Municipals Posted Positive Returns During the Week

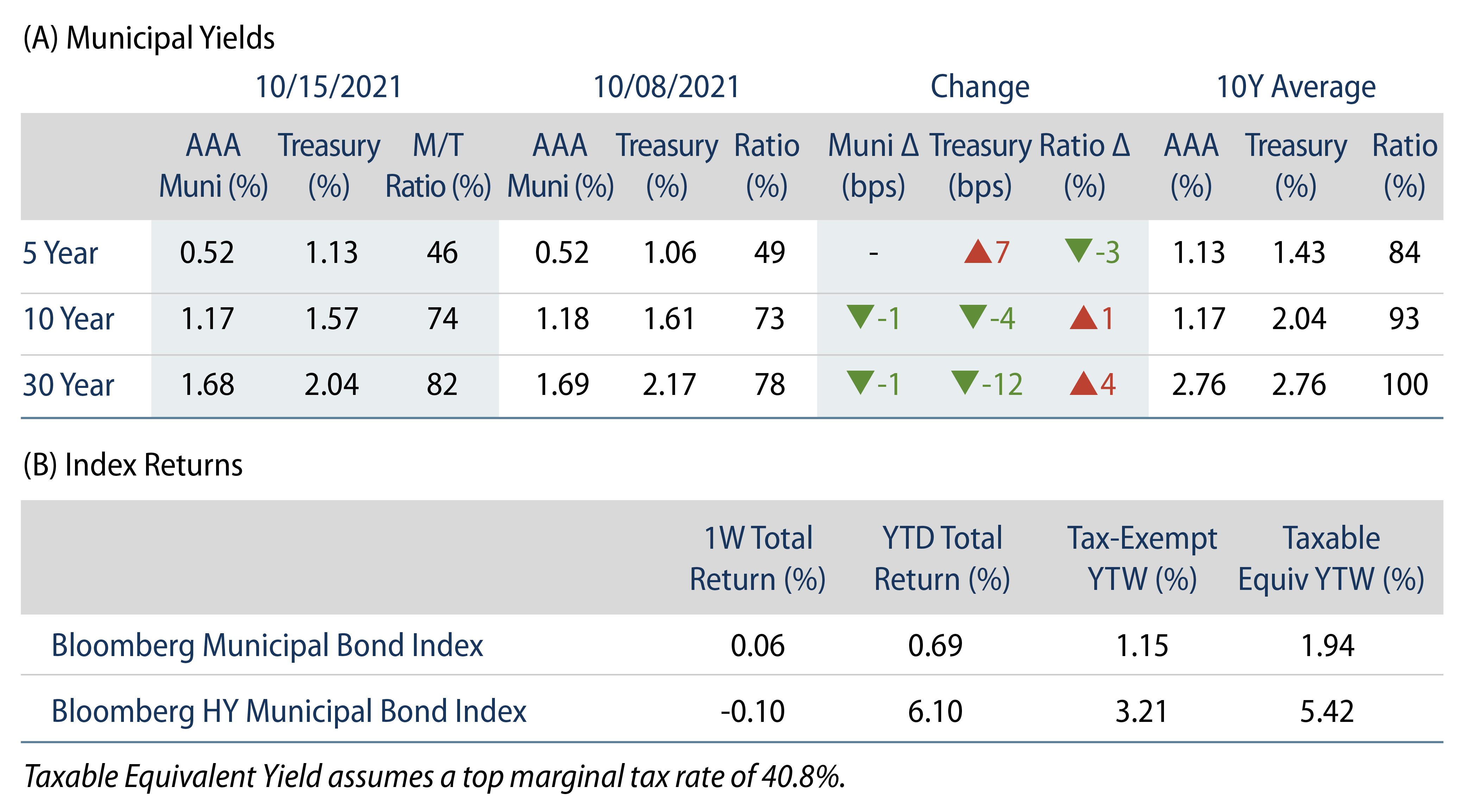

US muni yields moved 1 bp lower across intermediate and long maturities. Municipals underperformed the Treasury rally in short and long maturities, but outperformed on the short end. The Bloomberg Municipal Index returned 0.06%, while the HY Muni Index returned -0.10%. Muni fund flows improved over the week. This week we highlight the implications of a recent National Centers for Environmental Information report on record natural disasters.

Muni Demand Improved as All Major Fund Categories Report Inflows

Fund Flows: During the week ending October 13, municipal mutual funds recorded $461 million of net inflows. Long-term funds recorded $284 million of outflows, high-yield funds recorded $45 million of inflows and intermediate funds recorded $72 million of inflows. Municipal mutual funds have now recorded inflows 73 of the last 74 weeks, extending the record inflow cycle to $152 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $91 billion.

Supply: The muni market recorded $10 billion of new-issue volume during the week, down 11% from the prior week. Total issuance YTD of $368 billion is 2% higher from last year’s levels, with tax-exempt issuance trending 10% higher year-over-year (YoY) and taxable issuance trending 19% lower YoY. This week’s new-issue calendar is expected to stay elevated at $11 billion of new issuance. The largest deals include $875 million Central Puget Sound Regional Transit Authority and $600 million OhioHealth Corporation transactions.

This Week in Munis—Natural Disasters

The National Centers for Environmental Information recently reported that through September, 2021 has already been the costliest year for natural disasters. So far this year, 18 events caused more than $1 billion in damage each, totaling $105 billion, compared to the 22 events observed in 2020 that totaled $100 billion, and well above the annual average of seven events over the last two decades. The study cites the primary costs attributable to hurricanes Ida and Nicholas, as well as the persistent fires across the western United States.

Natural disasters present material risks worth monitoring in the municipal market as part of standard ESG risk integration. Municipalities confronted with natural disasters face a variety of costs, including immediate recovery costs and revenue losses associated with local economic slowdowns following the destruction. Perhaps more importantly, as the frequency of natural disasters increase, municipalities’ primary revenue source of individuals and corporations that comprise its tax base are greater longer-term risk considerations. Over the last decade, populations have migrated to states that have observed a greater share of these disasters, and the growing tax base in these areas has led to more value at risk for many municipalities if the impact of these disasters leads industry and individuals to move away from hard-hit regions.

While the severity of incidents caused by climate change is of concern, we are encouraged by the variety of actions taken by issuers to mitigate damages and costs. More issuers are building climate resiliency initiatives into their long-term capital plans. Select states in greatest jeopardy have also created authorities to serve as reinsurers, encouraging private firms to provide coverage for individuals and businesses to mitigate downside risks. Some states have also bolstered reserves specifically tied to climate risks. For example, Mississippi maintains a disaster trust fund to cover the costs of first responders and fund any state match for federal aid. It is also important to note that in the event of a natural disaster, FEMA often picks up 100% of the cost of remediating damage.

Despite the direct impact of natural disasters on municipalities, municipal credit has been thus far relatively resilient to major climate issues. While we have seen major disasters result in rating downgrades, there has never been a single default caused by climate shock. By accounting for outstanding climate risks in conjunction with mitigation efforts, we seek to provide our clients with risk-adjusted value in issuers that we believe are successfully navigating the new realities of climate change.