Municipals Posted a Third Consecutive Week of Negative Returns

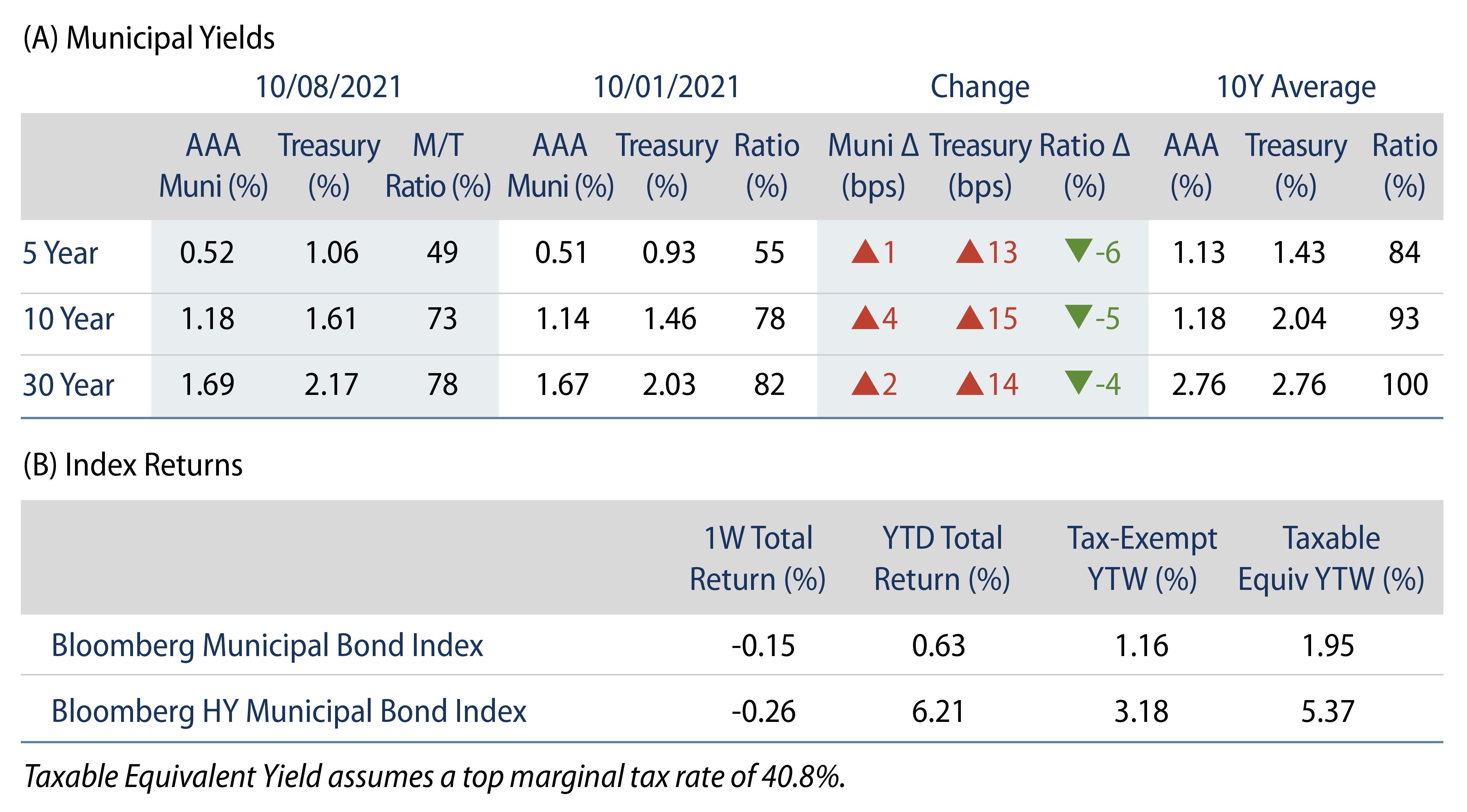

US muni yields increased 1 to 4 bps across the curve. Municipals outperformed the Treasury selloff as ratios grinded 4% to 6% lower. The Bloomberg Municipal Index returned -0.15% while the HY Muni Index returned -0.26%. Muni fund inflows continued to decelerate as long-term and high-yield funds experienced outflows. This week we provide an update on the state of state and local pensions.

Fund Flows Decelerate as Long-Term and High-Yield Categories Report Outflows

Fund Flows: During the week ending October 8, municipal mutual funds recorded $37 million of net inflows. Long-term funds recorded $173 million of outflows, high-yield funds recorded $460 million of outflows and intermediate funds recorded $223 million of inflows. Municipal mutual funds have now recorded inflows 72 of the last 73 weeks, extending the record inflow cycle to $150.5 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $89 billion.

Supply: The muni market recorded $11 billion of new-issue volume during the week, down 7% from the prior week. Total issuance YTD of $358 billion is 3% higher from last year’s levels, with tax-exempt issuance trending 12% higher year-over-year (YoY) and taxable issuance trending 18% lower YoY. This week’s new-issue calendar is expected to decline to $4.2 billion of new issuance, given the holiday-shortened week. The largest deals include $750 million Main Street Natural Gas and $366 million Texas Water Development Board transactions.

This Week in Munis—Pension Progress

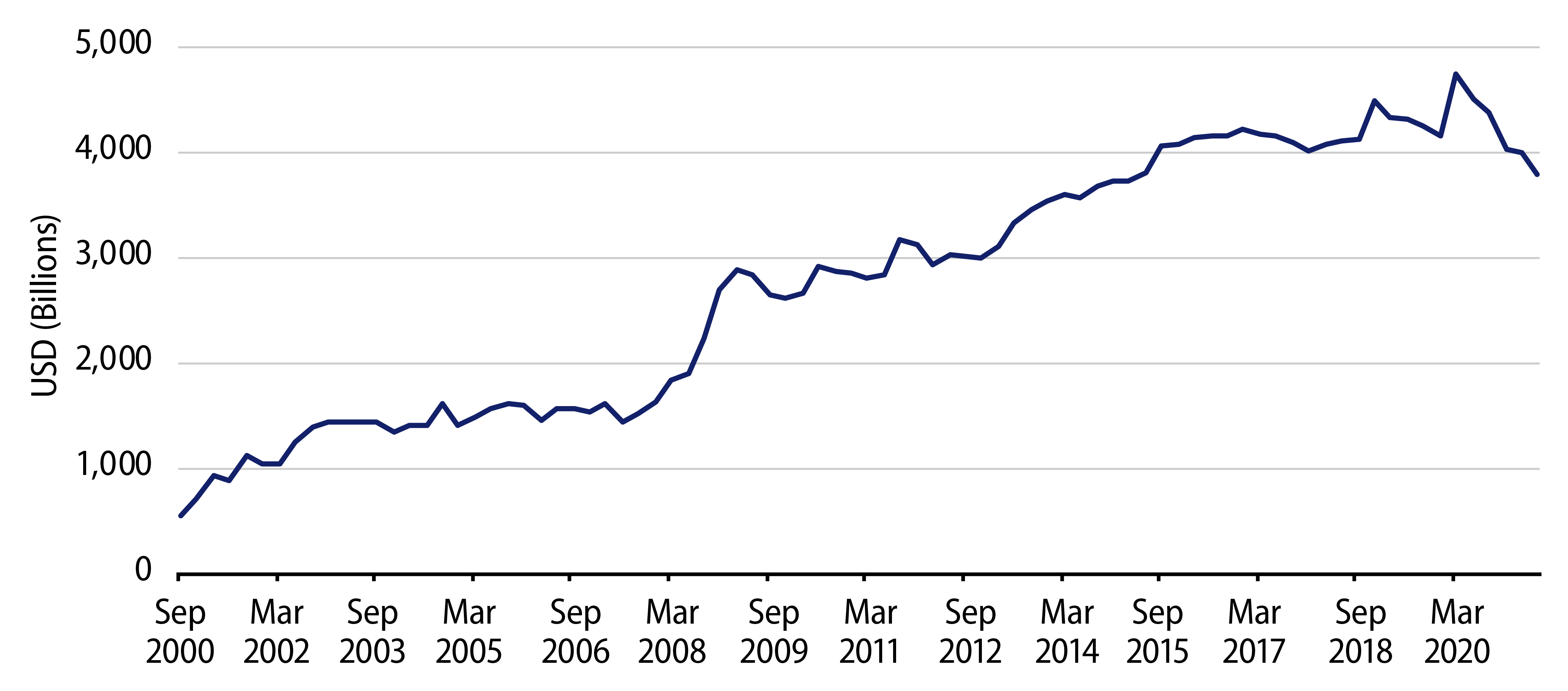

Municipal pension funding has been a well-documented credit concern over the past decade. According to the Federal Reserve Flow of Funds data, unfunded state and local pension liabilities doubled after the GFC to $3 trillion, then continued to grind higher to $4 trillion through the beginning of 2020, as underperforming market returns, underwhelming contributions and revisions to aggressive actuarial assumptions all contributed toward rising net pension liabilities. Pension concerns came back to the forefront when the COVID-19 pandemic emerged in March of 2020 and the S&P fell 34%. Total unfunded pension liabilities climbed to $4.75 trillion and those credits with underfunded pensions underperformed the broader municipal market.

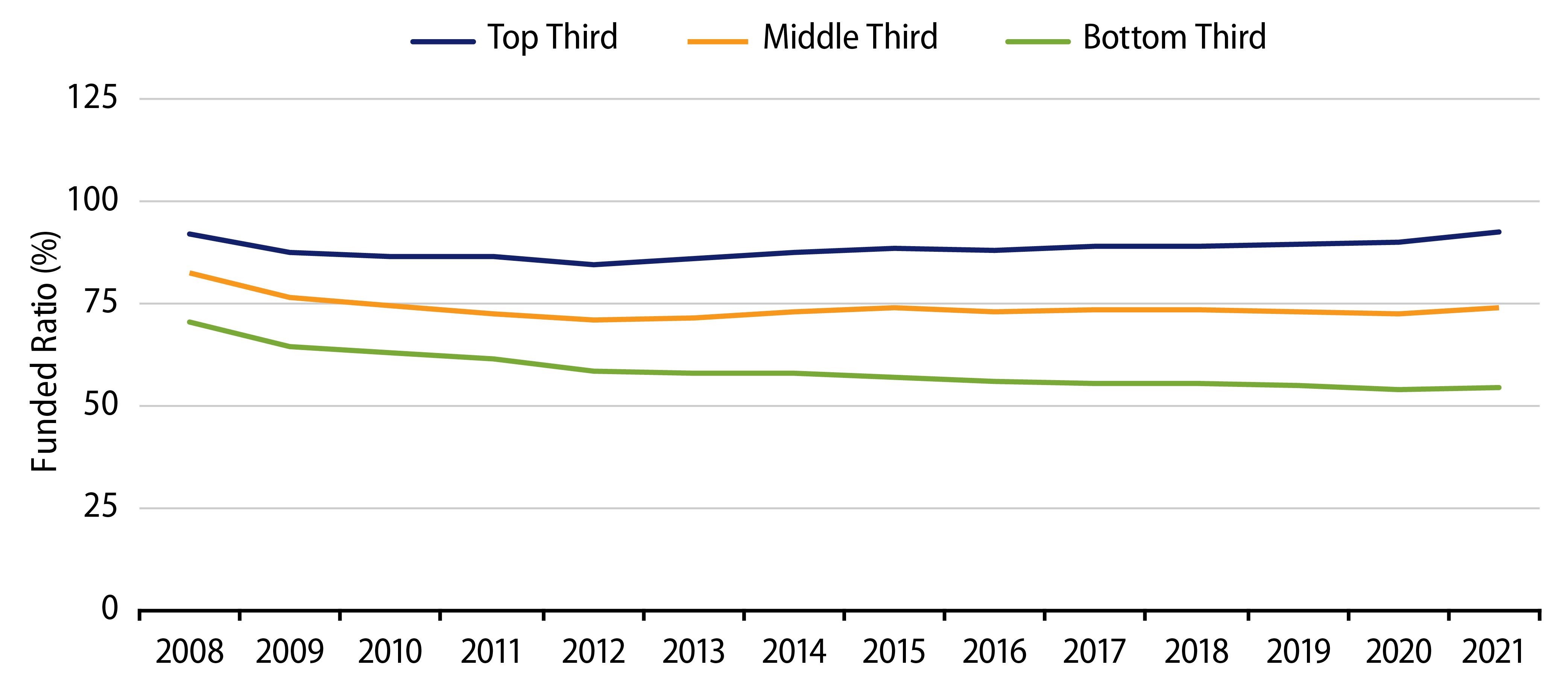

Widespread fears were soon abated by the robust market recovery since the market downturn. The S&P 500 climbed a remarkable 103% from March 2020 through early September 2021, and public pensions have reaped the benefits with overall expected investment returns ranging between 25% and 35% for the fiscal year ending June 30, 2021. In addition to strong investment returns, public pensions benefited from state-level reforms that have occurred over the past decade. Employer contributions have increased by 8% annually from 2008 to 2019. The most pension-challenged states of Illinois, Kentucky, New Jersey and Pennsylvania have seen contribution increases of 16%. All told, from March 2020 to June 2021, aggregate state and local unfunded liabilities declined by 20%, to $3.8 trillion, leading average funding ratios higher to 74.7% (up from lows of 71.7% in 2016).

While the majority of the public pension funds have improved and maintain relatively healthy funded ratios, a third of the market’s funded ratios still remain below 70%, with some below 20%. Moreover, the best-funded plans have shown the most improvement, while plans with lower funded ratios, and lower vested assets, did not observe the same benefit from the recent market rally. Over the last year, the average funded ratio of the bottom third of pension plans (by funding ratio) improved just 0.2%, compared to a 2.7% improvement of the top third, according to a recent Boston College Center for Retirement Research study. Municipal credits participating in these lower funded pension plans will likely observe higher forward-looking fixed costs, which could weigh on discretionary spending and budgetary flexibility in the next downturn, leaving these entities more vulnerable to rating downgrades and negative price volatility.