Negative Municipal Returns Extended Last Week

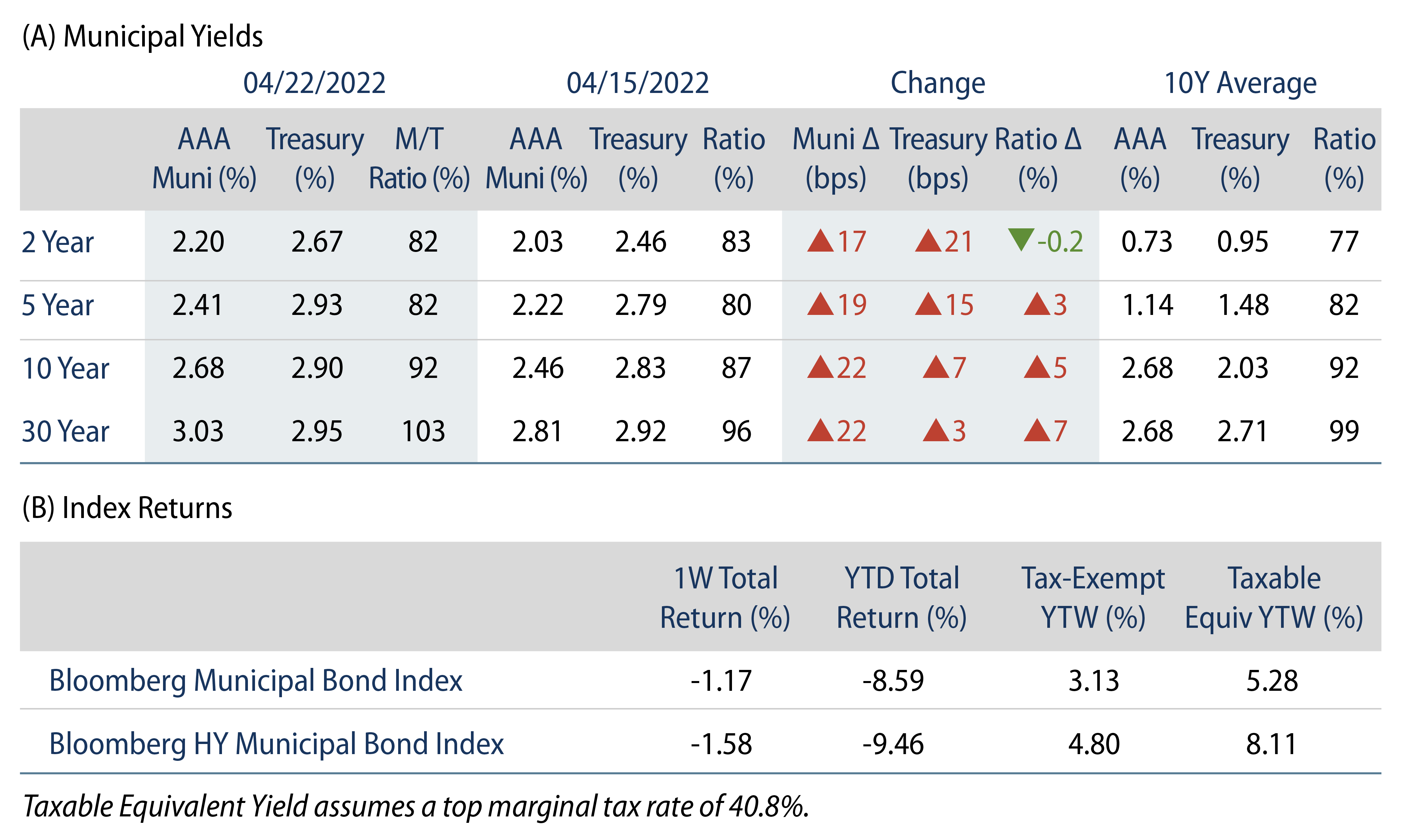

US municipals posted negative returns again last week, underperforming Treasuries across the curve, with high-grade muni yields moving 17-22 bps higher across the curve. Technicals weakened amid continued outflows and building new-issue supply. The Bloomberg Municipal Index returned -1.17 %, while the HY Muni Index returned -1.58%. This week we highlight improving agency rating upgrade-to-downgrade activity.

Technicals Remain Weak Amid Continued Fund Outflows and a Building New-Issue Calendar

Fund Flows: During the week ending April 20, weekly reporting municipal mutual funds recorded $3.5 billion of outflows, according to Lipper. Long-term funds recorded $1.9 billion of outflows, high-yield funds recorded $679 million of outflows and intermediate funds recorded $577 million of outflows. The week’s fund outflows extended the current outflow streak to 15 consecutive weeks and contributed to $38 billion of year-to-date (YTD) net outflows.

Supply: The muni market recorded $6.3 billion of new-issue volume, up 8% from the prior holiday-shortened week. Total YTD issuance of $124 billion was in line with last year’s levels, with tax-exempt issuance trending 13% higher year-over-year (YoY) and taxable issuance trending 34% lower YoY. This week’s new-issue calendar is expected to increase to $10 billion. The largest deals include $1.5 billion State of Washington and $1.2 billion University of California Medical Center transactions.

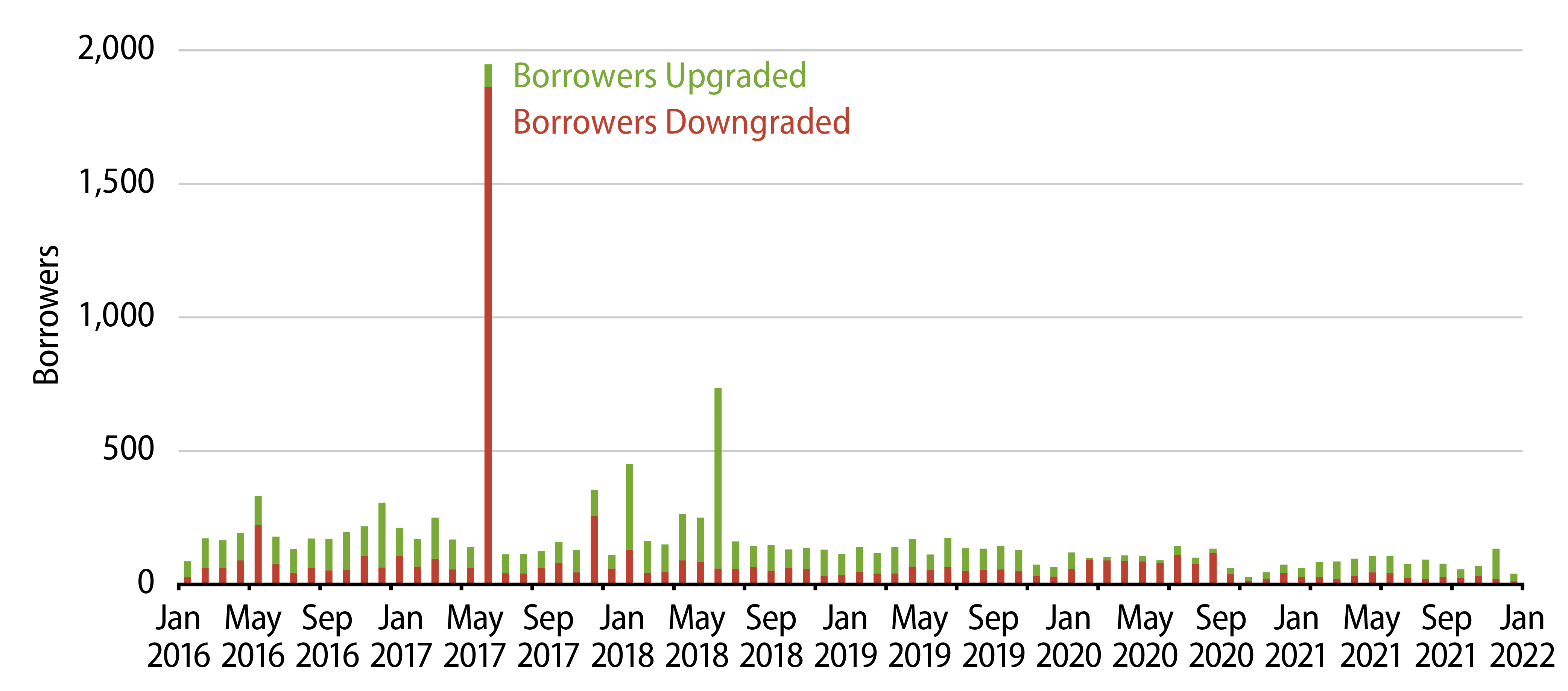

This Week in Munis: Upgrades Continue to Exceed Downgrades

In recent weeks we have highlighted data releases that emphasize the improving fundamental trends within the municipal market, which starkly contrast YTD negative returns. The improving fundamental landscape has been further demonstrated by rating agency upgrades that have exceeded downgrades YTD.

According to Bloomberg estimates, through the week of April 15, Moody’s, S&P and Fitch upgraded $178 billion of par value of municipal debt YTD, nearly 10 times the $18 billion of par that was downgraded so far this year. Much of the upgrade activity was a reversal of the downgrades observed in 2020 when the rating agencies had reacted aggressively to uncertainties posed by the Covid-related shutdowns. The upgrades also reflect robust revenue collections, record cash balances and widespread availability of vaccines that continue to support an economic recovery.

From a sector perspective, YTD upgrades were concentrated in income-tax backed, appropriation and toll-road sectors. The relatively smaller downgrade figure was concentrated in the municipal utility, health care and water & sewer sectors. At the issuer level, New Jersey’s approximately $35.8 billion in upgraded debt led YTD upgrades.

The trend of upgrades surpassing downgrades continued last week, led by Moody’s upgrading more than $26 billion of State of Illinois General Obligation debt from Baa3 to Baa2, citing improved reserves and pension funding. We anticipate that strong municipal fundamentals will continue to support a trend of improving credit quality in the municipal market. In addition to strong labor conditions, which should support forward-looking tax collections, federal stimulus funds granted last year have yet to be fully allocated and may be distributed through 2026, providing state and local governments with budgetary flexibility in the face of inflationary pressures or other unanticipated economic headwinds.