Headline retail sales rose 0.2% in February, though that was more than offset by a -0.4% revision to the January sales estimate. The softness in February sales was centered at motor vehicle dealers, service stations and restaurants. This was to such an extent that so-called control sales, which excludes these sectors as well as building material stores, showed a much stronger 1.0% increase, offset only very slightly by a -0.1% revision to its January sales estimate.

We and other analysts watch the control sales measure more closely because it focuses on sectors dominated by consumer demand. (In contrast, sales at vehicle dealers, service stations, restaurants and building material stores are transacted as much by businesses as by households.)

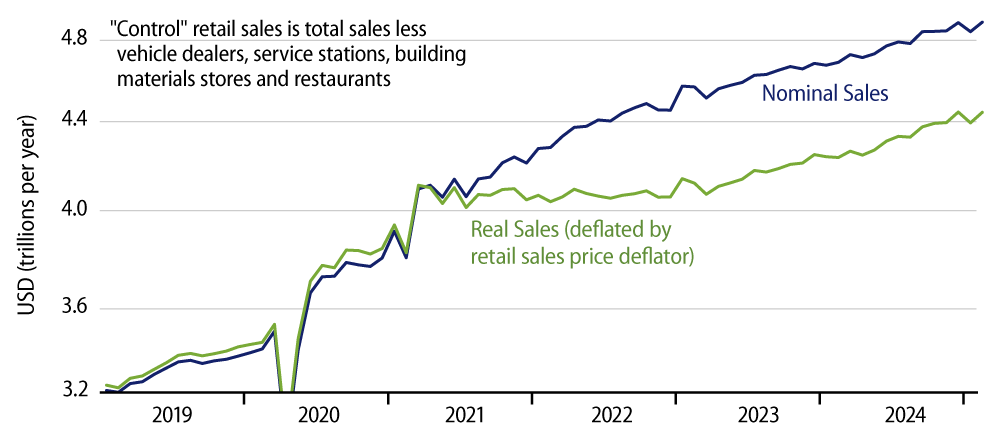

So, the relatively strong February rebound in control sales is likely the main story this month, although that rebound merely offsets an equal-sized decline in January. On net, retail sales have indeed gotten off to a softer start in 1Q25 than we saw in 4Q24, but these data do not look like the outright rout that some analysts were claiming based on last month’s data. Looking at both nominal and real control sales in the chart, the January/ February swings look to us more like ''normal'' month-to-month fluctuations than they do an incipient consumer meltdown.

This is especially true given the seasonal volatility that almost always occurs around turn-of-the-year months. Especially strong Christmas season sales often lead to relatively soft January/February sales and vice versa. Similarly, especially severe winter weather in January or February can restrain sales then, and by the same token, relatively mild winter weather can lead to apparently strong sales. Government seasonal adjustment factors take account of ''normal'' seasonal variations, so that non-normal variations typically lead to transient softness or strength in the data.

We stated these cautions a month ago with respect to the ''weak'' January sales data, and we take the decent February sales rebound as vindication of that caution. Lately, the fashionable take among financial market pundits is that the US economy is weakening. We think that is a much more definitive interpretation of the recent data than is justified, and we say that even though we have been looking for some slowing in growth.

Manufacturing has been in a very mild recession for the last three years. Construction has been treading water at best for just as long. Meanwhile, consumer spending has been surprisingly strong for the last two years (that is, despite slower rates of income growth and low saving rates). Those asserting emerging weakness are exaggerating the severity and significance of recent consumer spending data while harping on manufacturing and construction trends that they had previously ignored. Maybe they are correct, but to this analyst their take looks premature at this point.