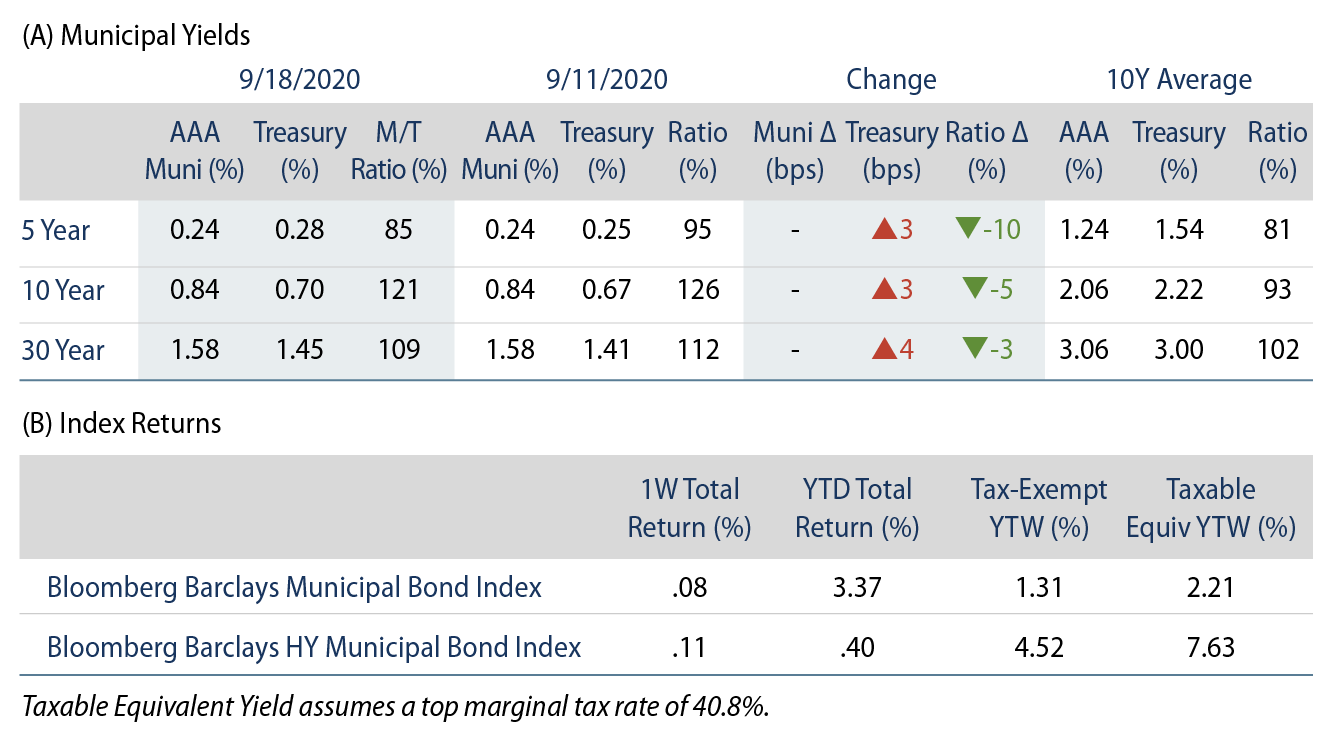

AAA Municipal yields were generally unchanged during the week. Muni technicals softened as inflows lowed amid an elevated new issue calendar. New Jersey passed a bill to increase the top marginal tax rate. AAA municipal yields were unchanged during the week, outperforming Treasuries. The Bloomberg Barclays Municipal Index returned 0.08%, while the HY Muni Index returned 0.11%.

Technicals: Supply Remains Elevated While Fund Flows Slow

Fund Flows: During the week ending September 16, municipal mutual funds reported a 19th consecutive week of inflows of $612 million according to Lipper. Long-term funds recorded $64 million of inflows, intermediate funds recorded $116 million of inflows, while high yield funds recorded $61 million of inflows. Municipal mutual fund net inflows total $19.8 billion YTD.

Supply: The muni market recorded $11.1 billion of new issue volume last week, up 36% from the prior holiday-shortened week. Issuance of $322 billion YTD is 27% above last year’s pace, primarily driven by taxable municipal issuance that comprises over 30% of YTD issuance and is up over 250% from last year’s levels. We anticipate approximately $13 billion in new issuance this week, which would mark the sixth consecutive week of issuance above $10 billion. Largest deals include $923 million New York City IDA (Yankee Stadium) and $600 million Texas Water Development Board transactions.

This Week in Munis: More Tax Hikes

Facing a $5.7 billion budget gap, New Jersey Governor Phil Murphy was finally successful in persuading the state legislature to increase the state’s top marginal rate to 10.75% from 8.97% for taxpayers who earn $1 million or more. The state now has the dubious distinction of having one of the highest marginal income tax rates in the nation, trailing just California (13.3%) and Hawaii (11.0%).

The rate increase is expected to generate $390 million in new revenue for the state. The Governor intends to deploy that money to fund rebates of $500 to middle class households. Since the rebates are expected to cost $400 million, the rate increase is credit neutral in the short term. While Governor Murphy is hoping that increasing the progressivity of the tax structure will strengthen the state’s longer-term prospects by reducing the tax burden on the middle class, the initiative runs the risk of driving residents out of state (particularly those that contribute more to the state's coffers), as well as discouraging those who are leaving New York City from relocating to the Garden State.

New Jersey has long faced structural budget challenges, high debt burdens, and pension issues that have been compounded by the COVID-19 pandemic. The $5.7 billion budgetary shortfall represents 10%-15% of its estimated $40 billion 2021 budget. In addition to these revenue measures, the Governor also intends to issue $4 billion of debt to finance the deficit. Major rating agencies all assign negative outlooks to their ratings, which are A3/A-/A-.

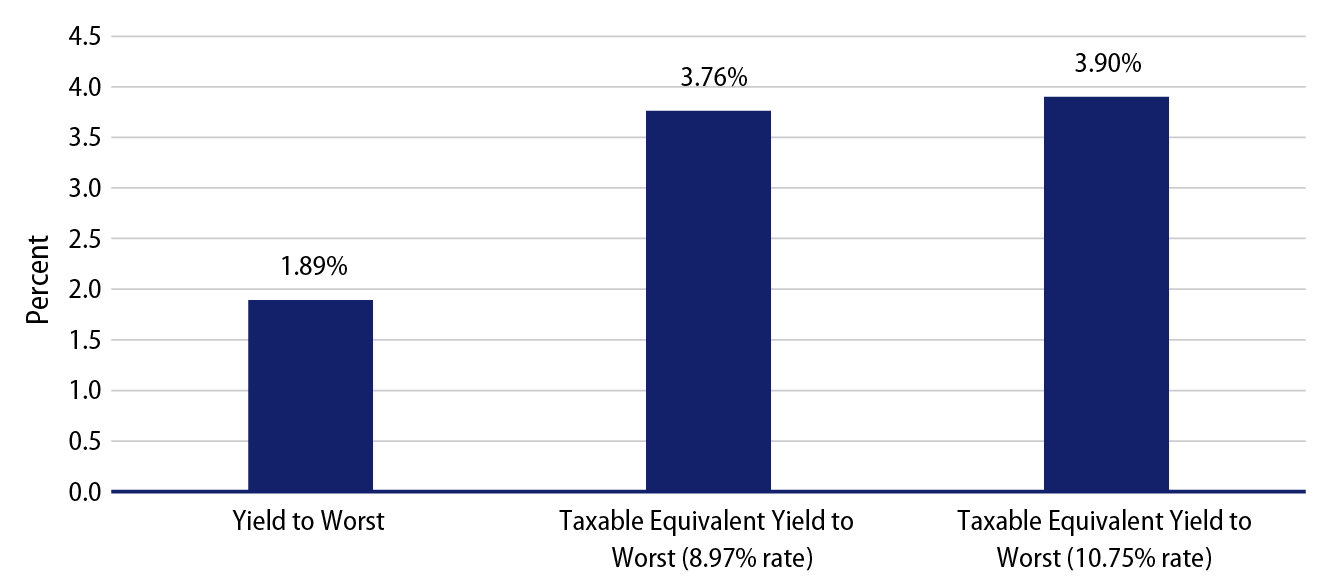

While we anticipate additional supply and headline issues to create volatility around the state and its appropriation credit, higher marginal tax rates do bode well for relative valuations. Considering the new tax proposal, the 1.78% tax increase increases the taxable equivalent yield of the Bloomberg Barclays New Jersey Municipal Bond Index from 3.76% to 3.90%.