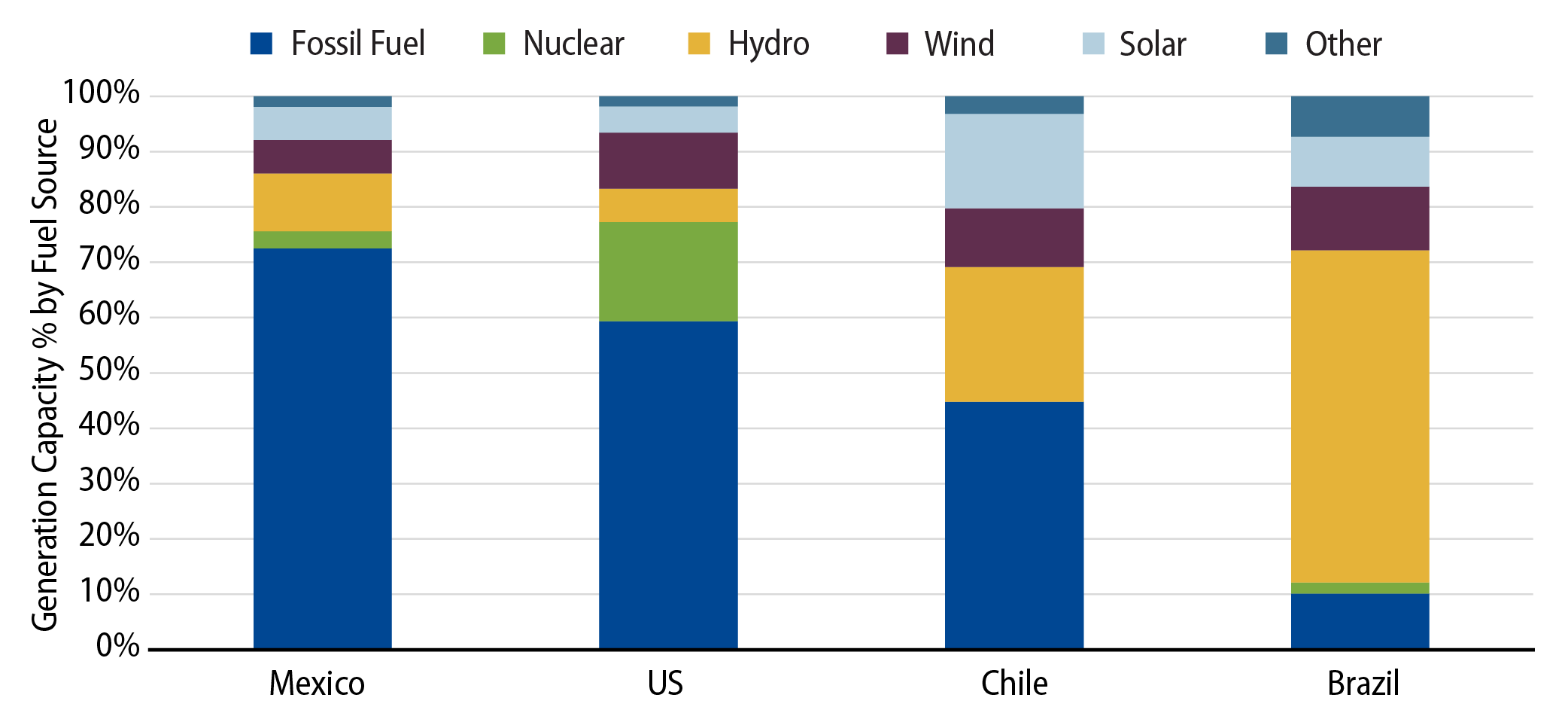

- Underinvestment in renewable energy and transmission infrastructure has limited Mexico's ability to grow cost-efficient capacity to keep pace with growing demand. Mexico’s generation mix is now approximately 75% thermal energy, which is mostly powered by natural gas imported from the US.

- Significant financing is needed to fund future power infrastructure capital expenditures. CFE is already heavily subsidized by the Mexican government and does not have the capacity to fund large-scale national projects.

- Mexico’s current reform plan for the power sector includes the elimination of independent regulators. This could trigger a USMCA dispute between the US, Canada and Mexico, leading to trade penalties or tariffs on Mexico.

Sheinbaum’s new government will have an opportunity to define the future of energy in Mexico. During the election campaign, Sheinbaum made renewable power generation and transmission build-out one of her administration's signature issues. She pledged to invest $13 billion in power generation and transmission infrastructure if elected. She also suggested using public-private partnerships to promote private investment in Mexico’s power infrastructure. However, she also stated that her administration would follow AMLO’s plan to help government-owned power utility company CFE maintain a majority market share in the country’s power-generation market, leaving only 46% of the market for the private sector. Implementing more free-market policies while maintaining a nationalistic view on the power market will be a challenging task for the next administration.

While the Sheinbaum administration appears to have both the will and tools to improve Mexico's power market, more clarity is needed on how the government plans to fund power infrastructure investments, either through the government's balance sheet or public-private partnerships. Our view is that Sheinbaum will take a pragmatic approach in opening the sector to private investment while maintaining CFE’s dominant role in the power market. We are watching the recent appointments of Luz Elena Gonzalez to the Energy Ministry and Emilia Esther Calleja as CFE’s CEO for signs that Sheinbaum’s technocratic rather than populist approach to governing could bear fruit for the electric sector. It is clear that Mexico needs more efficient generation and transmission assets to maintain its current growth trajectory. We believe independent power producers would benefit under a credible and market-friendly power policy, while CFE will remain an important part of the country’s energy strategy.

Opportunities in Mexico Under a Sheinbaum Administration

Western Asset continues to believe that Mexico enjoys structural advantages relative to other EM countries, such as a competitive manufacturing base, stable political/regulatory environment and access to the US market. However, to truly capitalize on future nearshoring trends as well as maintain its investment-grade-rated balance sheet, we believe the incoming Sheinbaum administration will need to rethink recent approaches to regulation and funding for its key state-owned entities PEMEX and CFE. Given the companies’ large presence in EM bond markets, Sheinbaum’s policies will have a meaningful impact on Mexico’s economy and create opportunities for EM investors, including firms like Western Asset.