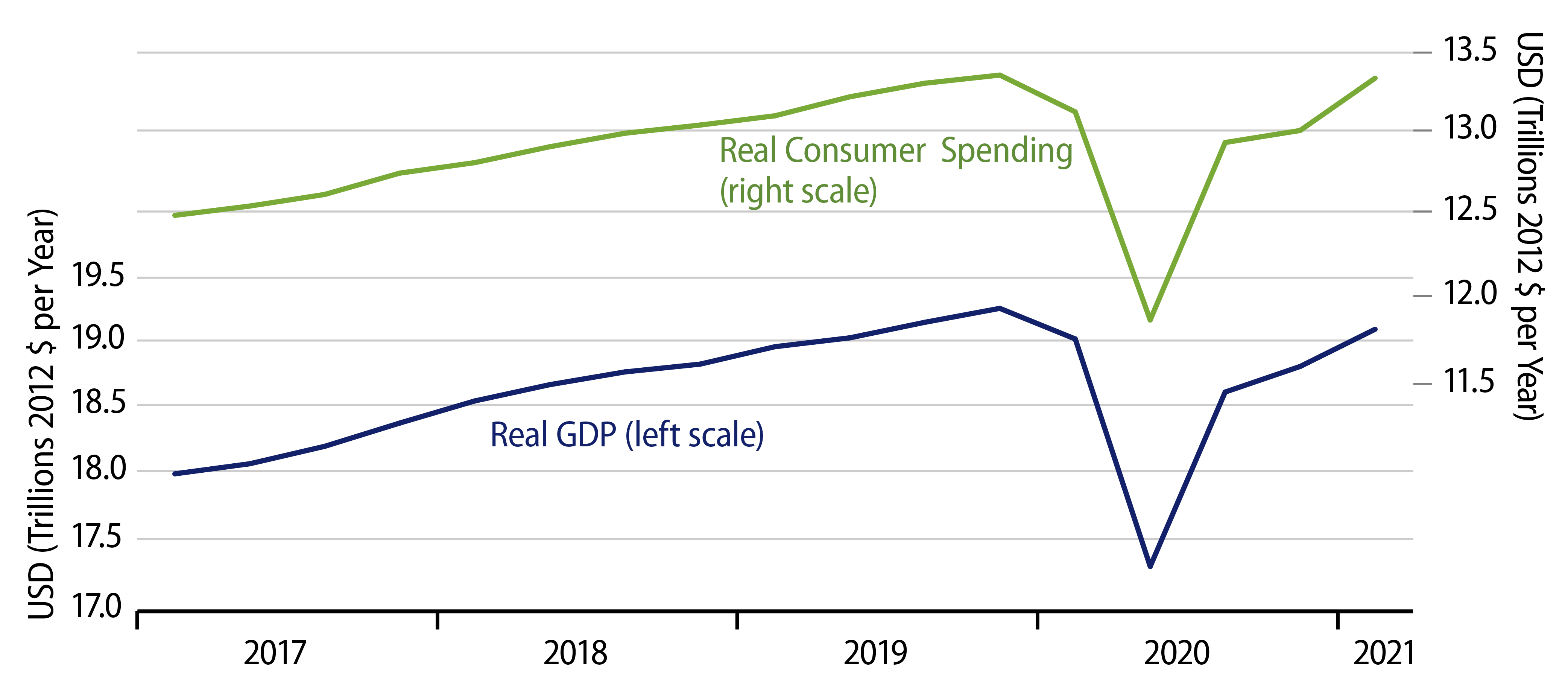

Real GDP grew at a 6.4% annualized rate in 1Q21, about in the middle of the range of Wall Street forecasts. As expected, the bulk of the growth came from consumer spending, which grew at a real annualized rate of 10.7%. The real dollar increase of consumer spending actually exceeded that of GDP, so that other sectors appear to have contributed negatively to 1Q growth.

In those other sectors, there were nice reported gains in business capital spending and nondefense federal government purchases. The data released today give no further detail on where those nondefense government purchases occurred, but it is a relatively safe bet that this reflected Covid vaccination efforts.

The "surprise" amount of increase in federal purchases came to about $14 billion (non-annualized). Divide this by the roughly 100 million vaccinations provided between January and March, and that comes to about $140 per shot, which sounds about right. This means that the government’s vaccination drive efforts contributed about 1 percentage point to 1Q growth.

Within consumer spending, the largest spending gains by far were for merchandise, with all major components showing very strong gains. This was in line with the March retail sales data reported earlier this month. However, there were also nice gains in various service sectors not covered by the retail data, such as health care, recreation, financial services and others. Previously released monthly data through February had not shown much gain for these sectors, so it appears that they benefited from consumers’ March spending spree as well as did merchandise sectors.

The downsides of the GDP data were that rising imports accounted for a good portion of the increase in consumer spending, and much of that spending also came out of inventories. Many Wall Street analysts believe that the 1Q softness in inventories sets us up for restocking—thus further strong GDP growth—in 2Q. We are inclined to push back on this premise.

That is, we don’t expect the strong March consumption gains to be continued in 2Q, at least not for merchandise. We think much of the March strength reflects some final catching up with enforced abstinence during the shutdowns last year. Thus, we would look for much softer growth in goods sectors going forward, even with inventory restocking. Meanwhile, growth in homebuilding and construction in general slowed noticeably in 1Q, and we expect that slowing to continue going forward.

The big upside for the economy over the rest of the year resides in the service sectors and is thus dependent on how rapidly “final” reopening efforts are taken by both federal and local governments. Again, these sectors showed nice growth in 1Q, but they will have to step up that pace considerably if they are to carry the economy over the rest of the year.