Municipals Posted Negative Returns

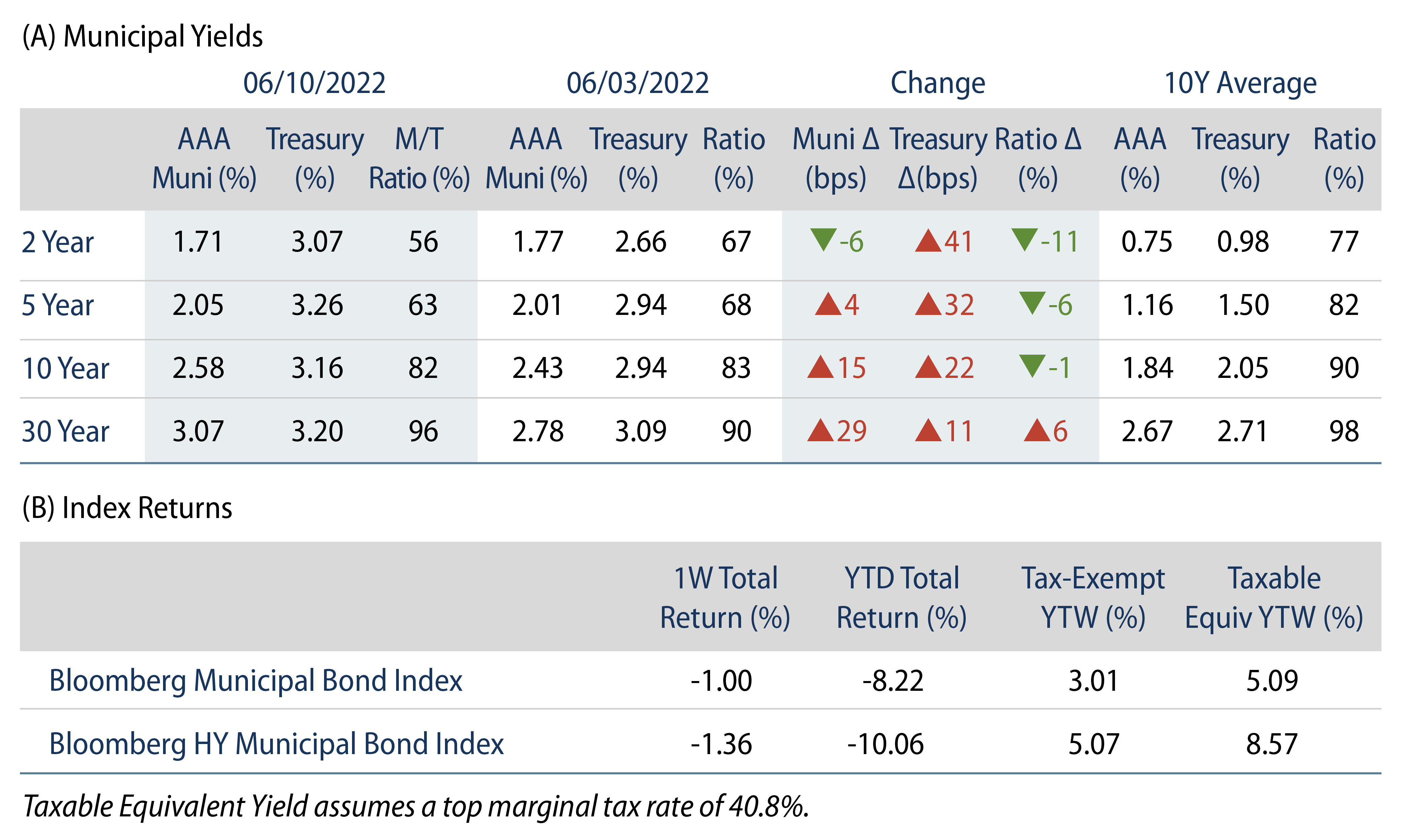

Munis posted negative returns last week and outperformed Treasuries in short to intermediate maturities while underperforming in long maturities. The high-grade municipal yield curve steepened, with AAA muni yields moving 6 bps lower in 2-years and 29 bps higher in 30-years. Weekly reporting municipal mutual funds reverted back to outflows. The Bloomberg Municipal Index returned -1.00%, while the HY Muni Index returned 1.36% as credit spreads widened. This week we highlight elevated defaults and the potential for additional headwinds in the senior living sector.

Municipal Mutual Funds Reverted to Outflows

Fund Flows: During the week ending June 8, weekly reporting municipal mutual funds recorded $2.1 billion of net outflows, according to Lipper. Long-term funds recorded $1.5 billion of outflows, high-yield funds recorded $26 million of outflows and intermediate funds recorded $290 million of outflows. The week’s fund outflows contribute to the $67.6 billion of net outflows recorded by municipal funds year to date (YTD), and diminish hopes for an end to this year’s outflow cycle following the inflows observed in the prior week.

Supply: The muni market recorded $7.5 billion of new-issue volume, up 23% from the prior week. Total YTD issuance of $185 billion is 2% higher than last year’s levels, with tax-exempt issuance trending 12% higher year-over-year (YoY) and taxable issuance trending 30% lower YoY. This week’s new-issue calendar is expected to decline to $5 billion. Large deals include $360 million Riverside County, CA Tax and Revenue Anticipation Notes and $301 million Salt Lake City Public Utilities Revenue Bond transactions.

This Week in Munis: Senior Living Stress

Bonds issued to finance senior living facilities (nursing homes, assisted living facilities, continuing care retirement communities, and memory care facilities) are considered among the riskiest debt type issued in the municipal market. Over the past two years, the sector comprised the majority of defaults despite representing just 1% of total municipal debt outstanding. In 2021, the segment recorded 60% of total municipal defaults as $1.1 billion of senior living bonds defaulted. So far in 2022, the numbers are even worse as the $560 million of senior living bonds that have defaulted YTD represent 75% of all municipal defaults.

Considering the inflation and labor backdrop, these default trends might not improve in the near term as the economics of operating senior living facilities are vulnerable to cost pressures specifically tied to human capital. McKnight’s Senior Living reported that 83% of senior living and skilled nursing operators cited attracting community and caregiving staff as a top challenge, followed by increased operating expenses (80%) and staff turnover (63%). Approximately one in three respondents reported that 11% to 20% of their full-time positions remain unfilled, whereas approximately two in five respondents reported that 20% or more positions are unfilled. The American Health Care Association/National Center for Assisted Living also reported that a survey of its members found that overall operating costs have risen by 41% over the past year. These labor headwinds not only impact existing costs, but also limit the capacity for these entities to maintain sufficient staff to onboard residents and achieve adequate revenue growth.

For an industry characterized by high leverage ratios and thin margins, Western Asset believes these cost increases are unsustainable for most issuers in the senior living sector, even in ideal conditions. While we believe pockets of value can be sought at the individual issuer level within the sector, we tend to favor established, well capitalized, multi-asset borrowers that can benefit from scale and manage through these economic challenges.