Headline housing starts rose 3.4% in August from a July level that was revised slightly upward. The more important single-family starts measure declined by 2.8%, continuing its downtrend of the past eight months.

As with most other economic indicators, the headline measure of starts is not the most meaningful. For homebuilding, monthly multi-family starts data are extremely volatile. Also, the dollars spent per unit are much smaller for multi-family units than for single-family. Finally, multi-family units typically take longer to build, so that multi-family starts don’t provide the near-term kick to construction spending that single-family starts do.

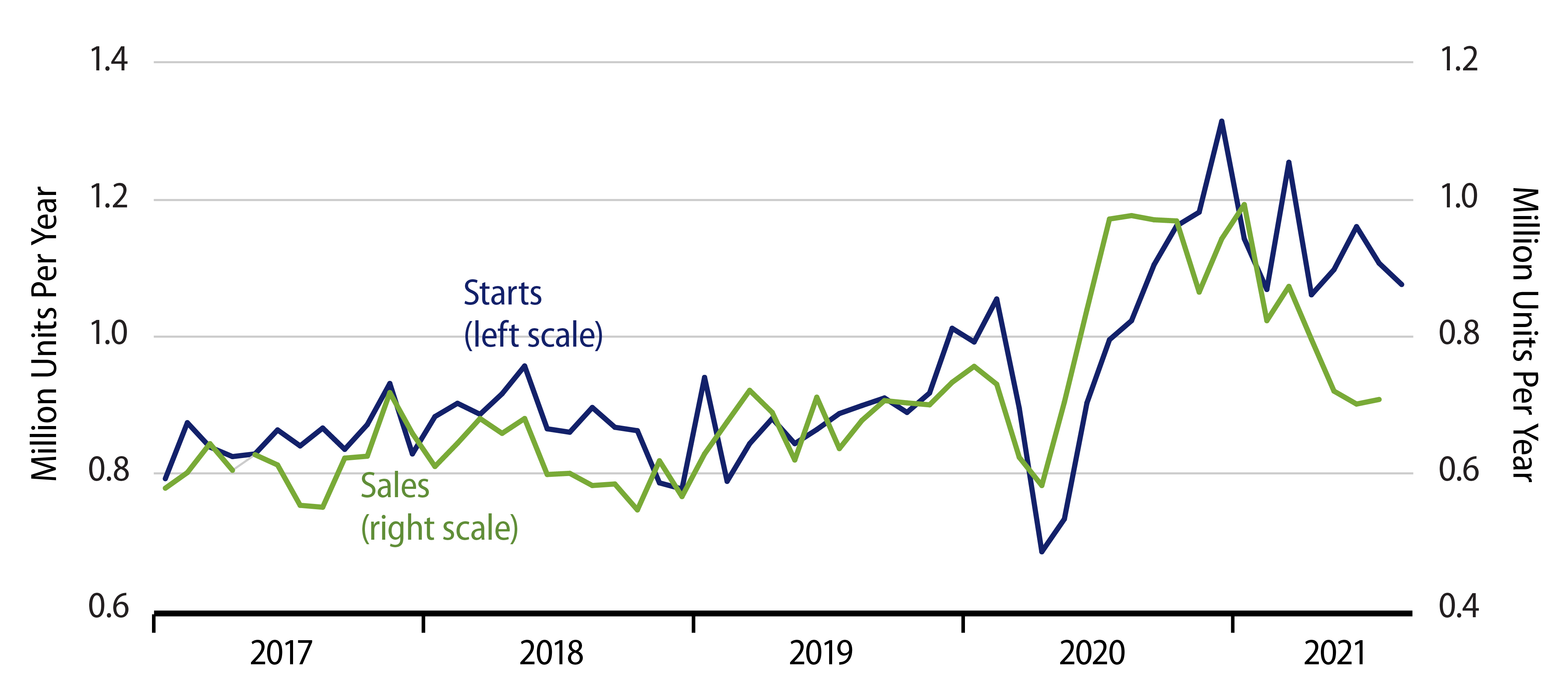

In any case, while multi-family starts have been trendless (and volatile) over the course of 2021, single-family starts have, again, worked steadily lower, in line with comparable and earlier declines in new-home sales. In the accompanying chart, the scales for starts and sales have been adjusted for the estimated effects of owner-builds, which show up in the starts data but not in sales.

The fact that the blue (starts) line has been above the green (sales) line pretty continually since November 2020 tells you that construction companies are building homes faster than they can sell them, and, indeed, inventories of unsold new homes have been rising throughout that span. Unsold inventories exceeded six months’ worth of sales in July, and, barring a sharp rise in sales in August, that overhang is set to increase further in August.

Standard Wall Street lore has it that homes are somehow in tight supply, because inventories of existing homes are low relative to sales. The problem with inventories of existing homes is that they generally reflect both a potential seller and a potential buyer (of another home): the resident homeowner himself. In contrast, with new homes, the seller is a homebuilder looking to go on to the next project, to build another home rather than buy one.

In any case, the two measures of home inventories are giving quite conflicting signals. We are inclined to believe the message from new-home inventories. The 2020 homebuilding boom is over, and builders need to intensify the pace at which they are cutting back construction rates before they are drowning in product.

Why would anyone think the Covid pandemic would drive permanently higher rates of homebuilding than were experienced pre-Covid? One or two months of stimulus checks does not a homeowner make. We saw a nice rebound in homebuilding activity when the shutdown was lifted, and both homebuyers and homebuilders got to heady activity levels for a while, but reality is setting back in. New-home sales are mostly back to pre-Covid rates, and we expect starts to get there as well in coming months.

This is not weakness, but rather merely a return to "normal." Still, housing construction will remain a modest but steady drag on GDP growth for quite a while.