Performance Overview

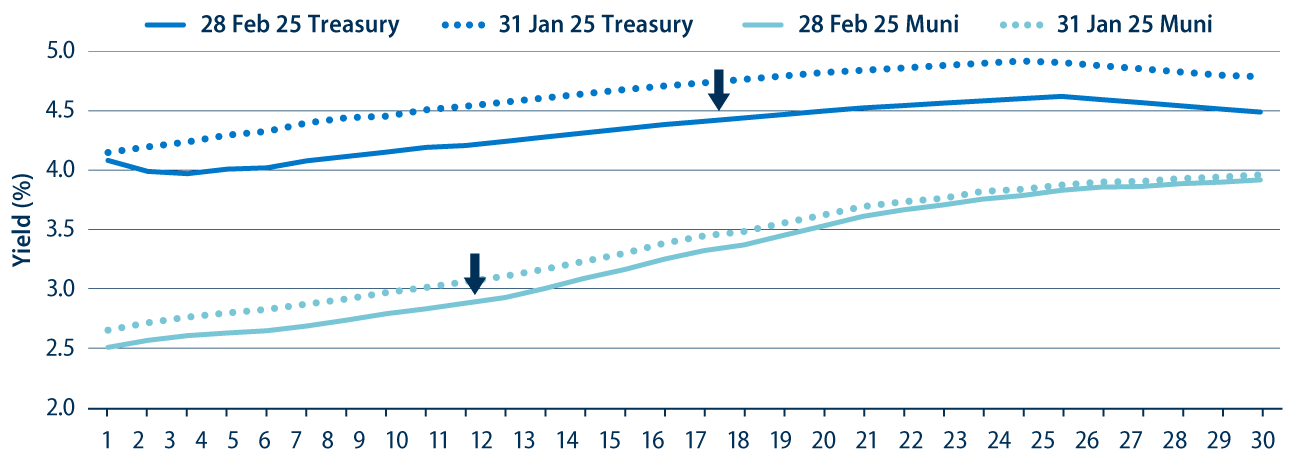

Muni yields moved lower alongside Treasuries in February as investors sought safety amid growth concerns.

Fixed-income markets rallied in February and outperformed equities against a backdrop of heightened tariff rhetoric and growth concerns, which contributed to risk-off sentiment and expectations of deeper Federal Reserve cuts than previously anticipated. The Treasury yield curve bull-flattened, with short maturities moving slightly lower, while longer maturities fell by up to 33 basis points (bps). Municipal bond yields also moved lower across the curve, but generally lagged the sharp Treasury decline amid elevated supply conditions.

Supply and Demand Technicals

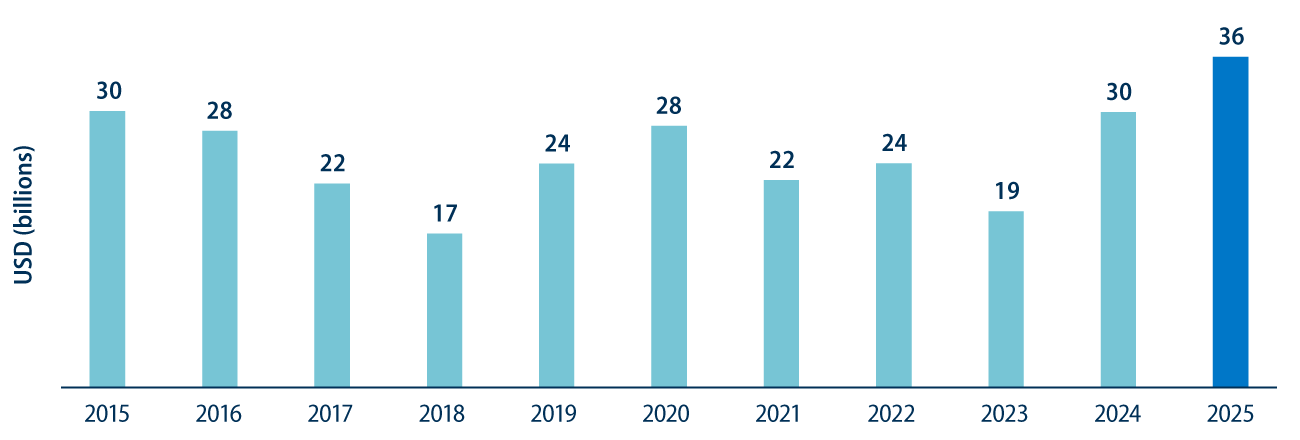

Tax-exempt supply for the month of February nearly reached a record high.

This month, total municipal supply reached $39 billion, with tax-exempt issuance of $36 billion accounting for 92% of total new issuance and nearly setting a February record. Conversely, muni issuers recorded $3 billion of taxable supply in February, which fell below recent monthly averages as issuers continued to favor the tax-exempt markets in the higher rate environment. Year-to-date (YTD) total new issuance of $76 billion is 20% higher than last year’s levels.

The strong pace of tax-exempt supply was well-absorbed as muni demand accelerated in February. Estimates from ICI and Lipper indicate six consecutive weeks of net inflows starting mid-January, as end-of-year tax-loss harvesting activity faded and investors sought relatively higher after-tax income opportunities further out the yield curve. Mutual funds recorded approximately $6 billion of inflows for the month through February 26, according to ICI, reversing the trend of outflows observed at the end of last year.

Fundamentals/Outlook

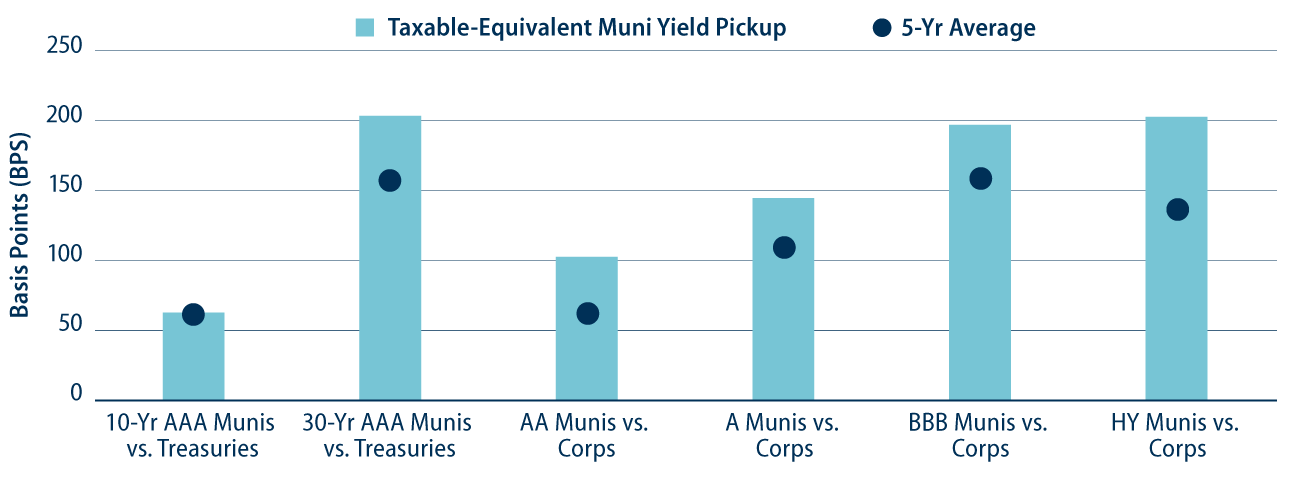

Municipals offer after-tax value versus their taxable counterparts.

Despite its strong performance in February, Western Asset believes the municipal asset class continues to offer attractive after-tax income opportunities and a compelling relative value proposition across the curve and rating cohorts. The 3.55% average yield-to-worst (YTW) of the Bloomberg Muni Bond Index remains 33 bps higher than at the start of last year, and equivalent to 6.00% on a taxable-equivalent yield basis for an investor in the highest marginal tax bracket. Compared to like-rated taxable fixed-income, municipals continue to offer a relative after-tax income advantage, particularly among longer-duration and lower-investment-grade segments.