Sales of new homes declined by 5.9% in May from an April level that was itself 5.3% lower than the April estimate originally published a month ago. With the May decline, new-home sales now look to have been on a downtrend for the past nine months, with a cumulative decline of 21.3% over that span.

Now, we will stipulate up front that these declines still leave new-home sales at healthy levels. Even the 769,000 annualized pace of sales in May is higher than anything we have seen since the bursting of the 2000s’ housing bubble. However, that downward direction of new-home sales is important on two counts. First, when it comes to the aggregate economy, it is the rate of change in homebuilding activity that contributes to growth in GDP, not whether the level is high or low. The fact that new-home sales have been generally declining for the past nine months and have pulled housing starts and residential construction spending down with them clearly indicates that the substantial boost to GDP growth provided by homebuilding in late-2020 is spent and will be replaced by modest drags on growth going forward.

Second, despite a downtrend in homebuilding activity now going on for nearly a year, some analysts are still proclaiming a housing boom. They argue that it is merely a lack of supply that is hindering housing activity. We strongly disagree with this contention.

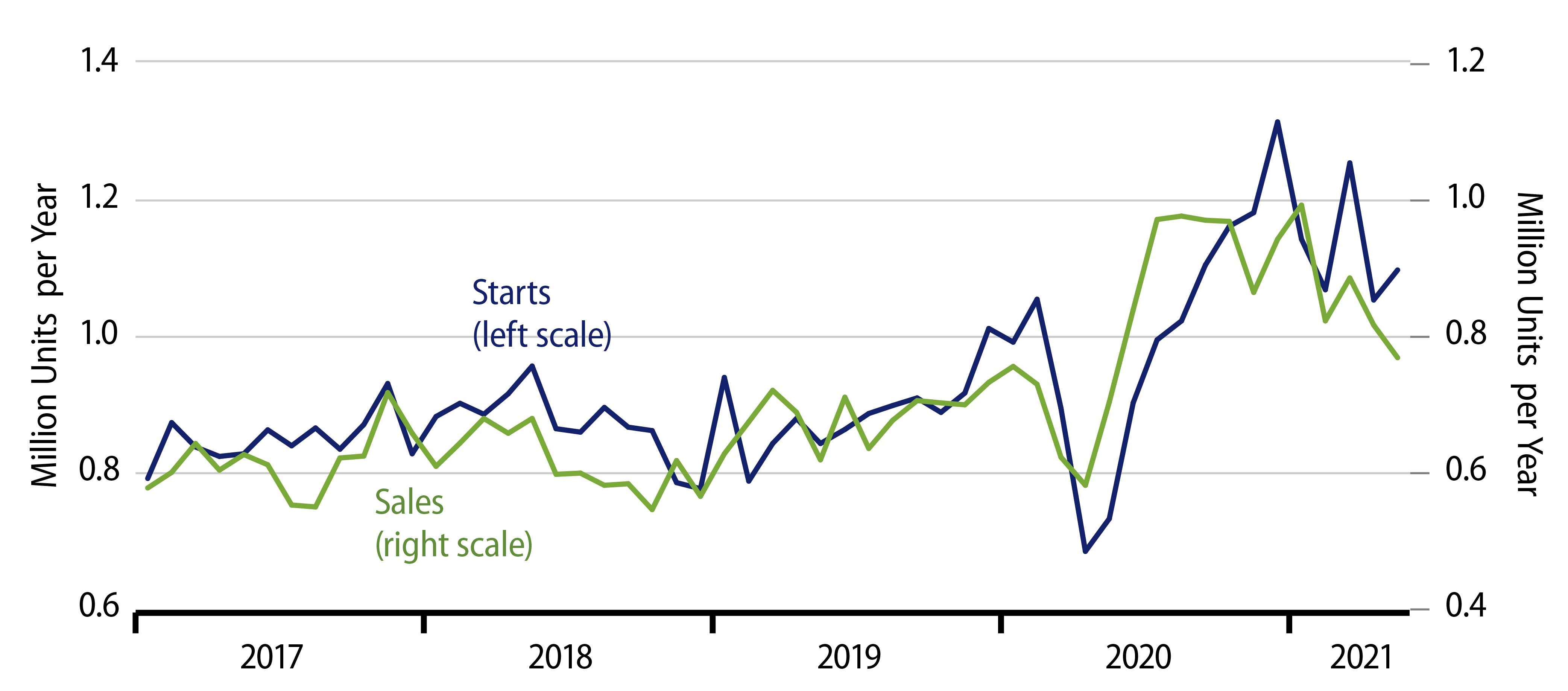

The scales in the chart are adjusted to account for owner-builds, which show up in housing starts but not in new-home sales. That the blue line (for housing starts) has been above the green line (for new-home sales) throughout the last seven months indicates that new-home supply (starts) has been ahead of demand (new-home sales) across this period.

Furthermore, inventories of unsold new homes have indeed been rising throughout this span. New-home inventories have risen by 44,000 units (15.4%) since new-home sales peaked in August 2020. The current ratio of new-home inventories to sales of 5.1 months is well above the 4.0 months of inventories that were generally held in the early-2000s, prior to the 2005 onset of bubble conditions. Bottom line: if inventories are so low and supply so tight, why have levels of new-home sales been falling for nine months, while inventories have been rising, and why did sales start declining a few months before starts did?

None of this is necessarily bad news for the housing market in general. None of this implies that home prices will fizzle. However, again, all of it seems to indicate that homebuilding is not going to be a prop for economic growth over the rest of this year and after.