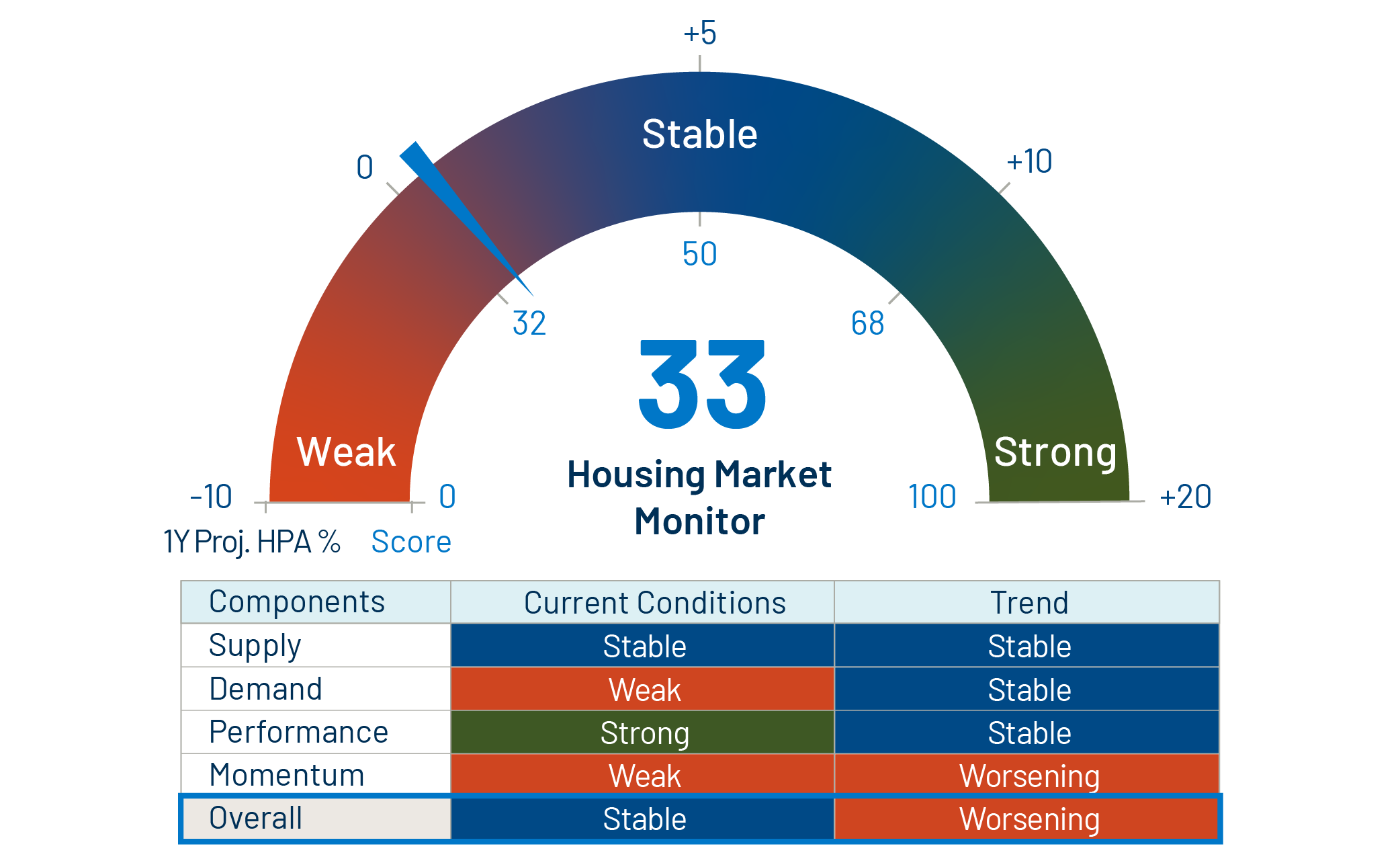

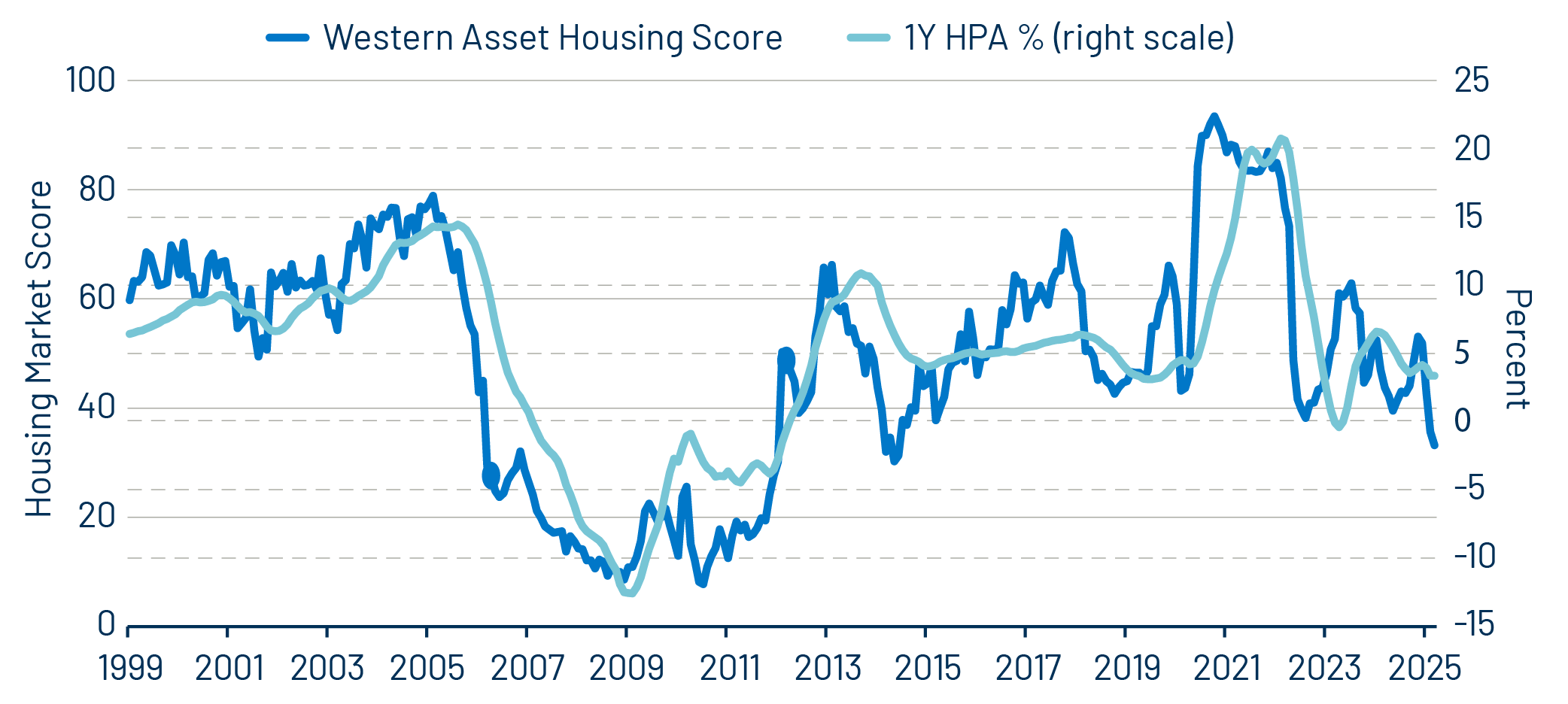

The Western Asset Housing Score now has a value of 33, which has declined each month so far this year and is meaningfully lower since we started 2025 with a score of 53. US residential housing remains constrained due to elevated mortgage rates (currently around 7%), an increasing supply of single-family homes and persistently high home prices. One-year-forward home price appreciation (HPA) on a national level is projected to be between 0% and 1% based on our housing score model. We have seen most dealer research groups lower their projections for HPA in recent months, and our estimate remains in the middle of those ranges (-2.5% to +2.5%).

The housing supply has picked up in recent months. As of May, there were more than 787,000 active home listings in the US—this is the highest single-month reading since the start of the Covid pandemic. Supply measures that are a core component of our scoring model are currently mixed (e.g., months of existing homes supply and months of new homes in available inventory). Months of supply for existing homes are at 4.4, which is the highest reading since the pandemic; however, new homes’ months of supply at 8.1 have decreased from the previous two months’ readings of 9.0 months. The expectation is that housing supply will continue to grow as the summer season typically sees a slowdown in sales.

With this increase in supply, demand has softened. Pending home sales data continues to slide, showing a year-over-year (YoY) decrease of 6.3% as of April. While application data is encouraging, the continued rise in mortgage rates approaching the summer season is expected to put downward pressure on borrower demand.

In terms of demand sentiment, home builders are becoming increasingly bearish on the market outlook. A current Home Builders Index reading of 23 (the lowest in the past two years) does not convey optimism, as the index has been well below the long run average score of 38. The drop in demand may be somewhat related to tariff uncertainty, as buyers are not as likely to make large purchases (capital expenditure) given the unpredictability of future costs related to housing. However, we did see the opposite in consumer behavior related to things like cars, as buyers rushed to make purchases ahead of potential tariff implementation. Meanwhile, as trade war uncertainty persists and higher mortgage rates continue, our view is that we are less likely to see demand recover meaningfully in the near term.

Nationally, mortgage borrower performance remains strong and overall delinquency rates are well below levels seen during either the Covid pandemic or global financial crisis (GFC). There is, however, some stress in 2022 and 2023 vintage collateral as those borrowers financed at the peak of mortgage rates and arguably funded purchases at the wide end of the credit cycle. In our view, the greatest threat to the fundamental strength in housing is a rise in unemployment. Credit standards since the GFC have been rigorous and have led to robust mortgage loan underwriting, which has carried through to securitization. As a result, we do not see a significant risk of defaults in the broad residential housing market.

The S&P CoreLogic Case-Shiller U.S. National Home Price Index fell in March from the previous month, on a seasonally adjusted basis, marking the first monthly decrease in over two years. The index posted a 3.4% annual gain, down from the previous month’s 4.0% YoY gain. As such, the momentum in home prices seen over the past few years now appears to be losing steam.

Overall, the US residential housing market has rapidly cooled, and this trend is expected to continue. Our view on non-agency securitized credit remains positive, and we believe opportunities exist at the top of the capital structure in fixed-rate investment-grade bonds. We are also finding select opportunities in various multi-family sectors such as residential transition loans, commercial real estate collateralized loan obligations and single-family rentals. Currently, buy-vs-rent analysis favors renting and multi-family supply is declining meaningfully while rents appear to be stabilizing and are likely to rise.