New-home sales dropped by 18.2% in February to an annualized rate of 775,000 units per year. However, sales estimates for November through January were all revised upward, and even the February sales rate is still 8.2% higher than that of February 2020, the last month before the Covid shutdown.

We haven’t covered housing in these posts since the January 21 piece, where we remarked that housing in late 2020 had more than made up for its enforced inaction during the shutdown, but that “in order to sustain recent starts/building levels, new-home sales are going to have to bounce again, as these have pulled back since July.” In a February 25 post covering manufacturing, we mentioned in passing that “recovery is essentially complete in the manufacturing and construction sectors, and little further growth from these can be expected in 2021.”

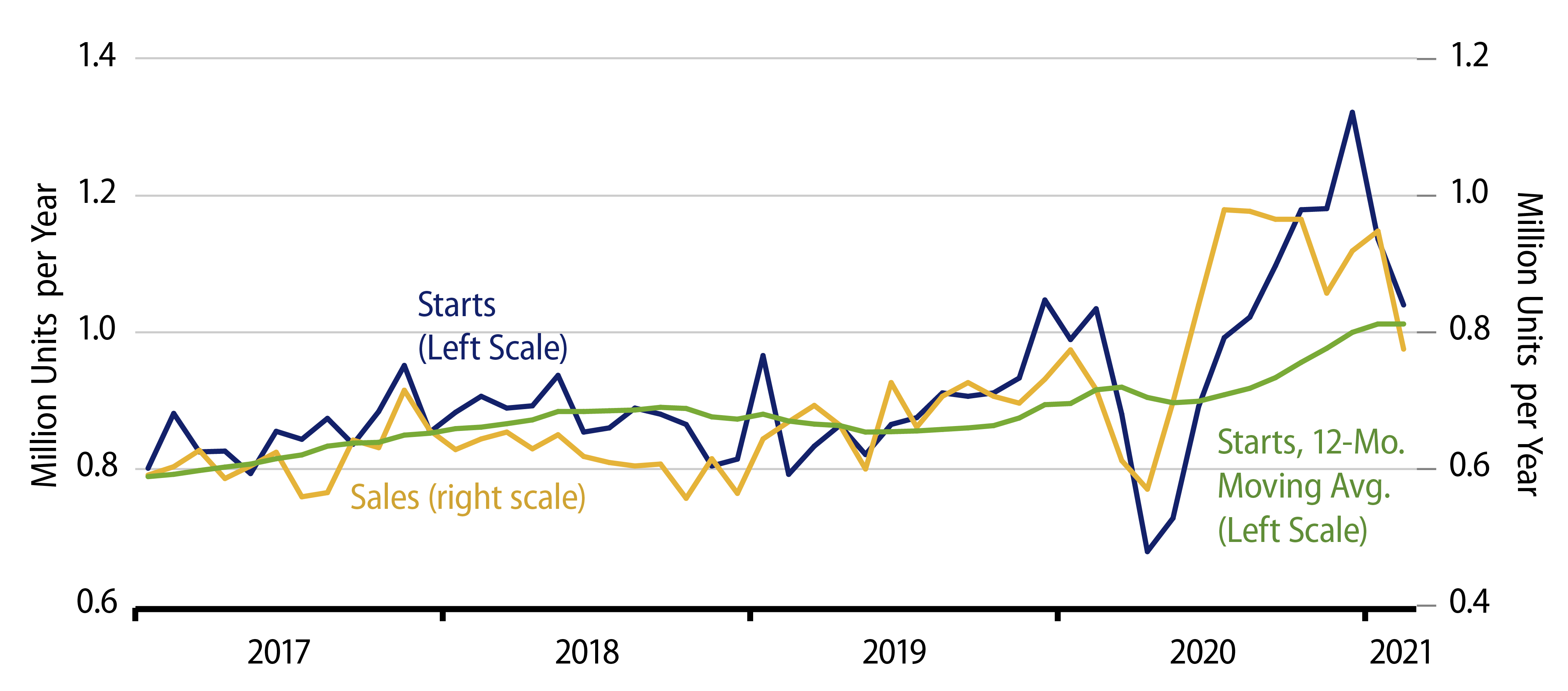

We mention these statements again now because the recent housing data has largely affirmed them. Yes, the blizzard buffeting the South in February held down housing starts and home sales, just as it did retail sales. However, as you can see in the accompanying chart, new-home sales had already been declining modestly over the six months prior to the February blizzard. What you can’t see in that chart is that February new-home sales showed declines in the West, where February was temperate, and in the Northeast and Midwest, where winter snows were nondescript, besides those in the South.

With better weather in March, we are likely to see some bounce-back in both housing starts and new-home sales in the data next month. However, we doubt that future new-home sales levels will restore an uptrend to that measure. And with new-home sales levels flat or falling, it is just a matter of time before housing starts—and then residential construction spending—also head lower.

We are not projecting a weak housing market per se. Rather, we are merely projecting a return toward the levels of activity seen pre-pandemic, which had been flat for years.

We saw a flurry of homebuilding activity late last year, when both homebuilders and homebuyers were making up for time lost during the shutdown. That catch-up process is now complete. As you can see from the green line in the chart, the average level of housing starts over the past year is way (10.5%) above the average level holding a year ago. Average the shutdown decline together with the post-shutdown surge, and activity on net is still up substantially.

We fully expect the economy to completely rebound from the effects of the pandemic … when the government allows that to happen. However, we see no reason to think that homebuilding activity will be sustained at levels substantially higher than those in place before the pandemic struck. The recent data are consistent with this, even when allowing for blizzard effects. Those data are not consistent with a contention that homebuilding activity is still on an upward arc.

Meanwhile, again, we expect a similar “cresting” of growth in the manufacturing sector, which also has largely completed its post-shutdown recovery. If the US economy is to grow robustly this year, that growth is going to have to occur in the services industries, and that depends on a timely reopening of these.