Macros, Markets and Munis

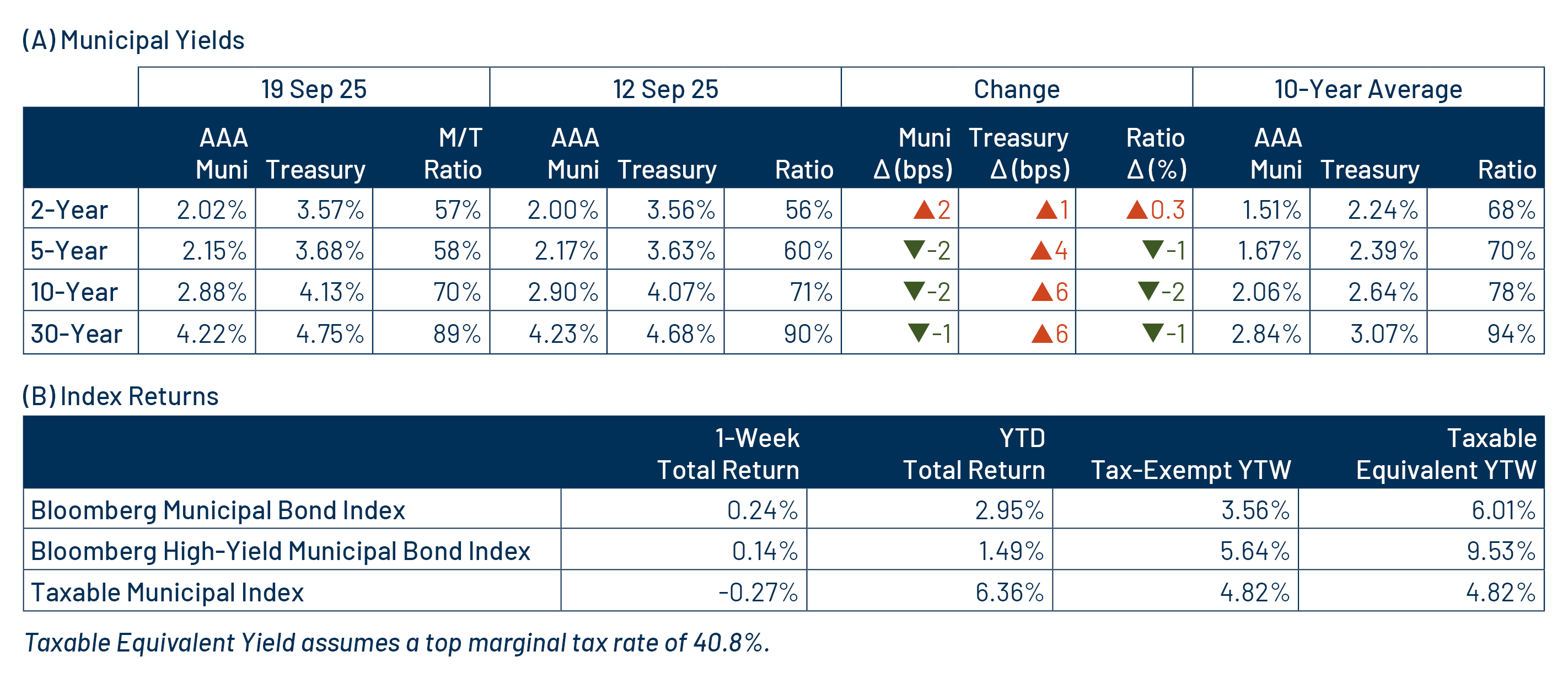

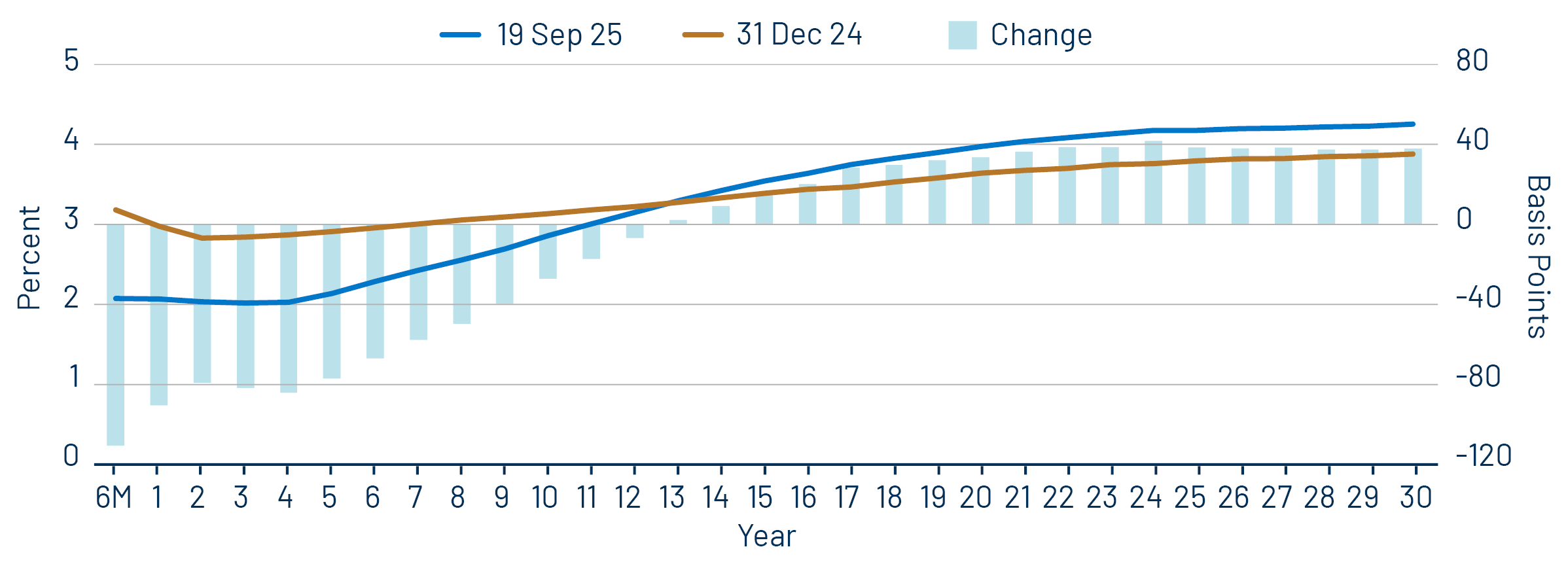

Munis rallied and outperformed taxable fixed-income last week. Technicals improved as supply slowed amid persistent demand. Fixed-income markets focused on the Federal Open Market Committee (FOMC) meeting last week. The Federal Reserve (Fed) reduced the federal funds rate by 25 basis points (bps) to a target of 4.25%, with the Committee citing increasing downside risks to the labor market and telegraphing the potential for two additional cuts by year end. From an economic data perspective, initial jobless claims fell below expectations and retail sales data moved higher from prior-month levels, exceeding expectations. The Treasury curve moved higher across the curve during the week. The high-grade muni curve outperformed and generally moved lower across most maturities as technicals strengthened. Following last week’s Fed cut, this week we touch on municipal performance during rate cut cycles.

Muni Mutual Funds Record Inflows Amid Softer New-Issue Supply

Fund Flows ($1 billion of net inflows): During the week ending September 17, weekly reporting municipal mutual funds recorded $2.2 billion of net inflows, according to Lipper. Long-term, intermediate and short-term categories recorded $875 million, $176 million and $56 million of inflows, respectively. Last week’s inflows led year-to-date (YTD) inflows higher to $29 billion.

Supply (YTD supply of $414 billion; up 18% YoY): The muni market recorded $8 billion of new-issue supply last week, down 34% from the prior week. YTD new-issue supply of $414 billion is 18% higher than the prior year, with tax-exempt issuance up 19% year-over-year (YoY), with taxable issuance unchanged from prior year levels. This week’s calendar picks back up to $16 billion. The largest deals include $1.9 billion Texas Water Development Board and $1.6 billion California State GO transactions.

This Week in Munis: Federal Reserve Cuts

Last week, the Fed reduced the federal funds target by 25 basis points (bps), from 4.50% to 4.25%. This marked the first interest rate cut since December 2024 and continued the current rate-cutting cycle that began in September 2024. The FOMC highlighted softening labor market conditions as the primary rationale for the cut and indicated the potential for additional cuts through the end of 2025.

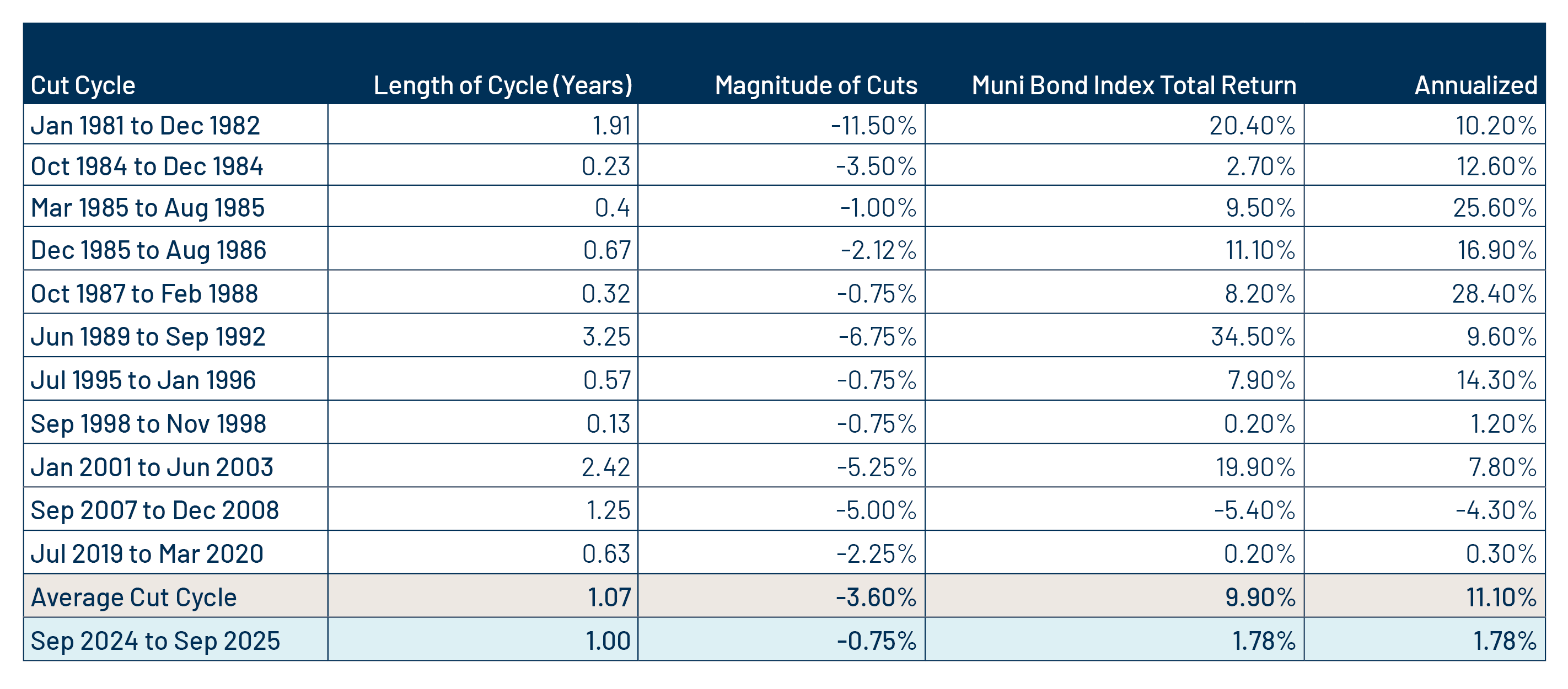

Rate-cutting cycles have historically contributed to fixed-income and municipal performance, as the impact of lower rates has tended to have a positive impact on duration-bearing fixed-income instruments. During the prior eleven rate cut cycles observed since 1981, the Bloomberg Municipal Bond Index posted total returns of 9.9% between the first and last interest rate cuts, or 11.1% when considering returns on an annualized basis.

While this cut cycle has reached the average tenor of the prior eleven rate cut cycles, returns have not yet reflected the average magnitude of positive outcomes traditionally seen when the Fed cuts rates. Since the Fed began reducing rates in 2024, the Bloomberg Municipal Bond Index has returned 1.78% through September 19, significantly below the 11.1% average annualized return of the prior eleven rate cut cycles. Western Asset attributes the relative underperformance to the elevated supply and curve steepening observed in the municipal market over the past year. However, with additional rate cuts anticipated through the end of 2025 and into 2026, the current cycle’s performance continues to evolve. If historical patterns hold, Western Asset believes that the potential for further rate reductions, combined with attractive income opportunities available today, could drive favorable total returns to be more consistent with prior rate cut cycles.

Municipal Credit Curves and Relative Value

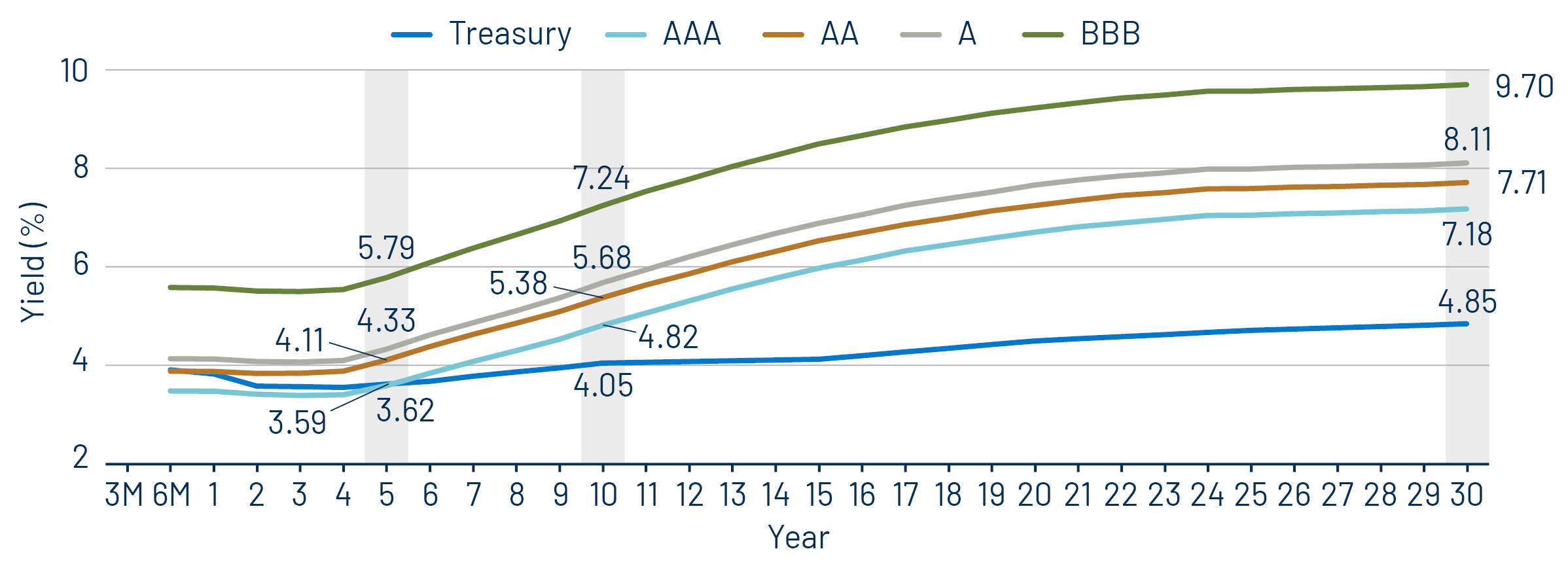

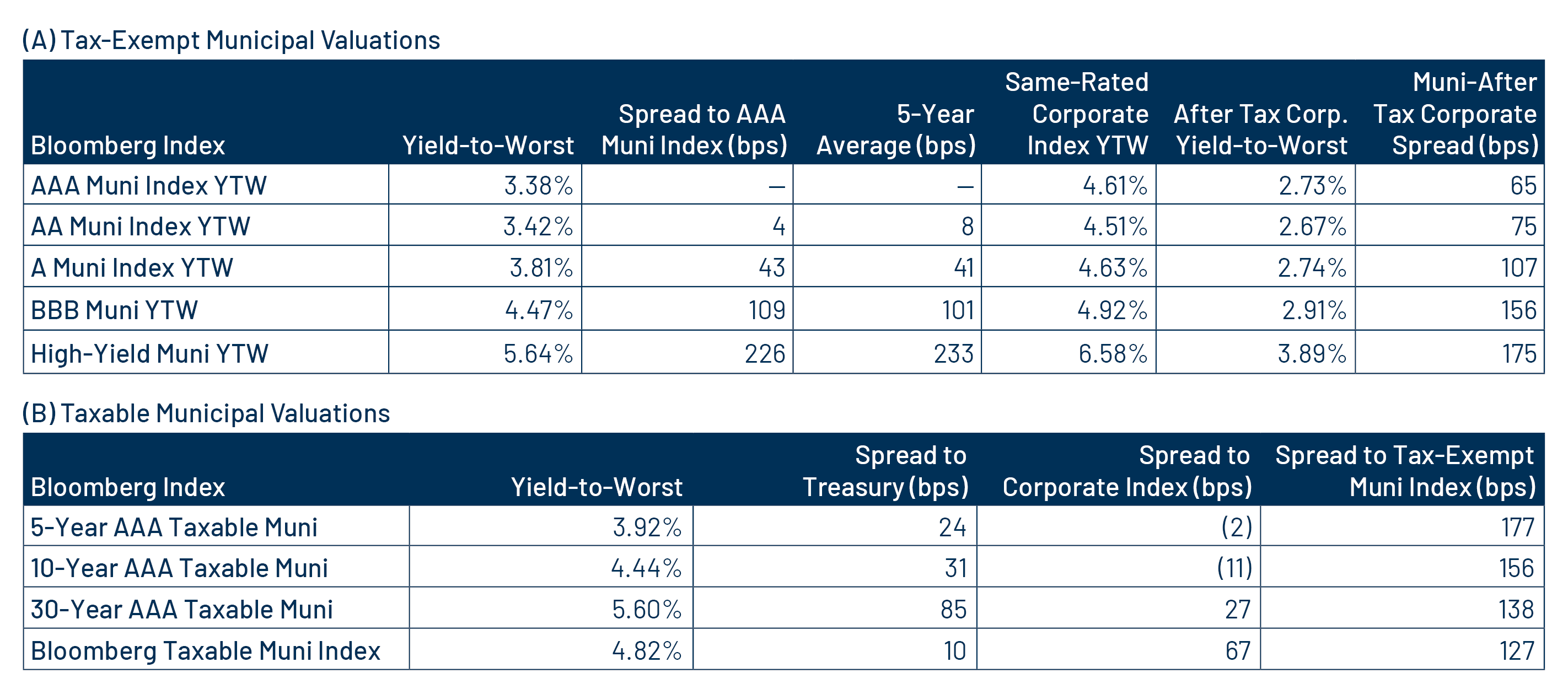

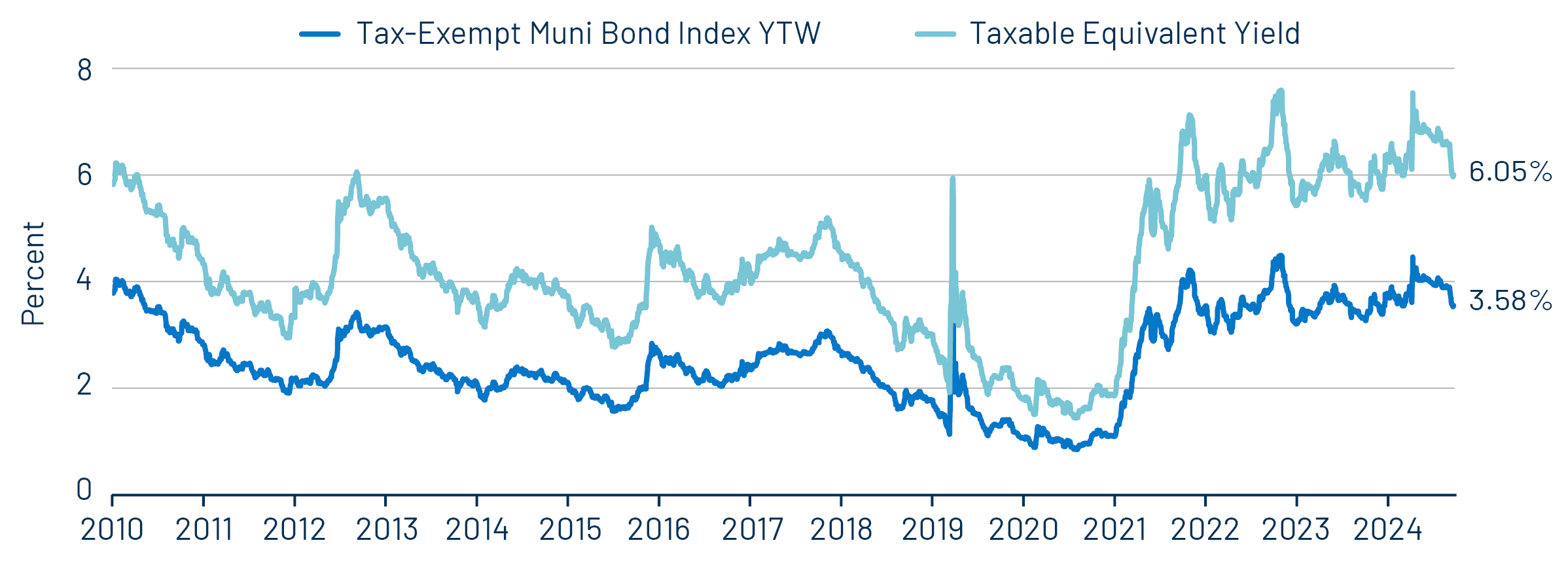

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

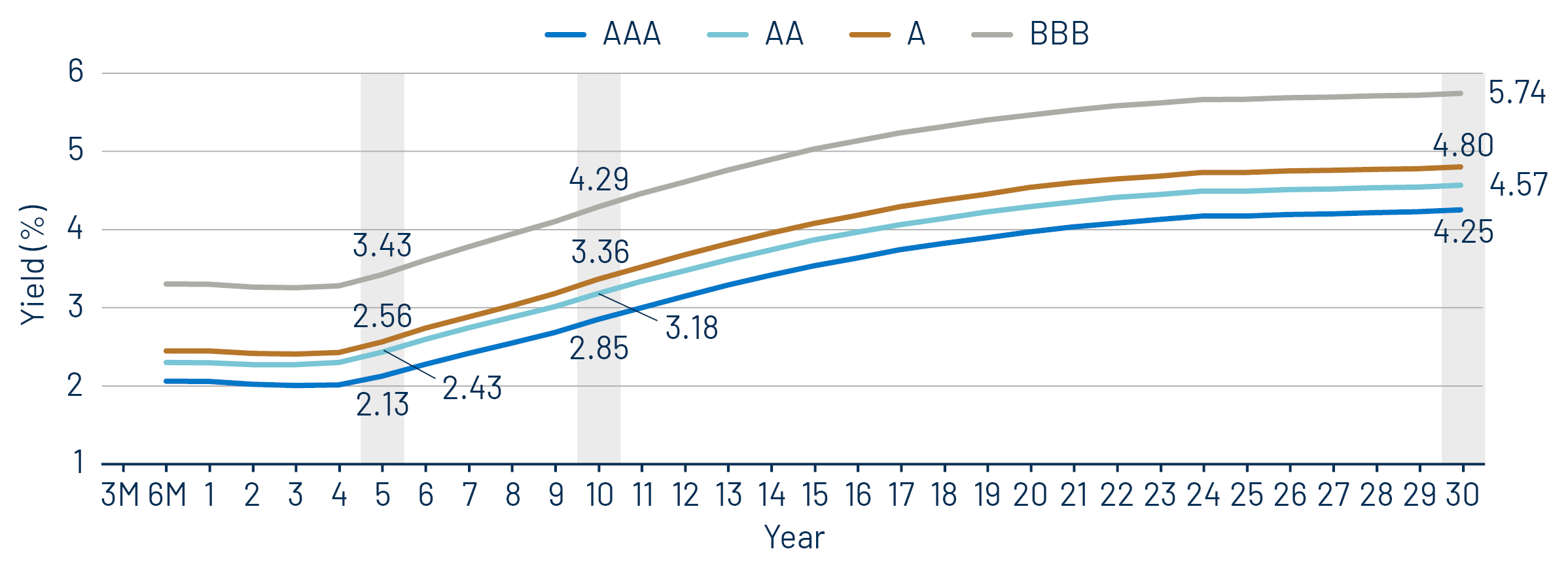

Theme #2: The AAA muni curve has steepened, offering better value in intermediate and longer maturities.

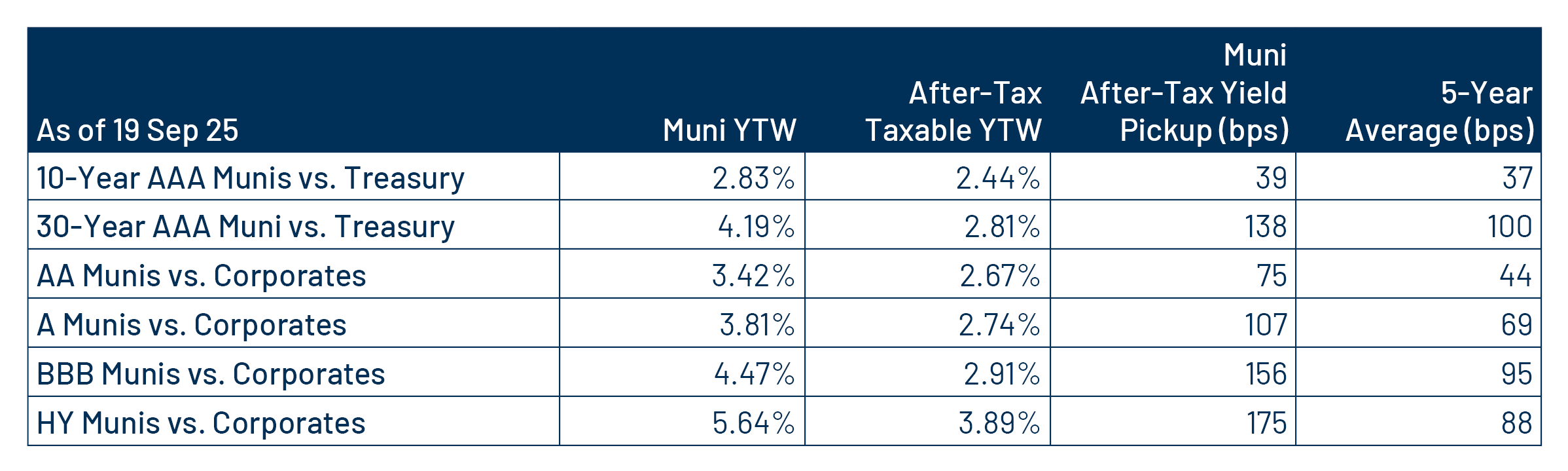

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.