Macros, Markets and Munis

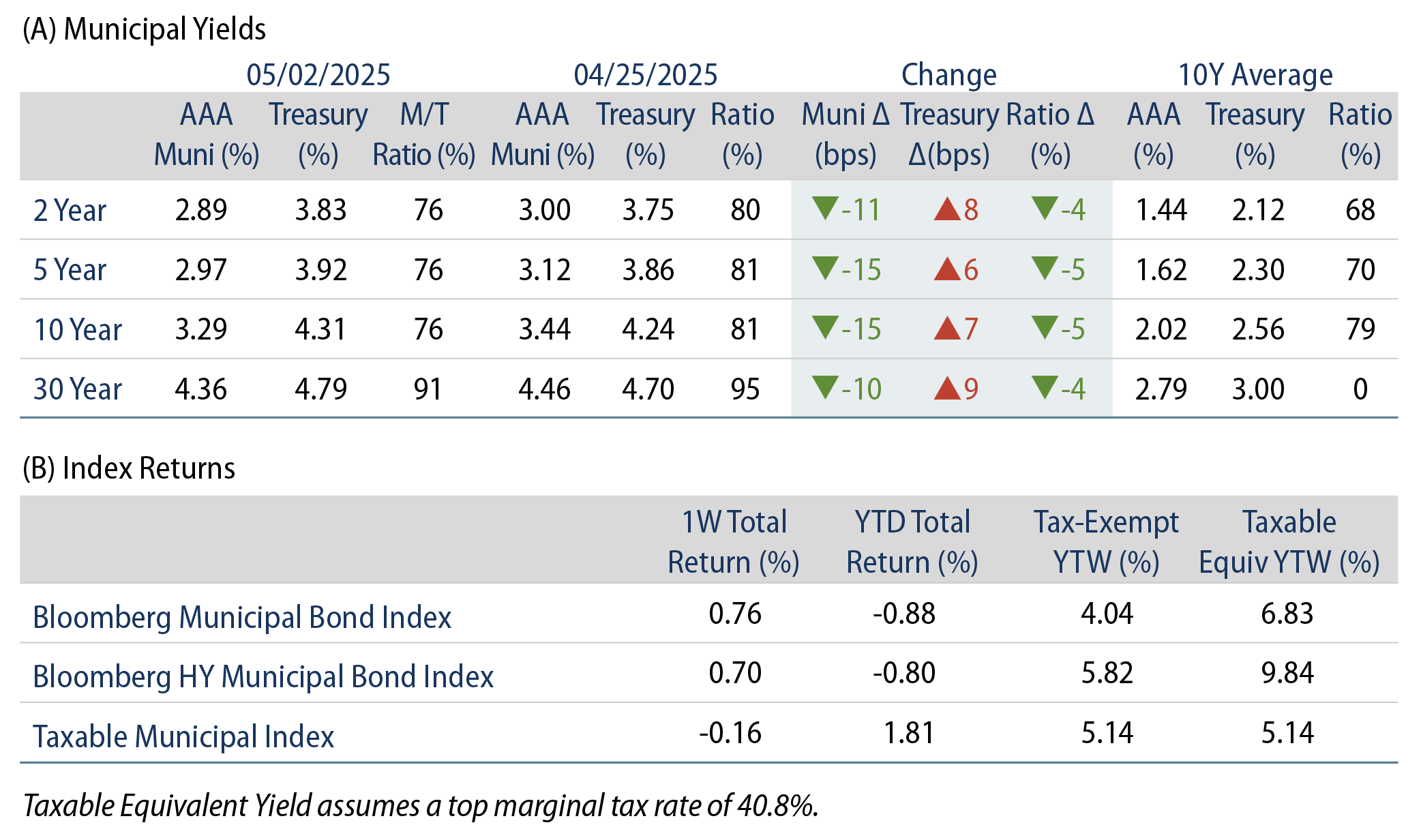

Municipals posted positive returns last week as demand sharply proliferated and supply remained elevated. Fixed-income markets rallied early in the week as 1Q25 GDP data indicated a 0.3% economic contraction, consumer confidence data declined and fell below expectations and March core PCE data declined from the prior month. The positive sentiment turned by the end of the week, in part due to the stronger-than-expected nonfarm payrolls report, which contributed to US Treasury (UST) rates ultimately ending higher. UST yields moved 6 basis points (bps) to 9 bps lower across the curve, while municipals generally side-stepped the late-week rate selloff as demand rebounded from seven consecutive weeks of outflows. The Bloomberg Municipal Index returned 0.76% during the week, the High Yield Muni Index returned 0.70% and the Taxable Muni Index returned -0.16%. Following the better-than-expected nonfarm payrolls report released Friday, this week we touch on state and local payroll conditions.

Muni Demand Improved as Fund Flows Rebounded Sharply

Fund Flows (up $1.6 billion): During the week ending April 30, weekly reporting municipal mutual funds recorded $1.6 billion of net inflows, according to Lipper. Long-term funds recorded $814 million in inflows, intermediate funds recorded $250 million in inflows, and high yield funds recorded $234 million in inflows. Last week’s inflows end seven consecutive weeks of net outflows and led year-to-date (YTD) inflows higher to $7 billion.

Supply (YTD supply of $179 billion; up 29% YoY): The muni market recorded $19 billion of new-issue supply last week, the highest weekly supply level of the year. YTD, the muni market has recorded $179 billion of new issuance, up 34% year-over-year (YoY). Tax-exempt and taxable issuance are up 28% and 37% respectively, though tax-exempt issuance has comprised the vast majority (93%) of YTD supply. This week’s calendar is expected to decline but remain elevated at $10 billion. The largest deals include $750 million Massachusetts Institute of Technology and $420 million New Hampshire Health Authority transactions.

This Week in Munis: State and Local Payrolls

Entering 2025, expected tax policy changes were a key focus, considering the new administration and the end-of-year expiration of the individual tax reductions associated with the 2017 Tax Cuts and Jobs Act. It has been widely expected that the current tax regime would be either extended or lowered, considering the Republican majority in Congress. Surprisingly, this month it has been reported that the White House has considered increasing the top individual marginal tax rate from 37% to 40% to offset the costs of other budgetary initiatives.

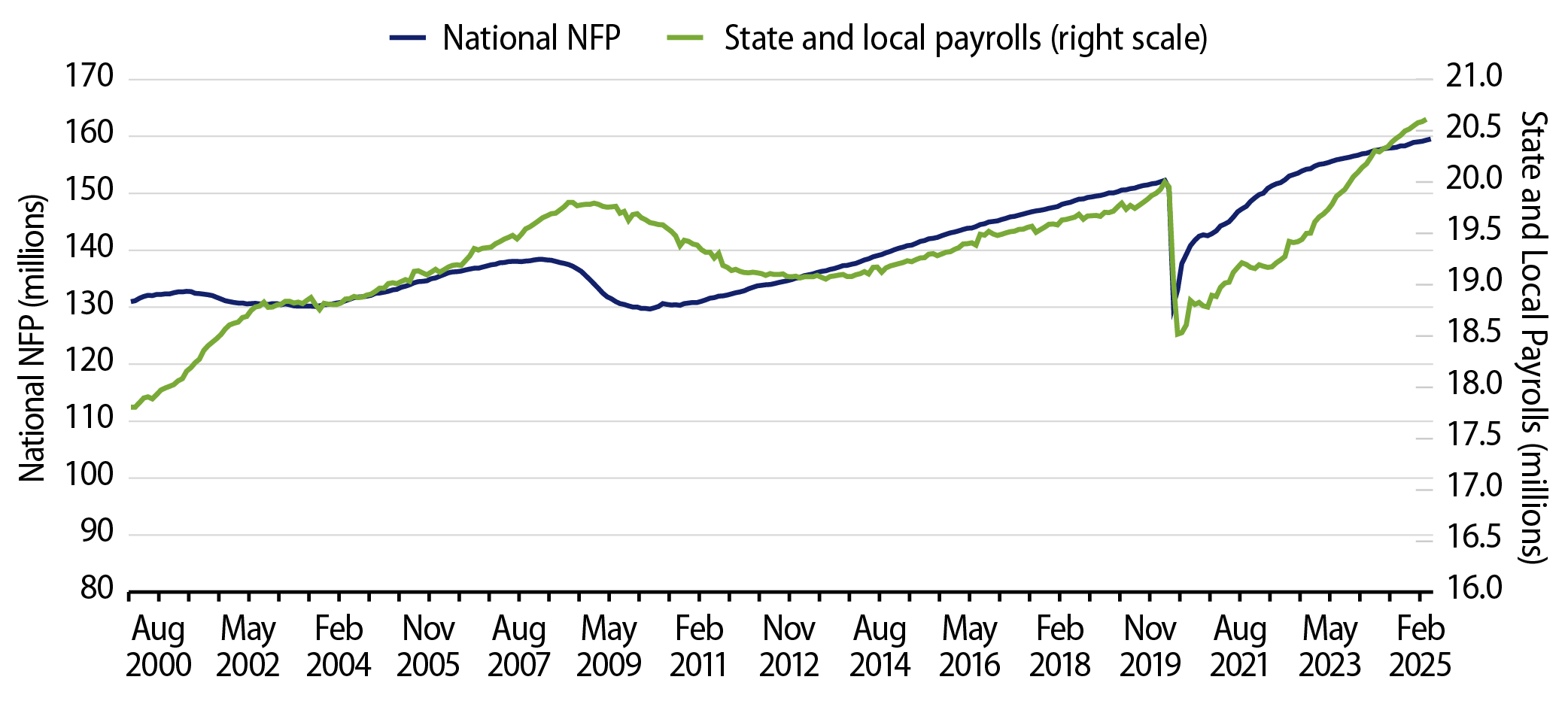

On Friday, the BLS reported nonfarm payrolls of 177,000, which exceeded expectations by 39,000. Despite broader concerns around federal funding cuts contributing to lower government payrolls, state and local payrolls have been resilient. According to the BLS data, YTD federal government payrolls declined 23,000, while state and local payrolls increased by 75,000.

Heading into Friday’s payroll report, state and local payrolls have been growing at a faster pace than national nonfarm payrolls. From the end of 2022 through the first quarter of 2025, state and local payroll growth of 6% well exceeded the national pace of 3%. This faster pace of job growth contrasts with the slower state and local payroll growth observed immediately following the depths of the pandemic from April 2020 to the end of 2022, when state and local payrolls grew just 2% versus the national payroll trend of 18%. State and local payrolls currently exceed pre-pandemic highs by 3%, while national payrolls remain 5% above pre-pandemic high levels.

The relatively strong payroll print last week as well as the rebound in state of local payrolls are indicative of the favorable fundamental backdrop for municipal credit. However, as federal funding concerns transpire from the state and local levels and several large issuers record budget gaps, Western Asset anticipates that municipal payroll growth could slow going forward. We continue to believe municipal investors are rewarded for lower credit quality exposures that are supported by the strong economic trends, but at tighter spread levels, we expect that diligent credit selection is of increased importance.

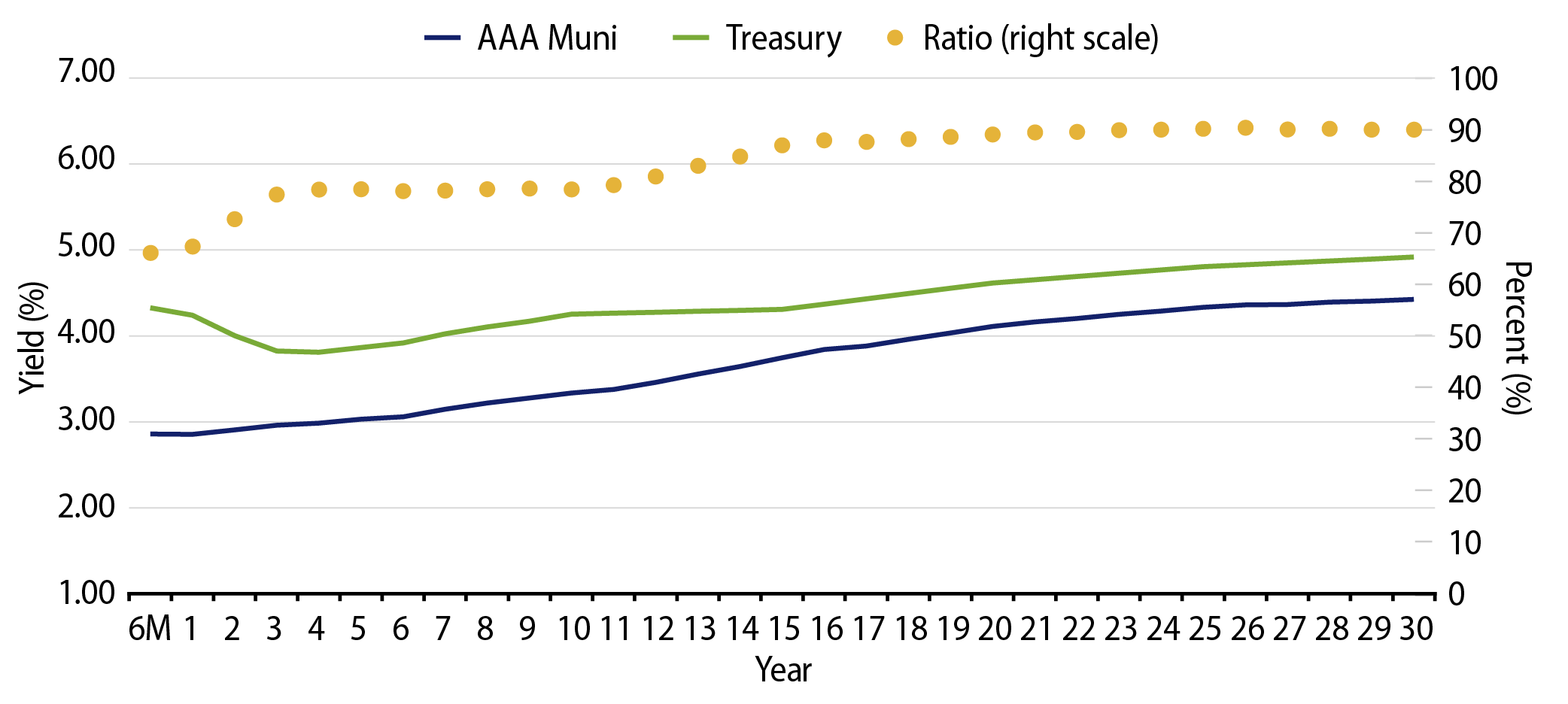

Municipal Credit Curves and Relative Value

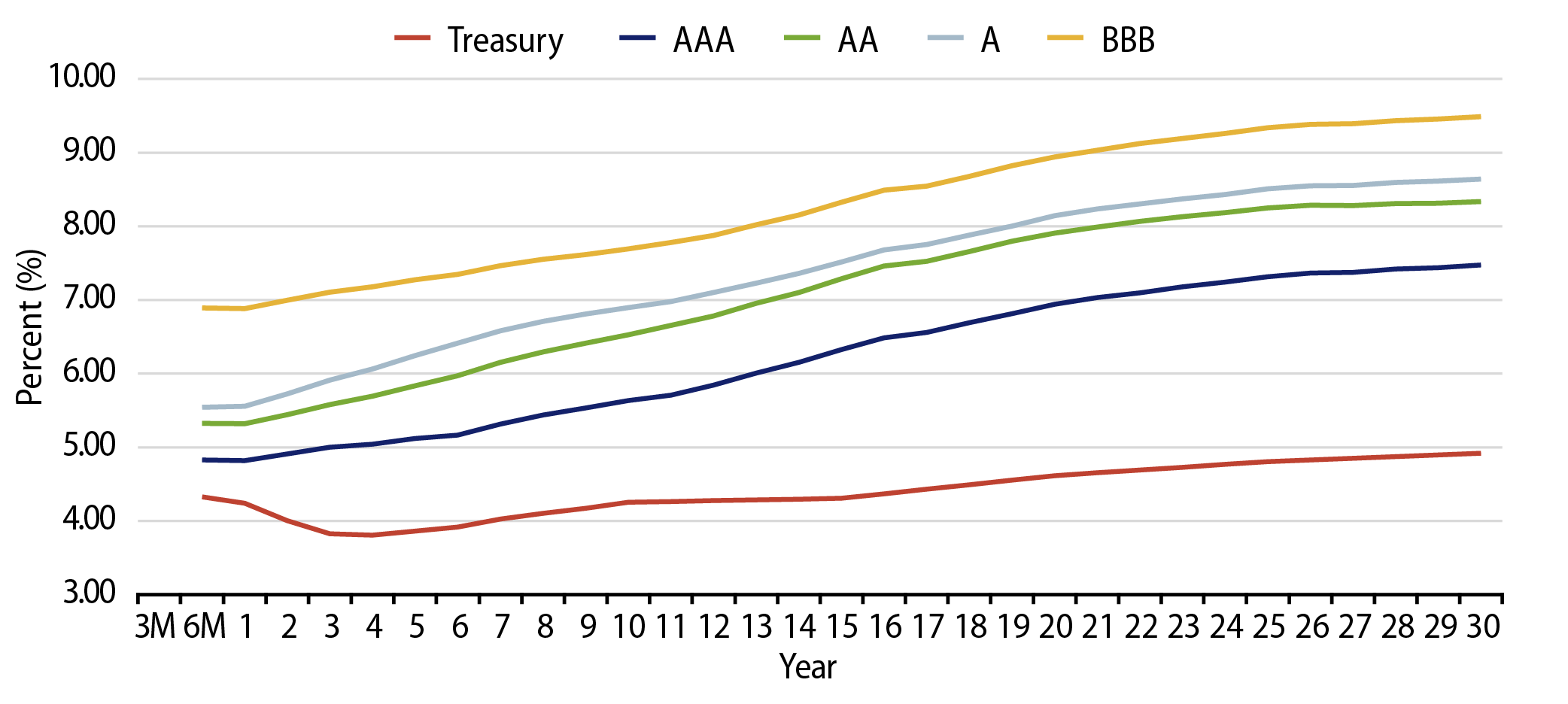

Theme #1: Municipal taxable-equivalent yields and income opportunities spiked to decade-high levels.

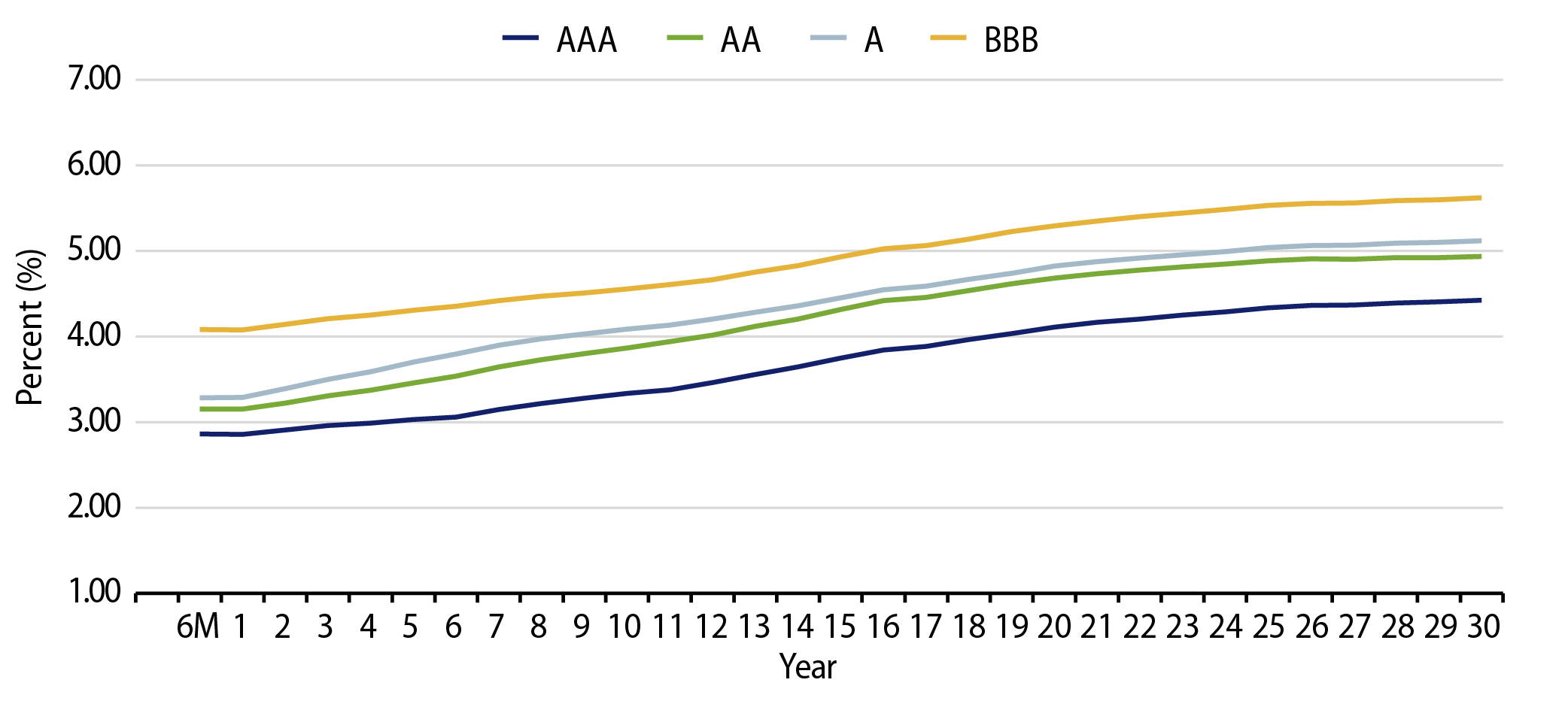

Theme #2: The muni curve has steepened, offering better value in intermediate and longer maturities.

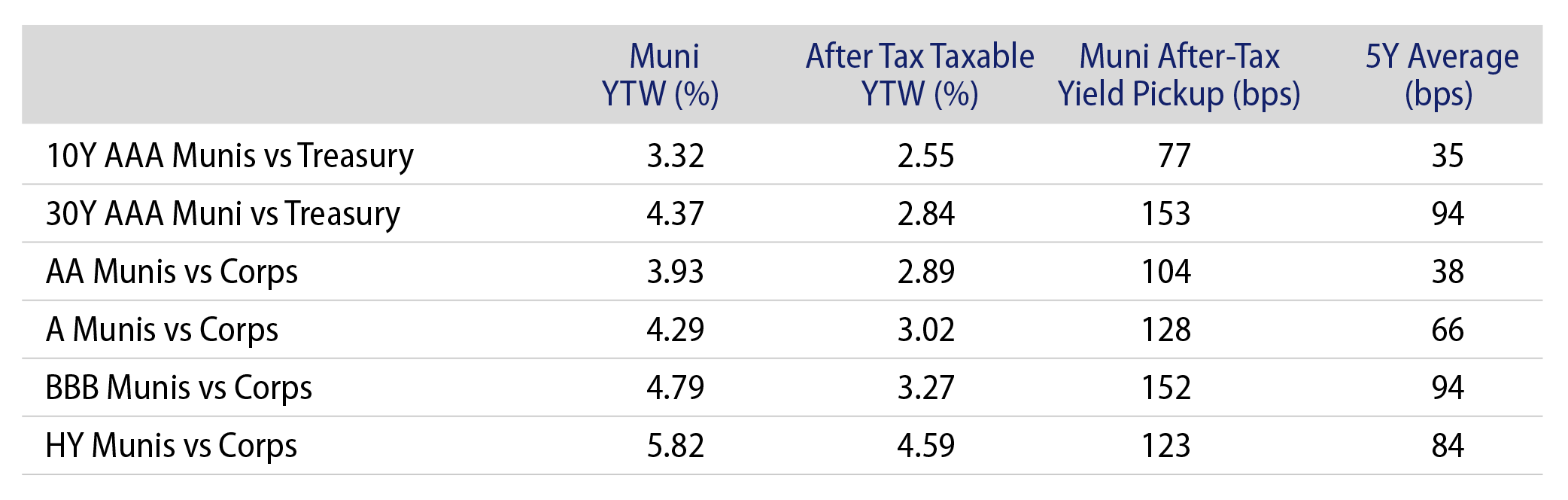

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.