Investment-Grade Municipals Posted Positive Returns Last Week

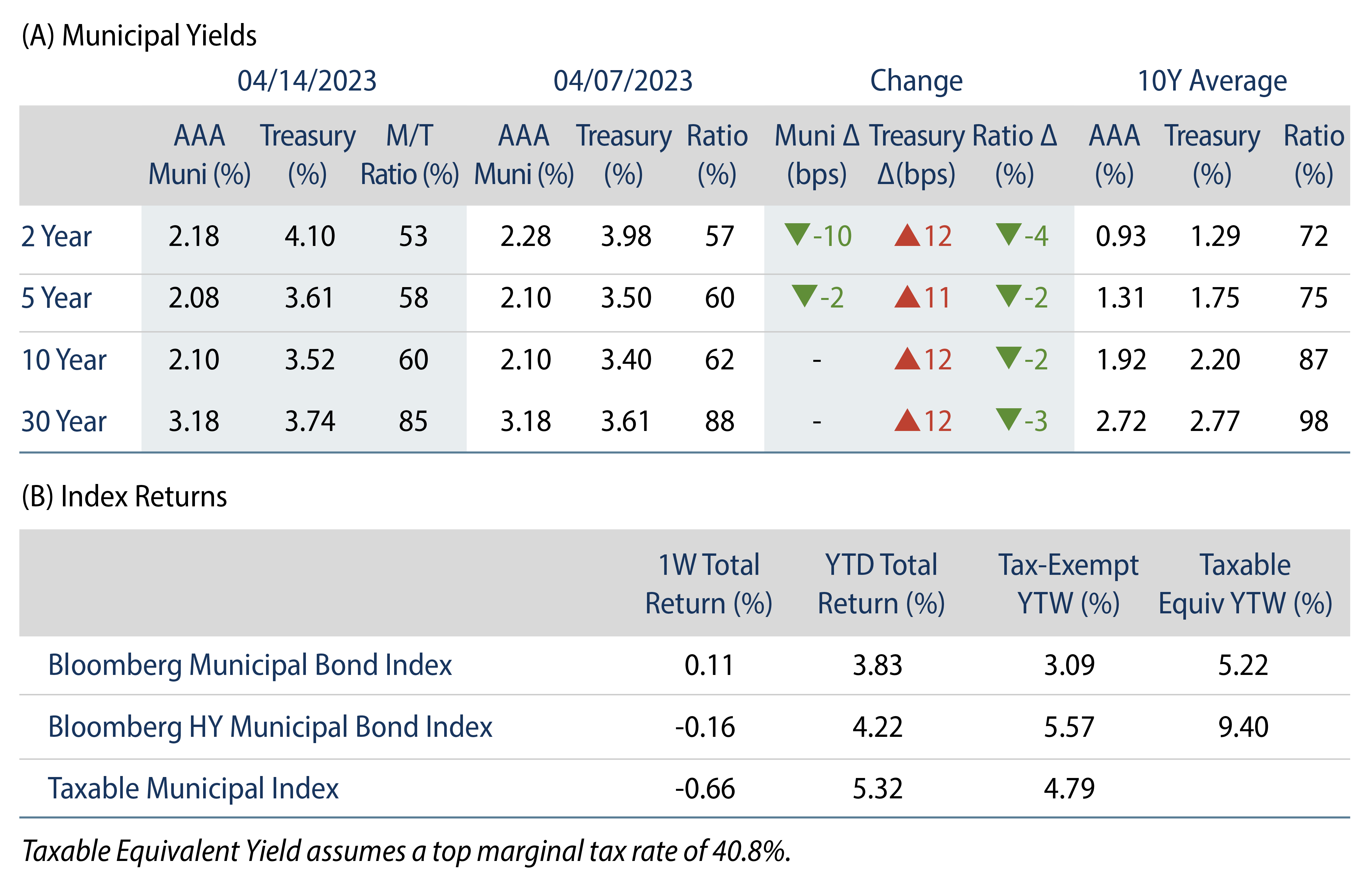

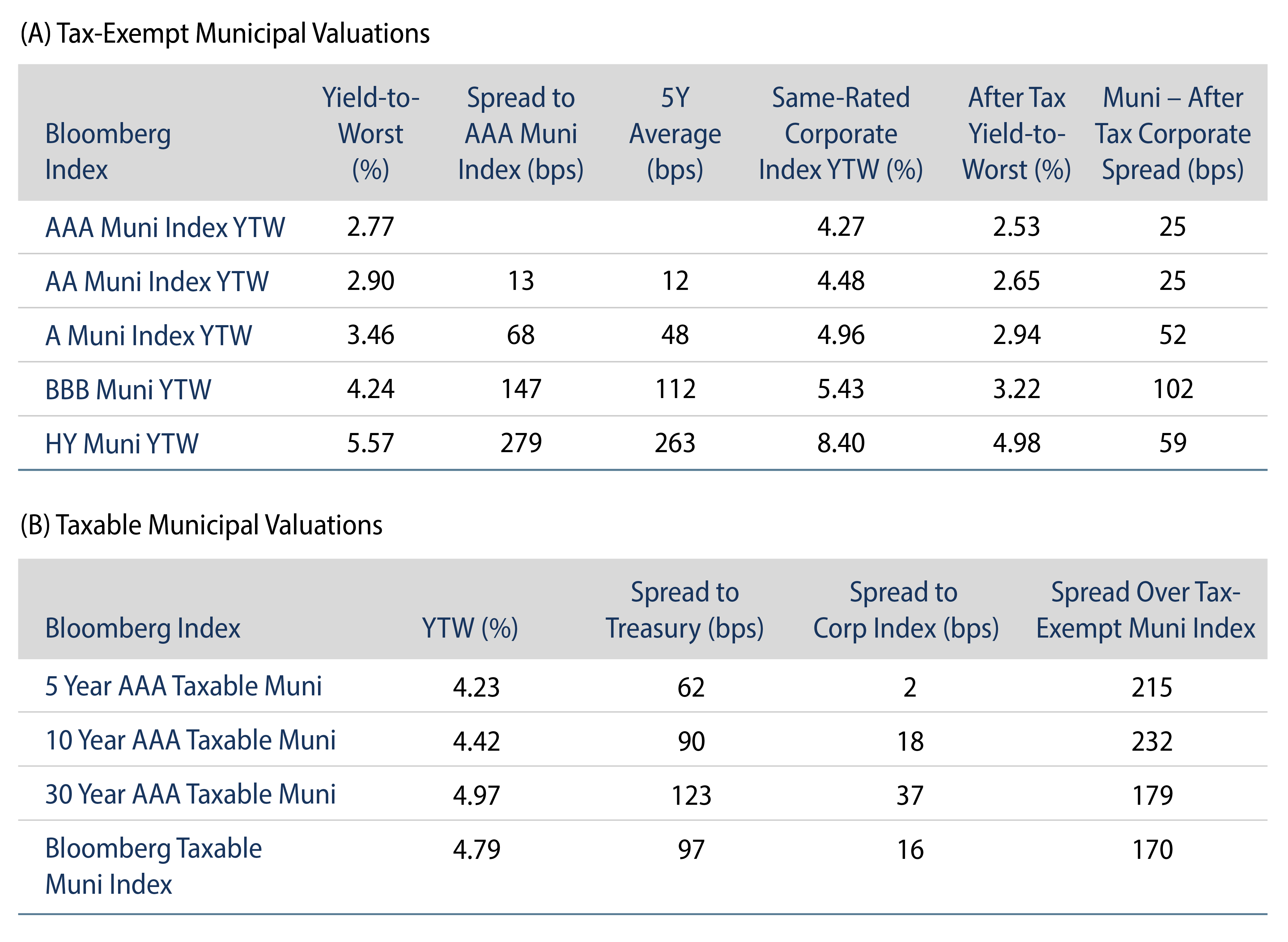

Municipal yields moved lower in short maturities as the curve steepened last week. Munis outperformed Treasuries across the curve, as strong bank earnings appeared to support the fact that the Federal Reserve (Fed) would not need to ease its tightening policy, despite the Consumer Price Index (CPI) falling from 6% to 5% and lower than expected Producer Price Index (PPI) data released earlier in the week. The Bloomberg Municipal Index returned 0.11% during the week, the High Yield Muni Index returned -0.16% and the Taxable Muni Index returned -0.66%. This week we highlight rarely seen strong technicals for March that supported the market ahead of tax season.

Market Technicals Weakened with an Uptick in Supply, Modest Outflows

Fund Flows: During the week ending April 12, weekly reporting municipal mutual funds recorded $256 million of net outflows, according to Lipper. Long-term funds recorded $224 million of inflows, high-yield funds recorded $198 million of inflows and intermediate funds recorded $24 million of outflows. Despite fund outflows, strong SMA demand continues to support high-grade munis within 10-year maturities.

Supply: The muni market recorded $8 billion of new-issue volume last week, up 26% from the prior week. Year-to-date (YTD) issuance of $89 billion is down 20% year-over-year (YoY), with tax-exempt issuance down 16% YoY and taxable issuance down 40% YoY. This week’s calendar is expected to jump to $13 billion. Large transactions include $2.5 billion State of Illinois and $847 million Southeast Energy Authority transactions.

This Week in Munis: Rare Tax Season Strength

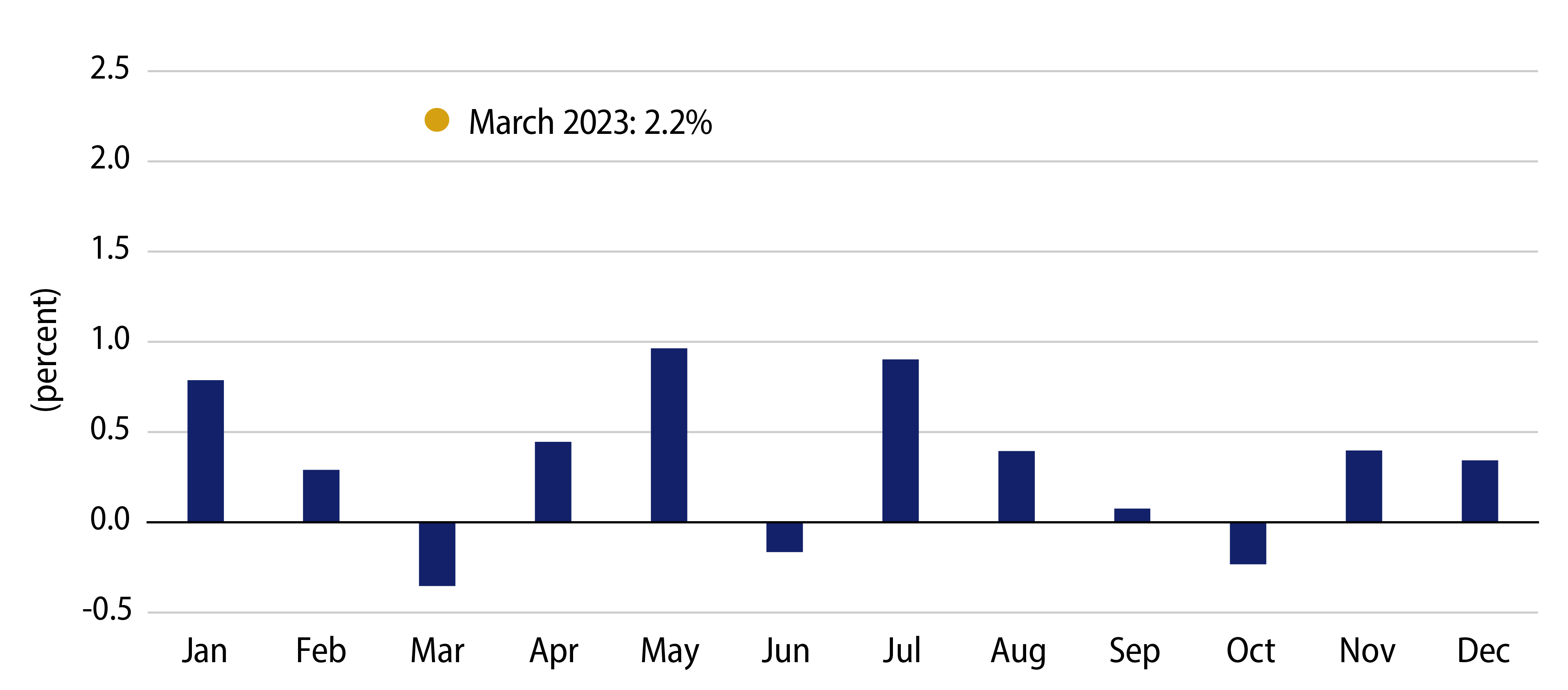

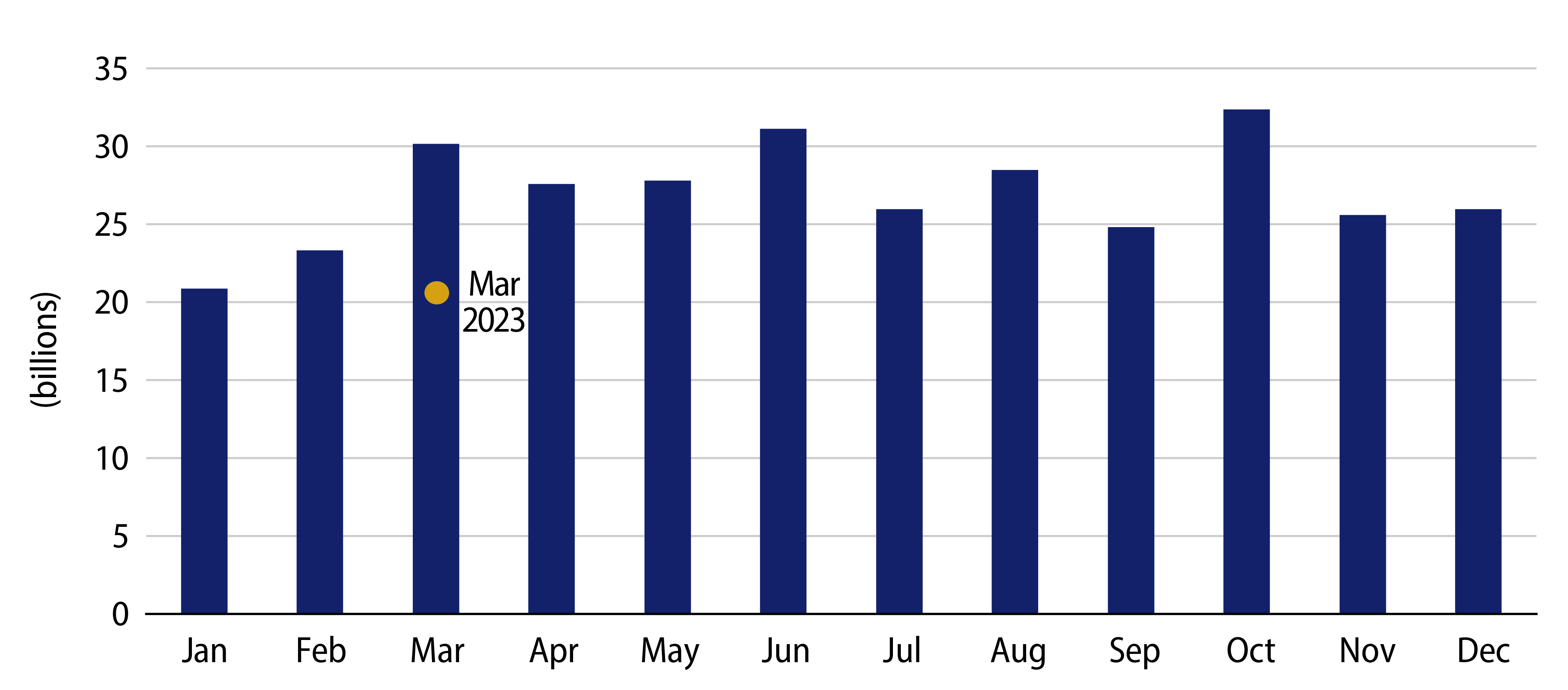

The weeks ahead of Tax Day have historically offered weak returns for the municipal market, and from 2009 to 2022 the average March total return of -0.35% has ranked last among all other months. March muni weakness has historically been attributable to weak demand as investors often sell munis to fund tax liabilities. In addition, March supply tends to be above average. This year’s March Muni Bond Index return of 2.22% has bucked the historical trend.

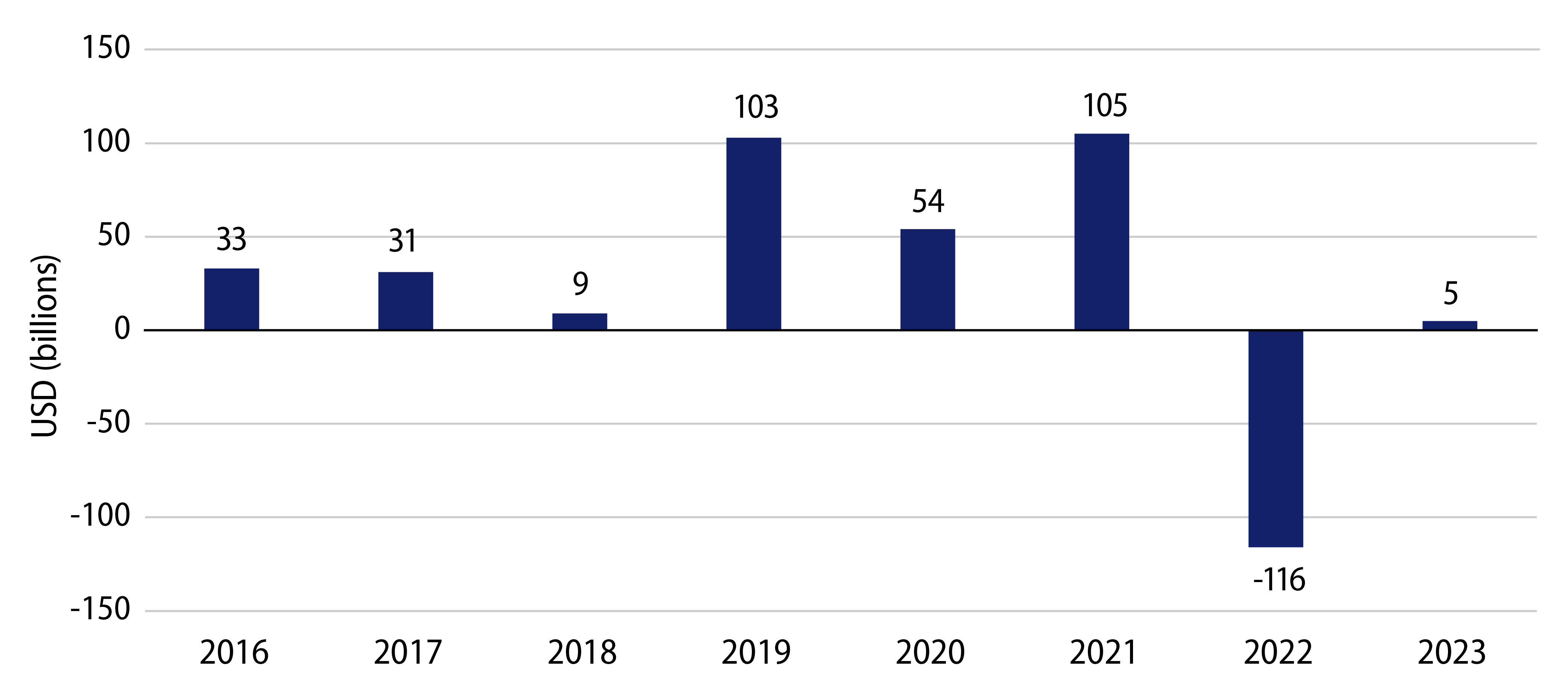

The March 2023 reversal of negative average returns is attributable to stronger than anticipated demand, as the muni market likely observed below average tax selling this year combined with the flight-to-quality sentiment that emerged amid the banking sector challenges. We believe the need for individuals to sell municipals to fund their tax liabilities was limited due to the negative returns observed across both equities and fixed-income in the 2022 tax year. In addition, some states, including California, have provided for tax filing extensions as part of natural disaster relief efforts, which could have also softened the concentrated selling we typically see ahead of Tax Day. All told, municipal mutual funds recorded $5 billion of inflows YTD through March, according to the Investment Company Institute (ICI).

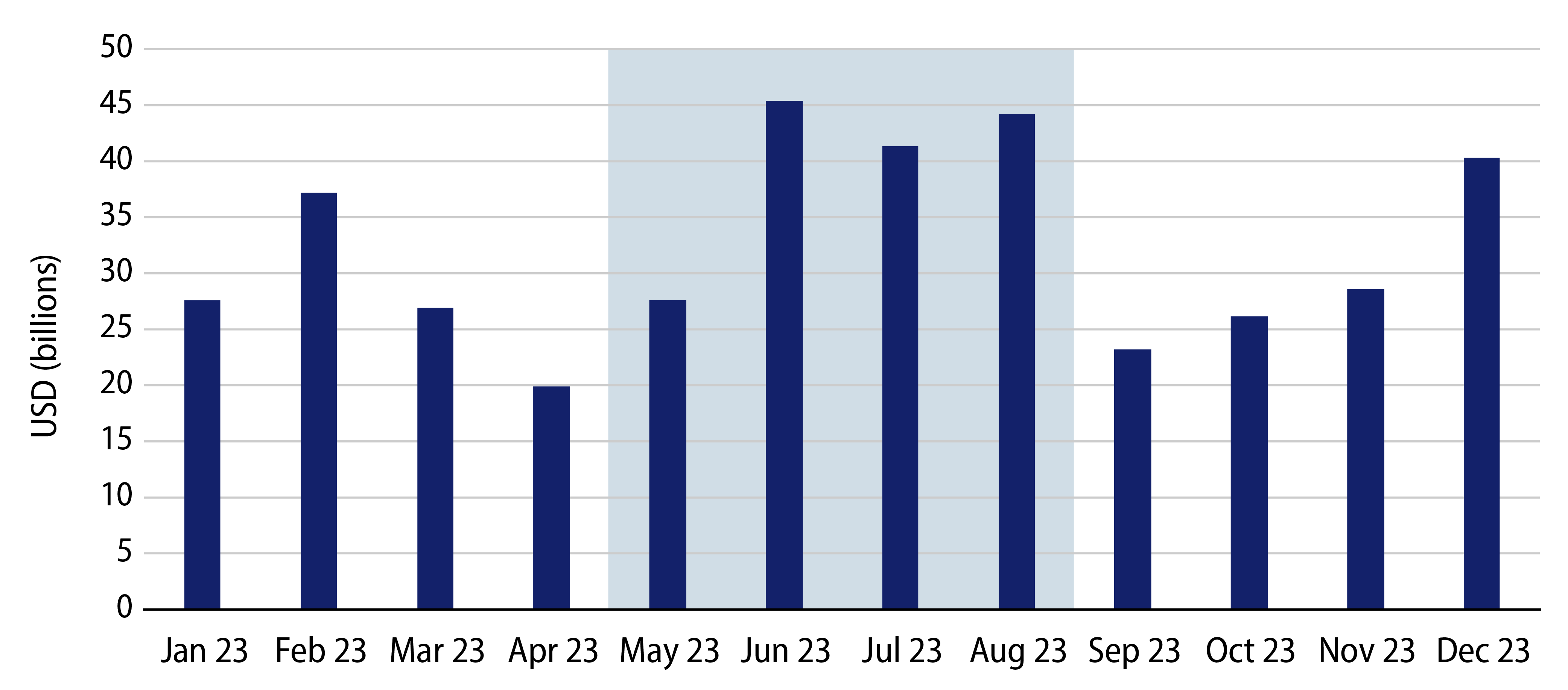

In addition to traditionally weaker demand technicals, we often observe above average supply levels in March which also contributes to the weakness. While the March 2023 tax-exempt supply of $20 billion ticked up significantly from limited January and February levels, it remained below the 10-year average of $29 billion for the month.

Looking ahead to summer, we anticipate supply and demand technicals could strengthen further and potentially drive tax-exempt yield levels lower. If issuers remain on the sidelines in the summer months, we expect the market could be challenged to absorb the estimated $158 billion of coupon and maturing bonds scheduled to come to market in May to August. Moreover, a rebound in municipal mutual fund inflows that could be supported by heightened tax increase rhetoric and a reduction of interest rate volatility may also support muni demand.