With US elections largely in the rearview mirror, global markets must once again face down the ongoing COVID-19 pandemic. The following post shares updated thoughts from the Western Asset Coronavirus Task Force amidst renewed optimism over vaccine prospects, offset by what is clearly a second wave of Covid infections in both Europe and the US.

Increased Confidence in COVID-19 Vaccine Efforts

“Gamechanger” is a word that we believe has been overused in response to COVID-19 news during the past nine months. Contact tracing was a gamechanger, the antiviral drug remdesivir was a gamechanger, and the 15-minute antigen test was also a gamechanger. Despite incremental progress from these developments, they did not halt ongoing damage to the global economy, they didn’t save the hundreds of thousands of lives that have been lost and they didn’t prevent all-time highs from recently being reached in daily Covid cases.

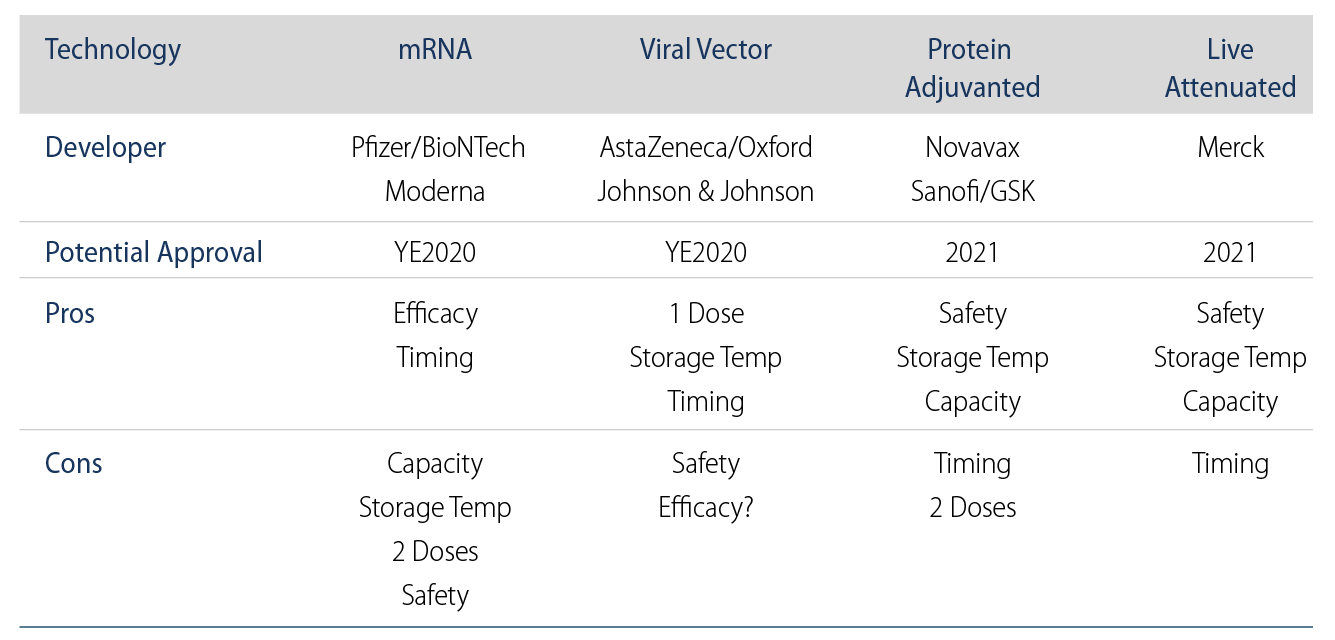

Despite our reticence about using hyperbolic language with regard to COVID-19, we believe that recent news from both Pfizer/BioNTech and Moderna about the efficacy of their experimental mRNA COVID-19 vaccines may truly be a gamechanger. Compared to the FDA’s 50% efficacy threshold and industry expectations of 60%-70%, Pfizer reported 90% efficacy in its interim data analysis on November 9, while Moderna topped that with 94.5% efficacy announced early on November 16. A highly effective vaccine could allow communities to approach herd immunity quickly while encouraging adoption by some members of the public accustomed to the mediocre efficacy of the seasonal flu vaccine. After the new vaccine candidates reach the end of their required two-month safety monitoring period over the next several weeks, we expect the FDA to quickly grant the vaccines Emergency Use Authorizations (EUAs), enabling the first vaccinations of vulnerable patients by the end of 2020. Looking beyond the two mRNA-based vaccines, we expect near-term viral vector vaccine trial results from AstraZeneca and Johnson & Johnson (Exhibit 1).

Now that we may be near the regulatory finish line for some COVID-19 vaccines, the challenge for society will be weathering an interim period of infections before vaccinations can become widely available. Pfizer’s mRNA vaccine will require two doses three weeks apart and extremely cold storage temperatures, adding to headwinds from the time it will take for Pfizer and its partners to ramp up manufacturing capacity (1.3 billion doses expected by the end of 2021). Moderna, on the other hand, announced that its vaccine is stable at higher, refrigerated temperatures for up to 30 days. While the two vaccines have yet to be approved by the FDA, having multiple approved vaccines would boost manufacturing capacity and accelerate the timeline for the public having access to a COVID-19 vaccination, thereby bringing the pandemic to a close more quickly. One outstanding wildcard for all COVID-19 vaccines is the durability of any potential immunity. We believe that the extremely rare nature of re-infection among COVID-19 patients suggests that the turbocharged immunity vaccines provide may be long-lasting, but only time will tell whether the public could face the issue and implications of waning immunity.

Pandemic Fatigue May Be Leading to More Lockdowns

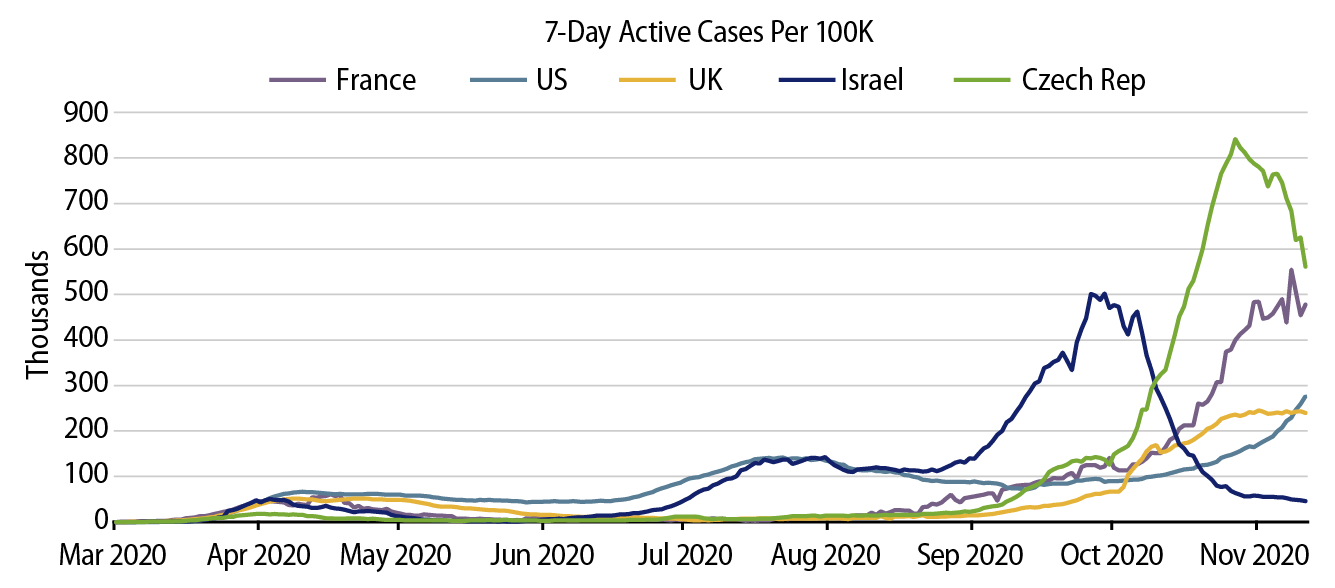

While we all wait for progress on the vaccine front, challenging viral trends across the globe may continue to test the public’s patience. A significant spike in active COVID-19 cases was observed earlier this fall in Israel after social distancing behavior became more relaxed, followed by more recent increases in continental Europe and the UK. While the US overall has been late to the second wave, the Midwest and more rural areas have been hit hard in recent weeks, taking nationwide new daily cases in the US to all-time highs of nearly 200,000 per day. The Task Force attributes this fall’s COVID-19 spread more to individual behavior rather than colder temperatures, although we acknowledge that more time spent inside could be a catalyst for faster spread given the greater difficulty of social distancing indoors. Even though we are characterizing current trends as a “second wave,” it’s clear from Exhibit 2 that there are rolling, unsynchronized waves of Covid that are influenced by both public policy and pandemic fatigue.

So far, Europe and the US have taken different approaches in addressing the uptick in Covid cases. The UK and France have implemented nationwide restrictions in recent weeks, albeit at less onerous levels than in the spring, while the US continues to generally handle containment at a state and local level. For those of us in the US, it’s clear that there is little appetite for large-scale lockdowns like those observed early in the pandemic. Given better understanding of viral propagation and health care capacity constraints, the original lockdowns have evolved into tiered and targeted containment measures that are adjusted based on both caseloads and individual behavior. While politics continues to influence the pandemic response in the US, even states with a bias toward fewer restrictions have started to implement containment measures in response to elevated virus transmission (e.g., Utah’s new statewide mask mandate). Ultimately, we believe that health care capacity may again be the driver of containment actions going forward in the US, with anecdotal evidence of regional health care constraints renewing anxiety from the spring about ICU availability. It’s worth noting that lockdowns, such as the recent one in Israel, are effective in drastically changing COVID-19 case trajectories, but obviously this comes at the expense of economic activity.

Why the Second Wave Hasn’t Been as Deadly as the First

Despite our concerns about COVID-19 cases hitting new highs, a combination of heroic efforts by health care professionals and the development of lifesaving therapeutics has kept deaths and mortality rates well below the spring’s peak levels (Exhibit 3). While we attribute some of the lower mortality rate (currently 1.5%) to a younger demographic being infected and a larger denominator from more testing of asymptomatic patients, it’s clear that the most severe COVID-19 patients have benefited from improvements in oxygen therapy and drugs such as remdesivir and dexamethasone. As markets have obviously been primarily focused on vaccines, it’s important to note that the recent Emergency Use Authorizations of monoclonal antibody treatments from Regeneron and Eli Lilly also have a further chance to diminish mortality rates, particularly for at-risk patients identified earlier in the progression of their COVID-19 symptoms.

Staying True to Our Value Discipline

With such divergent trends dominating the pandemic discussion, the challenge for market participants over the next three to six months will be to not let short-term developments obscure the longer-term investment outlook. We expect at least one effective and widely distributed vaccine by mid-2021 along with ongoing liquidity support from global central banks, but we think it will be volatile headlines that have the potential to drive equities, credit and rates in coming months. In the meantime, Western Asset is sticking to our overweight in developed market credit that has served us well since the market’s March lows, while looking to opportunistically add exposure to credits/asset classes (e.g., bank loans, EM, structured product) that should benefit from the eventual end of the pandemic. In closing, after a long nine months of headlines and debate, Western Asset’s Coronavirus Task Force finally sees a light at the end of the COVID-19 tunnel.