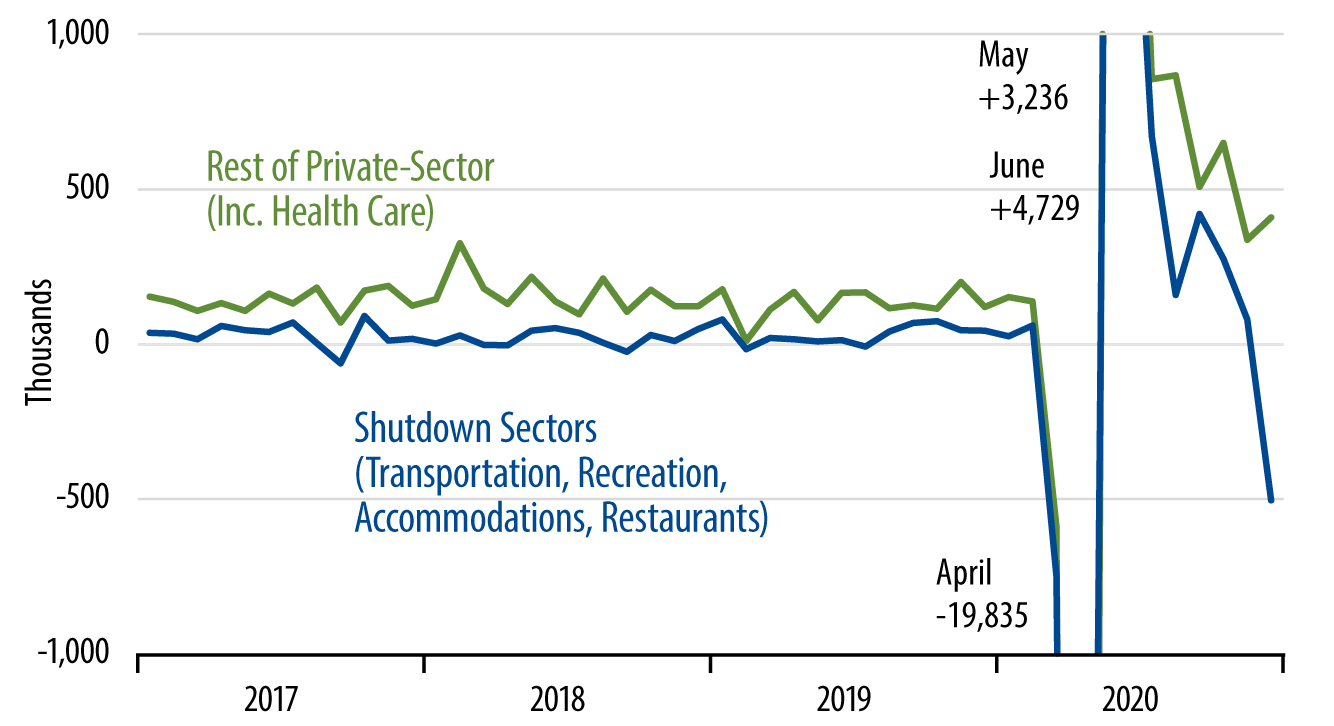

Private-sector employment declined by -93,000 in December, as job losses at sectors hit by newly re-imposed Covid-related shutdowns more than offset sizable gains elsewhere. The December job loss was itself offset by a +121,000 upward revision to the private-sector job count for November.

With the latest surge in Covid cases, shutdowns were reimposed on restaurants in much of the country. As a result, restaurant jobs declined by -372,000 in December. In addition, jobs declined by -103,000 at similarly affected theaters and recreation venues, and by -24,000 at lodging facilities.

In contrast, retailing added +121,000 jobs, construction +51,000 jobs, manufacturing +38,000 jobs, and health care +39,000 jobs. These sectors, obviously, were mostly unaffected by renewed shutdown orders.

Our take has been that while job growth—and economic growth in general—had been slowing in recent months from the spectacular pace of the summer, that was only to be expected as activity levels returned to nearly normal. This theme was largely repeated in December in those sectors not impeded by renewed shutdowns.

The manufacturing and construction gains continued the pace of steady recovery there. Similarly, while health care facilities had been shut down in March and April, they were generally not subject to the more recent strictures, and nice job gains there continued in December, along with a +33,000 revision to November job counts.

Retailing had been a disappointment last month, with retailing jobs declining -45,000 in November, and “control” retail sales then down -1.0%. This month’s data were more upbeat for retailing, with that sector gaining +121,000 jobs (+0.8%) and the November decline revised to -21,000. Perhaps the Christmas rush got started later in 2020 than was previously the case, which then got seasonally adjusted into a November decline. In any case, the strong December job gains in retailing (AFTER seasonal adjustment) augur for better December retail sales growth than some analysts have been projecting.

One can still debate whether the deep recession of spring 2020 was largely imposed by government shutdowns or was reflective of pandemic fears that would have restrained the economy even if it were left open. However, the December declines—and the lingering underutilization in various sectors—seem to reflect the “hand” of government-imposed shutdowns. That is, recovery continues in those areas where government is allowing it to, and in areas such as construction and manufacturing, activity has fully recovered—and then some—from the declines seen in March and April.

It may indeed be the case that renewed forcible shutdowns of restaurants and other facilities are necessary to prevent an even worse Covid spread than we have seen. However, the December job losses, where they have occurred, clearly indicate the magnitude of the economic costs offsetting the putative benefits of the shutdowns.