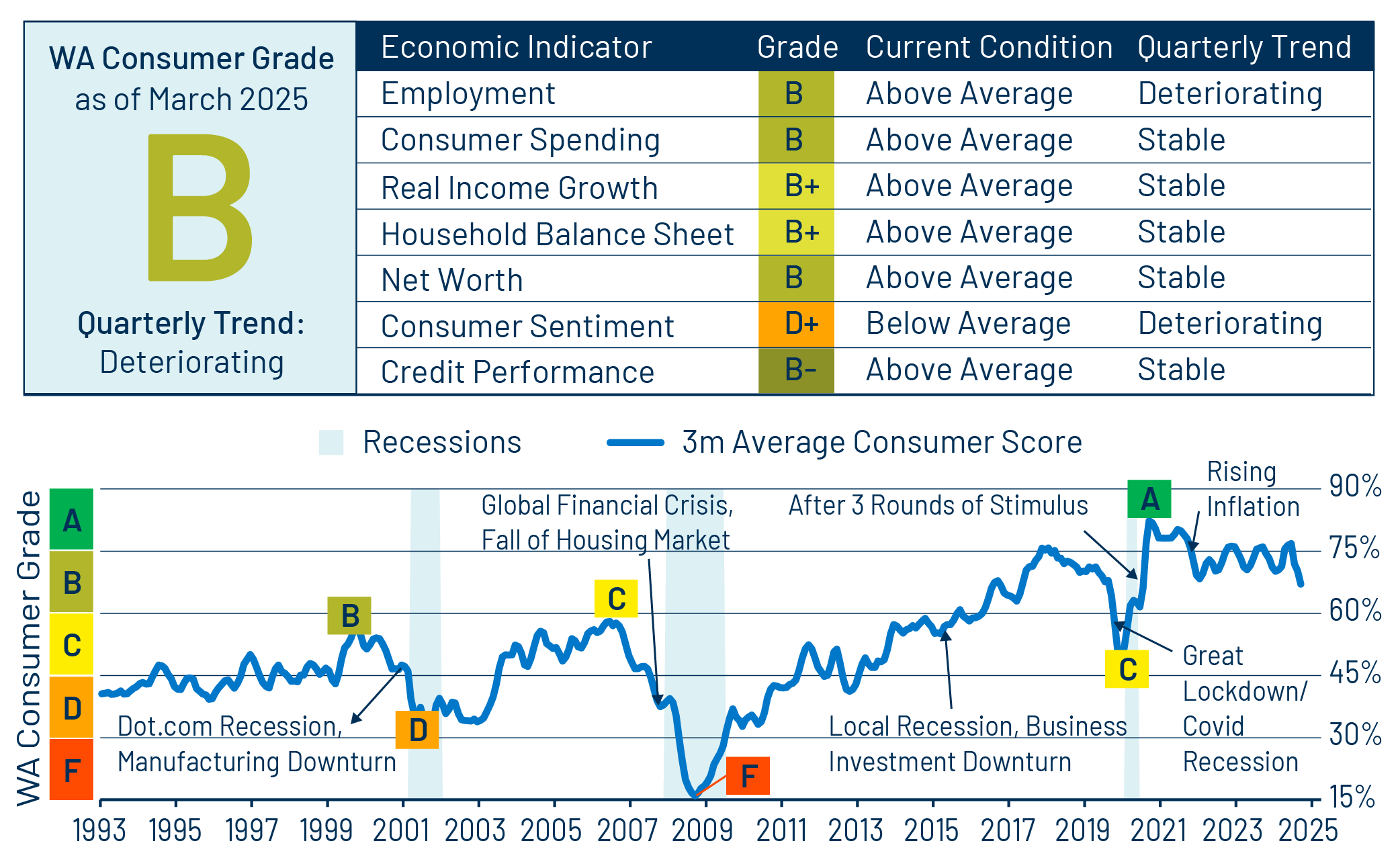

Overall Score: B

Trend: Deteriorating

Our outlook for the US consumer has deteriorated since last quarter, notching down from B+ to B. Most metrics show a gradual decline, with the largest impact on consumer sentiment due to uncertainty over the policy and inflation outlook. Although the recent consumer trend has been cooling from exceptionally strong readings at the time of peak stimulus during the pandemic, the current score of B (68%) remains well above the average score of C+ (55%) seen from 2010 to 2019. The quarterly trend is on the decline, and we expect further deterioration in economic indicators over the next few quarters given the challenging macroeconomic backdrop due to the uncertainty regarding tariffs along with higher inflation putting further pressure on US consumer health.

Employment: B

Trend: Deteriorating

The unemployment rate for March rose to 4.2%, reversing any improvement seen early in the year, increasing 0.2% from January. The labor market remains weak. The job openings rate declined in March, marking a four-year low, and part-time employment increased meaningfully, reflecting a challenging hiring environment. The hiring rate remains lower than it has been during the past decade. Expect further pressure due to a slowdown in immigration and government hiring, which will likely affect payroll growth.

Consumer Spending: B

Trend: Stable

Real consumer spending ticked down and the growth trend slowed to a 2.6% six-month annualized rate. March retail sales were stronger than expected, +1.4% month-over-month, as consumers frontloaded purchases led by motor vehicles ahead of expected higher prices due to impending tariff increases. Despite the slowdown, spending remains robust. Real consumer spending is expected to slow down following the administration’s tariff increases.

Real Income Growth: B+

Trend: Stable

Real disposable income growth continued to decline by 0.4% in Q1 to 1.8% on a year-over-year (YoY) basis due to slower growth of transfer income (i.e., government program income) and asset income, following the declining trend since 2023 highs. Expectations for higher inflation due to tariffs and the slower pace of job growth point toward a further slowing of real income growth.

Household Balance Sheets: B+

Trend: Stable

The rate of growth in consumer credit declined 0.85% YoY. Both revolving and fixed-rate debt declined in Q1 on an annualized basis, as demand for credit cooled. Household leverage and debt servicing costs remain low by historical standards, even though bifurcation between higher-income and lower-income consumers persists, and the lower-credit/lower-income subset of consumers remains under pressure.

Wealth/Net Worth: B

Trend: Stable

The net-worth-to-disposable-personal-income ratio and household equity remain elevated despite the pullback in equity prices. The savings rate ticked up to 3.9% in March, rising from a restated 3.3% rate in December 2024, and is expected to remain rangebound around 4% for the rest of the year.

Consumer Sentiment: D+

Trend: Deteriorating

University of Michigan’s consumer sentiment pulled back by 17 points since December 2024; the Conference Board’s index similarly declined by 15 points in December. These are both significant declines reflecting policy uncertainty and consumers’ concerns about rising inflation due to expected tariff increases. As a result, consumer sentiment is expected to remain volatile.

Credit Performance: B-

Trend: Stable

Credit card delinquency rates continued to level off in 1Q25, as new and seriously delinquent balances ticked down from December. Credit performance deteriorated at a slower pace than in prior quarters, which is a positive outcome, indicating that tighter lending standards are having the desired impact for the high-credit consumer.

1Q25 US Consumer Credit Summary

US consumer new credit originations for personal loans and credit cards slowed in Q1, reflecting cautious spending trends and tighter bank lending standards. Consumer credit utilization ratios fell slightly, indicating that borrowers are paying down balances. We expect to see credit scores falling for borrowers with defaulted student loans, as the administration has resumed collections. Later in the year, a larger subset of federal student loan borrowers who are currently in forbearance are expected to resume payments, and delinquencies are likely to increase, putting upward pressure on delinquencies for other consumer debt such as unsecured consumer loans, buy-now-pay-later and subprime auto loans.

Bifurcation between higher- and lower-income consumers is becoming more pronounced in the current economic environment. Affordability remains pressured for lower-income cohorts due to higher asset prices, higher financing rates and expectations for rising prices given increased tariffs. For challenged consumer credit, delinquencies are trending higher, but are not translating into higher losses, which we view as a sign of manageable stress. Persistent inflation, higher asset prices and a higher unemployment rate could translate to higher loss rates.

In this environment, we favor investing in high-quality consumer credit—such as private student loans, consumer sectors related to housing and prime auto loans—and we prefer positions higher up in the capital structure. We remain cautious about subprime consumer assets.

Background on Methodology

Our methodology rationale for creating the US Consumer Report Card first involves ranking economic indicators versus a historical dataset, with tracked periodic changes going back to 1990. We then calculate a weighted average score for each month. Assigned weights range from a high of 23% to a low of 10%. Employment, consumer spending and real income growth make up 60%, while the remaining indicators comprise 40%. The consumer score is mapped against letter grades, normalized for historical experience.