Consultants and institutional investors continue to demand bespoke solutions to meet varied investment objectives. At Western Asset, we view crafting client solutions to help meet these objectives as a collaborative and skilled process. Historically, these solutions have involved benchmarks and even hybrid benchmarks combining two or more indices representing different asset classes. However, we are increasingly seeing a demand for unconstrained solutions, as this approach allows clients to focus on the asset classes they are comfortable with to meet their investment objectives.

One example of this trend is the growing interest in multi-sector bond solutions, where asset allocation can be tailored to meet an objective, such as generating income. With the shift to unconstrained solutions, while the use of a benchmark to gauge portfolio risk is removed, understanding the client’s risk tolerance remains crucial. This understanding is expressed through the concept of the designated risk budget.

The terms “risk budget” or “volatility budget” are frequently encountered by investors delving into unconstrained or non-benchmarked portfolios. Although these concepts may not be immediately intuitive, their essence is straightforward: an investor or asset manager doesn’t earn a return merely by investing in a specific asset class; rather, they earn a return by assuming the risks associated with that asset class. In this context, a risk budget signifies the amount of risk or volatility an investor is willing to tolerate to achieve a desired return objective. Similarly, it can denote the level of risk an asset manager is willing to undertake to reach the same goal.1

A risk budget should not be confused with a “tracking error limit,” a term commonly associated with benchmarked portfolios. While both are risk tolerance parameters agreed upon by an investor and asset manager to help manage portfolio risk, they differ in a crucial aspect: a tracking error limit reflects the acceptable margin of risk or return volatility between an investment portfolio and its underlying benchmark, whereas a risk budget represents the “all-in” level or acceptable range of risk based on characteristics of the investment portfolio.

It is important to note that although some deviation from the benchmark (i.e., tracking error) is permitted for benchmarked portfolios, the overall behavior and risk of these portfolios are heavily influenced by the behavior and risk of the benchmark. In contrast, for unconstrained portfolios with a risk budget, the risk tolerance is fixed and does not depend on the risk variations of a benchmark.

In general, risk budget allocations in unconstrained portfolios are determined by the asset manager’s level of conviction in the potential gains of a particular investment idea. For instance, a higher allocation might be assigned to investments that exhibit low volatility and have a low or negative correlation with other investments in the portfolio. Conversely, if an investment idea is deemed too risky—perhaps because it consumes too much of the stated risk budget—the portfolio manager may either reduce the position size or consider an alternative investment idea altogether.

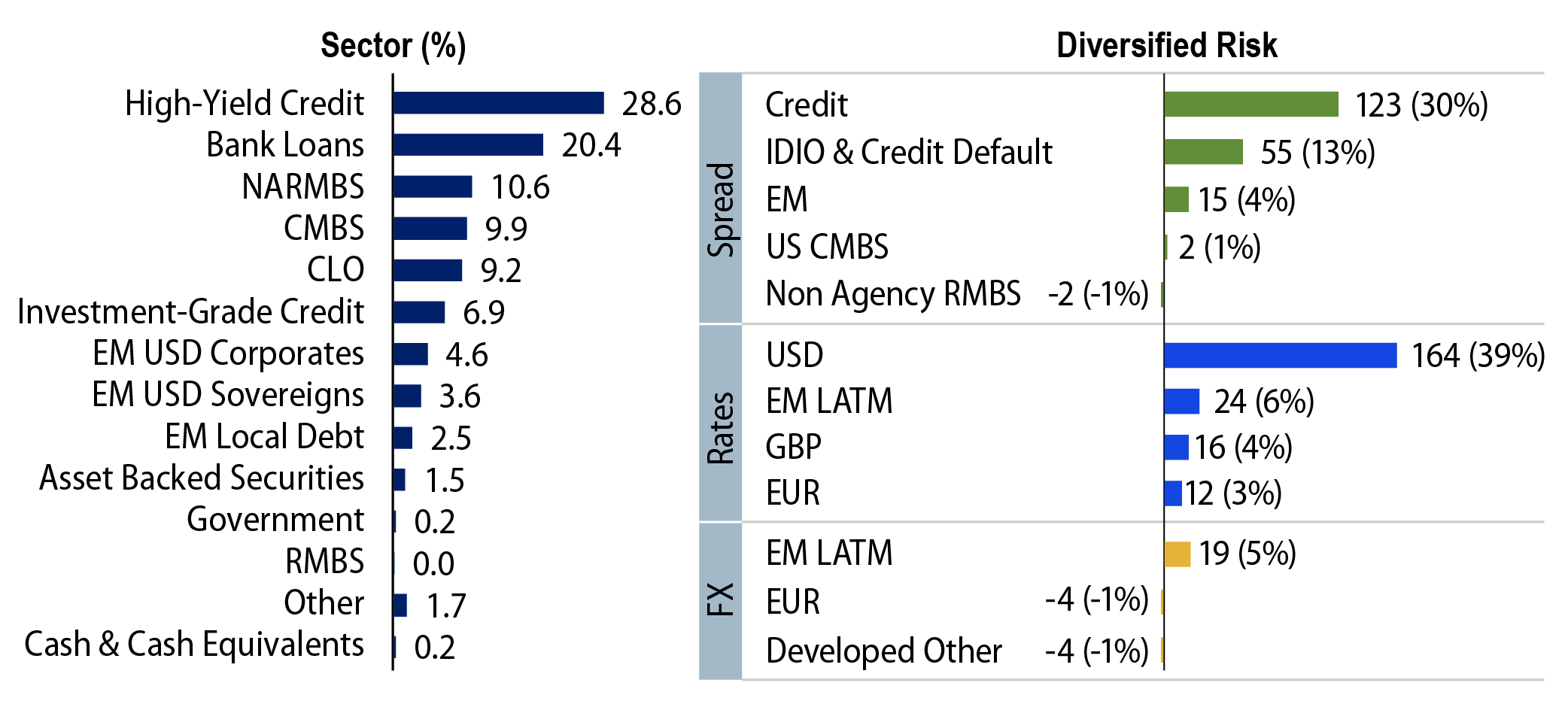

Assessing portfolio “risk” solely based on dollar amount allocations or market value percentages can be challenging. This is where evaluating a portfolio through a risk lens becomes beneficial. Consider a hypothetical multi-asset credit portfolio with the asset allocation mix illustrated in Exhibit 1. From a market value perspective, the percentage allocations are clearly skewed towards high-yield corporate credit and bank loans. Based on this alone, one might assume that spread risk fully dominates the portfolio.

However, when examining the portfolio from a contribution-to-risk perspective—taking into account each investment’s volatility and correlation—we observe that while spread risk comprises 48% of the portfolio, another 39% reflects US interest rate risk. In a risk-off scenario, the rates exposure could serve as a significant form of ballast or a diversifying hedge against spread-related risk within the portfolio.

At Western Asset, risk budgeting is not merely a quantitative, risk-focused exercise. It’s an integral part of our broader unconstrained asset allocation process, which involves a fundamental assessment of the global macroeconomic landscape and major trends and developments across fixed-income markets, including sectors, industries and issuers. This holistic approach, reflecting the qualitative judgment and experience of our seasoned portfolio managers and research analysts, is enhanced by robust proprietary risk analytics that generate scenario analysis, stress testing, and an examination of standalone risks based on historical correlations with other investments. These insights help our portfolio managers navigate complex asset allocation and position sizing decisions. Given that history serves only as a guide to potential future events, risk budgeting at Western Asset is undoubtedly a dynamic, iterative process that involves close collaboration between our investment and risk management teams.

We have collaborated with numerous clients and consultants to arrive at multi-sector solutions tailored to their needs since the 1990s. Utilizing a risk budget instead of a benchmark can potentially maximize the attractive relative value of fixed-income investing. This approach eliminates the necessity of owning lower-return assets simply because they are part of a benchmark.

Where return targets are present, one institutional investor might prefer a higher-quality portfolio that serves as a ballast, while another might seek a greater contribution from fixed-income to their overall target. Given our expertise and resources, we are well positioned to work with clients with diverse objectives to create appropriate portfolios.

In Closing

Given the unpredictable nature of markets, we encourage investors to remain open to a variety of investment solutions to meet their objectives. Unconstrained portfolios are particularly unique because there is no “one-size-fits-all” approach to investing. These portfolios can be customized to leverage the most desirable characteristics of fixed-income—such as income, return, diversification, and risk mitigation—with the guidance of a well-informed risk budget.

ENDNOTES

1. More formally, a risk budget is a comprehensive suite of risk measures and thresholds. These include active risk exposure volatility (tracking error), active tail risk (expected shortfall), active exposure in industries, countries, issuers and risk factors, as well as scenario analysis and liquidity risk thresholds. Risk budgets are established with consideration to portfolio return targets.