Munis Posted Positive Returns Last Week

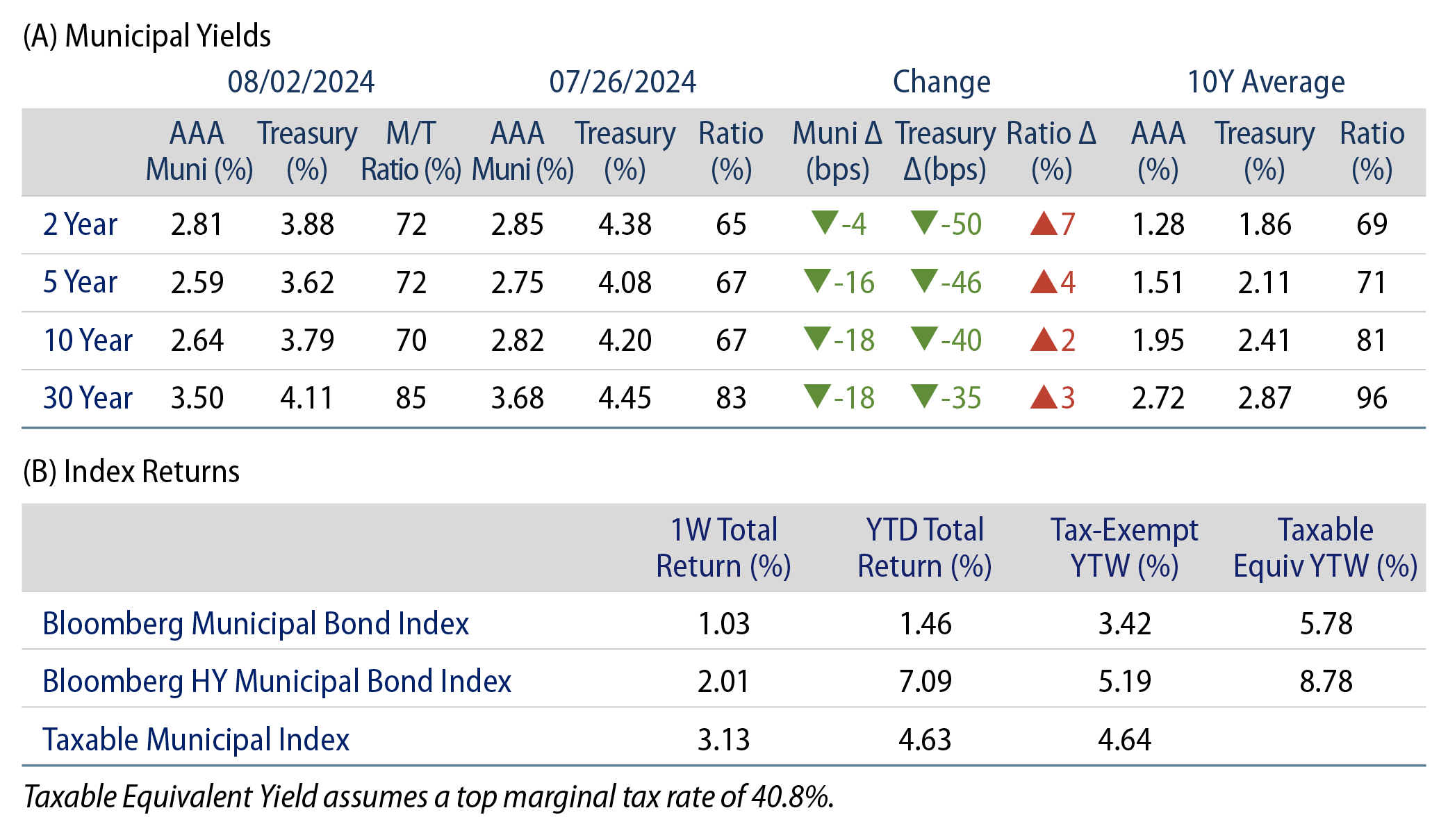

Municipals posted positive returns last week as muni yields underperformed Treasuries, which moved sharply lower on weaker-than-expected payroll data that accelerated recession fears. High-grade muni yields moved lower across the curve as rates rallied. Meanwhile, muni supply and demand remained elevated. The Bloomberg Municipal Index returned 1.03% during the week, the High Yield Muni Index returned 2.01% and the Taxable Muni Index returned 3.13%. This week we touch on the record tax-exempt muni supply observed this year.

Supply and Demand Continue to Trend Higher

Fund Flows (up $1.1 billion): During the week ending July 31, weekly reporting municipal mutual funds recorded $1.1 billion of net inflows, according to Lipper. Long-term funds recorded $948 million of inflows, high-yield funds recorded $222 million of inflows and intermediate funds recorded $101 million of inflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $15 billion.

Supply (YTD supply of $281 billion, up 41% YoY): The muni market recorded $8 billion of new-issue volume last week, down 27% from the prior week. YTD issuance of $281 billion is 41% higher from last year’s level, with tax-exempt issuance 45% higher and taxable issuance 4% higher year-over-year (YoY). This week’s calendar is expected to accelerate to $16 billion, which would represent the highest level this year. Largest deals include $1.3 billion Louisiana Public Finance Authority and $1 billion Long Island Power Authority transactions.

This Week in Munis: Record Supply

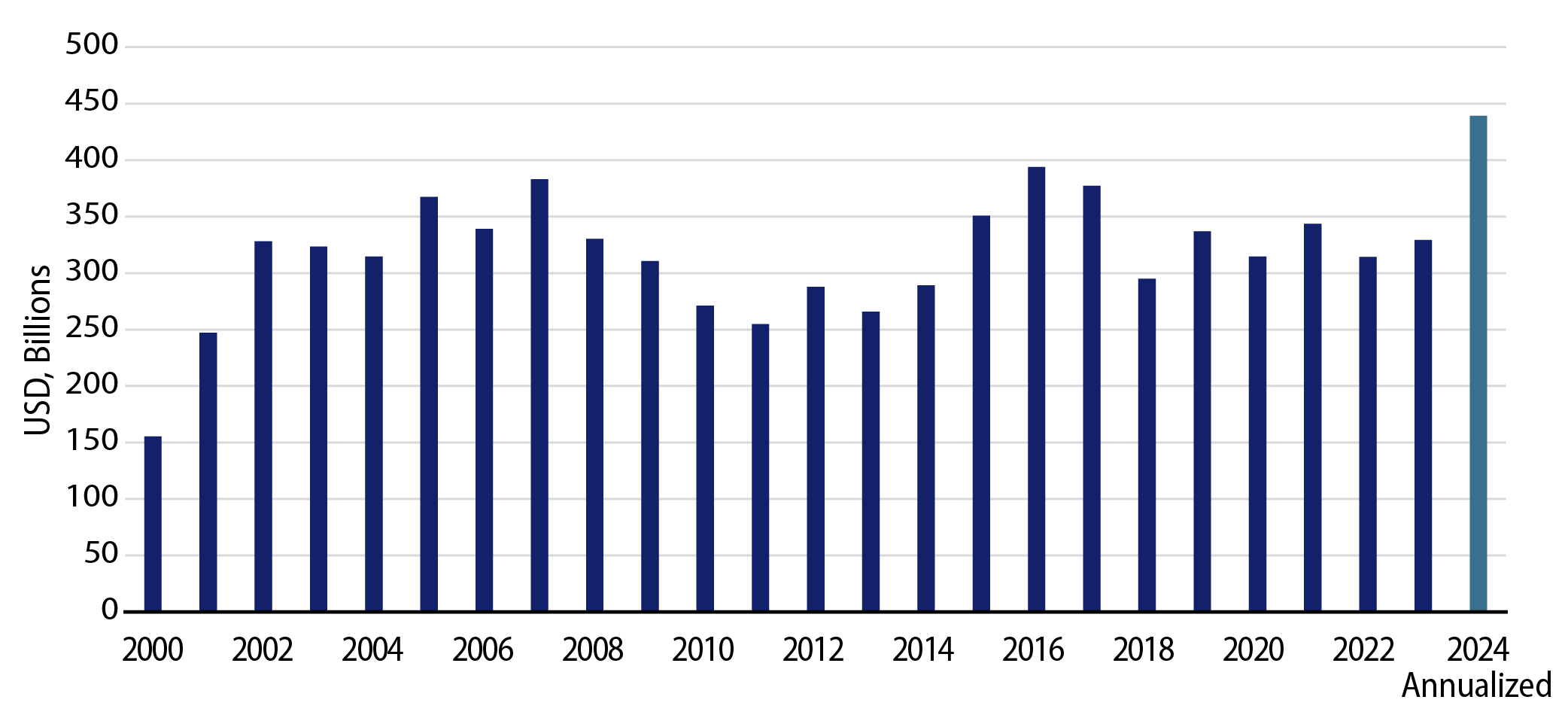

The summer months, and particularly the month of July, are characterized by the “summer doldrums,” or lower supply levels and overall market activity. Over the prior decade, July tax-exempt new-issue supply averaged $28 billion, ranking toward the bottom of months in terms of average issuance. In July 2024, tax-exempt supply reached $36 billion, surpassing the 10-year average by 30%, and leading YTD tax-exempt supply to $256 billion. If tax-exempt supply maintains its current pace, 2024 would reach a record $440 billion.

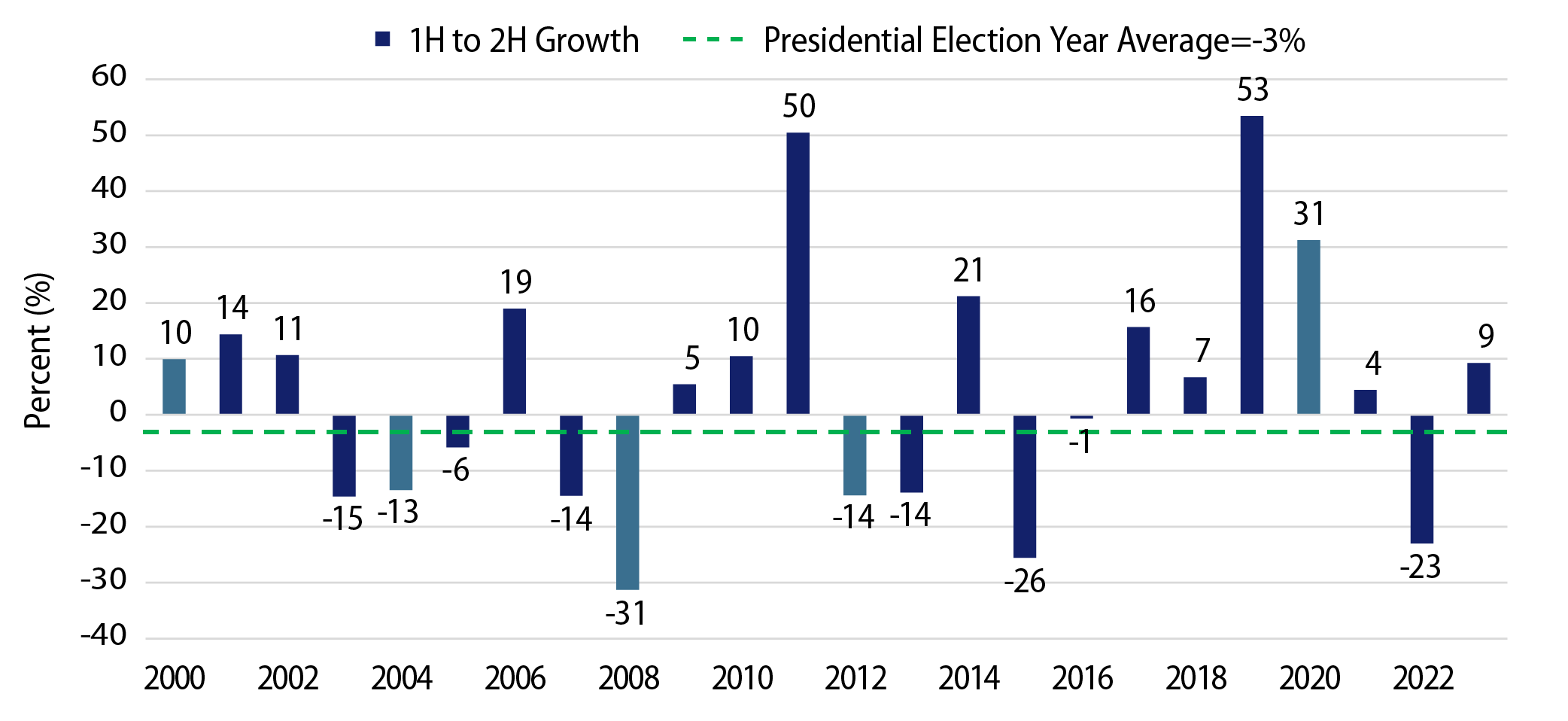

Many market participants point to prior presidential election years to guide supply expectations lower for the second half of 2024. Historical data does suggest that supply has moved lower in recent presidential election years, but only to an extent. From 2000 to 2023, average municipal supply increased by 2.3% from the first half of the year to the second half. Meanwhile, considering presidential election years only, muni supply declined by 3.1% on average. While these averages point to lower supply levels during election years, the variability of these election-year outcomes is quite high, considering the 31% YoY supply decline in 2008 and the 31% YoY supply increase in 2020.

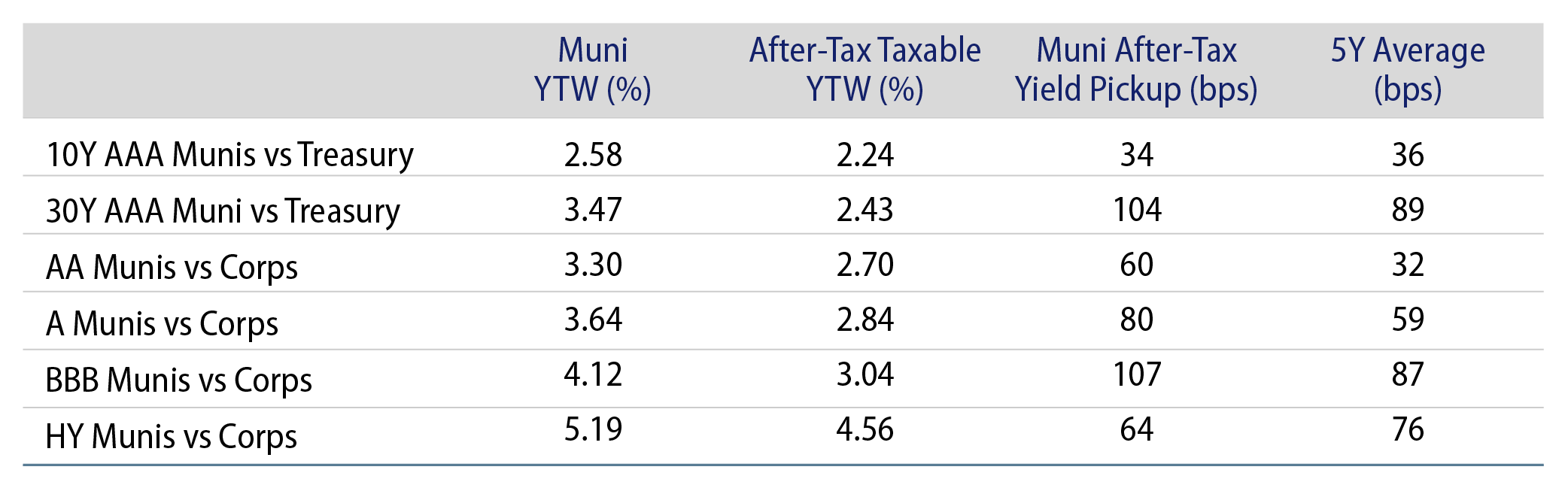

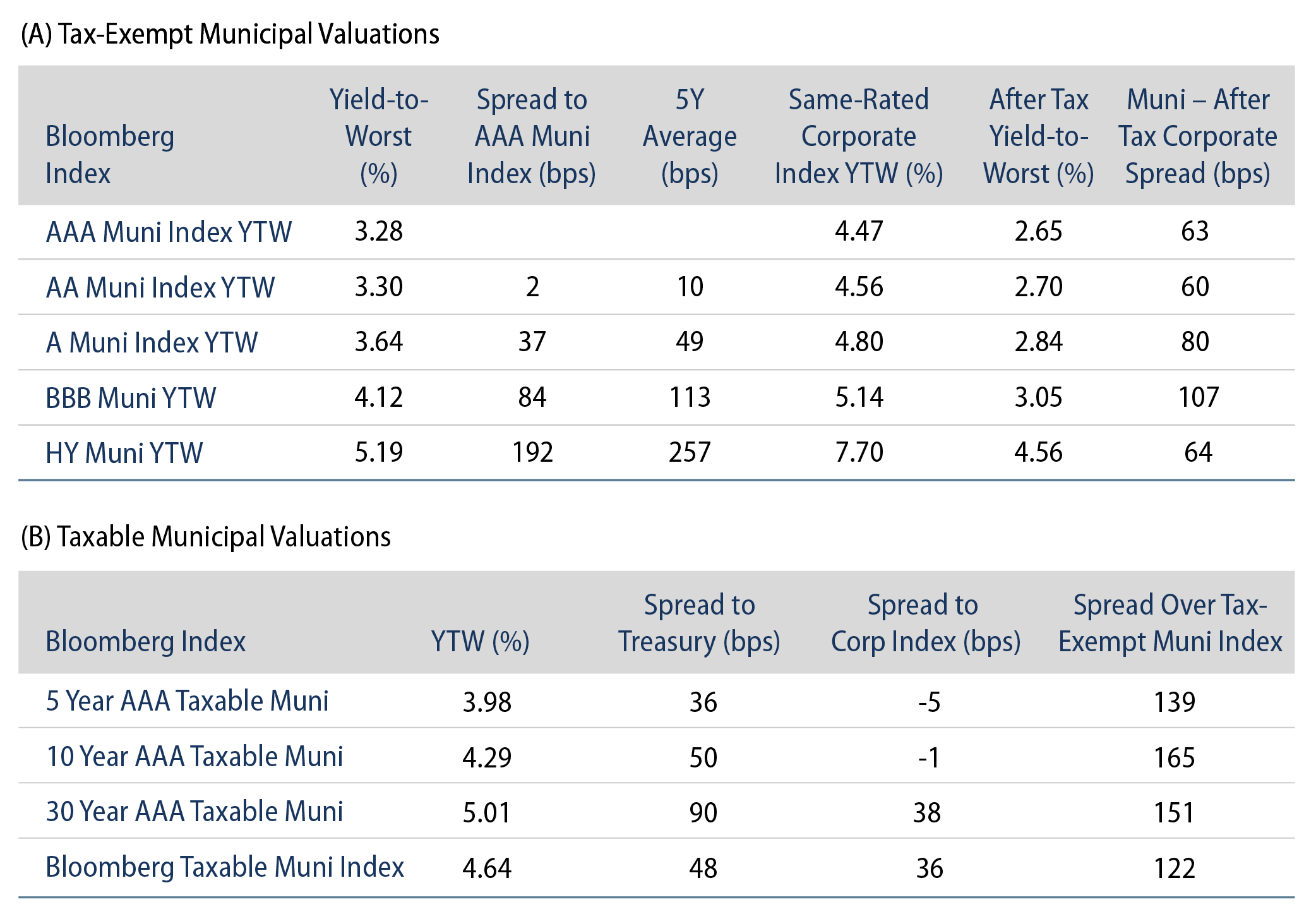

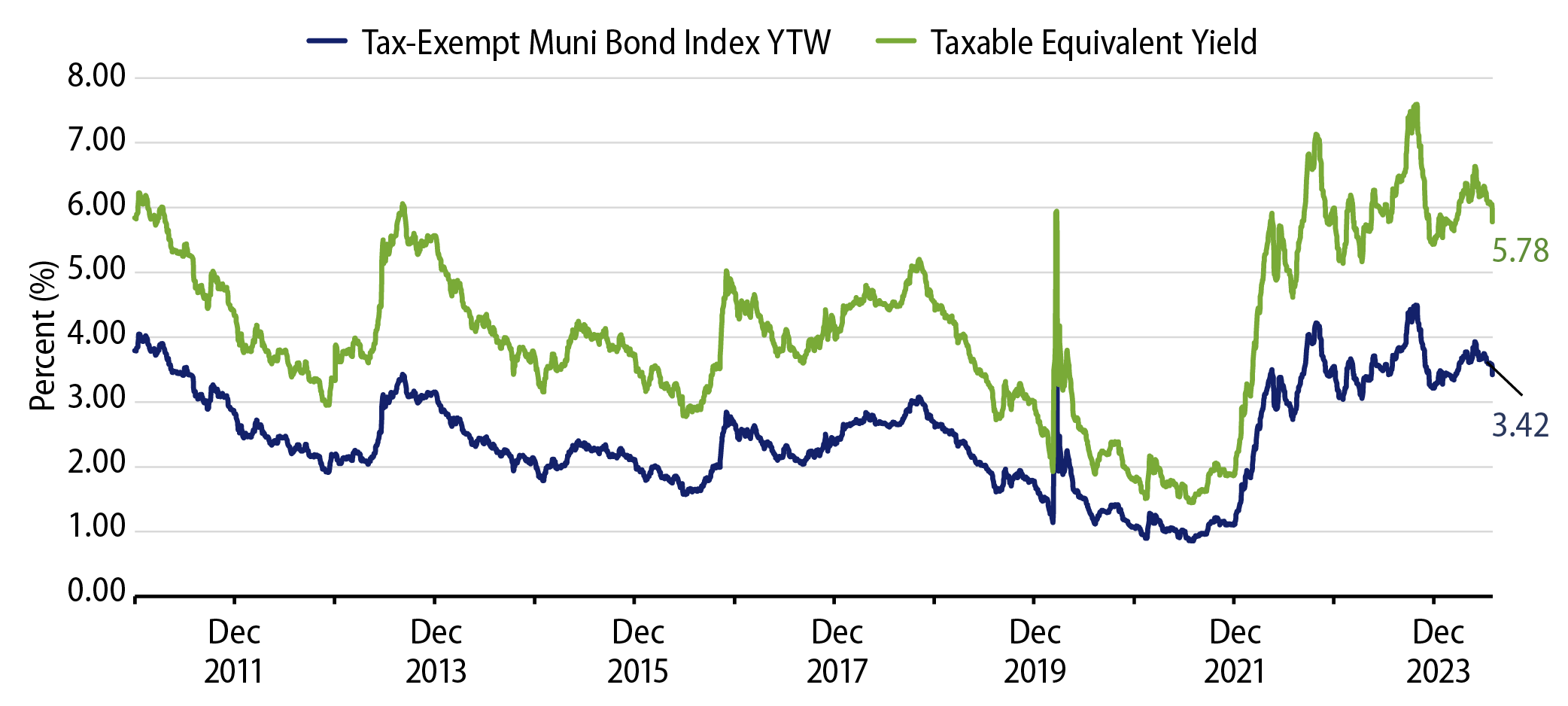

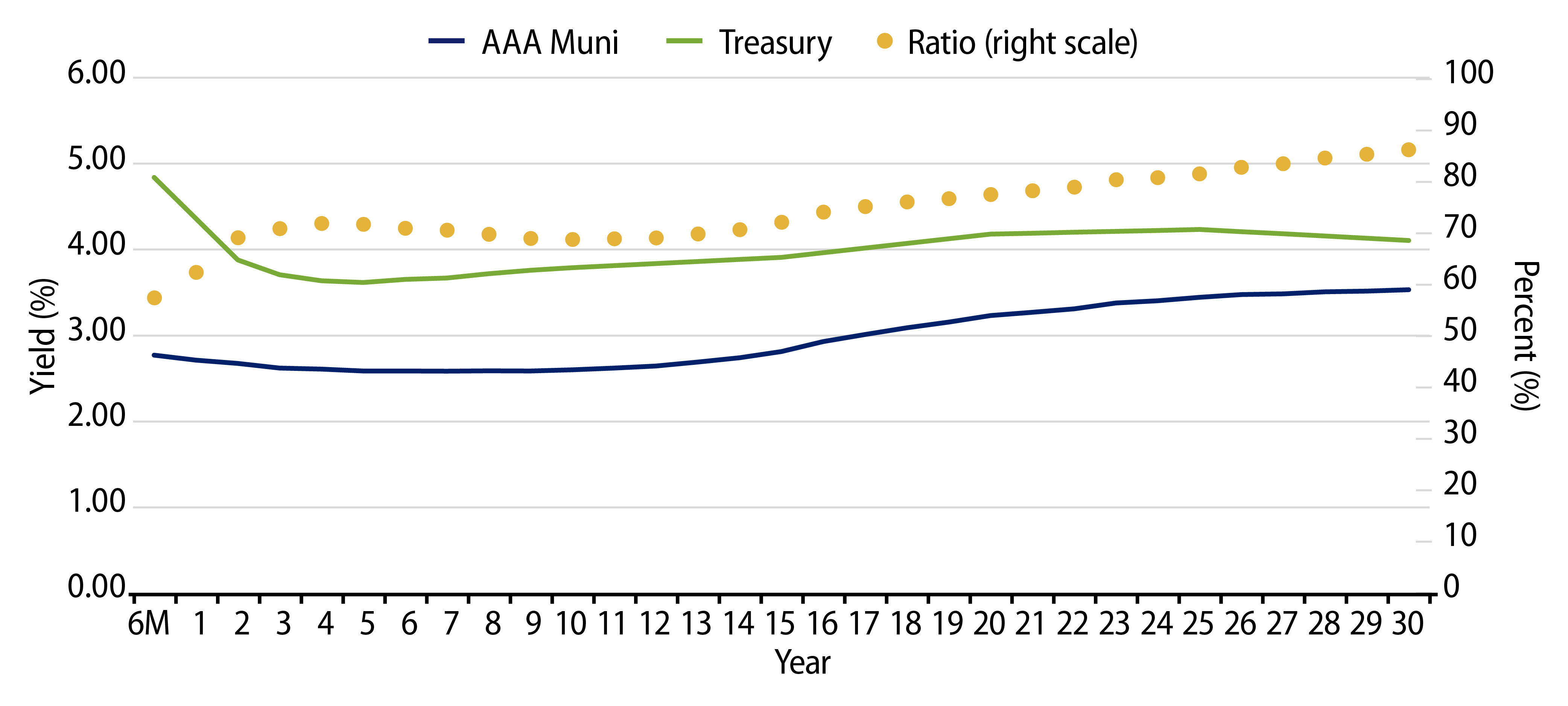

Even if supply declines an above-average 10% in the second half of 2024, total tax-exempt supply will still likely eclipse a record year, indicative of the scope of elevated supply observed in the first half of the year. These supply levels and relative muni underperformance have provided an attractive entry point for relatively attractive after-tax income levels. Since the beginning of July, the average Bloomberg Muni Index yield-to-worst (YTW) declined just 32 basis points (bps), while Bloomberg Corporate and Treasury indices declined 78 bps and 60 bps, respectively. This has resulted in improved after-tax yield advantages for the muni asset class for high taxpayers, which still range above 100 bps in longer maturity and lower credit quality cohorts.

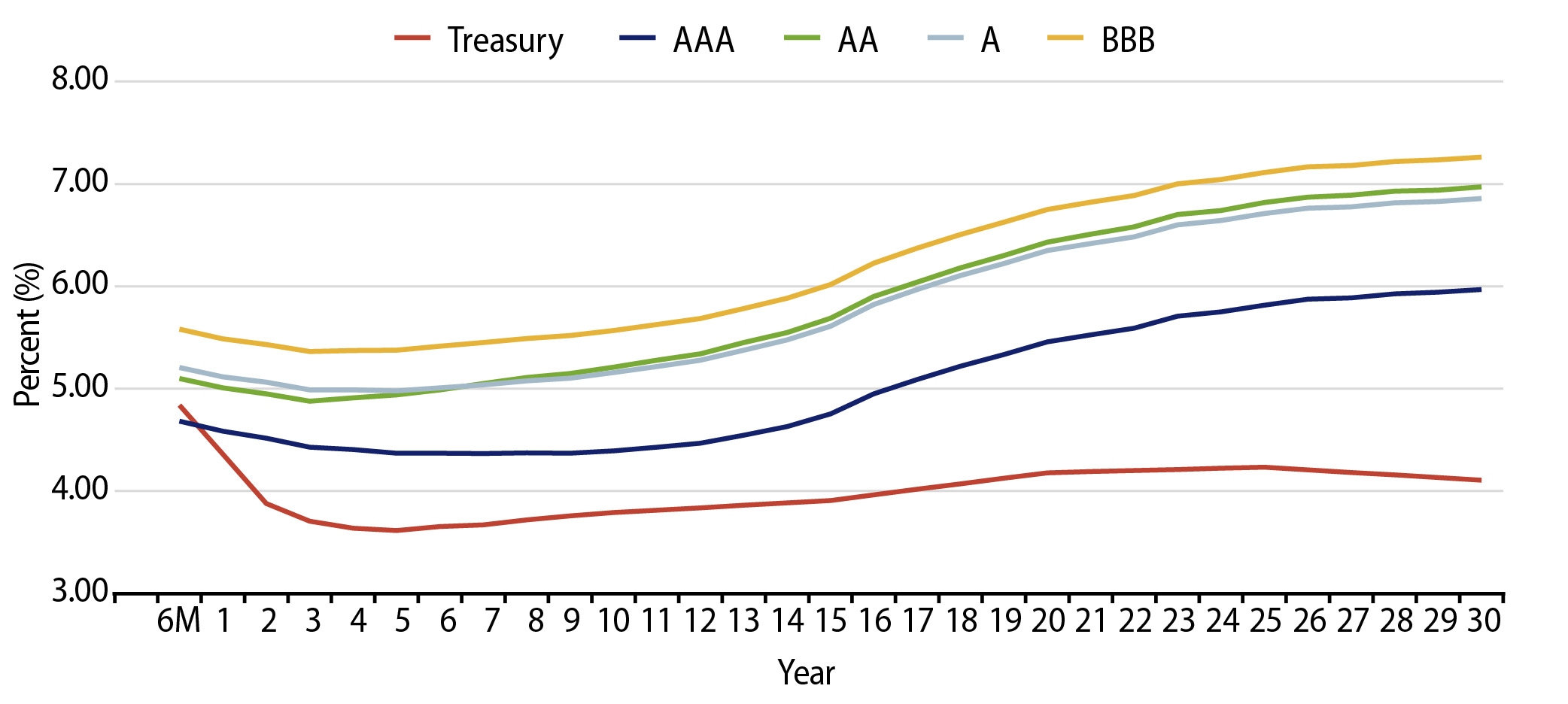

Municipal Credit Curves and Relative Value

Theme #1: Municipal taxable-equivalent yields, and income opportunities, are above decade averages.

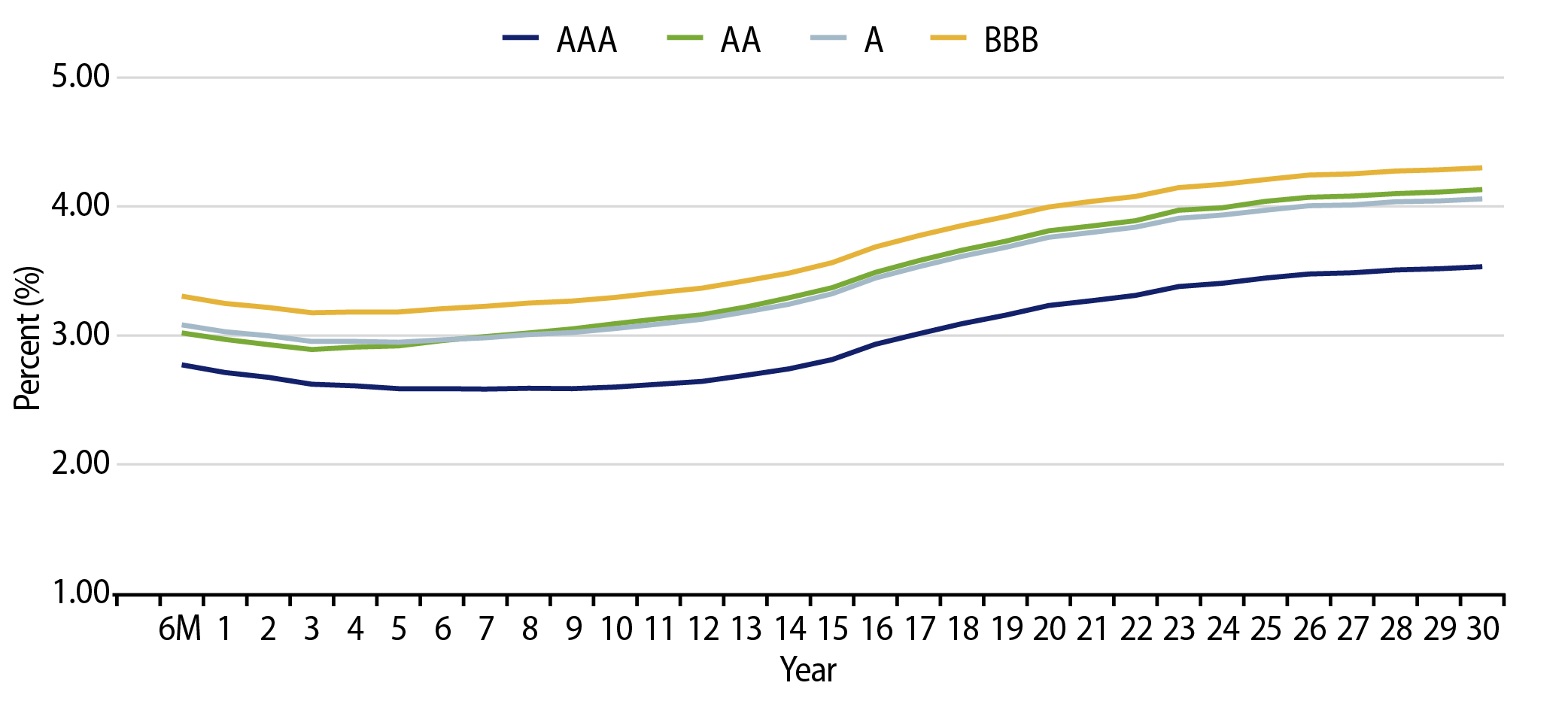

Theme #2: The muni yield curve has largely disinverted, offering potential value in extending maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.