Headline retail sales declined by -0.9% in May on top of a -0.4% revision to the April sales estimate. Things were quite different for the more closely watched “control” sales measure, which registered a healthy 0.4% increase in May on top of a +0.2% revision to its April estimate.

The control sales measure excludes motor vehicle dealers, service stations, building material stores and restaurants, partly because these store types are heavily frequented by other businesses as well as consumers and partly because of their volatility. The volatility aspect was certainly in play in today’s sales report, as both the May decline and the downward revisions to April in the headline sales aggregate came mostly from motor vehicle dealers.

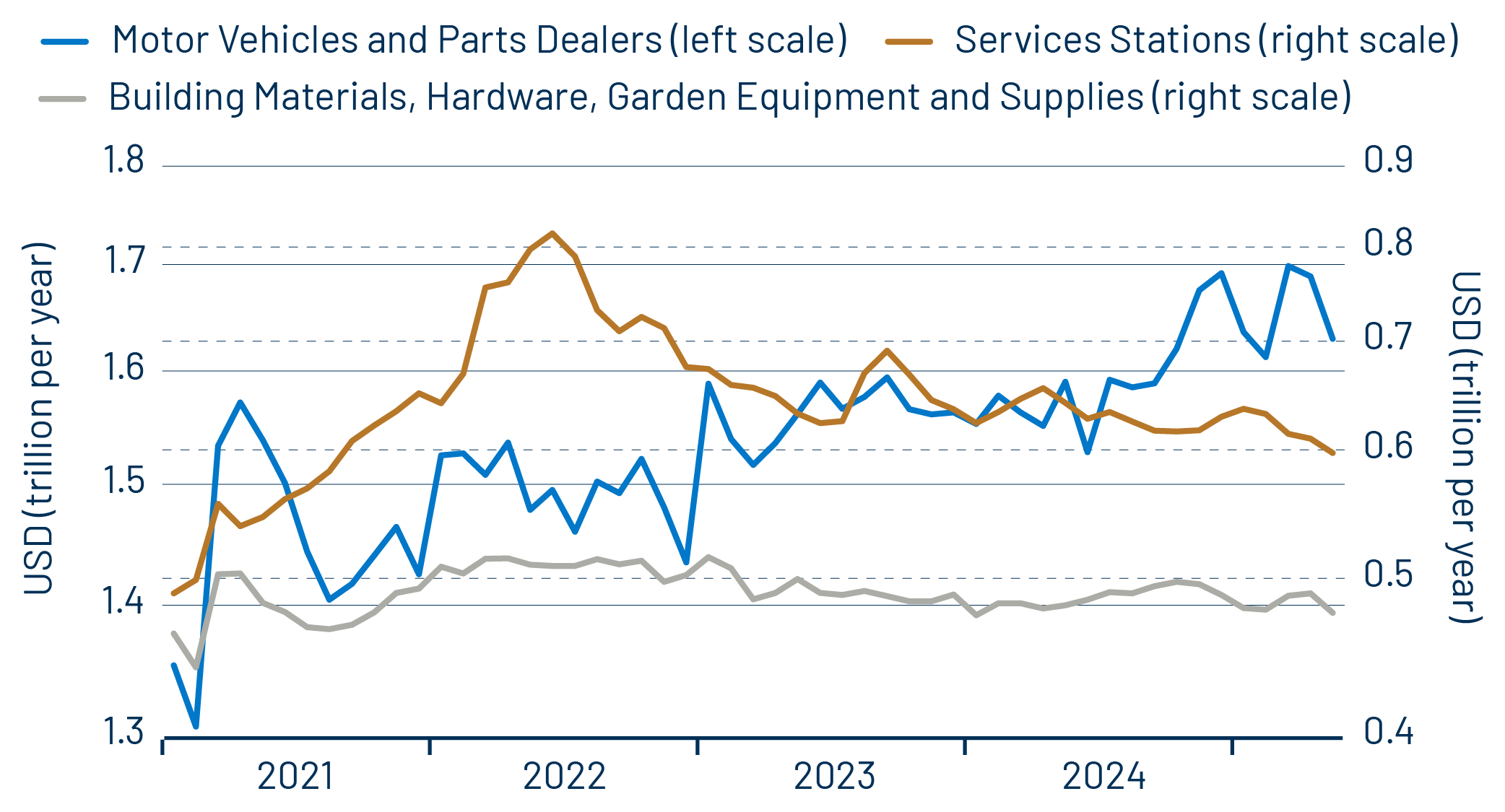

We’ve reported previously that car dealers’ sales had jumped earlier this year. Well, sales there declined substantially in May, along with a significant markdown of the April sales estimate. As you can see in Exhibit 1, net of all these gyrations, May sales levels at car dealers were still at reasonably healthy levels, holding well above 2024 sales levels.

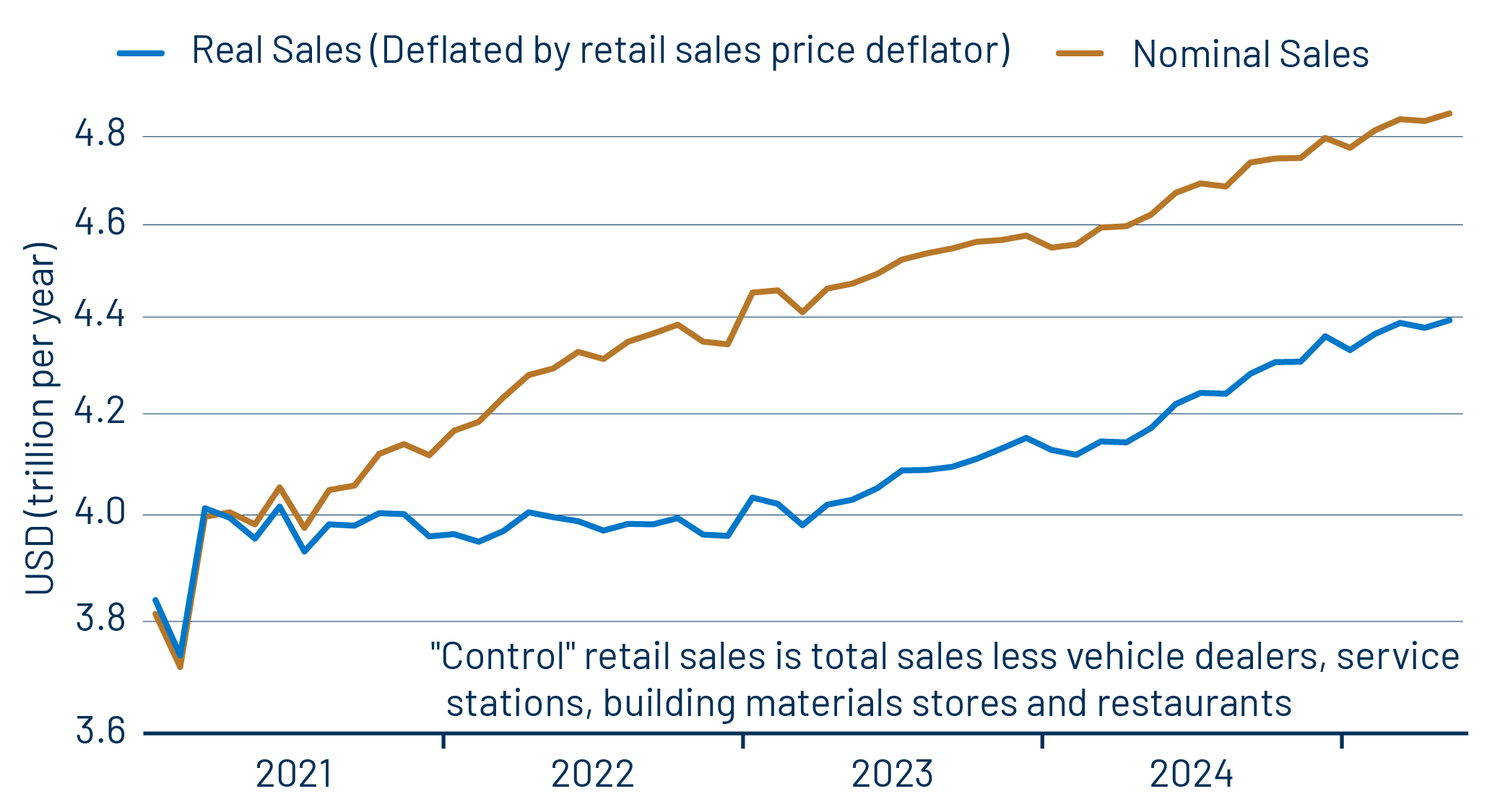

The broader story, however, is best captured in Exhibit 2, which we consider the main chart of this week’s story. As you can see there, “control” sales continue to plug along at a decent growth trend. Within this aggregate, sales rose in May at most store types, and we have seen exceptionally steady sales growth at the bellwether online vendor category. Similarly, furniture store sales continue their growth trend of the last 15 months, despite a recent slowing in new-home occupancies. There were slight sales declines at electronics and grocery stores, both of which look more like random variation than anything significant.

Elsewhere in Exhibit 1, you can see service station sales declining alongside falling gas prices. Building material store sales have been declining in line with the aforementioned slowing in homebuilding. Not shown are restaurant sales. These bounced substantially in March and April, and a reported May decline in sales there offset only a portion of the preceding months’ gains. (Current data show +2.5%, +0.8% and -0.9% changes in restaurant sales in March, April and May, respectively.)

In sum, consumer spending on merchandise continues to roll along. The reported decline in real GDP in 1Q came from a sharp increase that was only slightly offset by a rise in inventories, and despite healthy gains in consumer spending. When that news was first announced in April, we speculated that the reported GDP decline for 1Q would likely be offset by a sharp 2Q gain, as the drag from imports reversed. That indeed looks to be the case in the data so far, and there is no apparent softness in consumer spending to offset the GDP boost coming in foreign trade in 2Q. We stand by the opinion that the reported swings in GDP are statistical noise, and that underneath it all, the economy has continued to grow steadily to date.