A recent announcement by the Australian Prudential Regulation Authority (APRA) regarding proposed changes to the regulatory capital structure of Australian banks has potentially significant implications for the domestic hybrid market. The news promotes reflection on whether there are more appropriate options to generate defensive income.

In this blog post we explore AT1 capital securities (commonly known as hybrids), their valuations and APRA’s proposal and its ramifications. We also provide guidance on potential solutions.

Why Hybrids Are Attractive to Retail Investors

Enticed by stable yields, small minimum parcel sizes and franking credit benefits, the retail demand for hybrid securities in Australia has been particularly strong. The lead management of primary market hybrid issuance by retail brokerage firms earning attractive placement fees may have also played a role.

As a result, retail investors hold an unusually high proportion of AT1s, which APRA recognises as a heightened risk. Myriad factors such as limited secondary market trading, varied complexity and yields quoted gross of franking credits may have contributed to masking of true risks which has led to expensive valuations.

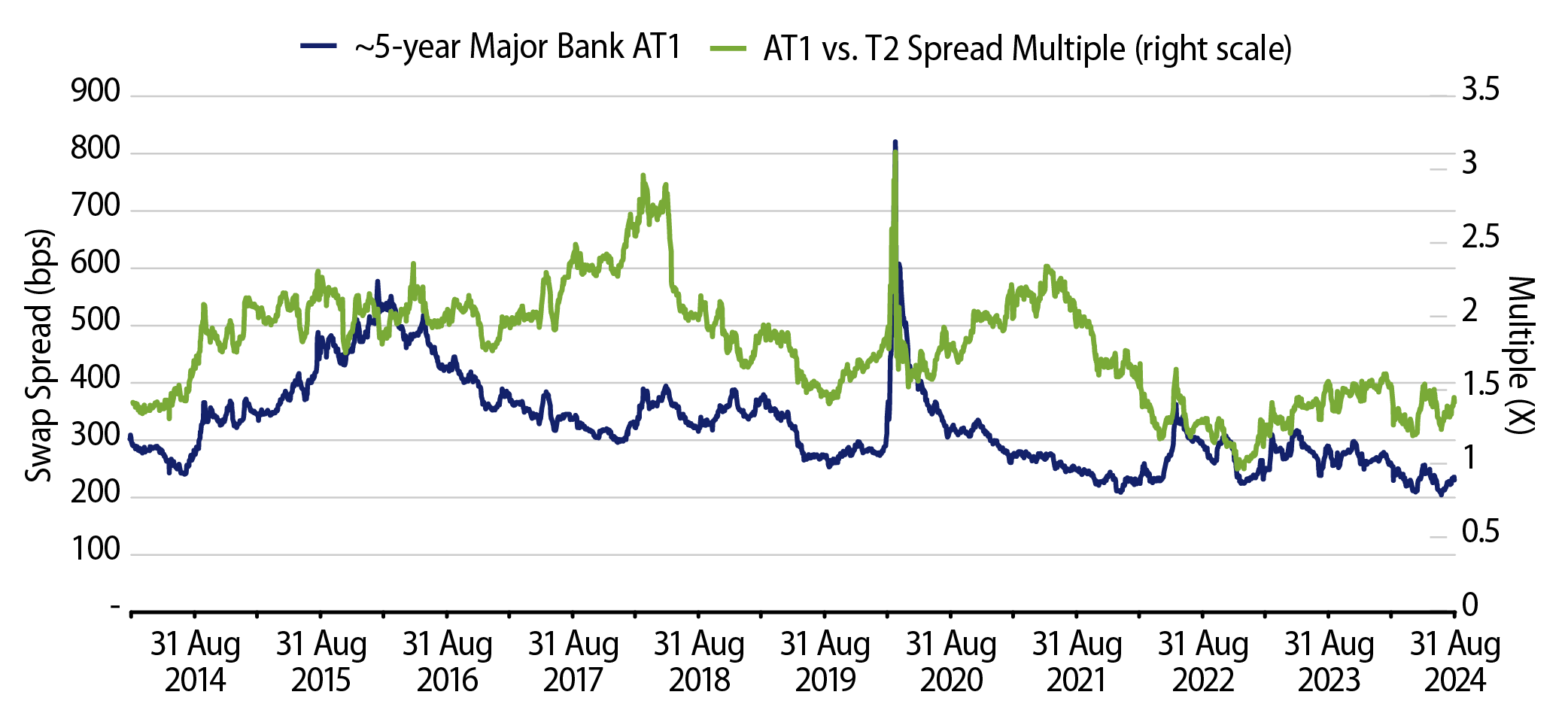

Exhibit 1 shows a comparison of AT1 spreads over time (231 basis points (bps) as at August 31, 2024 versus a 10-year average of 330 bps) and versus Tier 2 securities (1.4x current multiple versus a 10-year average of 1.8x).

Comparison of Australian hybrid yields ex-franking (green) and grossed up for franking (yellow) against equivalent-rated global AT1 securities Global Contingent Capital Index (blue) tells a similar valuation story (Exhibit 2).

Concentration risk is also an issue, with more than 78% of Australia’s circa $43 billion listed hybrid market represented by the “Big Four Banks” (89% once Macquarie Bank is included) and the weights of these securities also sizeable in domestic equity indices (Exhibit 3).

APRA’s recognition of heightened risks extends to recent international experience, which “has shown that AT1 capital securities (AT1s) may not fulfil their function in a crisis due to their complexity, potential for legal challenges and contagion risk.” The organization has now proposed steps to improve the effectiveness of hybrid securities during a crisis.

APRA Proposes Hybrid Phase-Out

APRA has proposed that AT1 use by banks be phased out. A new capital framework is proposed to apply beginning in January 2027, and current AT1 securities are expected to be replaced by 2032.

- Large, internationally active banks would be able to replace 1.50% AT1 securities with 1.25% Tier 2 and 0.25% common equity Tier 1 (CET1) capital.

- Smaller banks would be able to fully replace AT1 securities with Tier 2, with a reduction in Tier 1 requirements or a combination of Tier 2 and equity securities.

APRA’s proposed changes aim to “ensure that regulatory capital more effectively does what it is intended to do: absorb losses while the bank is a going concern and support resolution.”

Ramifications of Proposed Changes

For existing investors, APRA doesn’t envision an immediate impact with existing AT1 securities continuing to be eligible as regulatory capital until their first call dates.

Current estimates indicate approximately A$22 billion of Tier 2 securities would replace approximately A$38Billion of existing bank AT1 securities. There is some risk that additional supply could cause spreads to widen over time. Although APRA’s initial analysis is that there is likely sufficient market capacity to support an increased volume of Tier 2 supply.

Another consideration is the potential disappearance of a subordinated tier below Tier 2 securities in the capital stack. Increased volatility of Tier 2 securities may result. Investors may take comfort in the proportion of common equity Tier 1 capital to total assets in Australia being very high on a global relative basis, meaning that subordination beneath Tier 2 could still be regarded as very strong.

Encouragingly, a significant increase in Tier 2 capital supply has already occurred throughout 2024 and met with excellent demand. Ongoing profitability, along with a recent upgrade to Australian major bank Tier 2 securities by rating agency Fitch, brought all rating agencies into the A band and above their offshore equivalents.

Assessing Better Solutions

To navigate proposed APRA regulatory changes amid ongoing variations in market dynamics and changing valuations, it is worth considering a refreshed approach to targeting yields offered by hybrid securities.

Term Deposits?

While term deposits offer a simple solution, they have numerous pitfalls. First, term deposit rates have recently been reduced as banks strive to protect net interest margins. In late August 2024, ANZ Bank cut rates on term deposits by up to 80 bps, and Commonwealth Bank of Australia and National Australia Bank cut by up to 50 bps. New investors are locking in lower yields on application, which may be inferior to more diversified managed cash and money market solutions. Furthermore, term deposits are illiquid, carry an administrative burden, reinvestment risk and the distinct absence of capital uplift potential in a falling yield environment.

An Alternative Solution: Actively Managed Fixed-Income and Credit

For investors seeking similar yields, actively managed fixed-income and credit strategies offer a variety of attractive investment characteristics versus hybrids and term deposits, including:

- Greater flexibility and liquidity

- Upside return potential if yields decline

- Superior diversification and lower concentration risk potential

- Lower reinvestment risk

- Administrative efficiency

- Potential benefits of active management

Additionally, unlike hybrids, diversified fixed-income and credit solutions are more reasonably classified within the defensive part of investment portfolios.

Fund managers with global resources are equipped to navigate changes in fundamental value across regions, sectors and the capital stack. For investors wishing to add protection to their portfolios with the potential to generate attractive returns as yields fall, core fixed-income is worth considering. For those wishing to avoid interest rate risk, diversified approaches to credit have merit.