Data released today by the Bureau of Labor Statistics showed an increase of 179,000 in private-sector jobs in August, though this was partially offset by a downward revision of -59,000 to the July jobs estimate. Hours worked showed a slight increase, while average hourly wages showed their smallest gains in years. Unemployment rose from 3.5% to 3.8%. While this was due to a sharp increase in the labor force—and not to any weakness in jobs—the labor force gains are themselves a welcome sign of easing of labor market conditions.

Yesterday, disappointing news on July inflation was mostly ignored in the bond markets, with bond prices rising. Today’s news overall looks pretty favorable for bonds, but they are selling off, at least as of now. That’s life in the financial markets.

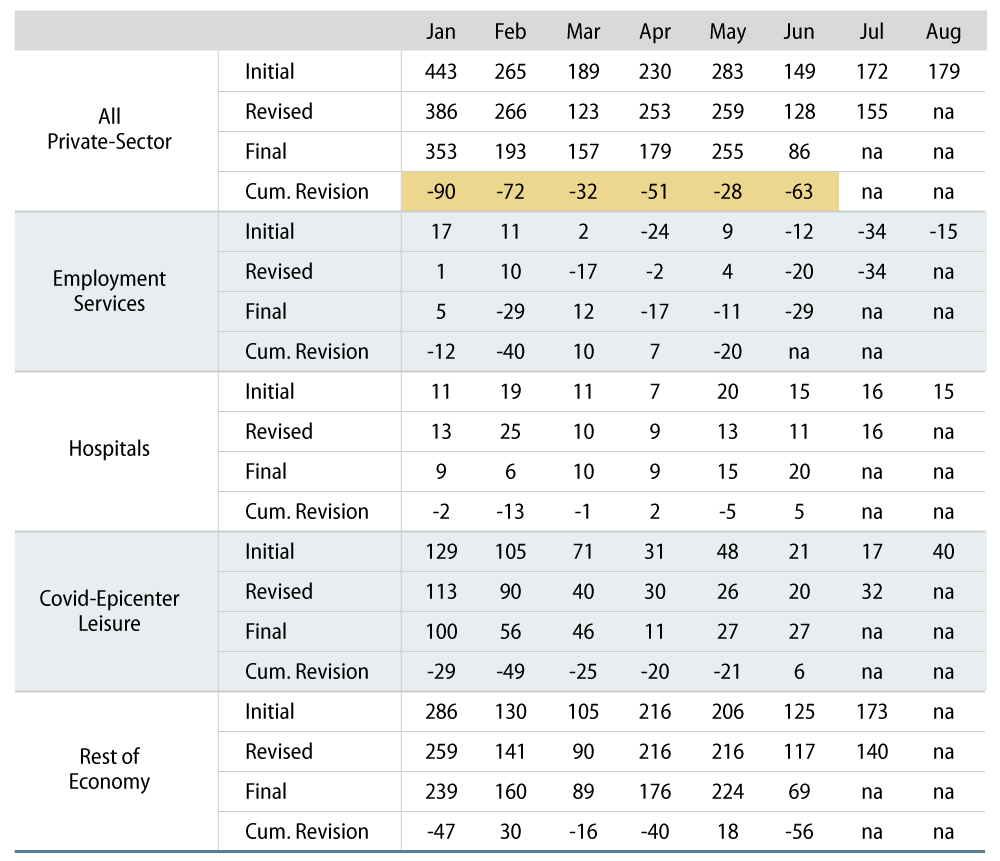

We’ve mentioned before that every preliminary monthly job release this year has been revised down substantially in subsequent months, and this month’s release continued the string. Of the 59,000 downward revision to the July private-sector jobs estimate, 42,000 came out of June job growth and 17,000 out of July growth. Final data are now available through June, and the current June job growth estimate stands at 86,000, which is 63,000 jobs less than what was initially announced for June two months ago.

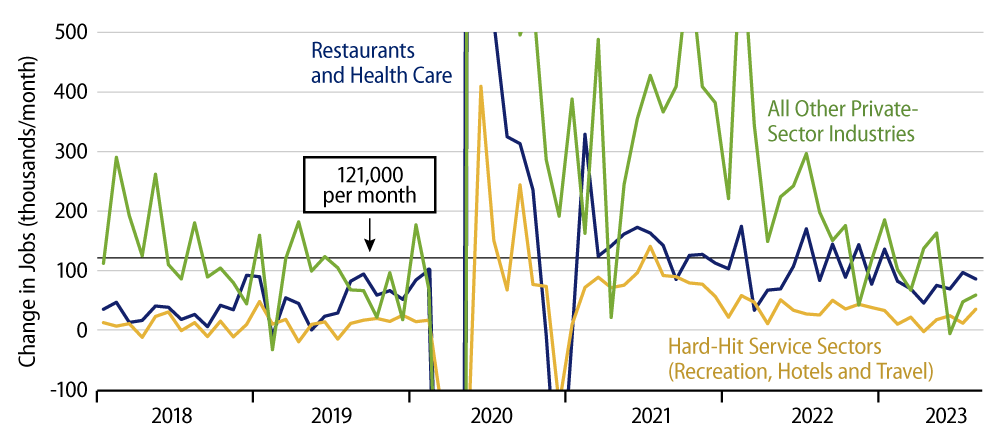

Initial monthly job growth numbers over the first half of the year were eventually revised lower by 56,000 per month on average, and every month in the first half was revised downward by at least 28,000. Early in the year, downward revisions were concentrated in employment services (think “temps”) and industries hard hit by the Covid shutdown three years ago (Covid “epicenter” sectors). Lately, the revisions have occurred mostly in other sectors.

The point is that while initially announced job prints have looked robust, the eventual data look less so. And all this is before any benchmark revisions that BLS might eventually apply due to overstated growth in the “birth-death” model it uses to construct initial payroll job data.

Of the 179,000 increase in jobs now initially reported for August (i.e., before coming revisions), 71,000 were in health care. Thank goodness people are starting to go back to the doctor, after largely staying away during the pandemic. However, elsewhere in the economy, staffing levels are largely normalized, and hiring is slowing.

On the average wage front, hourly wages both for all workers and for production workers rose by less than 0.3%. If sustained, such gains would annualize to less than 3% per year, which is within the range the Fed is shooting for. Yes, this is just one month, but it is at least a start.

As for the increases in the labor force that drove the August rise in employment, the one-month gains are likely overstated, but they are just part of a notable increase in labor force participation that has occurred since November 2022. Participation rates rose in late-2021, when extended unemployment benefits were cut off. They then stabilized over most of 2022, but have been increasing again lately. We have emphasized that as low as recent unemployment rates have been, actual levels of employment have remained millions of jobs below pre-Covid trends, thanks to folks leaving the workforce. The increases in the labor force in late-2021 and again this year indicate an amelioration of that shortfall.

Again, on a number of fronts, today’s employment report offered encouraging news to financial markets, even if bond investors, for now, think otherwise.