Municipals Posted Negative Returns as Yields Moved Higher

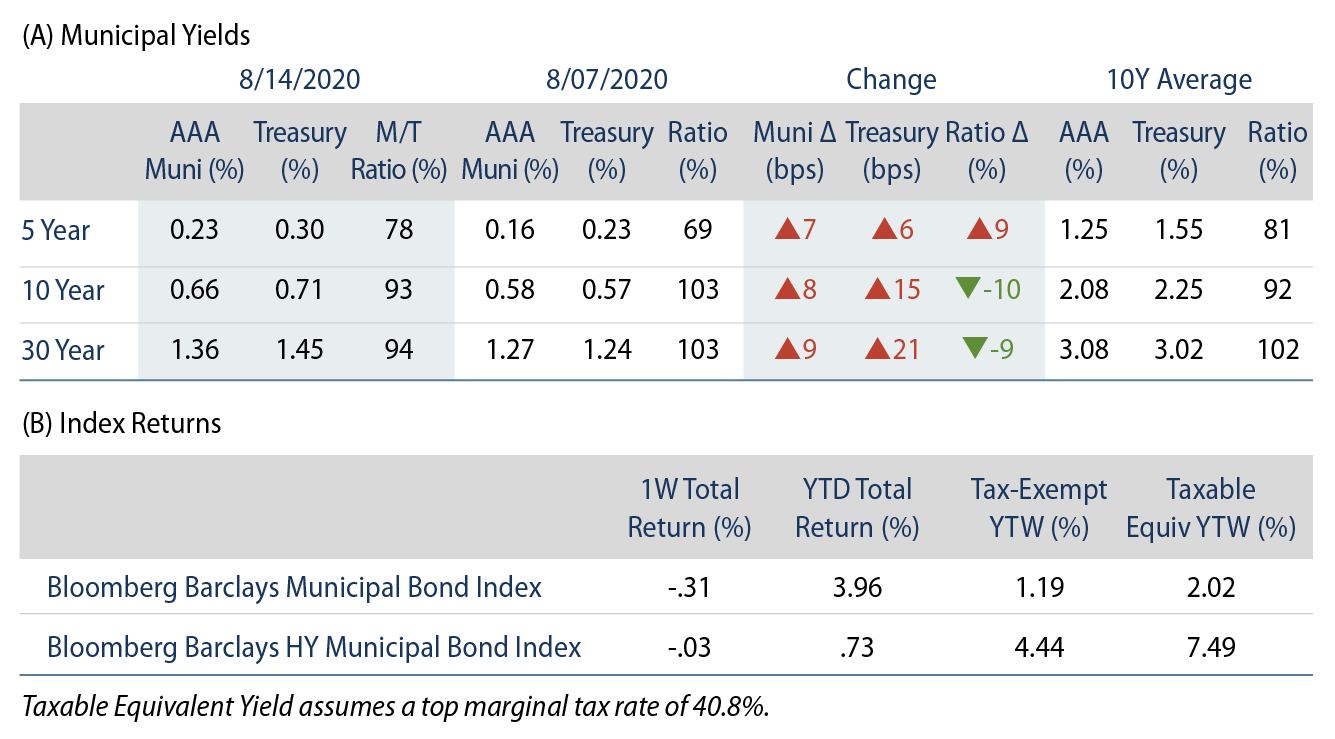

AAA municipal yields moved 7-9 bps higher across the curve during the week. Municipal/Treasury ratios declined below 100% across the curve for the first time since March volatility. The Bloomberg Barclays Municipal Index returned -0.31%, while the HY Muni Index returned -0.03%.

Technicals Soften with a Heavy Calendar

Fund Flows: During the week ending August 12, municipal mutual funds reported a 14th consecutive week of inflows at $2.3 billion, according to Lipper. Long-term funds recorded $1.2 billion of inflows, high-yield funds recorded $344 million of inflows and intermediate funds recorded $215 million of inflows. Municipal mutual fund net inflows YTD now total $11.4 billion.

Supply: The muni market recorded $10.4 billion of new-issue volume last week, up 25% from the prior week. Issuance of $265 billion YTD is 26% above last year’s pace, primarily driven by taxable issuance, which is up 366% from last year’s levels and comprises 26% of YTD issuance. We anticipate over $13 billion in new issuance this week (+31% week-over-week), led by $7.2 billion State of Texas TRANs and $1.6 billion NYC Transitional Finance Authority transactions.

This Week in Munis: Spread Tightening Stalled

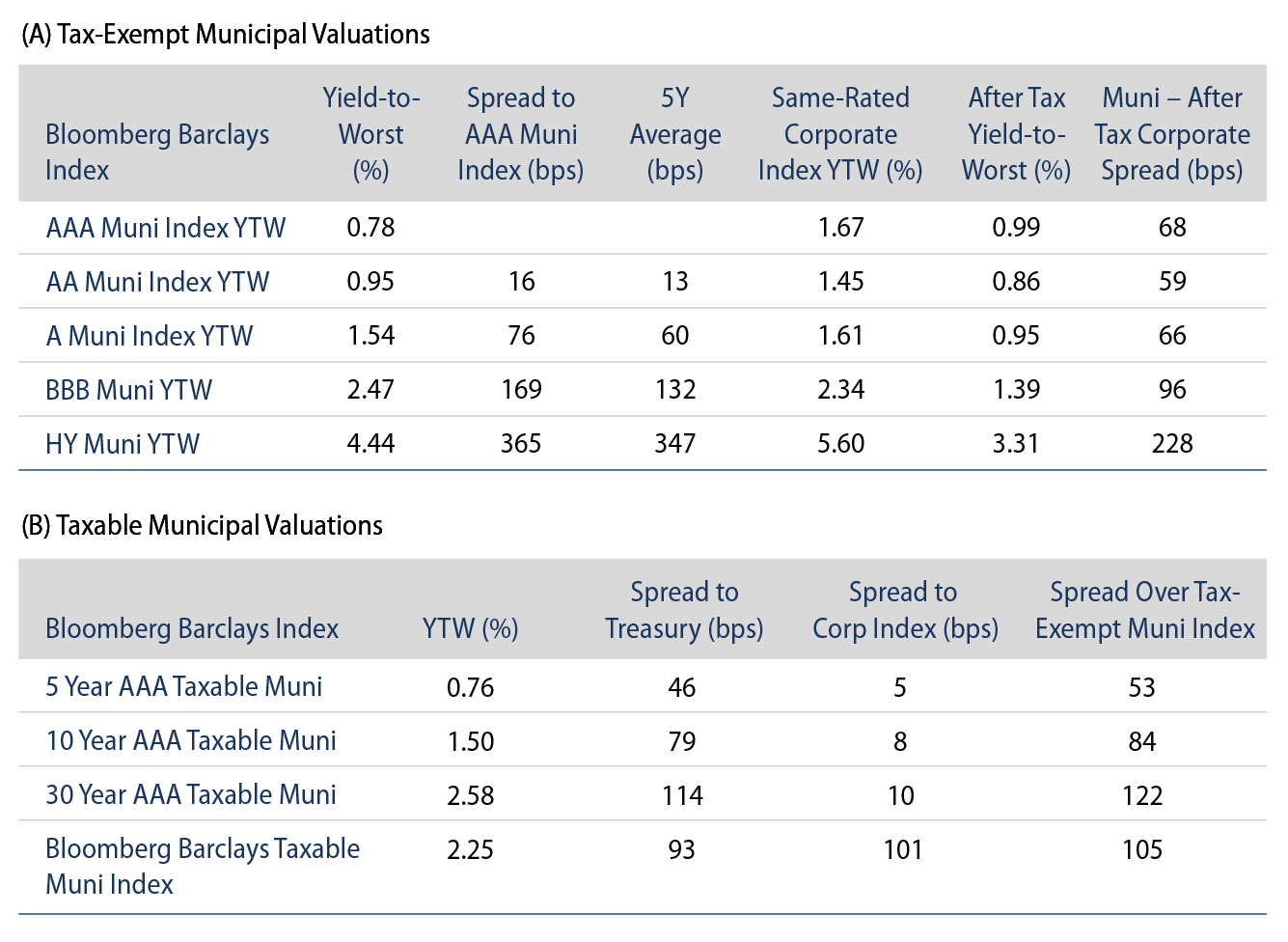

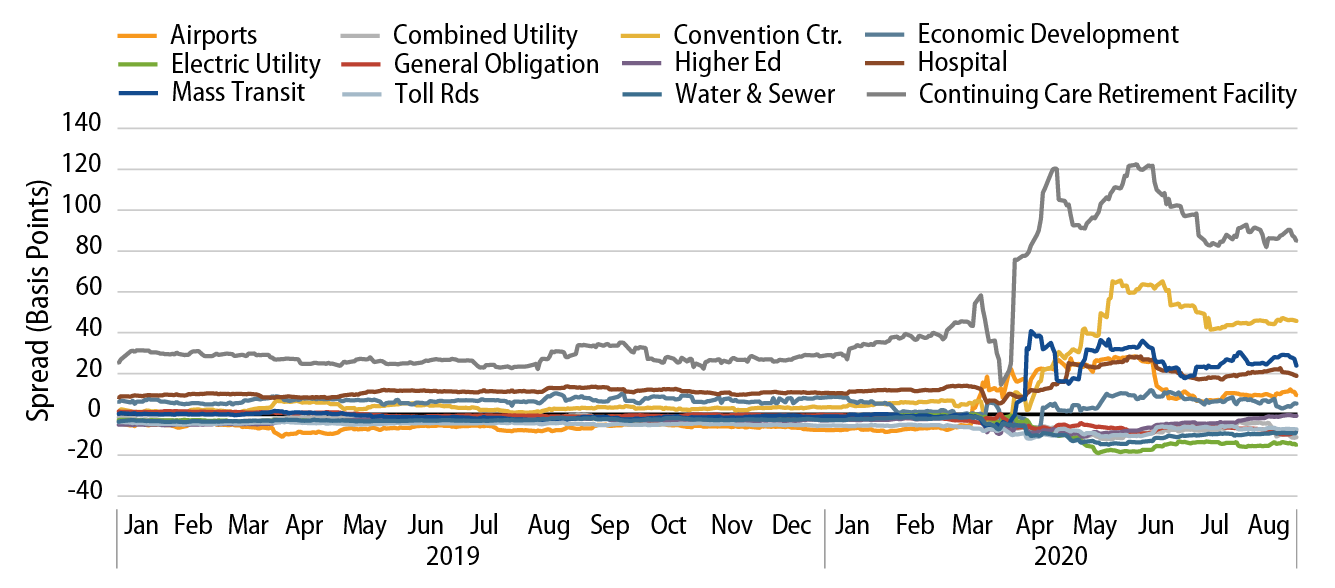

COVID-19 has repriced municipal risk across sector and quality levels—as transportation, industrial revenue, healthcare, single A rated and BBB rated securities sharply underperformed the broader municipal market and high-grade securities in March 2020 (Exhibit 1). Since March, however, this reversion appears to have paused and we do not expect additional spread compression absent improving fundamentals.

The reversal in market sentiment and liquidity from late March throughout the second quarter has contributed to strong demand for the asset class, as robust fund flows contributed to spread tightening and outperformance in these hard-hit sectors. Over the past couple months, this spread compression has stalled.

We believe municipal investors will continue to be rewarded with carry for choosing appropriate issuer-level risks within these segments of the market. However, we expect that at current nominal yield levels, the potential for significant outperformance associated with spread compression is limited, and will be driven by fundamental credit trends at the issuer level.