The US balance of merchandise trade grew larger in January as exports declined and imports rose. In nominal terms, the trade balance went from -$1.21 trillion per year in December to -$1.29 trillion per year in January. In real, 2012-price terms, the balance went from -$1.34 trillion per year in December to -$1.42 trillion per year in December.

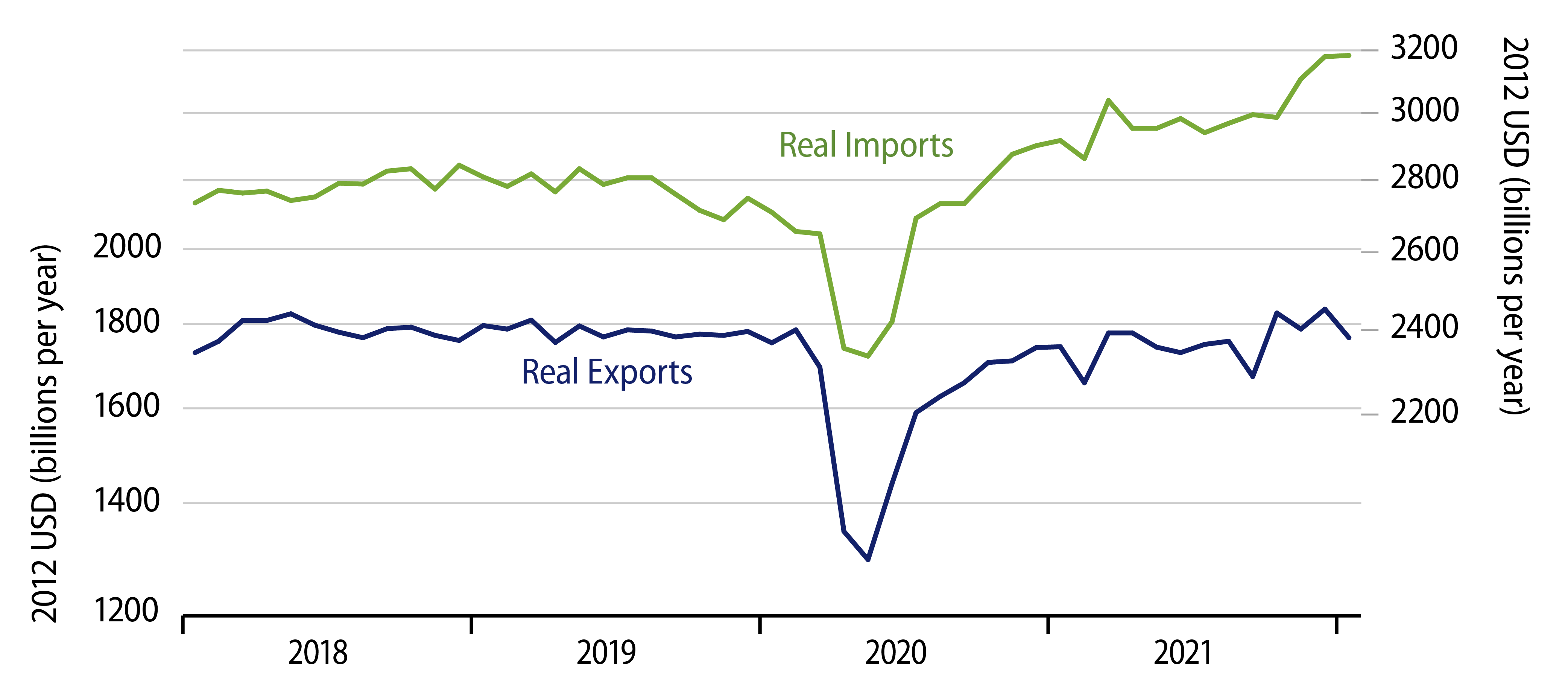

As you can see in the accompanying chart, the decline in exports was within the range of fluctuation seen in recent months. After a nice rebound in late-2020, US exports in real terms have since been holding essentially flat, though a 13% increase in export prices has propped up the nominal export data. Meanwhile, after a similar late-2020 bounce, imports had been growing steadily through most of 2021, before they rose more sharply over November through January.

The recent import bulge reflects a gradual easing of congestion at US ports, especially those in the Los Angeles area. The much-discussed surge in consumer spending on goods early last year depleted US merchants’ inventories, and merchants, US importers, and foreign exporters have been scrambling in recent months to catch up.

With consumer demand for merchandise roughly flat for the last 10 months and imports up sharply recently, US merchants’ inventories have been recovering rapidly. As remarked in previous posts, inventories contributed 5 percentage points of the 7.0% reported growth in 4Q21 real GDP.

Now, inventory investment indeed adds to GDP, but imports subtract from it, so you would think the related import and inventory surges would be largely offsetting. However, in real world data, it doesn’t always work that way. Possibly due to the vagaries of seasonal adjustment, 4Q21 GDP data showed a huge add from inventories, but only a substantial drag from foreign trade.

In 1Q22, the story is likely to be reversed, with trade showing a huge drag and inventories also imparting a drag on GDP. (A less frenetic rate of inventory growth in 1Q22 than in 4Q21 translates into a drag on GDP growth.) So, as strong as 4Q21 GDP looked, 1Q22 is likely to look just as weak, possibly even negative. “True” growth in the economy is likely somewhere in between these extremes in the reported data.

Finally, of course, these data reflect conditions well before the onset of the Ukrainian crisis. Geopolitical concerns will make their own mark on the foreign trade data starting in March, to be released in two months. In case, you are wondering, the data released today show US trade with Russia comprising 0.3% of US exports and 0.9% of US imports. Readily available data do not show detail on trade with Ukraine.