Municipals Posted Positive Returns During the Week

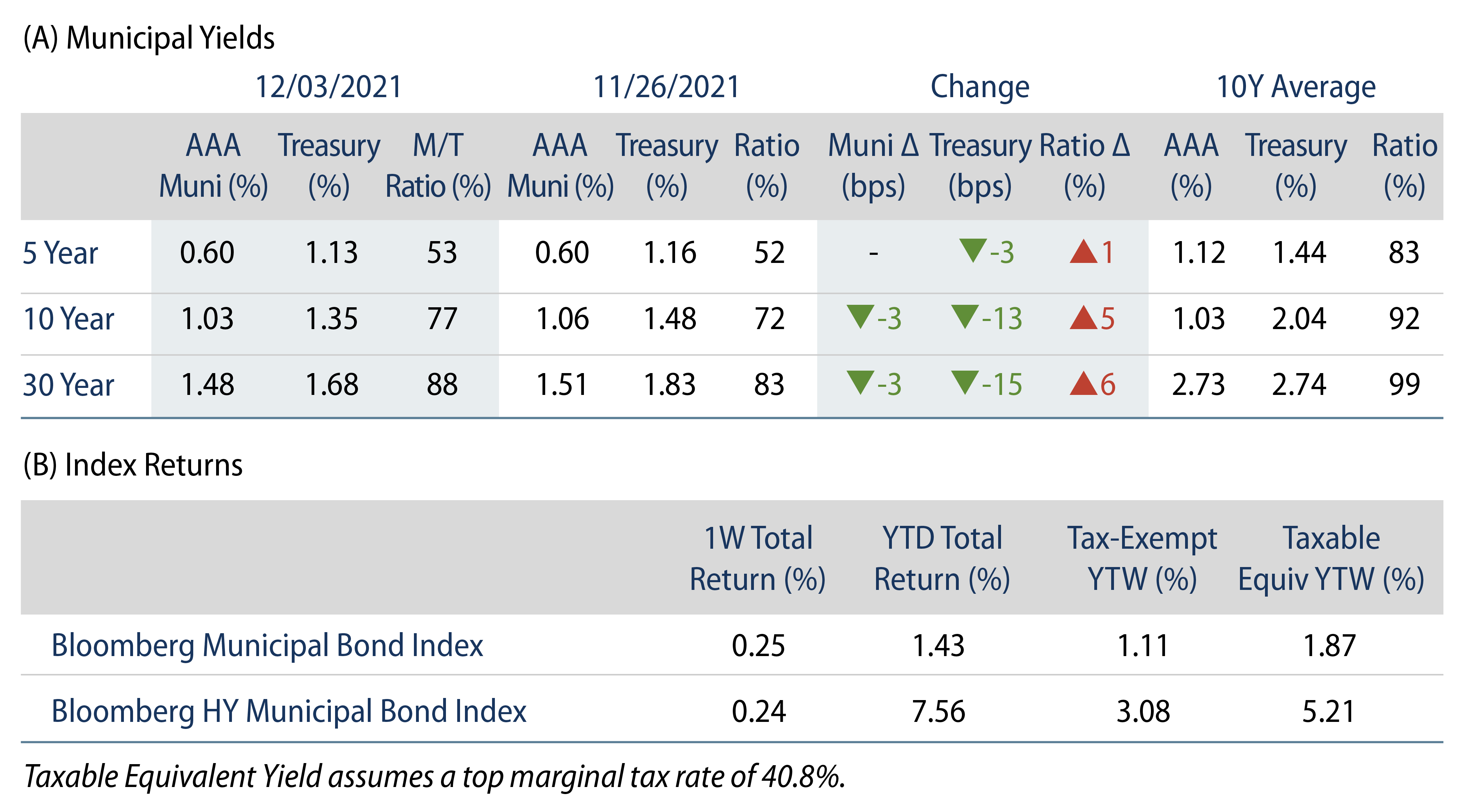

The AAA US muni yield curve moved 3 bps lower across intermediate and long maturities. Municipals underperformed the Treasury rally and Municipal/Treasury ratios moved higher as demand softened around the Thanksgiving holiday. The Bloomberg Municipal Index returned 0.25%, while the HY Muni Index returned 0.26%. This week, we take a look at potential budget impacts as states expanded gambling legislation in 2021.

Municipal Technicals Soften as Demand Slowed Around Thanksgiving

Fund Flows: During the week ending December 1, municipal mutual funds recorded $36 million of net inflows. Long-term funds recorded $120 million of inflows, high-yield funds recorded $53 million of outflows and intermediate funds recorded $14 million of outflows. Municipal mutual funds have now recorded inflows 80 of the last 81 weeks, extending the record inflow cycle to $158.4 billion, with year-to-date (YTD) net inflows surpassing a record calendar year pace at $97 billion.

Supply: The muni market recorded $9.8 billion of new-issue volume during the week. Total YTD issuance of $434 billion is in-line with last year’s levels, with tax-exempt issuance trending 9% higher year-over-year (YoY) and taxable issuance trending 21% lower YoY. This week’s new-issue calendar is expected to jump to approximately $14 billion. The largest deals include $2.7 billion Golden Tobacco and $755 million Massachusetts Water Resources Authority transactions.

This Week in Munis—Gaming Expands in 2021

Legalized gambling has become increasingly popular as eleven states expanded sports betting regulations in 2021. Thirty states and the District of Columbia now allow for legal betting, and it is legal but not yet operational in an additional two states.

The rapid expansion of gaming is not a surprise considering the potential dollars at stake. The American Gaming Association reported Americans spent more than $21 billion on sports betting in 2020, generating $210 million in state tax revenue. Nevada, New Jersey and Pennsylvania observed the highest tax collections last year. In the case of gambling mecca Nevada, gaming taxes generated 42% of its general fund budget. However, for the more diverse state economies of New Jersey and Pennsylvania, gaming tax collections comprised just 0.8% and 2.9% of their budgets, respectively.

As gaming continues to expand to other states, we look to more mature “sin tax” sectors to evaluate the potential impact gaming revenues may have on state budgets. In fiscal year 2021, states collected $27 billion from tobacco taxes, and about $6.8 billion from alcohol consumption. Considering total state expenditures from their own sources amounted to $923 billion, these sin tax collections comprised roughly 3.7% of state budgets.

Gaming tax receipts may be more consequential for local budgets. Mayor Lightfoot of Chicago is hoping to raise $200 million from a proposed casino to dedicate to the city’s challenged pension system. This would equate to 4.5% of the city’s budget, and would help to close about 27% of the budget gap Lightfoot faces in fiscal year 2022. While gaming revenues can provide funds for needed budget relief, many consider government-sponsored gaming as a regressive tax, contributing to social risks such as income inequality. In a market that is more sensitive to ESG considerations, issuers relying on this incremental revenue may contend with the ramifications of longer-term social costs and reputational issues.