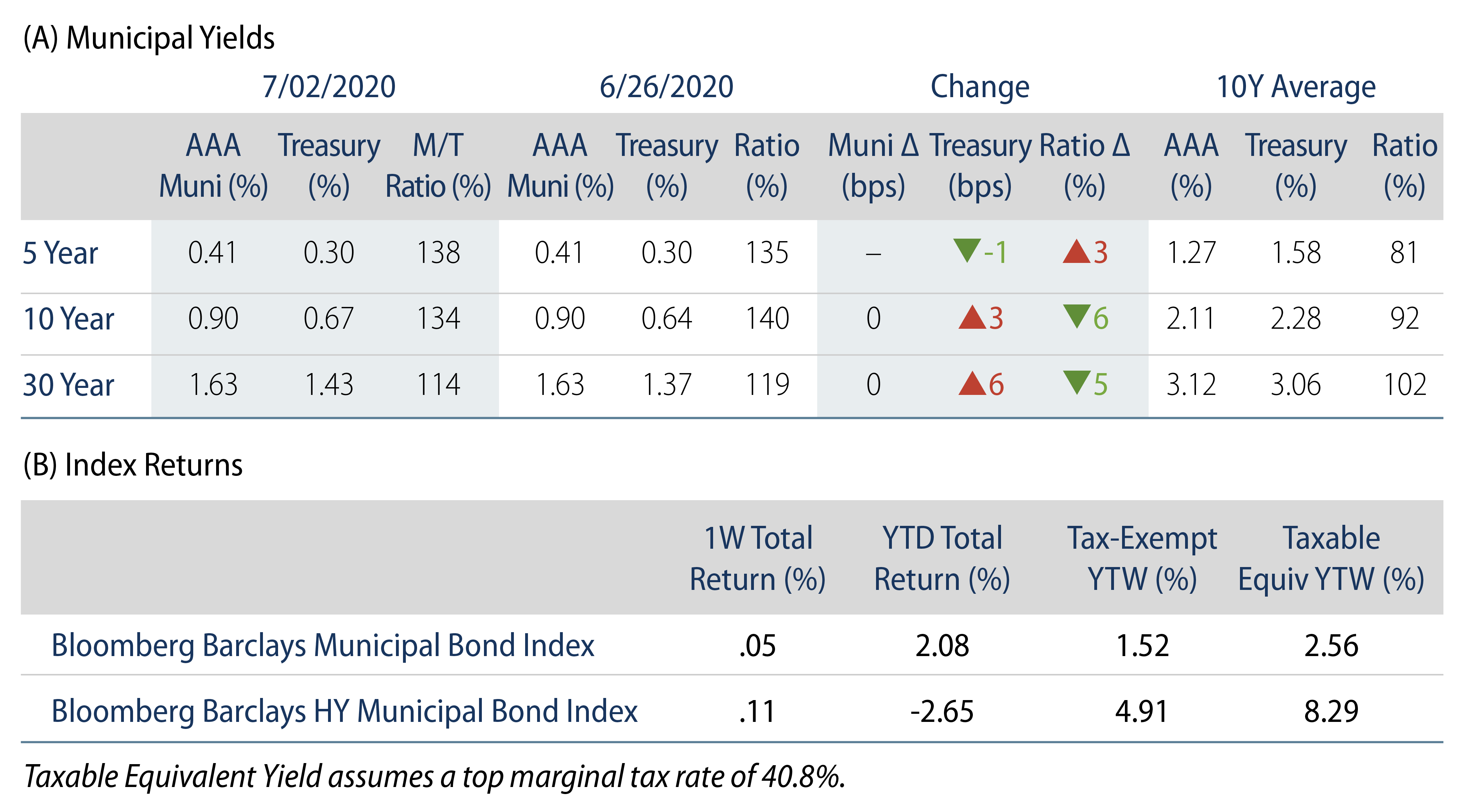

AAA municipal yields were generally unchanged during the quiet, holiday-shortened week, and outperformed Treasuries, which moved higher in intermediate and long maturities. The Bloomberg Barclays Municipal Index returned 0.05%, while the high-yield muni index returned 0.11% for the week. Halfway through the year, the investment-grade muni index has returned 2.08% while the high-yield municipal index has returned -2.65%.

Fund Flows and Coupon/Principal Reinvestment Continue to Support Muni Technicals

During the week ending July 1, municipal mutual funds reported an eighth consecutive week of inflows at $1.1 billion, according to Lipper. Long-term funds recorded $426 million of inflows, high-yield funds recorded $119 million of inflows and intermediate funds recorded $9 million of outflows. Year-to-date (YTD) municipal fund net outflows now total $6.2 billion. In addition to fund inflows, the market has also been supported by seasonally high coupon and principal reinvestment demand, with over $40 billion of coupon and principal payments delivered in the last 30 days, according to Bloomberg.

The muni market recorded $6.1 billion of new-issue volume last week, down 37% from the prior week given the holiday-shortened week. Issuance of $203 billion YTD is 22% above last year’s pace, though tax-exempt supply is 2% lower than last year’s levels. We anticipate approximately $10.2 billion in new issuance next week, led by $1.2 billion short-term Los Angeles Tax and Revenue Anticipation Notes and $2.3 billion taxable and tax-exempt University of California transactions.

This Week in Munis: Halftime Report

Performance:

In what has been the most volatile first half of the year in the history of the municipal market following price declines of over 10% in March, the Bloomberg Barclays Municipal Index posted positive returns of 2.08% YTD through June 30 following a strong second quarter.

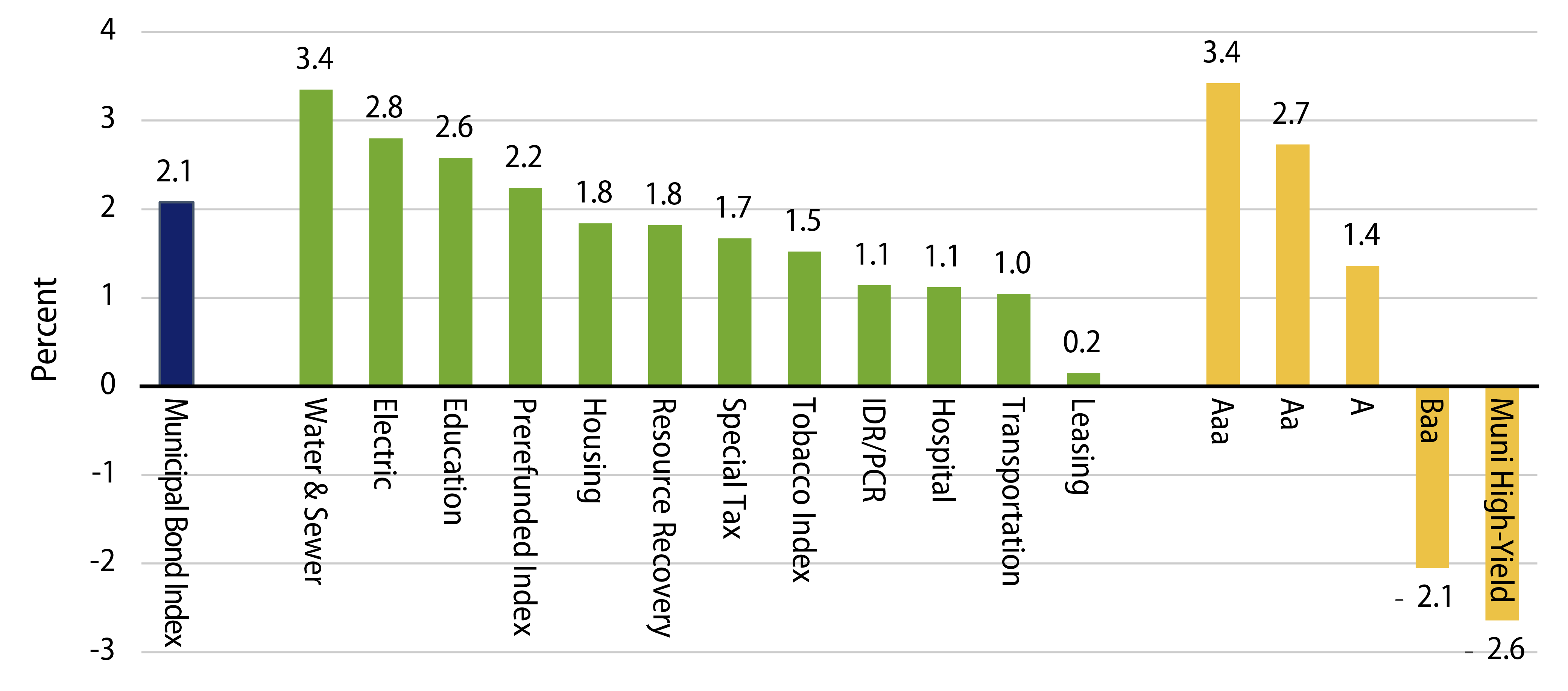

- Quality returns: Highest quality municipals were the best performers, with AAA and AA Indices returning 3.42% and 2.73%, respectively. A and BBB municipal indices underperformed, returning 1.36% and -2.05%, respectively.

- Sector returns: From a sector perspective, essential service water & sewer and electric utility sectors outperformed, returning 3.35% and 2.80%, respectively. Lease-backed and transportation sectors lagged the market, returning 0.15% and 1.04%, respectively.

- Curve returns: The belly of the municipal curve outperformed with the 10- and 15-year municipal indices returning 2.47% and 2.35%, respectively. The 1-Year Index and Long Municipal Bond Index (22+ Years) underperformed, posting returns of 1.28% and 1.70%, respectively.

Muni market outlook:

- Municipalities will undoubtedly grapple with acute budget stresses associated with COVID-19. May unemployment rates as high as 25.2% in some states will result in lower tax collections and drive austerity measures at the state and local levels. This degree of austerity and budgetary pain on those downstream entities will be on a case-by-case basis, and will ultimately be informed by the length of regional shutdowns and the degree of aid that is provided by Congress.

- Despite the challenged fundamentals associated with COVID-19, we are constructive on the cyclical and secular prospects for the municipal asset class which we believe will benefit from favorable after-tax relative valuations versus other fixed-income asset classes as global yields continue to grind lower and the prospect for higher tax rates.

- While certain segments of the muni market have normalized to pre-COVID valuations, we continue to find value in some of the least-loved segments of the municipal market this year. Looking to the issuer level in the transportation and healthcare sectors, we seek issuers with the revenue diversity and cash on hand to weather the economic challenges associated with COVID-19.