Municipals Posted Negative Returns

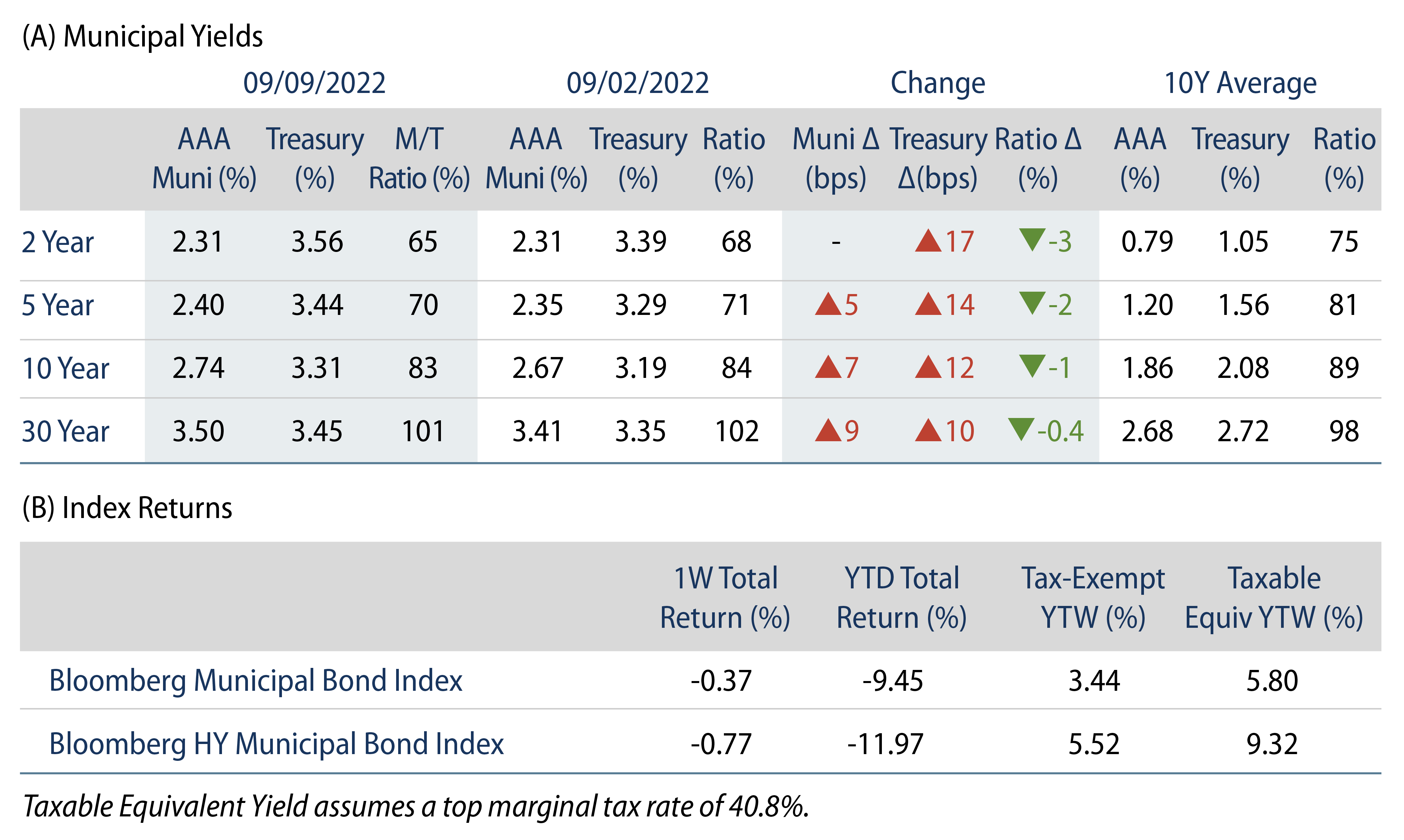

Municipals posted negative returns this week, but outpaced Treasuries even as Treasuries moved higher as a result of the market reflecting a greater probability of a 75-bp rate hike later this month. High-grade municipal yields moved 5 to 9 bps higher across the curve. Market technicals remained weak as fund outflows continued for a fifth consecutive week. The Bloomberg Municipal Index returned -0.37% while the HY Muni Index returned -0.77%. This week, following strong summer supply technicals, we highlight increasing supply conditions that could create favorable opportunities in upcoming weeks.

Technicals Remain Challenged Amid Ongoing Mutual Fund Outflows

Fund Flows: During the week ending September 7, weekly reporting municipal mutual funds recorded $1.1 billion of net outflows, according to Lipper. Long-term funds recorded $881 million of outflows, high-yield funds recorded $540 million of outflows and intermediate funds recorded $81 million of outflows. The week’s outflows mark the fifth consecutive week of outflows and extend year-to-date (YTD) outflows to $84 billion.

Supply: The muni market recorded $7 billion of new-issue volume, down 5% from the prior week. Total YTD issuance of $276 billion is 10% lower than last year’s levels, with tax-exempt issuance trending 1% higher year-over-year (YoY) and taxable issuance trending 43% lower YoY. This week’s new-issue calendar is expected to increase to $10 billion. Large deals include $876 million NY Utility Debt Securitization Authority and $667 million North Texas Tollway Authority transactions.

This Week in Munis: Swelling Supply Conditions

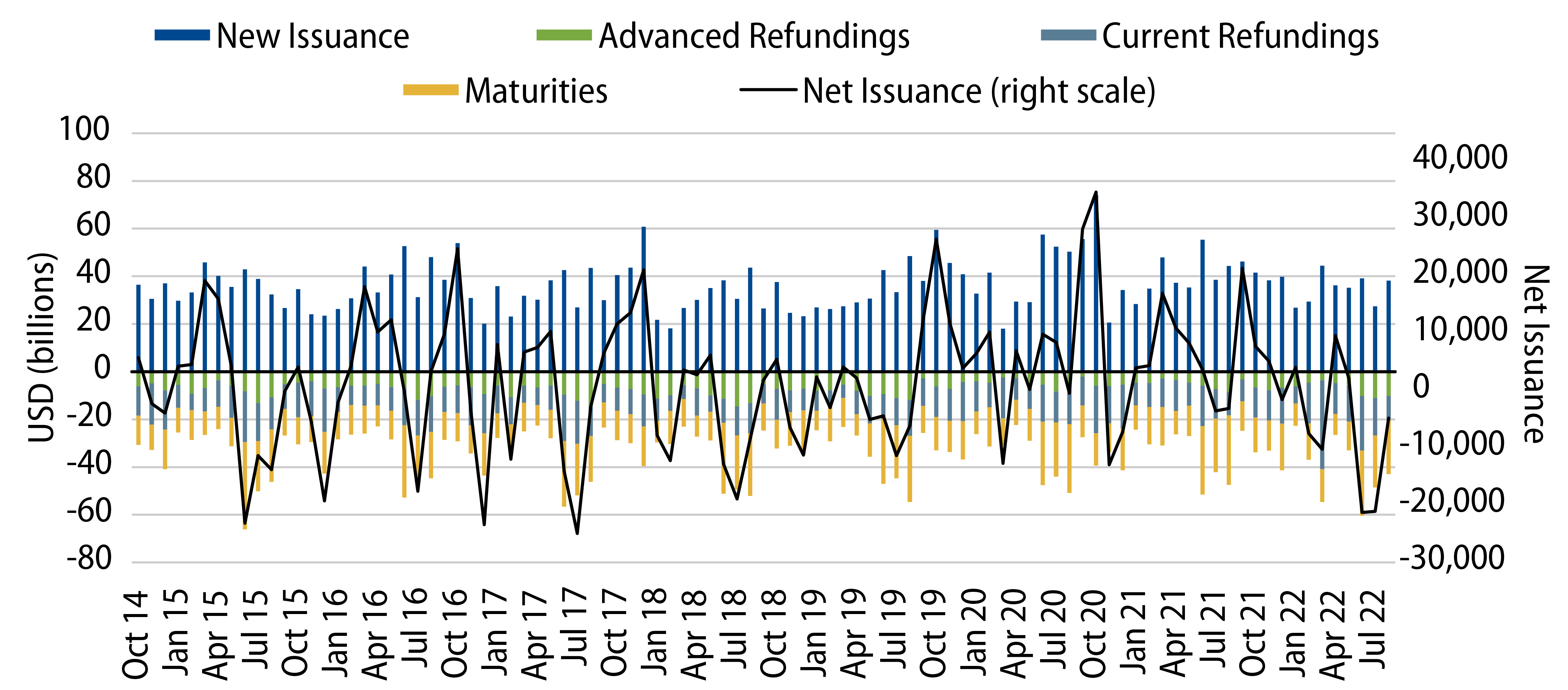

In a post earlier this summer, we highlighted an expectation for sharp negative net supply conditions to be supportive of favorable market technicals. Net supply in June, July and August ultimately totaled -$47 billion, as $105 billion of new issuance was offset by $152 billion of maturities and securities called out of the market. While the Bloomberg Municipal Index posted a negative return of -1.25% over this period due to rising rates, these negative net supply conditions likely contributed to the outperformance versus other fixed-income asset classes such as the Bloomberg U.S. Aggregate return of -2.01% and the U.S. Treasury Index return of -1.80%.

We believe that a key driver of the sharp negative net supply conditions over the summer were the elevated bond maturities and calls from the market (highest since the summer of 2015), which we anticipate will abate in the coming weeks. Maturing debt ranged from $21 billion to $27 billion in June to August 2022, but is scheduled to drop to $13 billion this September. Meanwhile, we expect net new-money issuance to move higher into the fall as markets attract better liquidity and issuers look to finalize annual capital plans ahead of the winter holidays. Over the past five years, such seasonal conditions led net municipal issuance to average $14 billion in September, a trend we expect to persist this year.

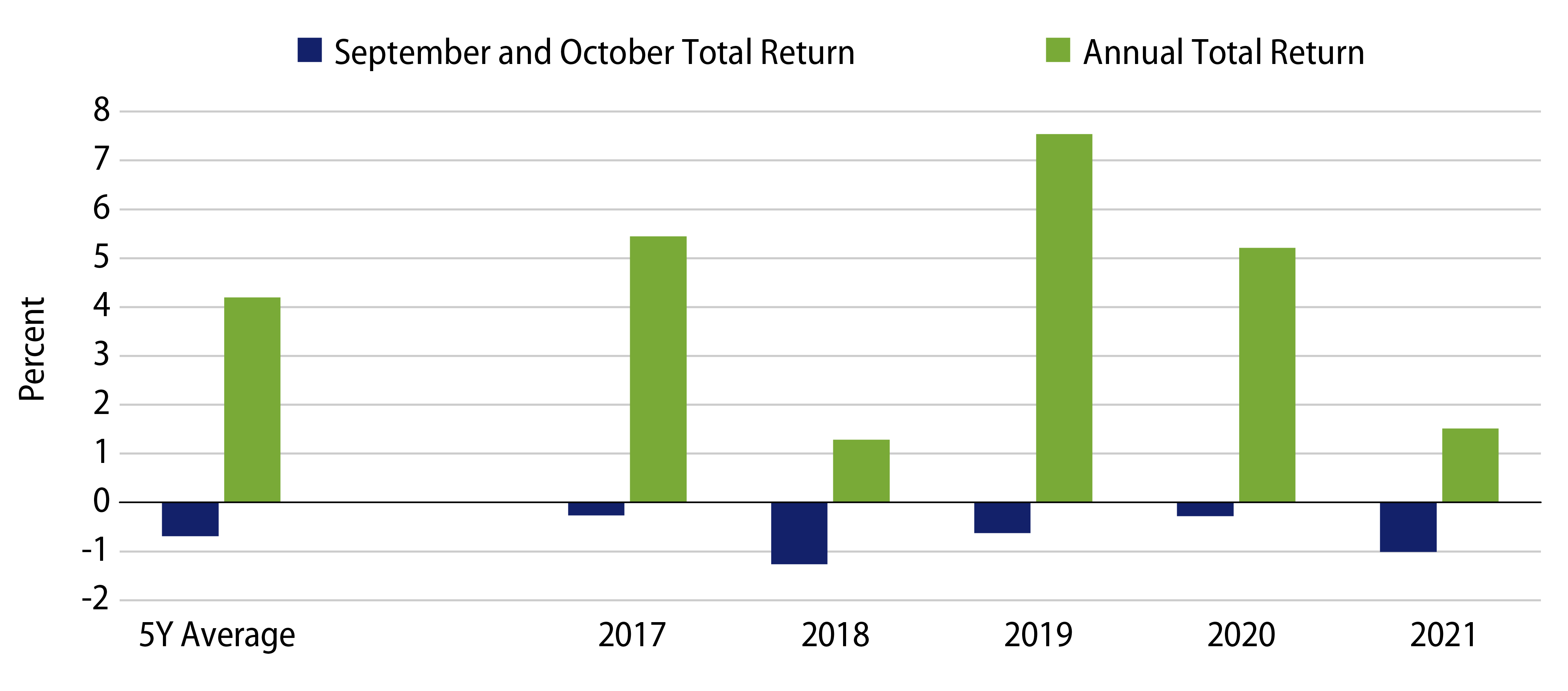

In addition to higher net supply conditions, lackluster demand conditions (considering the record municipal mutual fund outflow cycle) present an additional headwind. Notably, four of the five past years of cumulative positive supply conditions in September and October coincided with municipal mutual fund inflows. Until market demand is stabilized, we believe price activity could be more sensitive to supply conditions than observed in the recent past.

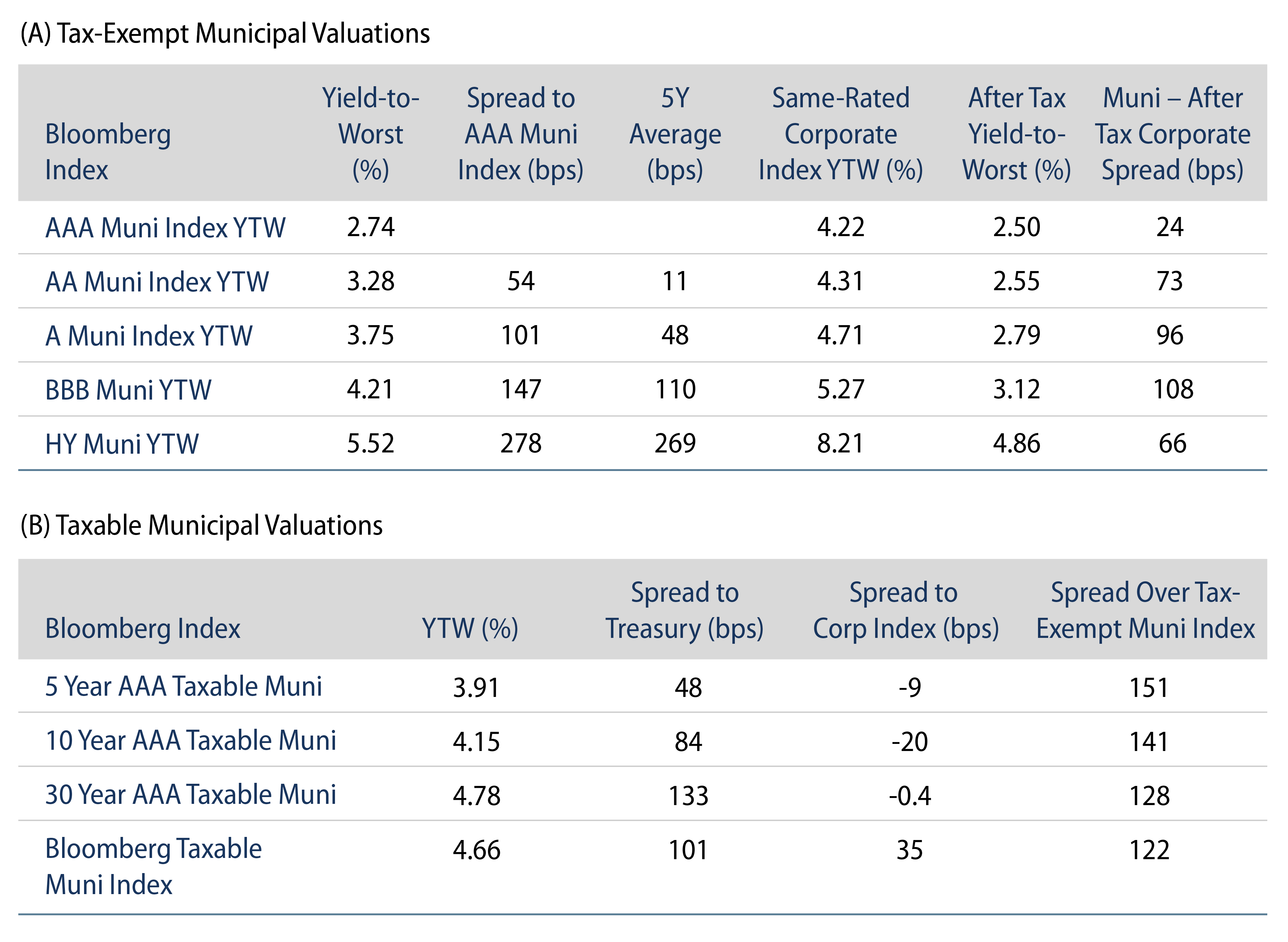

Western Asset remains constructive on the long-term relative value proposition of municipals versus other fixed-income asset classes. However, we believe these near-term technical pressures seek to present more favorable entry points that can add meaningful duration and spread risk to a portfolio allocation.