The Republic of Indonesia goes to the polls on Wednesday, April 17, to elect a President, Vice President and Members of Parliament. Indonesians based overseas have already voted in droves at foreign voting centers, but on Wednesday 193 million Indonesians will cast their ballots in more than 80,000 polling stations spread across this vast archipelago of 17,000 islands. The Presidential election is a rematch of current President Joko Widodo paired with Muslim cleric Ma’ruf Amin versus former general Prabowo Subianto and his running mate, business tycoon Sandiaga Uno.

Expectations and Context

Opinion polls have put incumbent president Joko Widodo well ahead of his challenger, ex-general Prabowo Subianto. However, Jokowi’s double-digit lead over Prabowo has narrowed significantly recently amid a strong campaign by his opponent including wide use of online social media to attack Jokowi’s track record on income inequality, the rising cost of living and resentment over China’s growing influence on Indonesia. To gain support from conservative Islamic voters, Prabowo’s campaign has continually questioned Jokowi’s Islamic credentials.

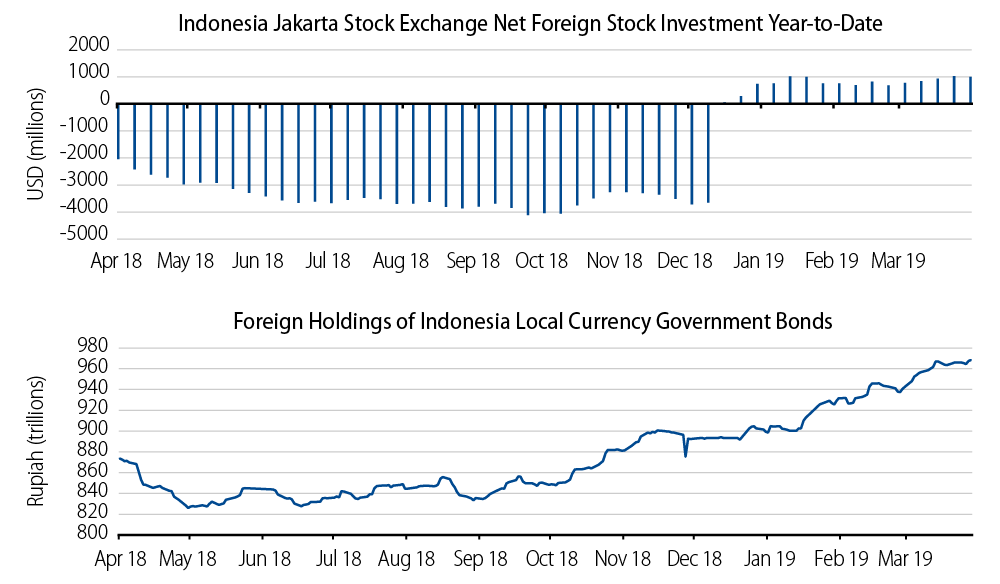

Since the Fed’s dovish tilt, foreigners have been steadily increasing their holdings of Indonesian bonds and stocks despite election uncertainty. Foreign holdings of Indonesia government bonds are at a record high of 38.5% of outstanding bonds, while at the same time foreign investors are returning to the Indonesian stock market (see Exhibit 1). In this year alone, foreigners have purchased more than US$1 billion worth of Indonesia stocks—the most in Southeast Asia.

Investment Implications

We have maintained an overweight to Indonesian bonds due to their attractive real yield amid benign economic fundamentals. Indonesian real interest rates, following substantial rate hikes last year, are the highest in Asia and the country’s fiscal prudence has been exemplary. However, Indonesia’s current account remains in a chronic deficit which requires that the country continually attract foreign capital inflows. Its dependence on key commodity exports (e.g., gas, rubber, palm oil and coal) subjects the economy to the vagaries of the commodity cycle and the risk of “dollarization.”

In view of the heavy foreign positions ahead of the crucial election results, our tactical preference is not to add risk by investing in long-dated Indonesian government bonds, where foreign investors are more heavily positioned. Instead, we like switches from long-end Indonesian government bonds to short- and medium-dated Indonesian rupiah-denominated quasi-sovereign bonds (e.g., EXIM and select state-owned enterprises and multi-finance companies), which currently offer about an 8% yield with considerably less duration risk.