Municipals Recorded Negative Returns

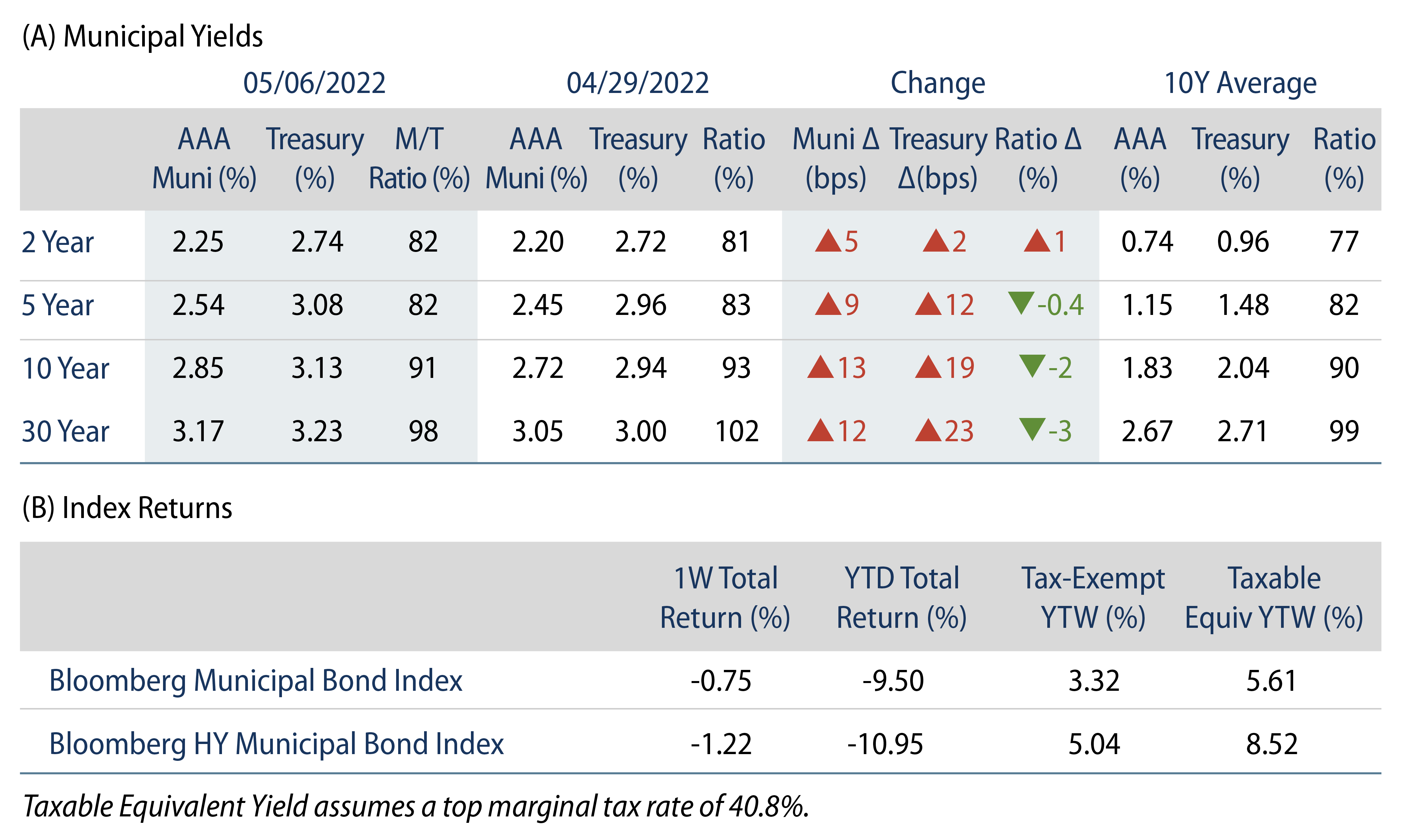

Negative muni returns extended last week, as high-grade municipal yields moved 5-13 bps higher across the curve, trailing Treasuries. Munis outperformed Treasuries across most maturities, resulting in lower Municipal/Treasury ratios. Meanwhile, municipal fund outflows extended for a 17th consecutive week. The Bloomberg Municipal Index returned -0.75%, while the HY Muni Index returned -1.22%. This week we highlight the improving credit trends within the airport sector.

Municipal Technicals Stay Weak, Driven by Ongoing Outflows

Fund Flows: During the week ending May 4, weekly reporting municipal mutual funds recorded $2.7 billion of outflows, according to Lipper. Long-term funds recorded $1.7 billion of outflows, high-yield funds recorded $879 million of outflows and intermediate funds recorded $196 million of outflows. The week’s fund outflows extend the current outflow streak to 17 consecutive weeks, and contribute to $45 billion of year to date (YTD) net outflows.

Supply: The muni market recorded $6 billion of new-issue volume, down 57% from the prior week. Total YTD issuance of $142 billion is in line with last year’s levels, with tax-exempt issuance trending 12% higher year-over-year (YoY) and taxable issuance trending 34% lower YoY. This week’s new-issue calendar is expected to increase to $12 billion. Largest deals include $3.2 billion Louisiana Local Government Environmental Facilities and Community Development Authority and $751 million DASNY School District Revenue transactions.

This Week in Munis: Airport Recovery Continues

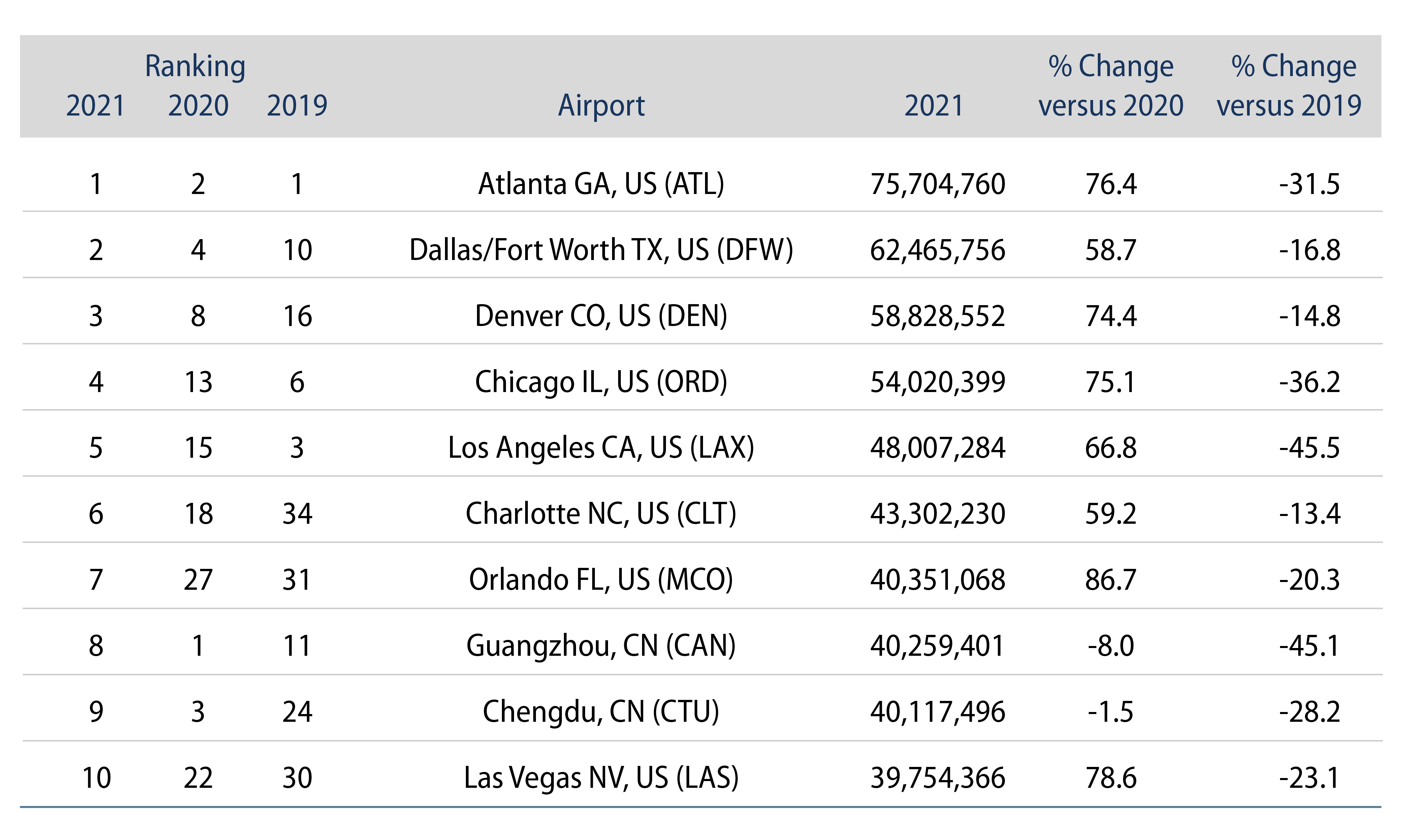

Following Western Asset’s corporate credit note on airlines, this week we highlight recently released airport trends. Last month, the Airports Council International released its annual report of the busiest global airports for 2021. The data shows that many of the legacy top 10 busiest airports rejoined the list of highest airport traffic in 2021 as COVID-19 vaccines and economic recovery led to a significant rebound in flying activity last year. US airports completed a sweep of the top five spots, led by Atlanta Hartsfield, followed by Dallas/Ft. Worth, Denver, Chicago O’Hare and Los Angeles’ LAX.

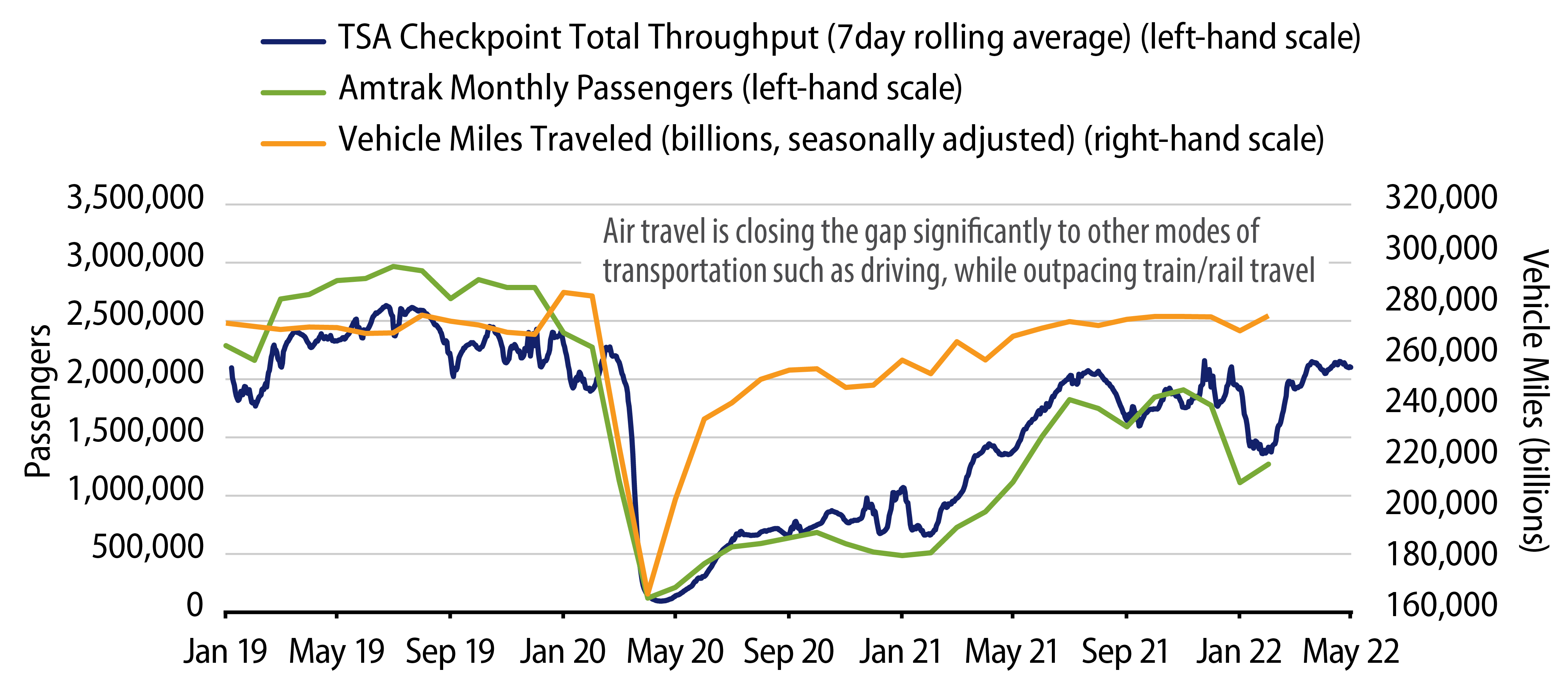

We expect improving passenger traffic trends to continue throughout 2022, as current Transportation Security Administration (TSA) passenger throughput data for late April/early May shows levels that are just 10% below 2019 pre-pandemic levels, while 1,400% and 52% above 2020 and 2021 levels, respectively. We also note that air travel is closing the gap versus other modes of transportation such as driving, while outpacing train/rail travel (Exhibit 2).

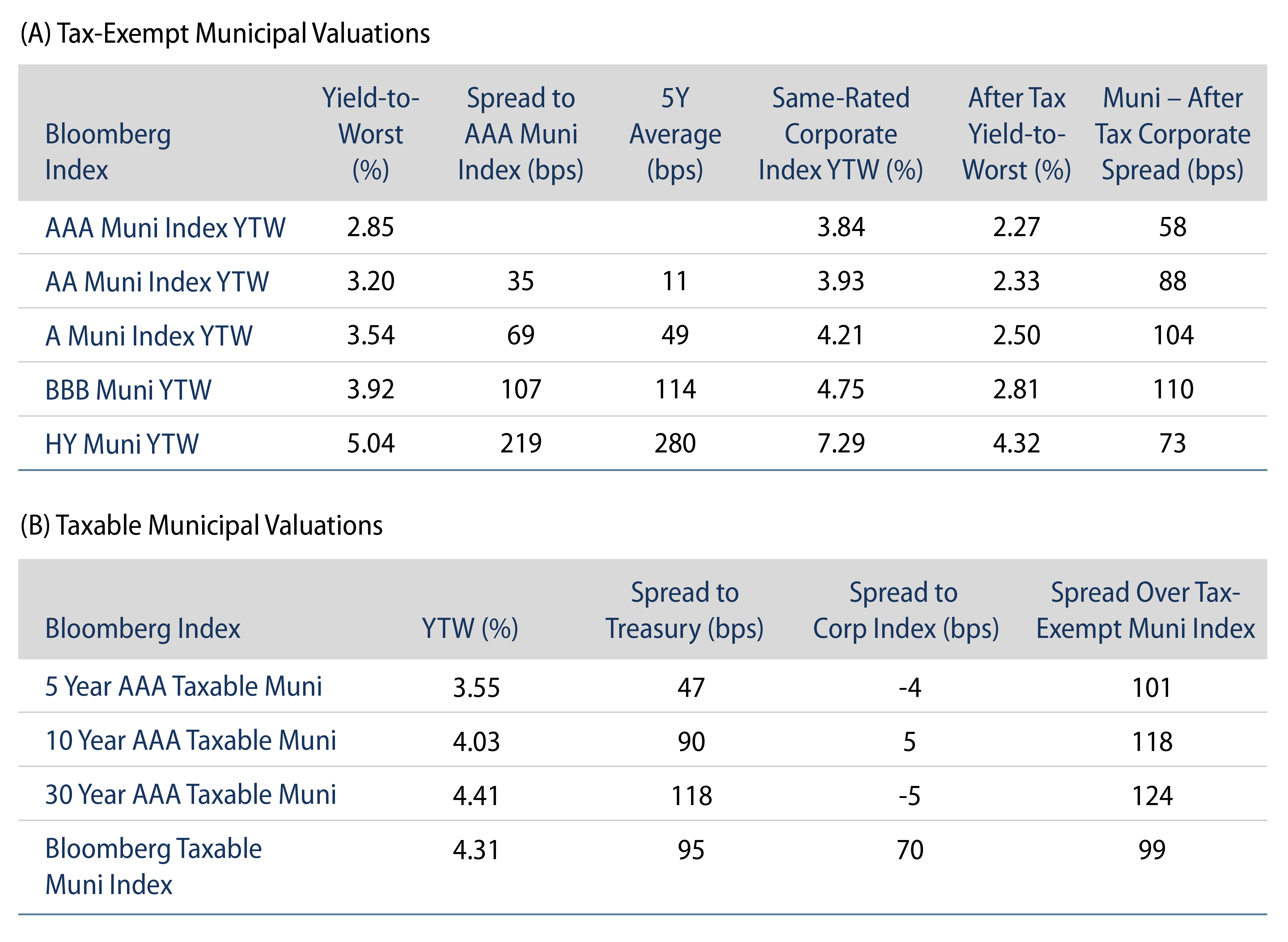

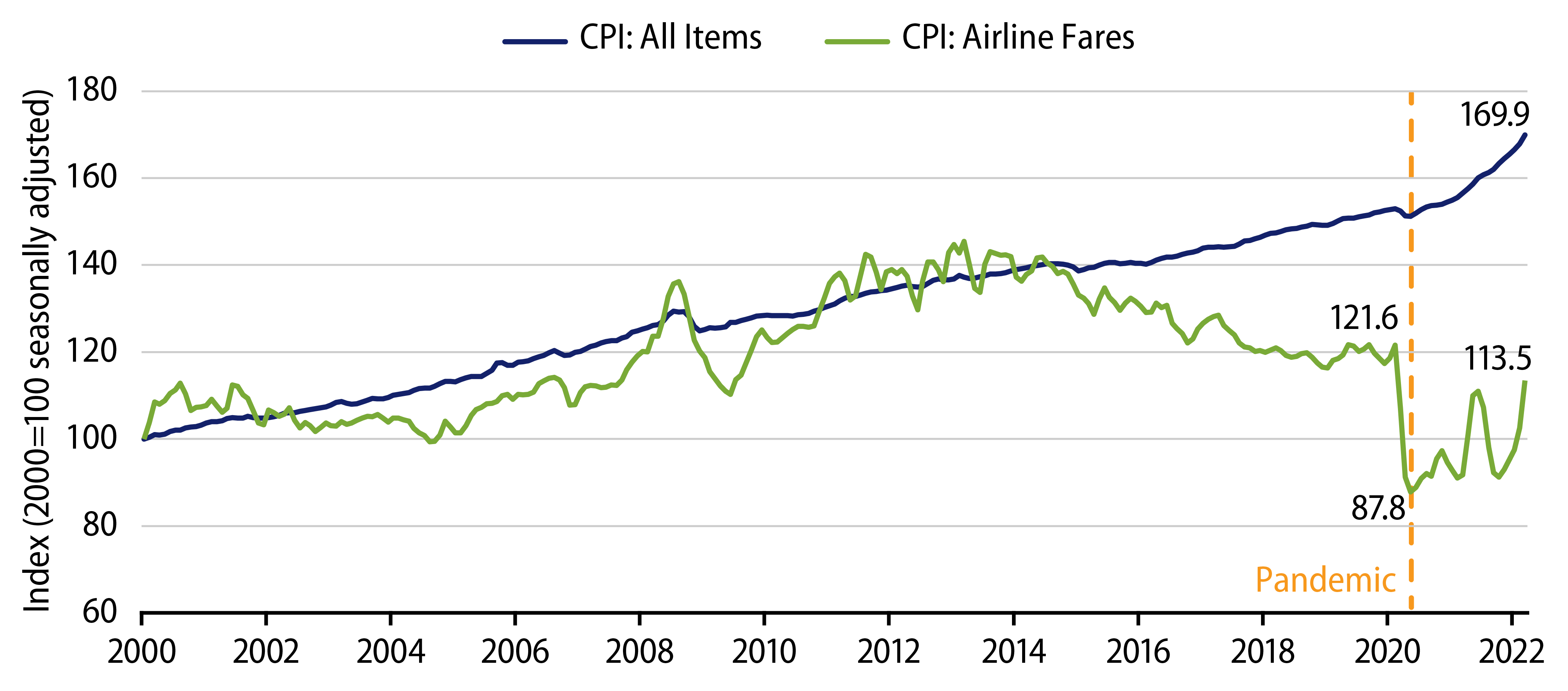

Western Asset remains constructive on airport credit quality, due to the essential and defensive nature of airports, rate and cost setting/pass through mechanisms, and buffer/cushion from the airlines served. In addition, these entities benefit from significant Federal Aid received as part of COVID-19 stimulus funds, which has boosted liquidity for the sector. A continuing rebound in business and international travel, higher domestic leisure demand, as well as airfare CPI that has run lower versus all items since the start of the pandemic (Exhibit 3) should support the outlook for airport fundamentals. However, the sector does face some headwinds, including corporate travel and bookings that remain 28% below pre-pandemic levels, anemic international travel, an uncertain operating environment considering the potential for additional variants, and rising inflation that can pressure both consumers and future air fares. As such, Western Asset believes independent credit research within the sector is paramount.

Airport bonds have generally recorded a significant rise in yields and spreads since the start of the year. Average AA and A option-adjusted spreads (OAS) recently reached ~90 bps and ~100 bps, respectively, up from summer 2021 tights of ~55 bps across credit cohorts, a level not seen since December 2020. Yields tell a similar story, with average 10-year AA and A airport bonds yields rising by ~200 bps YTD, now standing at ~3.3% and ~3.4%, respectively. Western Asset attributes much of this spread widening to technicals associated with mutual fund selling pressures, which—if they persist—could present attractive entry points for the sector.