A Brief Update on Money Market Fund Reform

For short-term investors aiming to keep their capital safe, minimize price fluctuations, invest and redeem their liquidity the same day, while earning a “market-competitive” yield on their cash, Rule 2a-7 money market funds (MMFs) have proved to be an effective investment choice for several decades. It is therefore surprising that for an investment product designed to operate without drawing significant attention, regulators and industry participants have spent considerable time and focus adapting regulations to both preserve the utility of MMFs while minimizing their potential systemic risks.

In this brief note, we summarize the background of new SEC proposals to amend aspects of Rule 2a-7 that were announced in December 2021, and expected for final publication in October 2022. We also aim to highlight a number of the SEC’s key measures and its rationale while providing some suggestions for ways that MMF investors can prepare in advance—in particular suggesting that investors review the potential impact of the new rules on their investment policy guidelines, or other documents defining their permissible short-term investments.

Why Are Changes Coming?

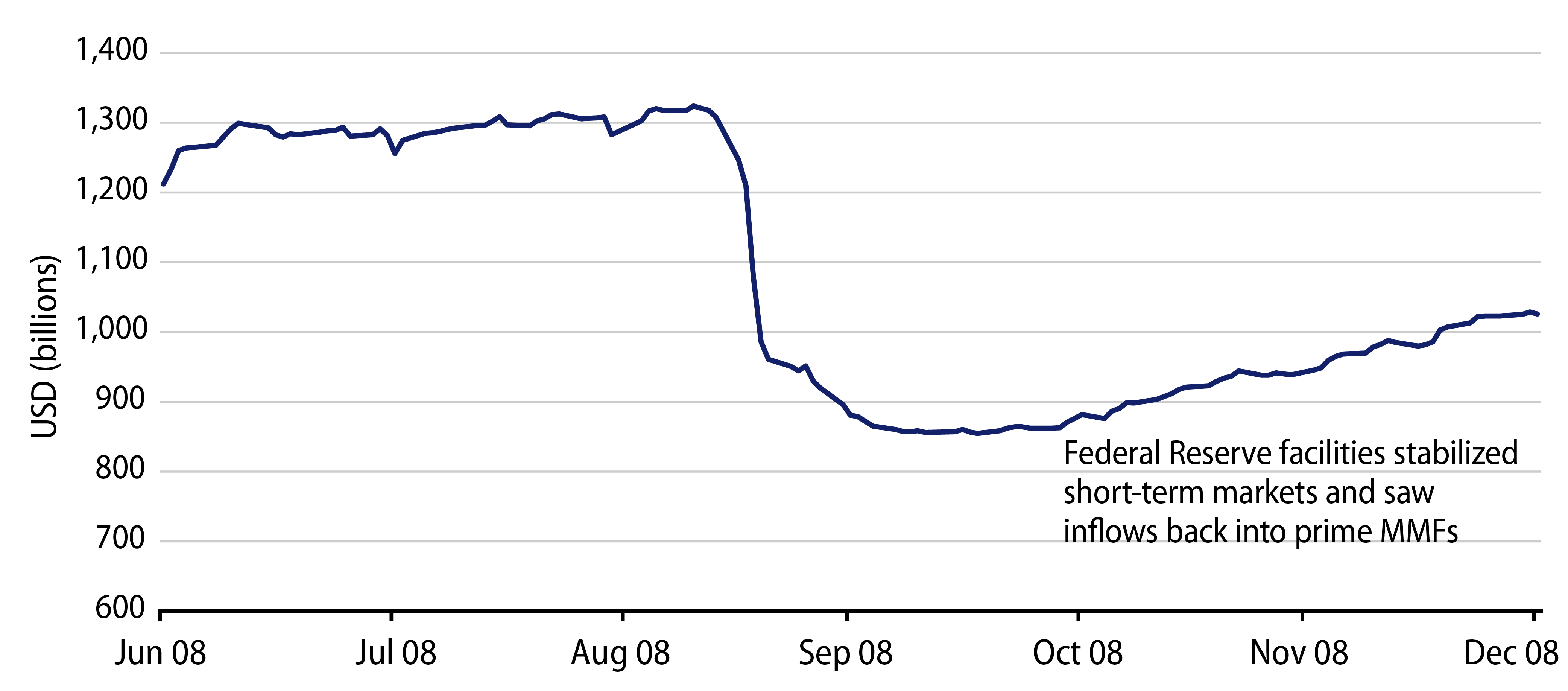

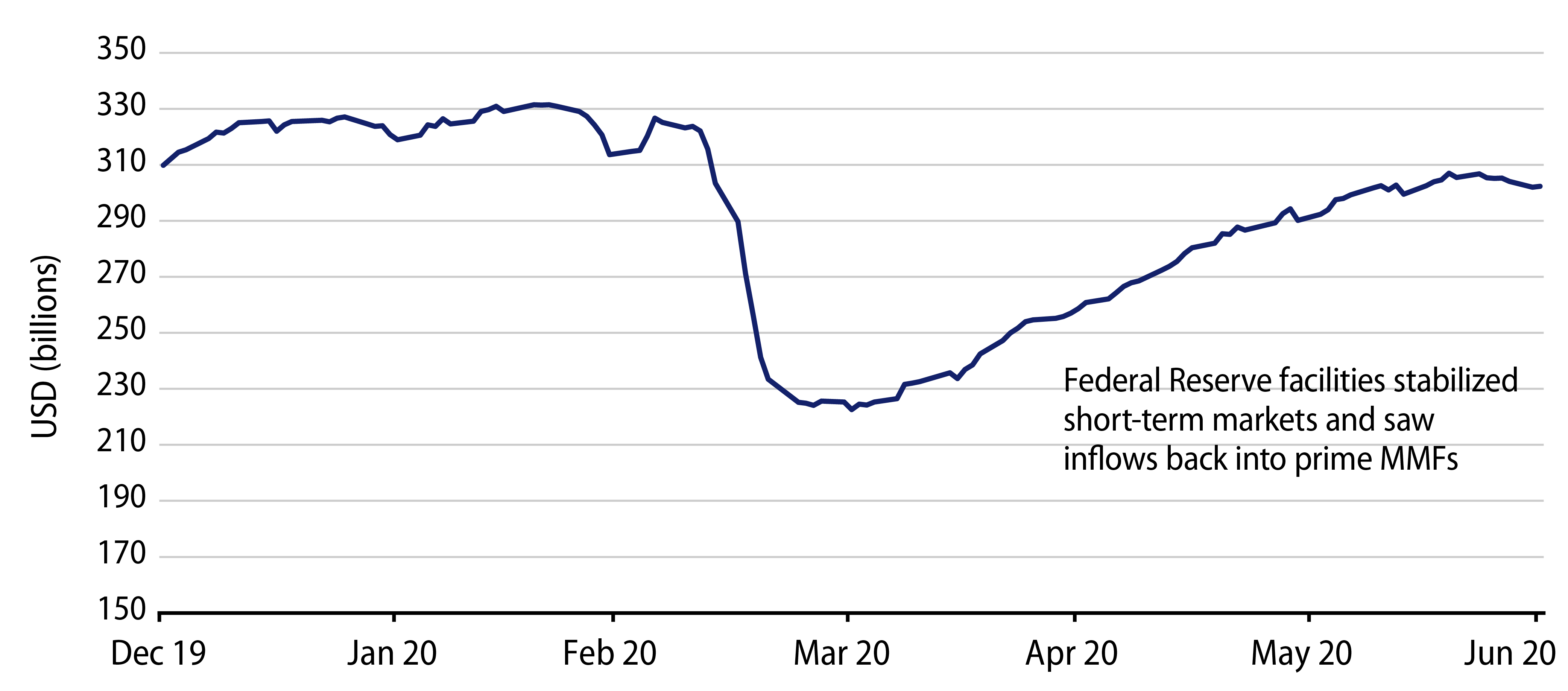

While drawing little attention during periods of market stability, Institutional Prime MMFs have been front and center during two extraordinary periods of systemic market disruption where wider market dislocations have been sufficient to cause regulatory threshold breaches by some MMFs. In September 2008, Prime MMFs experienced significant outflows following a default on Lehman Brothers commercial paper causing a large Prime MMF to “break the buck,” while in March 2020 the “dash to cash” or “flight to quality” induced by the onset of the COVID-19 pandemic saw Institutional Prime MMFs experience sufficient outflows causing some to breach their required weekly liquidity levels. This was arguably made worse by rules introduced in 2016 with Rule 2a-7 amendments that allow MMFs to introduce fees and gates when liquidity levels are diminished (see Exhibit 1 and Exhibit 2).

Following both instances shown here (in 2008 and 2020), the SEC responded by engaging with industry participants and ultimately proposing amendments to MMFs’ legal framework. After the 2008 crisis, the SEC consulted with industry participants and deliberated extensively prior to implementing significant updates to Rule 2a-7 in 2016 that introduced floating NAVs for Institutional and Prime MMFs, and requirements for introducing fees and gates based on daily and weekly liquidity levels. Following the March 2020 period of market volatility, the SEC once again published a range of new proposals intended to enhance Rule 2a-7.

What Can We Expect Ahead?

Following its December 2021 release, the SEC provided a comment period to interested parties with a deadline of April 11, 2022. Stakeholders in the MMF industry provided extensive feedback, and the SEC is now scheduled to announce its final amendments in October 2022.

Arguably, the most impactful of the possible rule changes is the expected introduction of swing pricing for Institutional Prime and Tax-Exempt MMFs. Other amendments may remove the link between MMF liquidity levels and fees and gates, increase regulatory levels for daily and weekly liquidity, introduce new rules around how government and other stable NAV MMFs operate during periods of negative interest rates, and also require increased levels of portfolio and shareholder transparency.

This table summarizes key measures within the SEC’s new proposals, together with the rationale behind them:

| Proposal | Rationale |

|---|---|

| Removal of link between liquidity levels and gates | In March 2020, investor outflows from Prime MMFs accelerated due to concerns that fees or gates would be introduced as some MMF weekly liquidity levels approached 30%. |

| Swing pricing mandated for Institutional Prime and Tax-Exempt MMFs | Swing pricing allows transaction and market costs of redemptions to be passed on to exiting investors, protecting remaining investors’ assets. |

| Increases in required daily liquidity from 10% to 25% and weekly liquidity from 30% to 50% | Higher levels of liquidity would better buffer significant outflows. |

| Requirement for CNAV MMFs to change to FNAV when interest rates are negative | Provides a mechanism for all MMFs to operate during periods of negative interest rates and better facilitates Federal Reserve policy flexibility (concerns around the impact to CNAV MMFs were quoted by the Federal Reserve as a gating issue for introducing negative rates in 2020). |

| Requirement for fund companies to validate that financial intermediaries can support FNAV MMFs on their platforms | Ensures consistency in approach across the MMF industry which is heavily intermediated by institutional and retail distribution/servicing firms. |

| Increased transparency around portfolio and shareholder information | Enhanced transparency allows regulators, shareholders and other industry participants to better assess fund specific risks. |

Implementation periods for the finalized rules may vary with some potential changes (for instance, higher liquidity levels) becoming effective immediately, and others to be effective after 12 months at a minimum.

During the recent comment period some industry associations and asset managers expressed significant concerns around the potential disruption, negative impact to MMF utility, and increased costs and limited benefits that they saw within the SEC’s proposals. The extent of the final amendments remains to be seen, but MMF investors should certainly be ready for changes in a familiar product.

How Should Investors Prepare for Possible Changes?

While the final Rule 2a-7 amendments will not be published until October 20022, we suggest investors prepare by:

- Engaging with your asset management partners or financial advisors to understand the possible impact of the changes

- Assess the possible impact and updates needed against your schedule of permissible investments, or investment policy guidelines (i.e., to allow for swing pricing for Prime MMFs, or permitting FNAV Government MMFs during periods of negative rates)

Depending on the purpose and investment horizon for your MMF investment (i.e., sweep, asset allocation, working capital), we suggest reviewing the range of alternatives suitable for your needs including differing types of MMFs (CNAV vs. FNAV, Government vs. Prime, Tax-Exempt), short-term fixed-income mutual funds, separately managed accounts, ETFs, or direct securities and bank deposits.

About Western Asset’s Liquidity Investment Solutions

Western Asset manages approximately $50 billion in Liquidity assets, as of June 30, 2022. We offer several short-term, highly rated investment solutions across a range of liquidity and risk profiles. These are designed to be ideal for investors’ operating cash, core cash and strategic cash needs. Reflecting the low-risk, conservative nature of our management approach, the key objectives across all of these solutions are constant: to preserve principal, maintain adequate liquidity and generate an attractive level of yield.