Municipals Posted Negative Returns During the Week

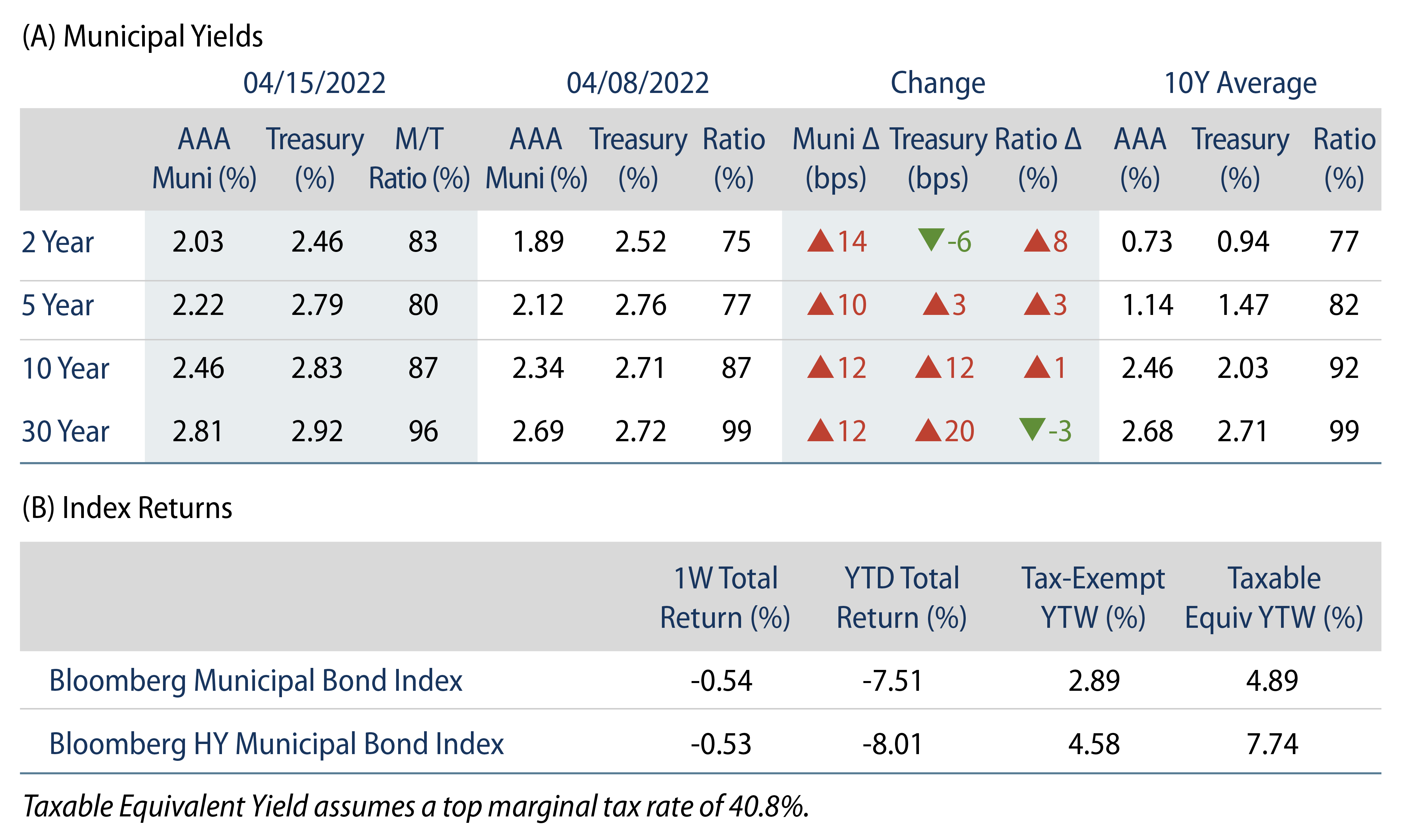

US municipals posted negative returns this week, with high-grade municipal yields moving 10-14 bps higher across the curve. Municipal funds recorded the largest week of outflows since April 2020. The Bloomberg Municipal Index returned -0.54%, while the HY Muni Index returned -0.53%. Munis underperformed Treasuries in short and intermediate maturities. This week we highlight diverging spreads and technicals between taxable and tax-exempt muni markets.

Municipal Fund Outflows Extend Ahead of the Holiday-Shortened Supply Week

Fund Flows: During the week ending April 13, weekly reporting municipal mutual funds recorded $4.1 billion of outflows, according to Lipper. Long-term funds recorded $1.9 billion of outflows, high-yield funds recorded $719 million of outflows and intermediate funds recorded $3.5 billion of outflows. The week’s fund outflows marks the highest level since April 2020, extends the current outflow streak to 14 consecutive weeks and contributes to $35 billion of year-to-date (YTD) net outflows.

Supply: The muni market recorded $6 billion of new-issue volume, down 44% from the prior week due to the holiday-shortened week. Total YTD issuance of $119 billion is 2% higher from last year’s levels, with tax-exempt issuance trending 14% higher year-over-year (YoY) and taxable issuance trending 31% lower YoY. This week’s new-issue calendar is expected to remain below average at $6.3 billion. Largest deals include $854 million Iowa Financing Authority and $398 million Wisconsin Public Finance Authority–NASA DC HQ transactions.

This Week in Munis: Diverging Muni Spreads and Technicals

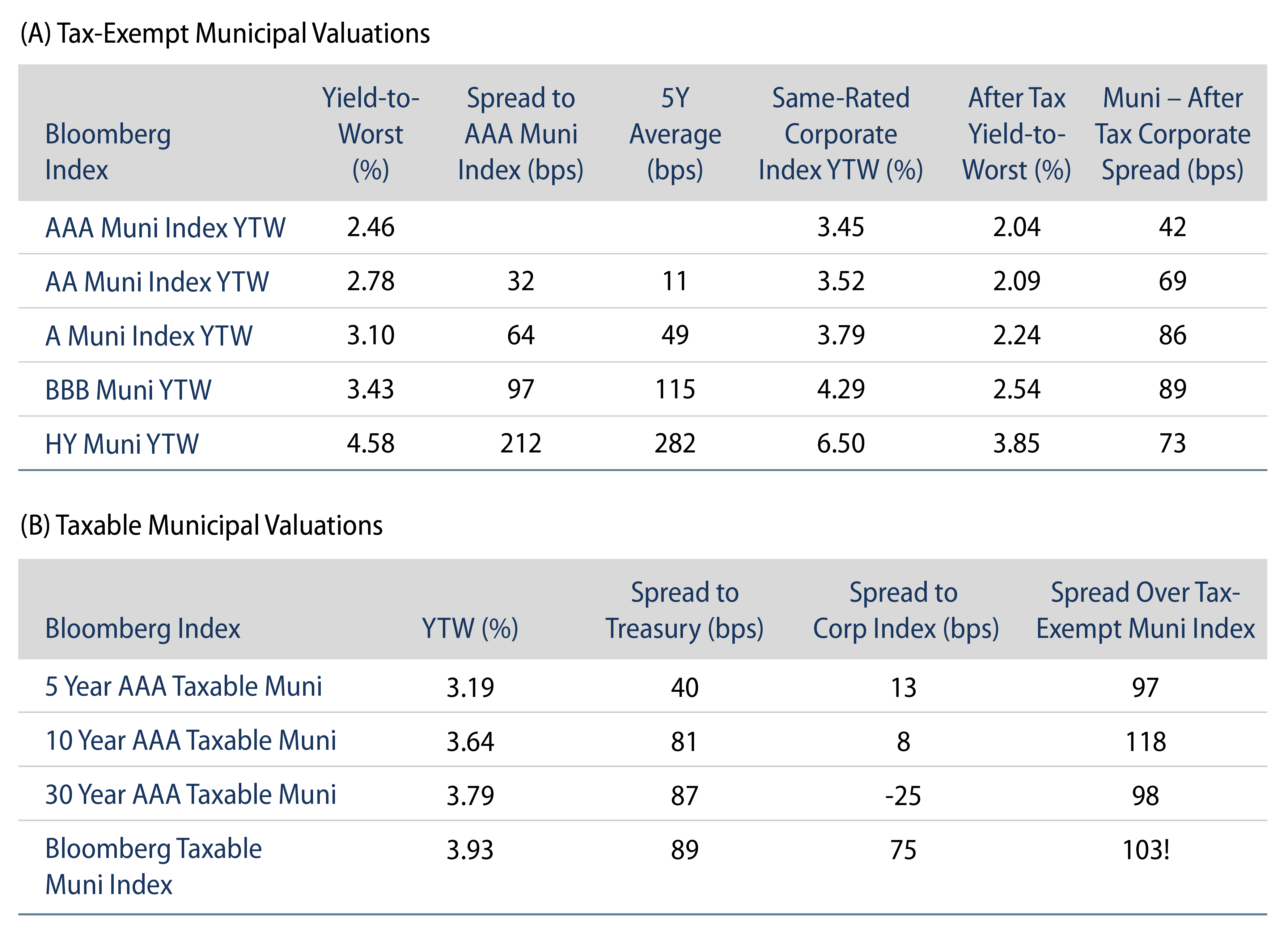

Tax-exempt and taxable spreads to Treasuries have diverged so far YTD. During the first quarter, the spread between the 30-year AAA Tax-Exempt Municipal Yield and the 30-year Treasury Yield (after the consideration of the top marginal income tax rate) increased 73 bps from 36 bps at the end of the year to 108 bps at month-end. Meanwhile over the same period, the spread between the 30-year AAA Taxable Municipal Yield and the 30-year Treasury Yield has held relatively steady, increasing just 2 bps in the first quarter to 57 bps. We attribute the YTD divergence between relative tax-exempt and taxable spreads to opposing supply and demand technicals within each market.

From a tax-exempt perspective, the majority of tax-exempt municipal demand is held by individual taxpayers in the US, increasingly in the form of mutual fund holdings. Other legacy demand sources, from brokers and dealers to large institutional investors such as insurance companies, have exhibited less interest in tax-exempt munis in recent years, in part due to lower corporate tax rates associated with the 2017 Tax Cuts and Jobs Act. As the individual retail investor reacted to inflation and rate-driven volatility, YTD municipal fund outflows of $35 billion were met with limited marginal buyers, weakening the demand and liquidity profile for tax-exempt munis. At the same time, the supply of tax-exempt municipals have increased 14% YoY, further weakening market technicals and contributing to the relative underperformance of the tax-exempt muni market.

From the taxable perspective, demand is increasingly concentrated in non-US domiciled investors not subject to US federal taxes, as well as US domestic corporate institutions, which under a lower tax rate regime now typically find better relative value in taxable municipals. These institutional entities tend to seek long-term quality income opportunities on a buy-and-hold basis, and as Taxable Municipal Yields have moved higher relatively in line with like-rated fixed-income, we have not observed significant negative demand from these institutional buyers. Meanwhile, supply of taxable municipals has declined 31% YoY, which has been supportive of market technicals and contributed to the relative spread performance of taxable municipals YTD.

While the recent selloff in the tax-exempt municipal markets has created better short-term entry points for investors subject to tax rates, the contained spread activity of the taxable market also highlights an improving value proposition. Non-US holders of taxable municipal debt increased 50% over the past 10 years to $108 billion in 4Q21, according to the Federal Reserve. As non-US holders continue to expand familiarity with the asset class, from attractive risk-adjusted nominal yields to favorable ESG and regulatory characteristics, we expect an increasingly diversified taxable municipal investor base could help further improve liquidity and future downside volatility, further improving the relative value proposition of taxable municipal asset class.