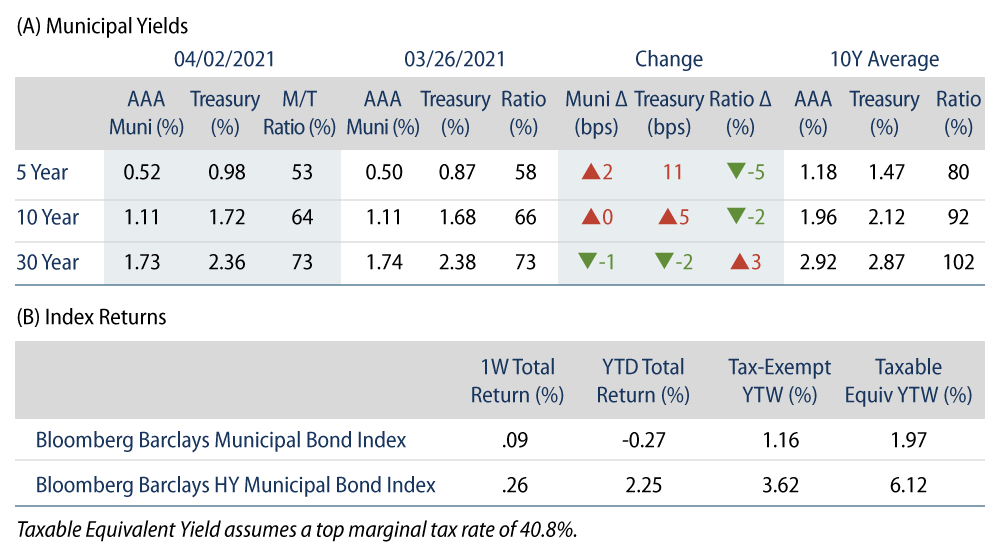

Municipal Yields Were Mixed and Muni Indices Posted Positive Returns for the Week

US municipal yields were mixed as the AAA muni curve flattened with Treasuries. Municipals outperformed Treasuries in short and intermediate maturities as ratios grinded lower. Fund flows remained positive while supply was limited due to the holiday-shortened week. The Bloomberg Barclays Municipal Index returned 0.09%, while the HY Muni Index returned 0.26%. This week we touch on the potential return of tax-exempt advance refunding and how that could shape tax-exempt and taxable muni market technicals.

Municipal Mutual Funds Flows Marked a Record First Quarter as Supply Declined Over the Holiday Week

Fund Flows: During the week ending March 31, municipal mutual funds recorded $161 million of net inflows. Long-term funds recorded $179 million of inflows, high-yield funds recorded $254 million of inflows and intermediate funds recorded $107 million of inflows. First quarter net inflows totaled $31.7 billion, a record high level.

Supply: The muni market recorded $5.2 billion of new-issue volume during the week, down 55% during the holiday-shortened week. Total issuance year to date of $108 billion is up 17% from last year’s levels, with tax-exempt issuance 14% higher and taxable issuance 26% higher. This week’s new-issue calendar is expected to jump back to elevated levels, to $10.8 billion. The largest deals include $1.5 billion taxable Novant Health and $700 million Iowa Tobacco transactions.

This Week in Munis: A Potential Return of Tax-Exempt Advance Refunding

A bipartisan effort to repeal the restriction on tax-exempt advance refunding progressed through Congress last week. Maryland House Representatives Dutch Ruppersberger (D) and Steve Stivers (R) introduced a bill that would overturn the restriction instituted by the 2017 Tax Cuts and Jobs Act (TCJA). Tax-exempt advanced refunding already had support from the executive branch, as Transportation Secretary Pete Buttigieg had previously touted the mechanism, citing “As mayor, few things gave me more fiscal pleasure than to find that we could save taxpayer dollars by refunding previously existing debt.”

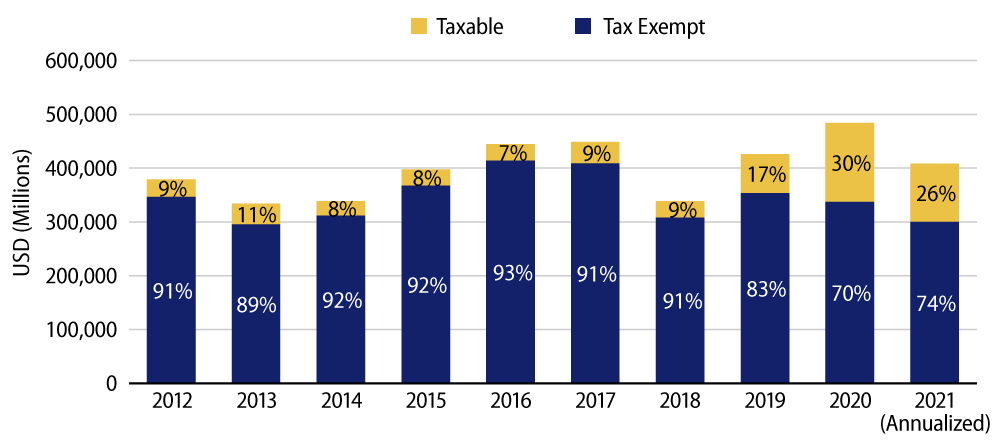

The provision has a material impact on supply technicals for the tax-exempt and taxable municipal markets. In the three years leading up to the TCJA, current and advanced refunding issuance averaged $165 billion, (38% of annual municipal bond issuance) and was predominantly tax-exempt. In 2018, the year after TCJA and the repealing of the mechanism, total refunding volume fell 61% to $59 billion (18% of total municipal issuance). As Treasury rates continued to decline from 2018 to 2020, issuers found economy in taxable advanced refunding, which increased from $6 billion in 2018 to $89 billion in 2020. The increased taxable refunding volume supported the exponential growth of total taxable issuance to a record level of $146 billion in 2020, representing 30% of total municipal issuance.

We believe that the legislation has a significant chance of passing as the federal policy focus shifts back to infrastructure. The measure enjoys bipartisan support in both the House and Senate, and the cost of the legislation is relatively low at $1.7 billion per year, according to the Government Finance Officers of America (GFOA). We would expect a reinstatement of tax-exempt advanced refunding to bring much desired new issuance to the tax-exempt market which has observed declining net new supply amid persistent demand for tax-exempt income. A larger impact could be felt in the taxable market, absent a taxable bond incentive provision as part of a larger infrastructure program. A combination of rising Treasury rates and issuer hopes for even lower financing costs in the tax-exempt market could slow the pace of taxable new-issue volume we have witnessed over the last year, which provided vast opportunities to a growing global investor base.