Munis Posted Negative Returns Last Week

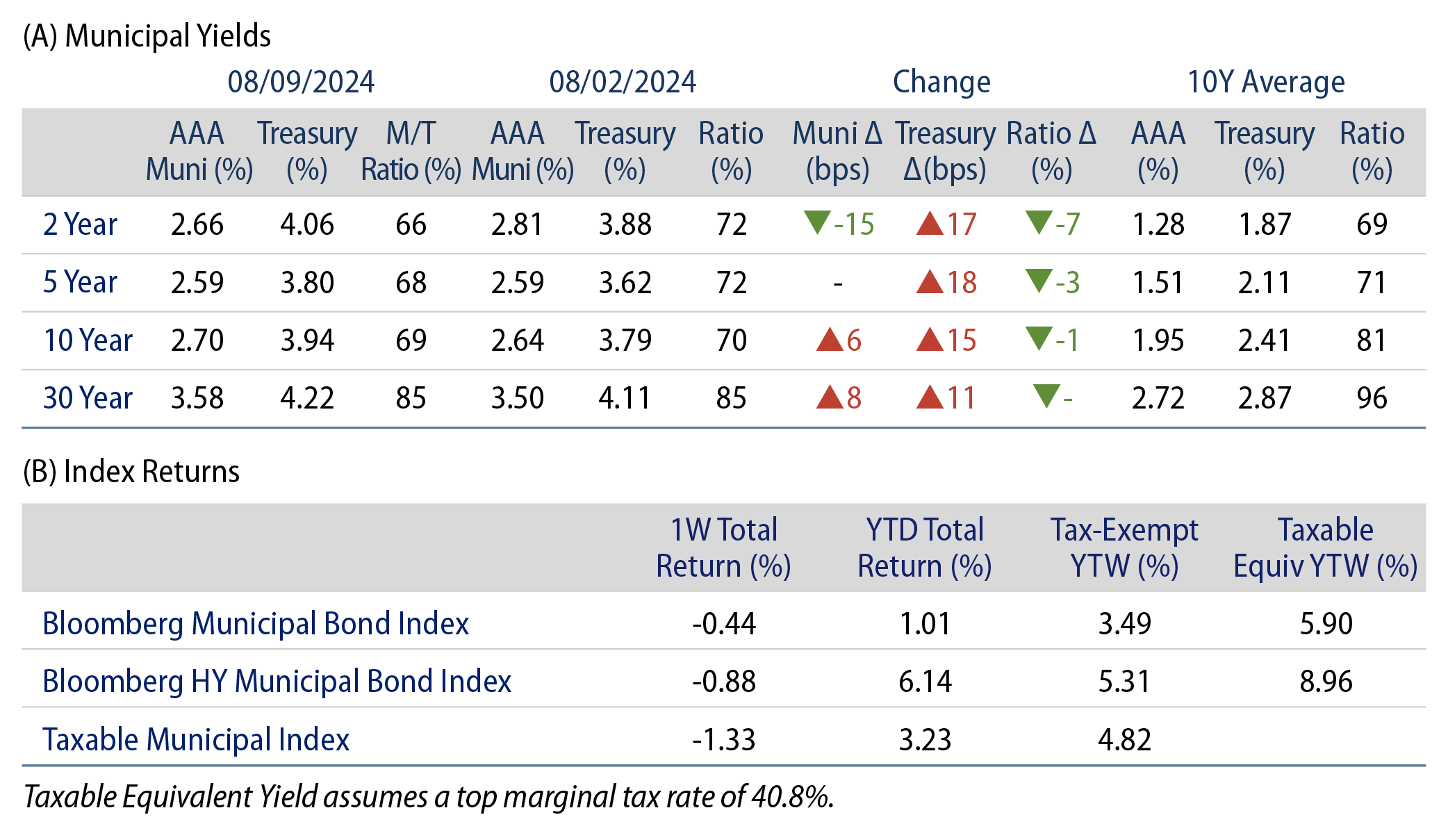

Municipals posted negative returns last week as yields outperformed Treasuries, which moved higher amid strong service sector data and lower-than-anticipated jobless claims data that quelled some of the labor market concerns of the prior week. Meanwhile, supply and demand remained positive. The Bloomberg Municipal Index returned -0.44% during the week, the High Yield Muni Index returned -0.88% and the Taxable Muni Index returned -1.33%. This week we touch on municipal performance during past recession periods.

Supply and Demand Continue to Trend Higher

Fund Flows (up $671 million): During the week ending August 7, weekly reporting municipal mutual funds recorded $671 million of net inflows, according to Lipper. Long-term funds recorded $1.8 billion of inflows, high-yield funds recorded $492 million of inflows and intermediate funds recorded $756 million of outflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $18 billion.

Supply (YTD supply of $296 billion, up 41% YoY): The muni market recorded $15 billion of new-issue volume last week, up 83% from the prior week. YTD issuance of $296 billion is 41% higher than last year’s level, with tax-exempt issuance 45% higher and taxable issuance 6% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $10 billion. The largest deals include $643 million City of Chicago and $445 million Triborough Bridge Authority transactions.

This Week in Munis: Muni Performance During Recessions

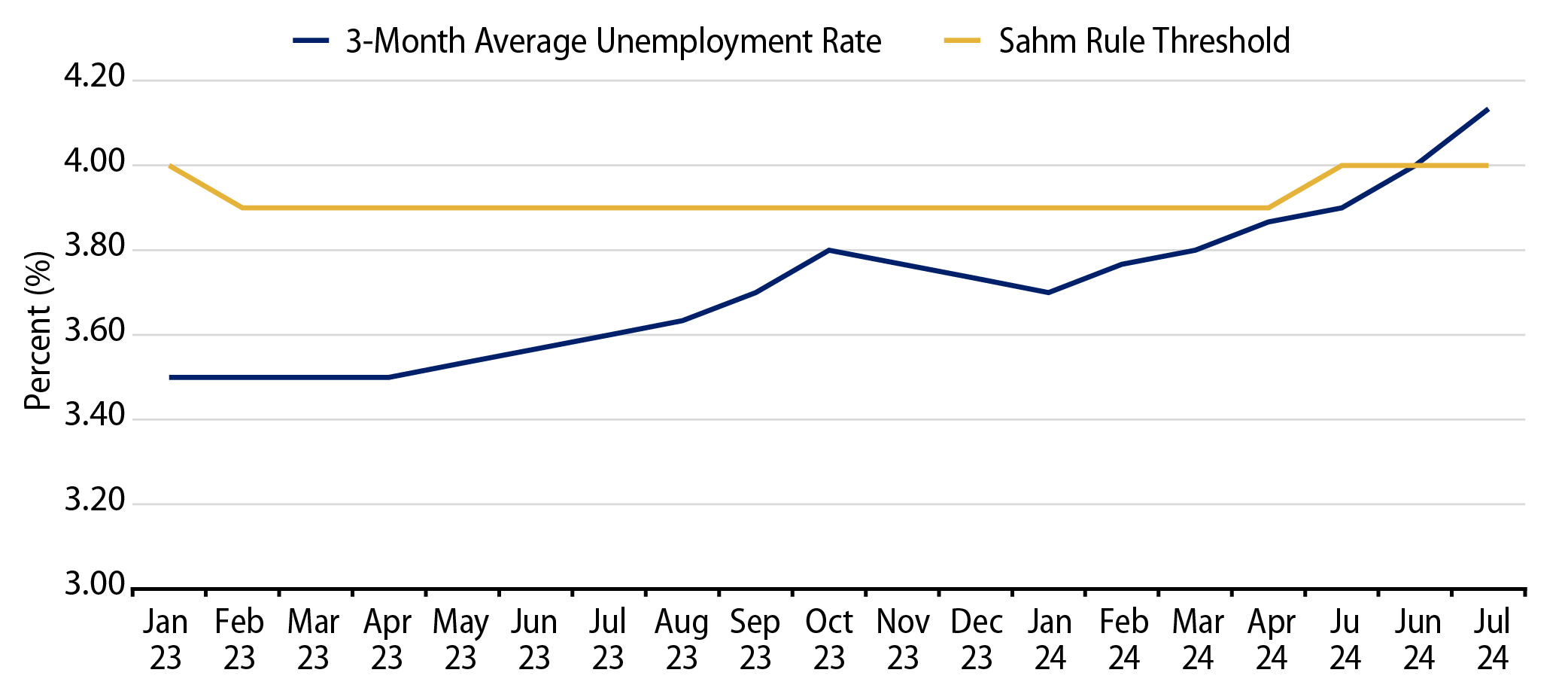

Recession fears spiked following labor data reported earlier this month that detailed weaker-than-anticipated July payrolls and downward revisions of prior months. The unemployment rate climbed to 4.3%, triggering the Sahm Rule recession indicator, as the 3-month rolling average unemployment rate exceeded the prior 12-month low by more than 50 basis points (bps). So far this month, the municipal market has benefited from the flight-to-quality sentiment, as the Bloomberg Muni Index returned 0.51%, outperforming the negative returns observed in equity markets.

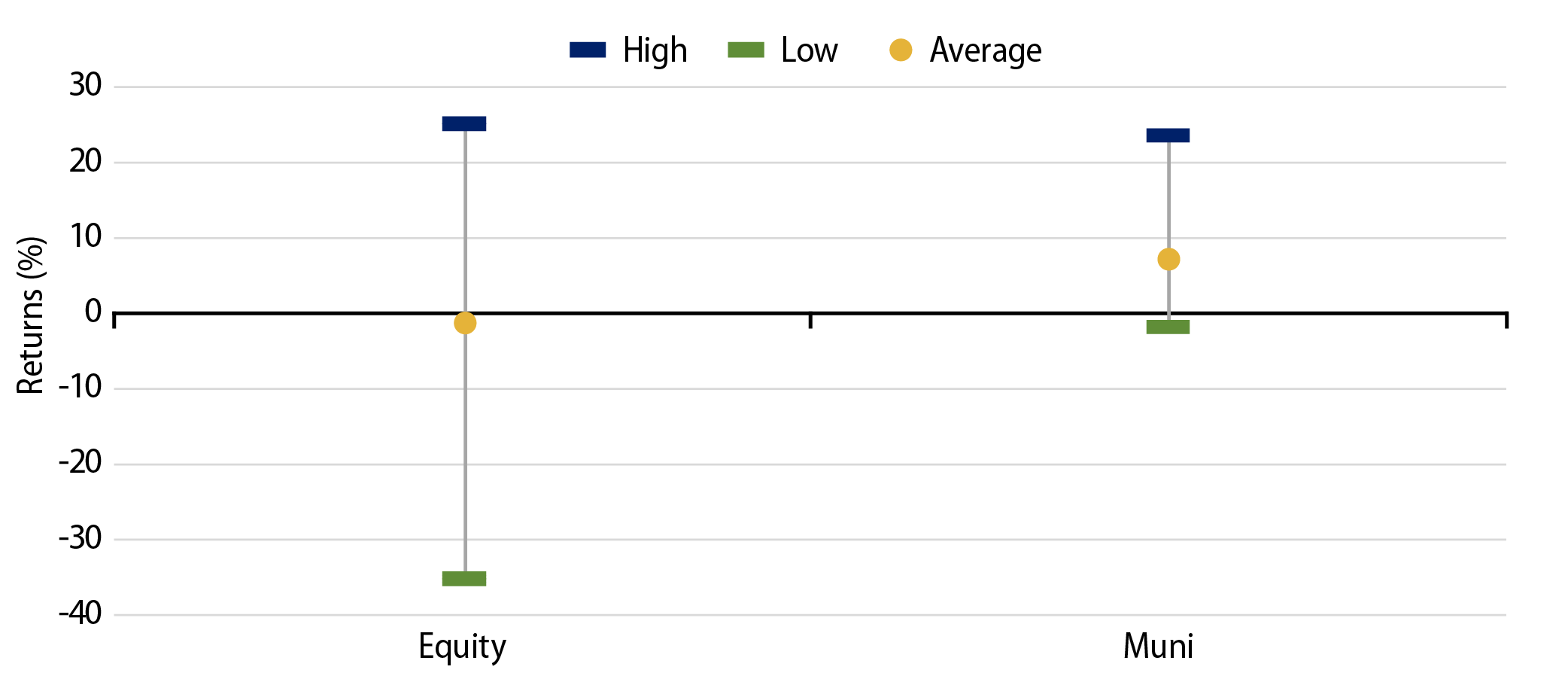

Municipals historically offered attractive risk-adjusted returns during prior recessions. Considering recession periods as defined by the National Bureau of Economic Recovery (NBER) since 1980, the Bloomberg Municipal Bond Index returned 7.21% on average, outpacing the average negative return experienced by the S&P 500. Moreover, municipals offered better downside outcomes during these periods, considering the largest municipal drawdown of -1.88% versus the largest equity drawdown of over -35%.

As growth continues to show signs of slowing and recession fears increase, Western Asset believes that municipals can continue to serve as ballast to overall portfolio allocations. We expect that elevated tax-exempt income opportunities, strong credit fundamentals and diversification characteristics can offset volatility from riskier parts of a portfolio allocation and contribute to after-tax portfolio outcomes during bouts of volatility.

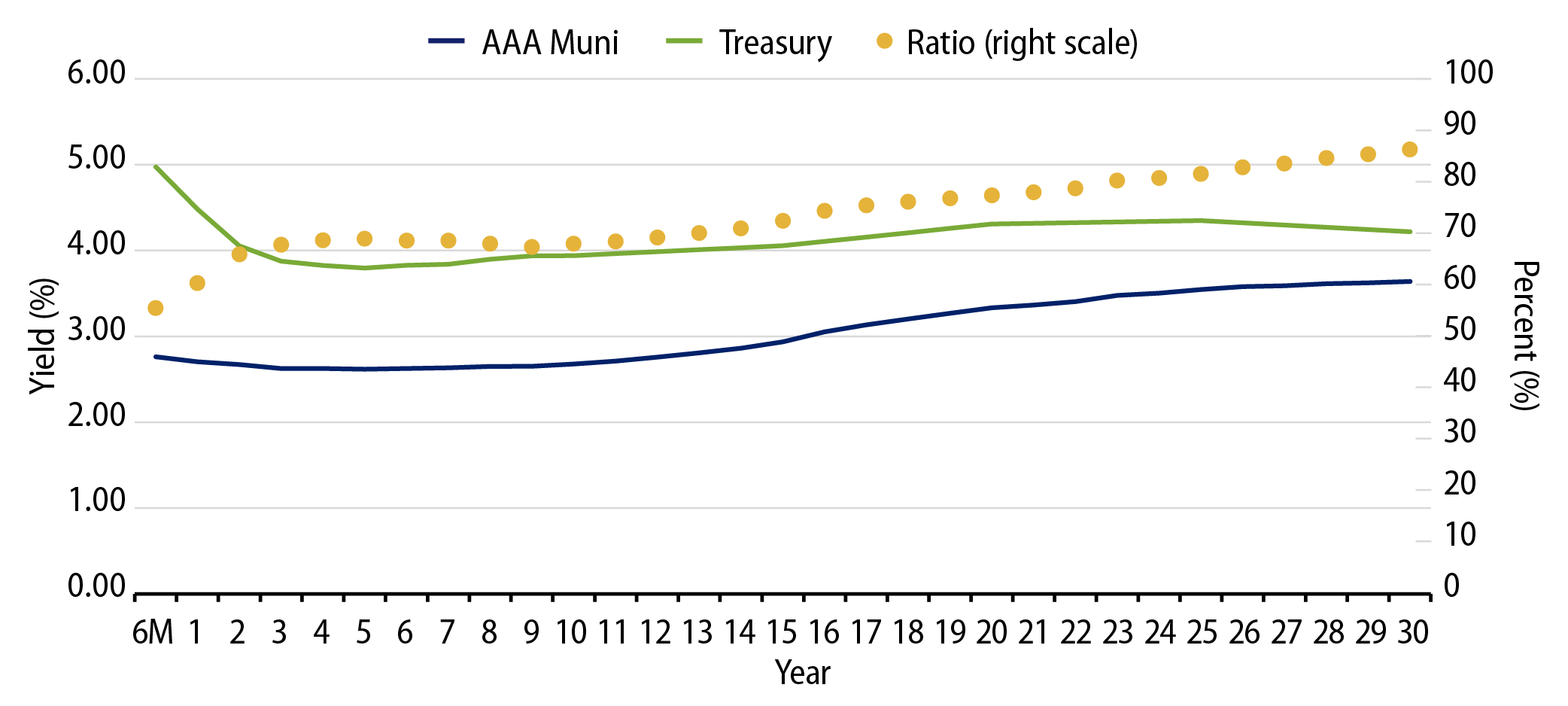

Municipal Credit Curves and Relative Value

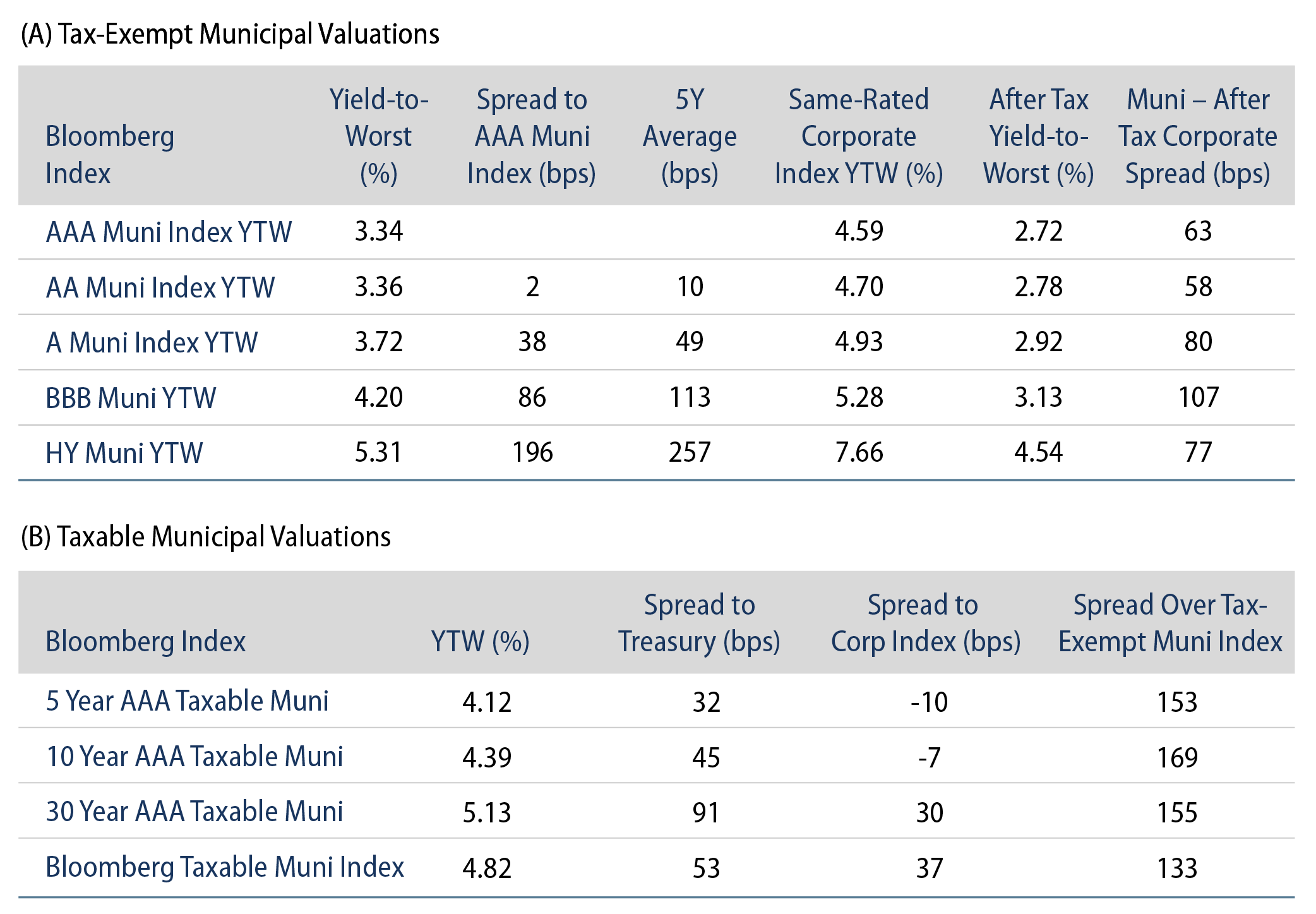

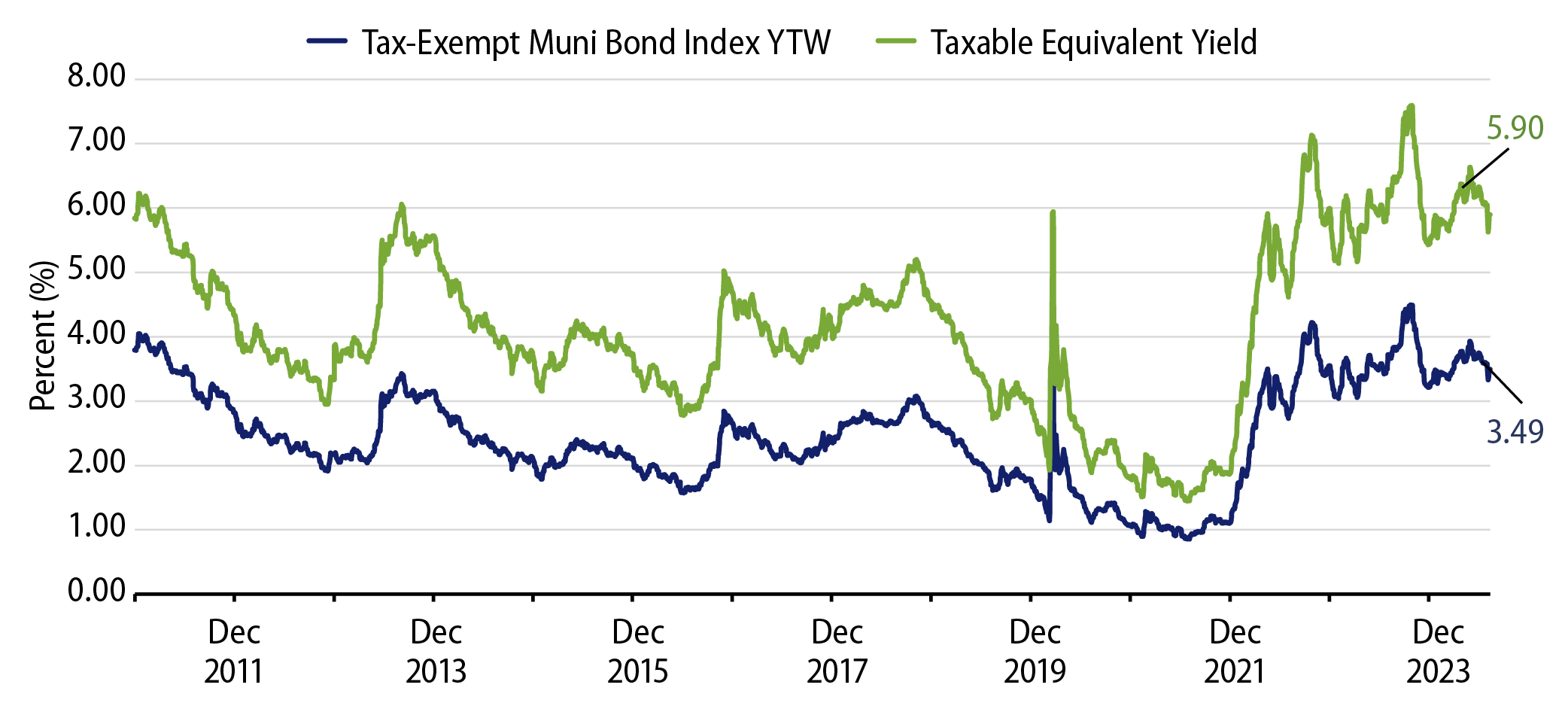

Theme #1: Municipal taxable-equivalent yields and income opportunities are above decade averages.

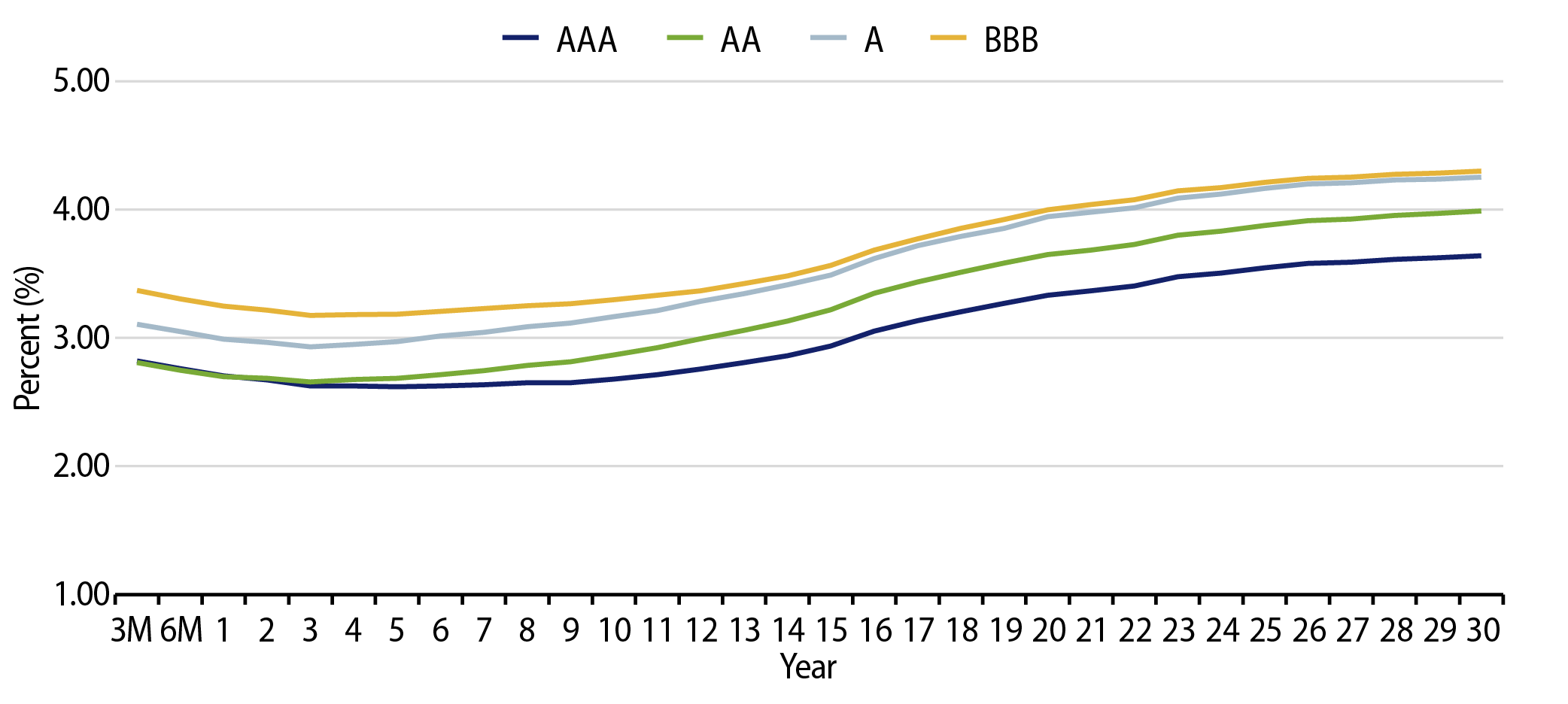

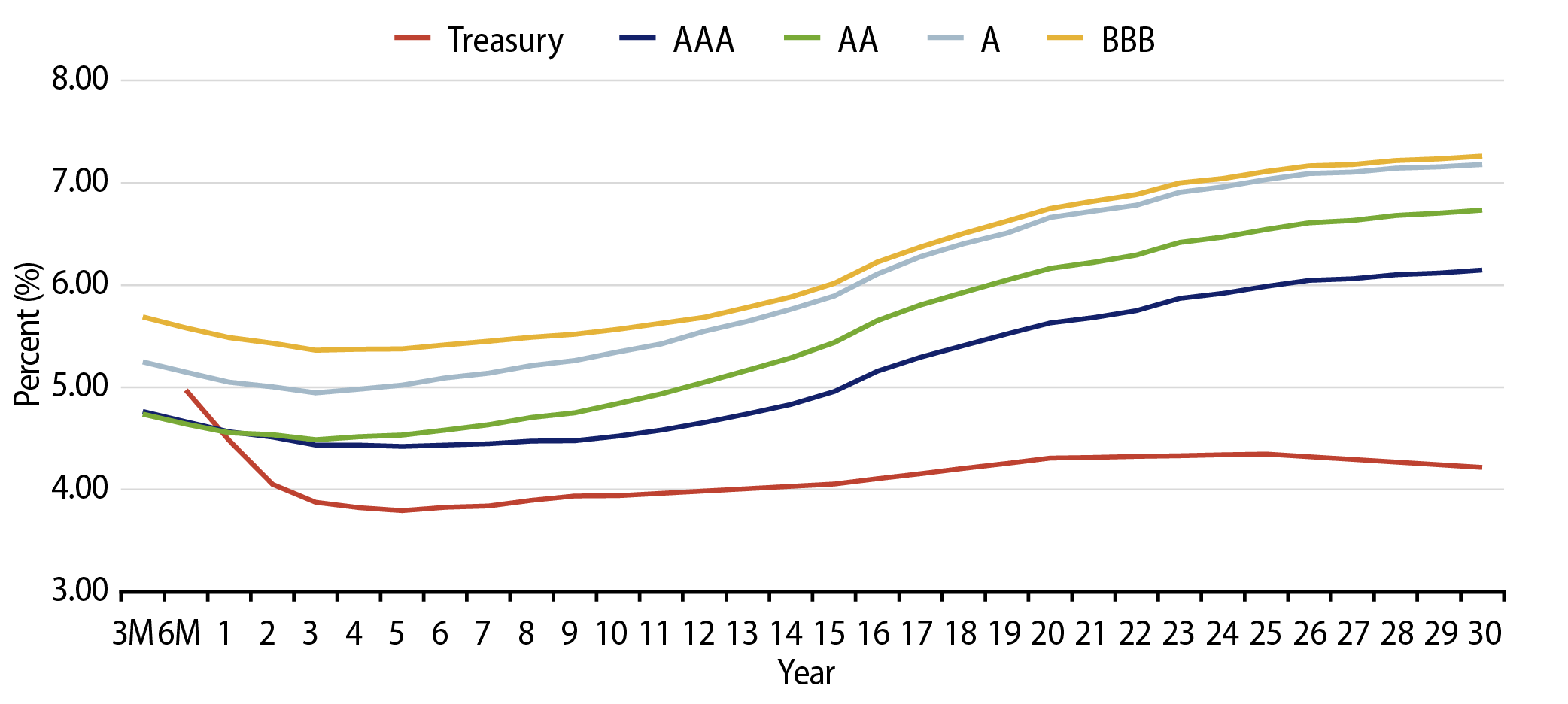

Theme #2: The muni yield curve has largely disinverted, offering potential value in extending maturities.

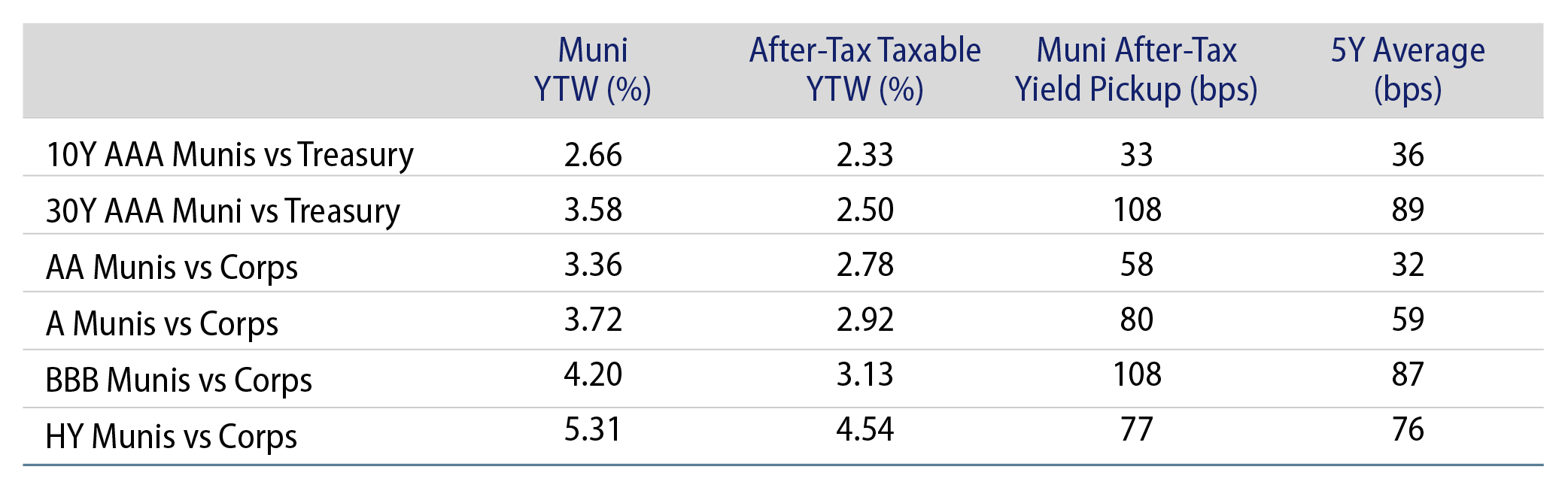

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.