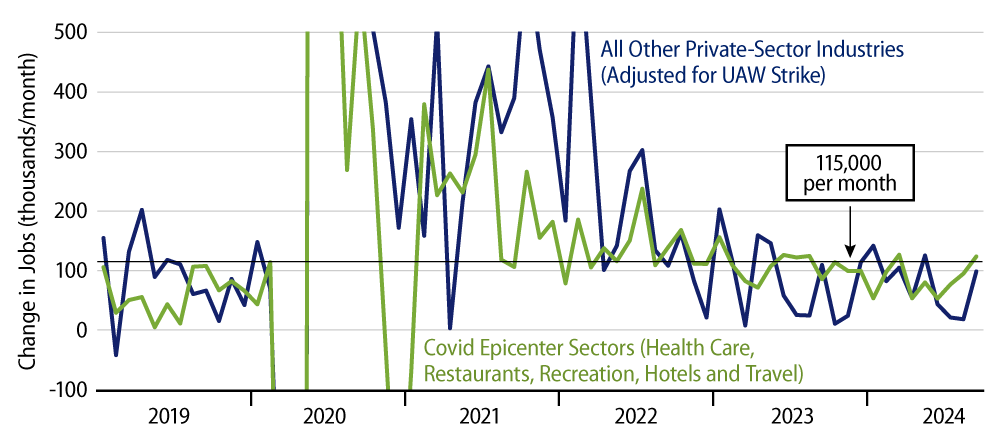

Private-sector payrolls rose by 223,000 jobs in September, and there was a +21,000 revision to the August estimate for that series. Furthermore, average hourly wages rose 0.37% in September, or at a 4.5% annualized rate. Much of the September job growth occurred in what we have called the “Covid epicenter” sectors, with health care jobs up 45,000 and restaurant jobs up 69,000. (The other “epicenter” sectors, passenger travel, hotels and recreation saw little change in payroll jobs.) Nevertheless, job growth outside the epicenter sectors rose by 99,000, the best gain in four months (Exhibit 1).

The restaurant job gains are a bit suspect. Real restaurant sales have shown no growth for the last 18 months, and restaurant job growth had been averaging only 17,000 per month over the previous six months, prior to the reported gain of 69,000 jobs in September. Nevertheless, as already stated, even without the outsized gain in restaurant jobs, payroll job growth elsewhere was still more than decent.

Following the softer August jobs report a month ago, we speculated that fears by the Federal Reserve (Fed) of further slowing in job growth might lead to an aggressive (50 bps) rate cut in September. We thought that was possible but not likely, but lo and behold, the Fed indeed went ahead and cut 50 bps anyway. The stronger job growth announced today might lead the Fed to rue that decision.

We are always quick to say that one month doesn’t make a trend. The stronger September job gains might prove to be a flash in the pan. However, again, the fear a month ago was not that job growth was weak, but that it was on a slowing trend and might become weak some months down the road if that trend continued. Well, September’s job gains threaten to suspend or reverse that softening trend.

Even if the October report a month from now comes in very soft, one could still average September and October growth together and argue that the slowing trend in job growth is arrested. In order to argue that a slowing trend in job growth was still in place, next month we would need to see a substantial downward revision to September job growth and near-zero growth in October.

Anything could happen with next month’s release. However, the fact remains that the September jobs data released today give the Fed a lot less to worry about concerning the economy, and so they weaken the case for further aggressive cuts by the Fed. Granted, given the sharp selloff in bond prices today, you probably didn’t need us to make that point for you, but hopefully the analysis here has provided some substance for what you already might have known.